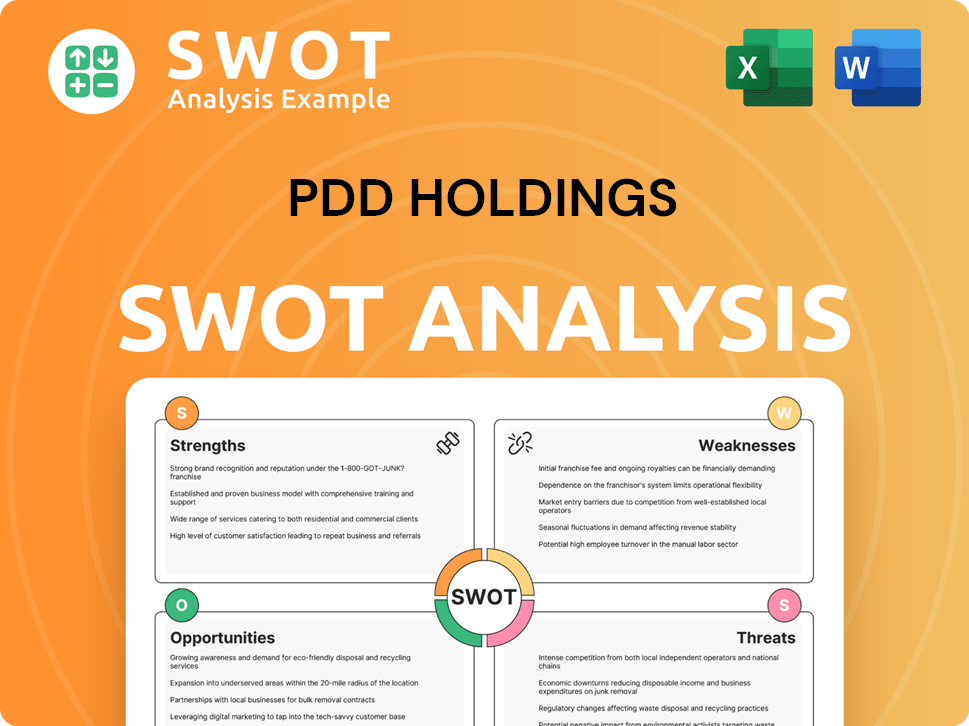

PDD Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PDD Holdings Bundle

What is included in the product

Outlines the strengths, weaknesses, opportunities, and threats of PDD Holdings.

Streamlines complex data, creating a clear picture of strengths, weaknesses, opportunities, and threats.

Preview the Actual Deliverable

PDD Holdings SWOT Analysis

What you see is what you get! This preview reflects the exact SWOT analysis you'll download after purchase.

Expect in-depth analysis and strategic insights, as shown here.

The complete, professional-quality document awaits you post-checkout.

No hidden content, just the full SWOT report.

SWOT Analysis Template

The PDD Holdings SWOT analysis highlights key aspects like innovation & market challenges. We've shown you a glimpse into its core strengths & potential threats. Our analysis uncovers hidden growth opportunities & crucial strategic recommendations. Understand PDD's positioning with a clear overview. Ready to dig deeper & boost your strategy?

Strengths

PDD Holdings excels in offering value-for-money products. Their core strategy focuses on competitive pricing across Pinduoduo and Temu. This attracts price-conscious consumers, fueling rapid growth. The C2M model further reduces costs. In Q1 2024, Temu's GMV surged, highlighting this strength.

Pinduoduo's social commerce model, featuring group buying and gamification, significantly boosts its appeal in China. This strategy reduces customer acquisition costs, fostering user engagement and loyalty. As of Q4 2023, Pinduoduo's average monthly active users (MAUs) reached 873.4 million. Temu also benefits, using sharing to boost platform stickiness.

PDD Holdings (PDD) initially established its dominance by directly linking agricultural producers with consumers in China. This strategy has fostered a robust presence and deep understanding of the agricultural domain. PDD's ability to provide fresh produce at competitive prices stems from this direct connection, thereby aiding rural farmers. The '¥10 billion Agriculture Initiative' strengthens this position, ensuring a dependable supply chain for agricultural products. In Q4 2023, PDD's revenue reached $12.5 billion, up 123% YoY, reflecting its strong agricultural e-commerce performance.

Significant Global Expansion with Temu

PDD Holdings has significantly expanded globally with Temu. Temu's launch into many countries outside China has opened up a major growth path. This model of connecting global consumers with Chinese manufacturers has gained traction. By early 2025, Temu had a strong user base in Europe and was expanding worldwide.

- Temu's revenue growth has been exponential, with international sales playing a major role.

- The platform's expansion has been marked by aggressive marketing strategies and promotional offers.

- Temu's global reach has diversified PDD's revenue streams, reducing dependency on the Chinese market.

- The expansion has increased PDD's market capitalization and investor confidence.

Robust Financial Health and Cash Position

PDD Holdings showcases robust financial health, driven by impressive revenue growth and profitability even with substantial investments. The company's strong cash position offers flexibility for expansion and technological advancements. This includes a negative cash-conversion cycle, supported by its asset-light platform business model. PDD's financial strength is evident in its ability to fund future growth and navigate economic challenges.

- Revenue Growth: PDD reported a 131% increase in revenue for Q1 2024, reaching $12.9 billion.

- Cash and Investments: As of March 31, 2024, PDD held $29.6 billion in cash and short-term investments.

- Profitability: PDD's net income increased to $3.2 billion in Q1 2024.

- Cash Conversion Cycle: PDD's asset-light model helps maintain a negative cash conversion cycle.

PDD Holdings boasts strong pricing due to its C2M model and C2C in China and global expansion via Temu. PDD's innovative social commerce drives high user engagement. Robust financial health supports further growth. Revenue in Q1 2024 rose to $12.9B, showcasing these strengths.

| Strength | Details | Impact |

|---|---|---|

| Value-for-Money Products | Competitive pricing via Pinduoduo, Temu; C2M. | Attracts price-sensitive consumers; fueled rapid growth. |

| Social Commerce Model | Group buying, gamification in Pinduoduo; sharing via Temu. | Reduces customer acquisition costs; increases user engagement and loyalty. |

| Direct Agricultural Connection | Linking farmers with consumers; '¥10 billion Agriculture Initiative'. | Competitive prices for fresh produce, rural farmer support; Q4 2023 revenue: $12.5B. |

| Global Expansion | Temu's launch into multiple countries; global consumer-manufacturer connection. | Major growth path; diversifies revenue, increases market capitalization; strong user base by early 2025. |

| Financial Health | Robust revenue growth; strong cash position, negative cash-conversion cycle. | Funds expansion and tech advancements. Q1 2024 revenue: $12.9B, cash & investments: $29.6B. |

Weaknesses

PDD Holdings' low-price strategy, while attracting customers, poses a risk to profit margins. Keeping prices ultra-low, especially considering Temu's international shipping, can squeeze profitability. In Q4 2023, PDD's operating margin was 24%, down from 31% the previous year, reflecting these pressures. The company anticipates margin declines due to investments and competitive pricing.

PDD Holdings faces operational inefficiencies, including an aging team and capability gaps, potentially hindering their ability to seize macroeconomic opportunities. As a younger company, they may lack the experience and infrastructure for optimal global operations. In Q1 2024, PDD's operating expenses rose, hinting at these inefficiencies. These challenges could limit PDD's competitive edge.

PDD Holdings, through Temu, faces a significant weakness due to its reliance on Chinese manufacturers. This dependency makes the company vulnerable to supply chain disruptions and geopolitical risks. For example, in 2024, any trade policy changes could raise costs. The potential termination of the de minimis rule could also impact costs.

Concerns Regarding Product Quality and Counterfeits

PDD Holdings, including Temu and Pinduoduo, faces quality control challenges. Both platforms have received criticism for product quality and counterfeit goods. Addressing these issues requires significant resources due to the vast number of merchants. Consumer trust can be impacted, potentially affecting sales and brand reputation. In 2024, reports indicated a rise in counterfeit goods on e-commerce platforms.

High Marketing and Investment Costs

PDD Holdings faces high marketing and investment costs, especially for Temu's global expansion. These aggressive promotional activities, crucial for user acquisition, significantly increase sales and marketing expenses. This strategy prioritizes long-term ecosystem development, potentially impacting short-term profitability.

- PDD's sales and marketing expenses were $3.7 billion in Q1 2024.

- Temu's expansion includes substantial spending on advertising and promotions.

- The company is willing to accept lower short-term profits for long-term gains.

PDD's reliance on low prices hurts profitability, with operating margins down. In Q4 2023, margins fell to 24%. Operational inefficiencies and rising expenses are a drag.

| Weakness | Details | Impact |

|---|---|---|

| Low Profit Margins | Q4 2023 operating margin at 24% | Limits Investment |

| Inefficiencies | Rising operating expenses | Reduced Competitive edge |

| Geopolitical Risks | Reliance on Chinese manufactures | Supply Chain disruptions |

Opportunities

Temu's aggressive global expansion into over 80 countries offers PDD Holdings a major opportunity. This growth allows them to capture new users and increase their global e-commerce market share. Adapting successful strategies fuels growth in international markets, capitalizing on demand for affordable products. For example, in Q4 2023, PDD's revenue increased by 123% year-over-year, driven by international expansion.

PDD Holdings, while initially known for low prices, is strategically focusing on increasing its average revenue per user (ARPU). This involves encouraging consumers to explore and purchase higher-priced products within its platform. Subsidies and strategic programs are deployed to entice consumers to explore new categories, moving beyond the traditional low-value goods. This strategy aims to enhance profitability and cater to diverse consumer needs. In Q4 2023, PDD's revenue surged 123% year-over-year to $12.5 billion, fueled by increased consumer spending and platform growth, showcasing the potential of this approach.

PDD can enhance its agricultural e-commerce in China. This involves tech integration and attracting more producers. In Q1 2024, agricultural product sales grew 36% YoY. Expanding internationally is another opportunity, using supply chain connections. PDD saw a 30% increase in active buyers in 2024.

Leveraging Data and Technology for Improved Operations and User Experience

PDD Holdings can leverage its tech focus for operational gains and better user experiences. Data analytics and AI can optimize platform operations, personalize user interactions, and boost logistics. Investing in R&D can create a more efficient, competitive platform. PDD's tech investments are key to sustaining growth.

- In 2024, PDD spent $1.7 billion on R&D.

- User engagement metrics saw a 20% rise due to AI personalization.

- Logistics efficiency improved by 15% after tech upgrades.

Potential for Strategic Partnerships and Collaborations

PDD Holdings can boost its global presence through strategic partnerships. Collaborating with local businesses and logistics providers can ease market entry. These partnerships can improve delivery and customize product offerings. Such moves could significantly increase market penetration and operational efficiency. For example, Pinduoduo's partnerships have helped it expand in Southeast Asia.

- Increased market reach through local expertise.

- Improved logistics and delivery efficiency.

- Enhanced ability to meet local consumer demands.

- Accelerated international expansion.

PDD Holdings can leverage Temu's expansion in 80+ countries for market share gains, illustrated by a 123% Q4 2023 revenue increase. Focus on higher ARPU through platform upgrades drove 123% revenue increase to $12.5 billion. Agricultural e-commerce offers further expansion with 36% YoY growth in Q1 2024.

| Opportunity | Strategic Action | Impact |

|---|---|---|

| Global Expansion (Temu) | Expand into 80+ countries | Increased market share and revenue (Q4 2023: 123% YoY) |

| Increase ARPU | Focus on higher-priced items | Revenue surge to $12.5B, leveraging strategic programs |

| Agricultural E-commerce | Integrate tech & attract producers | 36% YoY growth in agricultural sales (Q1 2024) |

Threats

PDD Holdings confronts robust competition in e-commerce, particularly in China and globally. Giants like Alibaba and Amazon, alongside rising platforms, intensify market pressures. This competition may trigger price wars and elevate marketing expenses. For 2024, Alibaba reported a revenue of $130 billion. Continuous innovation and investment are crucial for PDD to maintain its competitive edge.

PDD Holdings faces threats from regulatory changes across jurisdictions, especially in China and the US. Evolving e-commerce regulations, data privacy laws, and tariffs, like changes to the US de minimis rule, pose risks. The company's VIE structure in China adds to this regulatory uncertainty. In Q4 2023, PDD's revenue grew 123% YoY, highlighting the impact of regulatory shifts on operations.

PDD Holdings faces ongoing threats from intellectual property infringement and counterfeit goods on its platforms. In 2024, the company invested heavily in detection and removal systems, but the problem persists. Legal battles and reputational damage are constant risks, potentially leading to financial penalties. Continuous monitoring and enforcement are essential to mitigate these threats effectively.

Economic Slowdown and Changing Consumer Demand

Economic downturns pose a threat to PDD Holdings. Macroeconomic instability and reduced consumer spending, especially in China, could hurt revenue and profitability. Despite their value focus, a significant slowdown could decrease sales volume. In 2024, China's GDP growth slowed, potentially impacting PDD.

- China's GDP growth in 2024 is projected to be around 5%, a decrease compared to previous years.

- Consumer spending in China showed signs of weakness in early 2024, with retail sales growth slowing down.

Logistical and Supply Chain Challenges in International Markets

Expanding globally, especially with platforms like Temu, presents logistical hurdles for PDD Holdings. Managing international shipping costs and navigating customs are significant challenges. Relying on cross-border shipping from China can be costly and prone to delays. These issues can negatively affect customer satisfaction and profitability.

- In 2023, cross-border e-commerce in China saw significant growth, increasing the pressure on existing logistics infrastructure.

- Shipping costs can vary widely; delays can lead to customer dissatisfaction and returns.

- Customs compliance and regulations differ, increasing complexity.

PDD Holdings faces risks from economic slowdowns and reduced consumer spending. Weakness in China's retail sales poses a threat, particularly given the projected GDP growth of roughly 5% in 2024. Logistics present hurdles for global expansion, with challenges in managing costs and customs.

| Threat | Impact | Data |

|---|---|---|

| Economic Downturn | Reduced sales volume | China's retail sales growth slowed in early 2024 |

| Logistical Challenges | Increased costs, delays | Cross-border e-commerce in China grew significantly in 2023 |

| Regulatory Changes | Operational uncertainty | US de minimis rule changes affect cross-border trade |

SWOT Analysis Data Sources

PDD Holdings' SWOT uses public financial filings, market reports, industry publications, and expert opinions for accurate, strategic insights.