PDD Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PDD Holdings Bundle

What is included in the product

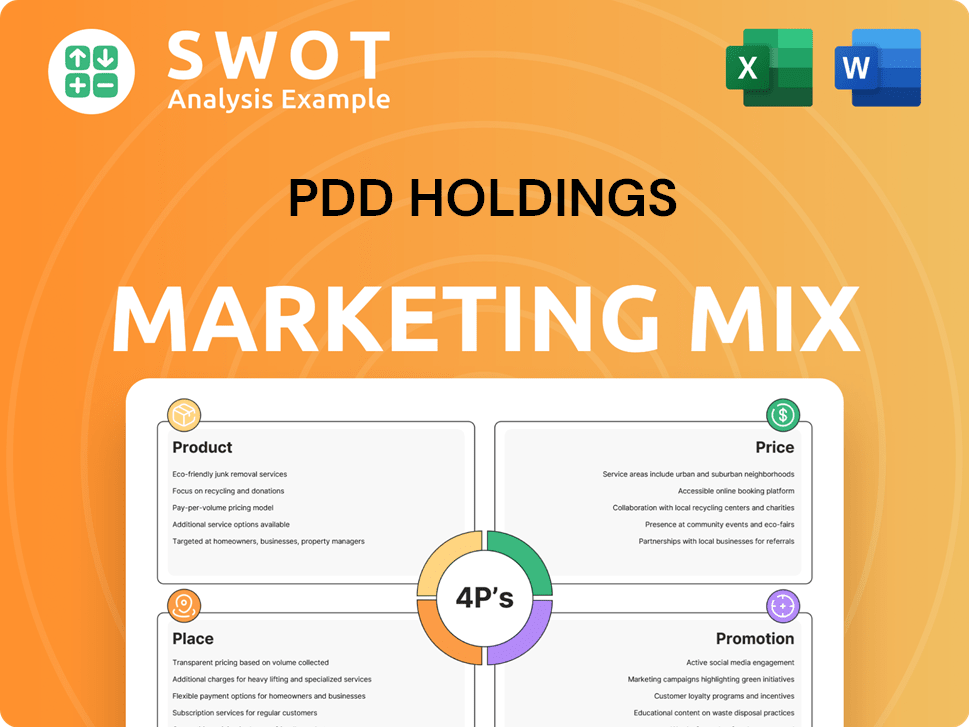

A complete examination of PDD Holdings’ marketing using the 4Ps framework.

Covers Product, Price, Place, and Promotion with strategic insights.

Helps non-marketing stakeholders grasp the brand’s strategic direction.

What You Preview Is What You Download

PDD Holdings 4P's Marketing Mix Analysis

See the real PDD Holdings 4P's analysis now! This preview is the identical document you'll download instantly after purchase. Expect a complete and ready-to-use marketing mix assessment. No extra steps, just direct access. You're getting the full report as is.

4P's Marketing Mix Analysis Template

PDD Holdings thrives in a competitive market, and their 4Ps—Product, Price, Place, and Promotion—are key. Their product strategy centers on variety, appealing to diverse consumer needs. Pricing often employs aggressive discounts to gain market share. Strategic distribution is facilitated via their platform. Clever promotions drive brand awareness.

However, our in-depth Marketing Mix Analysis goes further, offering a complete view of each 'P'. You will explore the nuances that drive their strategy. Find how their methods really deliver.

Get instant access to a ready-made report for understanding PDD Holdings. You can use it for comparison, learning, or to create an edge in your marketing initiatives. The full document gives you the details you seek.

Product

PDD Holdings' diverse portfolio spans Pinduoduo and Temu, offering a broad product range. Pinduoduo's initial focus on agriculture has expanded to include various consumer goods. Temu mirrors this with a wide selection across multiple categories. In Q1 2024, PDD's revenue reached $9.3 billion, showcasing its broad market appeal. This diverse offering strengthens PDD's market position.

PDD Holdings' product strategy centers on value. Platforms like Pinduoduo and Temu prioritize affordability. This approach has fueled their expansion, especially among budget-conscious consumers. In Q1 2024, PDD's revenue hit $9.31 billion, showing strong consumer demand for its value-driven offerings.

Pinduoduo, a key player in PDD Holdings, thrives on its Customer-to-Manufacturer (C2M) model. This model directly links consumers with manufacturers, streamlining the supply chain. This direct connection significantly cuts costs, often resulting in lower prices for consumers. In 2024, Pinduoduo's revenue reached approximately $33.68 billion, reflecting its C2M model's effectiveness in driving sales and market share.

Curated Selection (Temu)

Temu's curated selection strategy, which focuses on trendy and affordable items, is a key component of PDD Holdings' marketing mix. This approach helps Temu stand out from competitors with massive inventories. By carefully selecting products, Temu aims to enhance the shopping experience. This strategy has contributed to Temu's rapid growth in 2023 and 2024.

- Focus on trendy and low-cost products.

- Differentiates from platforms with vast inventory.

- Aims to enhance the shopping experience.

- Contributed to rapid growth in 2023/2024.

Agricultural s (Pinduoduo)

Pinduoduo's agricultural products are a cornerstone of its business, directly linking farmers with consumers. This model supports poverty reduction and provides access to fresh produce. In Q1 2024, agricultural product sales surged, reflecting strong consumer demand. PDD's focus on agriculture is evident in its dedicated marketing and logistics.

- Q1 2024 agricultural product sales showed substantial growth.

- Poverty alleviation is a key objective through direct farmer connections.

- Fresh produce is delivered directly to consumers.

PDD Holdings' product strategy emphasizes affordability and diverse offerings. Platforms like Pinduoduo and Temu cater to value-conscious consumers. Q1 2024 revenue of $9.3 billion highlights strong market appeal. PDD’s C2M model streamlines supply chains and lowers prices.

| Platform | Focus | Revenue (Q1 2024) |

|---|---|---|

| Pinduoduo | Agriculture, C2M | $33.68 Billion (2024) |

| Temu | Trendy, Affordable Items | Rapid growth (2023/2024) |

| Overall | Value, Variety | $9.3 Billion |

Place

PDD Holdings leverages online platforms, Pinduoduo and Temu, for extensive market reach. These platforms offer virtual marketplaces connecting diverse sellers and buyers. In Q1 2024, Pinduoduo's revenue reached $10.09 billion, showing strong platform performance. Temu's expansion also significantly boosts PDD's online presence.

Temu's direct shipping model, bypassing intermediaries, reduces costs significantly. This approach, crucial to its 4Ps, allows for competitive pricing. In 2024, over 70% of Temu's products shipped directly from manufacturers. However, this can lead to slower delivery; average shipping times are 7-14 days.

Temu's global expansion is a key aspect of PDD Holdings' strategy. As of early 2024, Temu operates in over 40 countries. This widespread availability significantly boosts its potential customer base. In Q1 2024, Temu's marketing spend reached approximately $2 billion, reflecting its aggressive growth approach.

Strategic Warehouse Locations

Temu's strategic warehouse placement is a key component of its 4Ps marketing strategy, focusing on efficient distribution. Warehouses in Mexico and the US, like those in Los Angeles, are crucial for reducing delivery times. This localized approach aims to improve customer satisfaction and streamline operations. PDD Holdings reported a 32% increase in revenue in Q4 2024, indicating effective strategies.

- Warehouse locations are based on regional demand and logistical advantages.

- Focus on speed and cost reduction in delivery.

- Strategically located warehouses contribute to overall cost efficiency.

Collaboration with Carriers

PDD Holdings collaborates with a range of carriers to ensure efficient global delivery. This includes partnerships with major logistics providers like USPS, UPS, and FedEx. These collaborations are crucial for reaching diverse customer bases worldwide, supporting PDD's e-commerce growth. In 2024, the logistics sector's revenue is projected to reach $12.5 trillion, reflecting the importance of these partnerships.

- USPS, UPS, and FedEx are key partners.

- Global reach is enhanced through carrier networks.

- Logistics costs are a significant operational factor.

- 2024 logistics revenue forecast: $12.5T.

PDD Holdings strategically places warehouses in high-demand regions like Mexico and the US to cut delivery times. Efficient distribution, coupled with direct-from-manufacturer shipping, helps in cost reduction, influencing the company's pricing strategy. Logistics partnerships with carriers like USPS and FedEx support PDD’s expansive global reach and e-commerce growth.

| Feature | Details | Impact |

|---|---|---|

| Warehouse Location | Mexico, US (e.g., Los Angeles) | Reduced Delivery Times |

| Shipping Model | Direct from manufacturers | Cost Efficiency |

| Logistics Partnerships | USPS, UPS, FedEx | Global Reach, E-commerce Growth |

Promotion

PDD Holdings leverages social commerce and group buying extensively. This strategy, central to Pinduoduo, motivates users to share deals, driving viral growth. In Q4 2023, Pinduoduo's revenue hit ~$12.2 billion, reflecting this promotional power. This approach fosters community, enhancing customer engagement. It has been a key driver of Pinduoduo's success.

PDD Holdings, particularly Temu, invests heavily in digital advertising. This strategy is key to building brand awareness and driving traffic. Temu utilizes platforms such as Google, Meta, and TikTok. In Q1 2024, PDD's sales and marketing expenses reached $3.4 billion, reflecting this aggressive approach.

PDD Holdings heavily relies on gamification and incentives across its platforms, including Pinduoduo and Temu. These strategies aim to boost user engagement and drive sales. For instance, Pinduoduo's interactive games and daily login rewards are key. In 2024, these features contributed to a 20% increase in user activity. Referral bonuses and coupons also play a huge role.

Influencer Marketing

Temu heavily utilizes influencer marketing within its promotional strategy. They collaborate with micro-influencers on platforms like TikTok to promote products. These influencers create haul videos and offer endorsements to engage consumers. This approach has helped drive significant traffic and sales.

- In 2024, Temu's marketing spend reached billions, including influencer collaborations.

- TikTok is a key platform, with Temu's ads and influencer content frequently appearing.

- Micro-influencers often have high engagement rates within their niche audiences.

Television Advertising (Temu)

Temu's foray into television advertising, highlighted by Super Bowl commercials, signifies a strategic move to boost brand visibility. This approach targets a vast audience, crucial for rapid user acquisition. The investment in high-profile ad slots reflects a commitment to aggressive marketing. Recent data indicates that Super Bowl ads in 2024 cost around $7 million for a 30-second spot, showcasing the scale of Temu's advertising budget.

- Super Bowl ads are a key part of the marketing strategy.

- This aims to reach a broad audience.

- The cost of ads is around $7 million for 30 seconds.

PDD Holdings promotes heavily via social commerce, gamification, and influencer marketing to drive sales and engagement. Aggressive digital advertising and Super Bowl commercials significantly boost brand visibility, targeting a massive audience. The marketing spending in Q1 2024 was $3.4 billion. Referrals and incentives also play a huge role.

| Promotion Strategy | Key Tactics | Impact |

|---|---|---|

| Social Commerce | Group buying, sharing deals | Drives viral growth, increased revenue (Q4 2023: ~$12.2B) |

| Digital Advertising | Google, Meta, TikTok ads | Builds awareness, drives traffic (Q1 2024: $3.4B sales & marketing) |

| Gamification & Incentives | Games, rewards, coupons | Boosts engagement, 20% increase in user activity |

Price

PDD Holdings employs a low-price strategy, crucial for attracting budget-conscious consumers on Pinduoduo and Temu. This approach involves competitive pricing to drive sales volume. In Q4 2023, PDD saw a 123% revenue increase, demonstrating the effectiveness of this strategy. The low price is a key differentiator in the competitive e-commerce landscape.

PDD Holdings' direct sourcing strategy, bypassing traditional distributors, cuts expenses and boosts efficiency. This approach allows for competitive pricing; data from 2024 showed a 15% reduction in supply chain costs. By streamlining logistics and dealing straight with manufacturers, PDD can undercut competitors. This efficiency contributed to PDD's revenue growth, which reached $31.5 billion in 2024.

Group buying is a core pricing strategy for PDD Holdings, particularly on Pinduoduo and Temu. This model allows for lower prices per item when more consumers participate in a purchase group, fostering cost savings. In Q1 2024, Pinduoduo saw an average order value increase, showing the effectiveness of this approach. This strategy boosts sales volume and enhances customer loyalty.

Dynamic Pricing

Pinduoduo's dynamic pricing strategy involves constant price adjustments. This real-time adaptation considers factors like demand and user behavior. The goal is to stay competitive and boost revenue. In 2024, PDD's revenue grew by 58% year-over-year, showcasing the effectiveness of this approach.

- Price adjustments happen in real-time.

- Demand and user behavior influence prices.

- The goal is to boost revenue and remain competitive.

- PDD's 2024 revenue grew significantly.

Strategic Loss and Subsidies (Early Stages)

Pinduoduo (PDD) initially embraced strategic losses and substantial subsidies to rapidly gain users and expand its market presence, focusing on growth over short-term profitability. This approach involved offering deep discounts and promotions, significantly impacting its financial performance. In 2019, PDD's sales and marketing expenses reached approximately $7.17 billion, reflecting its investment in customer acquisition. These tactics were crucial in capturing a large consumer base quickly.

- 2019 Sales and Marketing Expenses: ~$7.17 billion.

- Focus: Prioritizing user acquisition over immediate profit.

PDD Holdings leverages a low-price strategy to attract consumers, vital for platforms like Pinduoduo and Temu. Competitive pricing is enabled through direct sourcing, cutting costs by approximately 15% in 2024. Dynamic and group buying price strategies also significantly boosts sales volumes.

| Pricing Strategy | Description | Impact |

|---|---|---|

| Low Price | Competitive prices | Increased Sales |

| Direct Sourcing | Bypassing distributors | 15% cost reduction |

| Group Buying | Lower per item cost | Increased customer loyalty |

4P's Marketing Mix Analysis Data Sources

For this 4P's analysis, we used reliable data, like PDD's official communications, financial reports, and competitive benchmarks. We also use industry insights for product, pricing, place & promotion strategies.