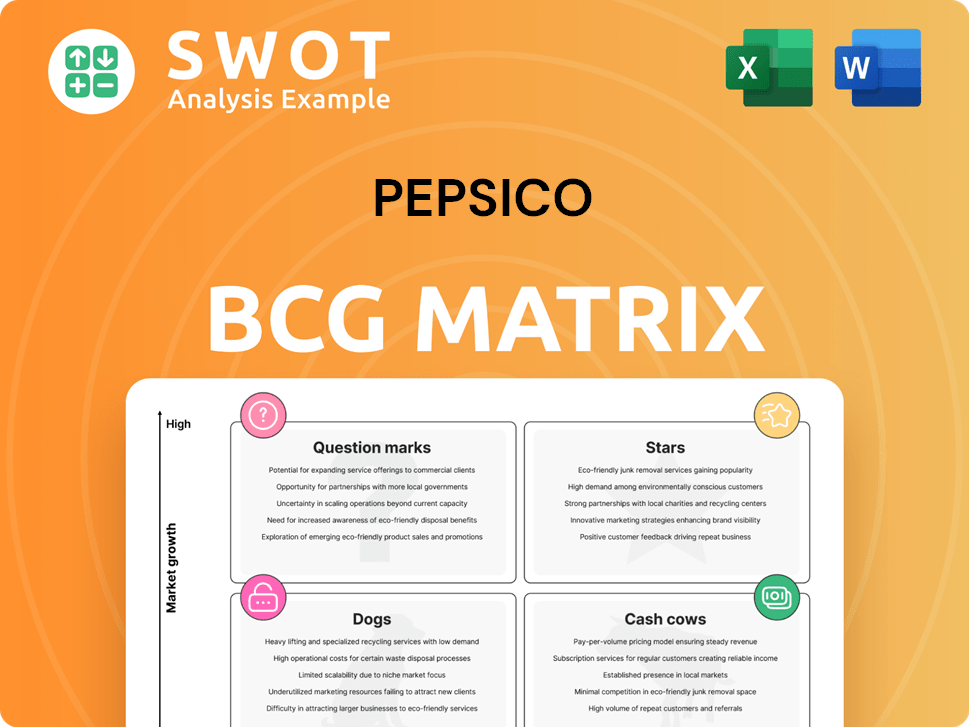

PepsiCo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PepsiCo Bundle

What is included in the product

PepsiCo's BCG Matrix assesses its diverse portfolio, revealing growth opportunities and areas needing strategic adjustments.

The PepsiCo BCG Matrix offers a clean, distraction-free view optimized for C-level presentation.

What You See Is What You Get

PepsiCo BCG Matrix

The BCG Matrix preview mirrors the complete, purchasable PepsiCo analysis. This is the identical, watermark-free report you'll receive, providing a full strategic overview. Download the ready-to-use file immediately after purchase.

BCG Matrix Template

PepsiCo's vast portfolio presents a complex BCG Matrix. Snacks and beverages occupy different quadrants, impacting resource allocation. Analyzing each brand's market share and growth potential is key. This matrix guides investment decisions, from "Stars" to "Dogs." Understand PepsiCo's competitive landscape with a strategic lens.

The complete BCG Matrix reveals exactly how this company is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Gatorade, a key player in PepsiCo's portfolio, is a Star. It commands a substantial market share in the sports drink category. In 2024, Gatorade's revenue grew, driven by innovation. New lines like Hydration Boosters fueled its success. This growth aligns with a booming market.

Lay's, a key player in PepsiCo's portfolio, is a Star. It generates significant revenue, bolstered by global brand recognition and consistent innovation. Lay's leverages its strong position in the snack food market, which is projected to reach $525 billion by 2024. The brand's ability to meet diverse consumer preferences ensures its continued growth.

Pepsi Zero Sugar, a rising star, has shown strong growth. In 2024, it saw double-digit net revenue gains. This success highlights the demand for low-sugar drinks. The brand benefits from health trends, securing its future.

Emerging Market Growth

PepsiCo's strong presence in emerging markets, such as Asia-Pacific and Latin America, fuels its growth. These regions offer substantial revenue and market share opportunities. PepsiCo strategically invests and tailors products for these markets. This strategy has bolstered its "Star" status in the BCG Matrix.

- Asia-Pacific and Latin America sales saw growth in 2024.

- Investments in these regions are part of PepsiCo's long-term strategy.

- Tailored products cater to local consumer preferences.

- Emerging markets' growth supports PepsiCo's overall revenue.

Functional Hydration Beverages

PepsiCo's functional hydration beverages, such as Propel, are a Star in its BCG Matrix. These products meet the rising demand for beverages with health benefits, including added vitamins and electrolytes. The functional hydration segment is experiencing significant growth, with the global market valued at $25.8 billion in 2024. This growth is fueled by health-conscious consumers.

- Propel's sales grew by 8% in 2024.

- The functional beverage market is projected to reach $35 billion by 2027.

- PepsiCo invests heavily in innovation for functional drinks.

PepsiCo's Stars—like Gatorade and Lay's—hold significant market share. These brands drive revenue, supported by innovation and strong brand recognition. The snack food market is expected to reach $525 billion by year-end 2024, fueling growth.

| Star Brands | 2024 Revenue (Estimated) | Market Share |

|---|---|---|

| Gatorade | $7B | 70% Sports Drinks |

| Lay's | $8B | 30% Snack Foods |

| Pepsi Zero Sugar | $2B | 15% Carbonated Drinks |

Cash Cows

Pepsi-Cola, a cash cow in PepsiCo's portfolio, consistently generates significant revenue. Despite market competition, its brand recognition ensures stable cash flow. In 2024, PepsiCo's net revenue reached approximately $91.47 billion, with Pepsi-Cola contributing substantially to this figure. The brand's global presence ensures enduring strength.

Frito-Lay North America, a cash cow for PepsiCo, boasts brands like Doritos and Cheetos. Despite volume declines, its strong market share ensures consistent cash flow. The snack food giant maintains its dominance. The Simply line relaunch targets sustained market position. In 2024, Frito-Lay's revenue reached approximately $28 billion.

Aquafina, a key part of PepsiCo's portfolio, is a solid Cash Cow. It boasts strong brand recognition and a vast distribution network, ensuring consistent cash flow. The bottled water market, though mature, still provides reliable demand for Aquafina. In 2024, the bottled water market was valued at approximately $35 billion, with Aquafina holding a significant market share, contributing to its steady performance.

Mountain Dew

Mountain Dew, a key "Cash Cow" for PepsiCo, boasts a strong brand and loyal following, especially with younger consumers. Its widespread availability and steady demand ensure consistent revenue. Despite competition, Mountain Dew's established market position solidifies its role in generating cash flow for PepsiCo. In 2024, Mountain Dew's sales contributed significantly to PepsiCo's overall revenue, reflecting its continued success.

- Strong Brand Recognition

- Consistent Revenue Generation

- Loyal Consumer Base

- Established Market Presence

Tropicana

Tropicana, a prominent juice brand under PepsiCo, functions as a Cash Cow due to its strong brand recognition and established market presence. Although facing some market challenges, its extensive distribution network ensures consistent cash flow. Tropicana's long-standing position in the juice sector solidifies its Cash Cow status. Its steady revenue generation is supported by consumer loyalty. In 2024, Tropicana’s revenue contributed significantly to PepsiCo’s overall beverage sales.

- Brand recognition and distribution network support steady cash generation.

- Established position in the juice category.

- Contributes to PepsiCo’s overall beverage sales.

- Steady revenue generation.

PepsiCo's Cash Cows, like Pepsi-Cola, Frito-Lay, and Aquafina, consistently generate substantial revenue due to strong brand recognition and market presence. These brands ensure steady cash flow, exemplified by Frito-Lay's approximately $28 billion in 2024 revenue. Tropicana and Mountain Dew contribute significantly as well.

| Brand | Category | 2024 Revenue (approx.) |

|---|---|---|

| Pepsi-Cola | Beverages | Significant |

| Frito-Lay | Snacks | $28 Billion |

| Aquafina | Bottled Water | Significant |

| Mountain Dew | Beverages | Significant |

| Tropicana | Juice | Significant |

Dogs

Certain Quaker Foods products, like some cereals and snacks, are considered "Dogs" in PepsiCo's BCG matrix. These items have low market share in a slow-growing market, facing issues like product recalls. The Quaker recall in late 2023 significantly impacted sales. For example, in Q4 2023, PepsiCo's North America Beverages organic revenue grew 7%, while Quaker Foods saw a 1% decline.

7UP Nimbooz could be a Dog in some areas due to low market share and growth. PepsiCo's other drinks might outshine it. Poor market presence and growth potential make it a Dog. In 2024, it faces strong competition.

Some regional beverage brands within PepsiCo's portfolio, such as certain juice or tea brands, may have limited market share and growth potential. These brands may not receive the same level of investment or marketing support as global powerhouses like Pepsi or Gatorade. Their localized presence and slower growth rates could classify them as "Dogs" in the BCG Matrix. For example, in 2024, PepsiCo's focus on core brands saw some regional products deprioritized.

Products with Declining Health Perception

Products like sugary snacks and sodas, viewed as unhealthy, are "Dogs" in PepsiCo's portfolio. These items often see low growth and market share due to health trends. Consumers are increasingly opting for healthier options, impacting these products. For instance, in 2024, sales of carbonated soft drinks declined by 1.5% in North America.

- Decline in sales for sugary drinks due to health awareness.

- Low growth potential and limited market share.

- Consumers are switching to healthier alternatives.

- Impacted by changing consumer preferences.

Divested or Discontinued Products

Products PepsiCo divested or discontinued due to poor performance or strategic shifts are "Dogs." These no longer boost revenue or growth. Divestitures show a move toward higher-growth sectors.

- In 2024, PepsiCo likely continued to streamline its portfolio.

- Specific product exits are part of ongoing portfolio adjustments.

- Divestments help PepsiCo focus on key brands.

- This strategy aims to boost overall financial performance.

In PepsiCo's BCG matrix, "Dogs" are products with low market share in slow-growing markets, often facing sales declines.

This includes certain Quaker products, regional beverages, and unhealthy items like sugary drinks, impacted by health trends and changing consumer preferences.

PepsiCo divests or discontinues these underperforming products to focus on growth, like in 2024, where carbonated soft drinks sales declined by 1.5% in North America.

| Category | Characteristics | Examples |

|---|---|---|

| Products | Low growth, market share decline | Quaker, 7UP Nimbooz, some regional drinks |

| Drivers | Health trends, consumer shifts | Sugar drink sales down 1.5% in 2024 |

| Strategy | Divestment, streamlining | Focus on core brands |

Question Marks

Poppi, the prebiotic soda brand, fits into PepsiCo's BCG Matrix as a Question Mark. It has high growth potential in the health-conscious beverage sector, valued at $2.6 billion in 2024. However, Poppi's market share is still small compared to giants. PepsiCo hopes to boost sales, aiming to capitalize on the functional beverage trend, with a projected CAGR of 12.6% through 2030.

Siete Family Foods, part of PepsiCo, competes in the "better-for-you" snack sector. It aims to gain market share with healthier ingredients and innovative products. However, its market share is currently lower than larger snack brands. PepsiCo's net revenue in 2023 reached over $91.47 billion.

PepsiCo's plant-based ventures, like snacks and beverages, are Question Marks. They tap into the rising plant-based trend, aiming for health-focused consumers. Despite potential, these products face low market share, requiring investments. PepsiCo's 2024 revenue was about $91.47 billion, with plant-based still a small portion.

Functional Beverage Enhancers

PepsiCo's functional beverage enhancers are positioned as Question Marks in the BCG Matrix. These products, including tablets and enhancers, cater to the rising consumer interest in customized, health-conscious hydration. Despite their innovative approach, they currently hold a relatively small market share compared to PepsiCo's established beverage brands. The success of these products hinges on their ability to capture a significant portion of the expanding market for personalized beverages. PepsiCo's strategic investments and marketing efforts will be crucial in determining if these products can transition from Question Marks to Stars.

- PepsiCo's beverage revenue in 2023 was approximately $27 billion.

- The functional beverage market is projected to reach $150 billion by 2028.

- PepsiCo's innovation spending in 2024 is around $3 billion.

Emerging Health-Focused Beverage Lines

Emerging health-focused beverage lines, such as those with added vitamins or electrolytes, are considered "question marks" in PepsiCo's BCG matrix. These products target the growing wellness market and health-conscious consumers. Currently, they hold a low market share, signifying high potential with uncertain outcomes. Strategic marketing and investment are essential to boost growth and market penetration.

- Market share is low, indicating high growth potential.

- Requires significant investment and strategic marketing.

- Focuses on health-conscious consumers and wellness trends.

- Examples include beverages with added vitamins or electrolytes.

PepsiCo's Question Marks include Poppi and emerging health beverages, indicating high growth but low market share. These products require significant investment and marketing to capture the health-conscious consumer market. PepsiCo's innovation spending in 2024 is about $3 billion, supporting these ventures.

| Product Category | Market Share | Growth Potential |

|---|---|---|

| Poppi | Small | High |

| Plant-Based | Low | High |

| Functional Beverages | Small | High |

BCG Matrix Data Sources

The PepsiCo BCG Matrix leverages public financial filings, market analysis, and industry reports for rigorous evaluation.