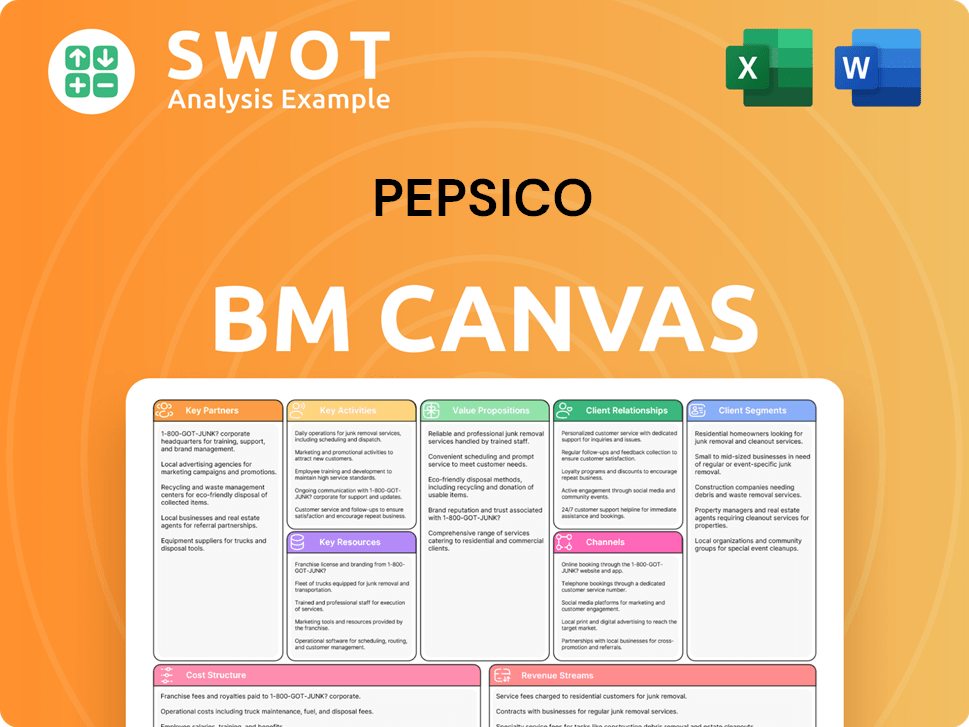

PepsiCo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PepsiCo Bundle

What is included in the product

PepsiCo's BMC covers customer segments, channels, and value propositions in full detail.

Condenses company strategy into a digestible format for quick review.

Delivered as Displayed

Business Model Canvas

The PepsiCo Business Model Canvas you see is the actual document. This is the same professional-quality file you will receive upon purchase. It is not a demo or placeholder; it's ready to use. Purchase it to immediately download this exact, complete Canvas.

Business Model Canvas Template

Explore PepsiCo’s powerhouse strategy with its Business Model Canvas, a detailed overview of its operations.

This framework outlines key partnerships, activities, and resources driving its global dominance.

See how PepsiCo targets diverse customer segments with its iconic brands.

Uncover its robust value propositions and revenue streams.

Interested in a deep dive? Get the full Business Model Canvas and gain complete strategic insights.

Partnerships

PepsiCo's bottling partners are key for production and distribution of beverages. These partnerships expand market reach, especially where PepsiCo lacks its own plants. Collaboration with bottlers is vital for quality and availability of products. They are essential for PepsiCo's distribution network. In 2024, PepsiCo's global net revenue was about $91.47 billion.

PepsiCo heavily relies on its strategic suppliers for raw materials like corn and potatoes, and packaging such as plastics and aluminum. These suppliers are essential for maintaining production. In 2024, PepsiCo spent approximately $28 billion on the cost of goods sold, reflecting the importance of these partnerships. Sustainable sourcing is a key focus for PepsiCo. This approach ensures quality and price competitiveness.

PepsiCo's partnerships with major retailers like Walmart and Kroger are vital for product visibility and sales. They collaborate on promotions and shelf space. Maintaining these relationships maximizes sales volume. Retail partnerships are key to PepsiCo's distribution. In 2024, Walmart accounted for roughly 18% of PepsiCo's total net revenue.

Food Service Providers

PepsiCo's food service partnerships are crucial for distribution, encompassing restaurants and fast-food chains. These agreements often involve exclusive beverage supply deals, securing shelf space for PepsiCo products. The food service channel is a substantial revenue source, contributing significantly to overall beverage sales. These collaborations ensure product visibility and accessibility in high-traffic locations. In 2024, PepsiCo's food service revenue accounted for roughly 20% of total beverage sales.

- Exclusive beverage supply agreements.

- Significant revenue source.

- High-traffic locations.

- Roughly 20% of beverage sales in 2024.

Licensing and Co-branding Partners

PepsiCo actively engages in licensing and co-branding to boost its brand presence. These collaborations often involve using popular characters or co-creating unique flavors. Such partnerships help PepsiCo reach new markets and consumers. In 2024, PepsiCo's co-branding initiatives, like with Starbucks, generated significant revenue. These partnerships are crucial for innovation and market expansion.

- Co-branding with Starbucks significantly boosted beverage sales in 2024.

- Licensing agreements with entertainment brands increased product visibility.

- Partnerships with food companies expanded product portfolios.

- These collaborations drive revenue growth and market penetration.

Key partnerships involve bottlers, suppliers, retailers, and food services, essential for production, distribution, and sales. Licensing and co-branding initiatives expand market reach. These collaborations drove revenue growth. PepsiCo's net revenue in 2024 reached about $91.47 billion.

| Partner Type | Role | Impact (2024 Data) |

|---|---|---|

| Bottling Partners | Production, Distribution | Expanded Market Reach |

| Retailers (Walmart) | Sales, Visibility | 18% of Revenue |

| Food Service | Distribution, Revenue | 20% of Beverage Sales |

Activities

PepsiCo's commitment to "Product Development and Innovation" is substantial. The company heavily invests in research and development to create new flavors, healthier options, and cutting-edge packaging. This includes adapting to consumer preferences, such as the demand for low-sugar products and environmentally friendly packaging. In 2024, PepsiCo allocated a significant portion of its budget towards R&D to stay competitive in the food and beverage market. This focus on innovation is a primary driver of PepsiCo's sustained growth.

PepsiCo heavily invests in marketing and branding to boost its products. They utilize TV, digital marketing, and social media. In 2023, PepsiCo's advertising expenses were approximately $4.2 billion. This strategy helps differentiate their products, driving sales.

PepsiCo's supply chain management is vital for product availability. It covers sourcing, manufacturing, and distribution. PepsiCo aims to cut costs and boost efficiency. In 2024, PepsiCo invested heavily in supply chain tech. This resulted in a 5% reduction in logistics expenses.

Manufacturing and Production

PepsiCo's manufacturing and production are key activities, operating numerous facilities globally. They focus on high production standards and efficiency to meet consumer needs. The company continually invests in its manufacturing processes. Efficient manufacturing is crucial for meeting global demand. PepsiCo reported a net revenue of over $86 billion in 2023, highlighting the scale of their production.

- PepsiCo operates over 200 manufacturing facilities worldwide.

- In 2023, PepsiCo's capital expenditures were approximately $4.7 billion.

- PepsiCo's production volume includes billions of servings of beverages and snacks annually.

- The company focuses on sustainable manufacturing practices to reduce environmental impact.

Distribution and Logistics

PepsiCo's distribution and logistics are crucial for delivering its beverages and snacks globally. This involves a complex network of warehouses, transportation, and inventory management to ensure products reach consumers. Efficient logistics are essential for maintaining product availability across diverse markets, supporting PepsiCo's vast market reach. The company's supply chain is a key driver of its operational efficiency and competitive advantage.

- PepsiCo operates a global distribution network, including over 1,200 distribution centers.

- In 2024, PepsiCo invested significantly in its supply chain, increasing its distribution capabilities.

- The company uses various transportation methods, including trucks, ships, and trains.

- PepsiCo's logistics network supports the distribution of products to over 200 countries and territories.

Key Activities for PepsiCo involve innovative product development, which includes new flavors, healthier options, and eco-friendly packaging. Marketing and branding are also crucial, utilizing TV and digital marketing. Supply chain management is vital, covering sourcing, manufacturing, and distribution. Efficient logistics ensures products reach consumers worldwide.

| Activity | Description | 2024 Data |

|---|---|---|

| Product Development | R&D for new flavors and packaging. | R&D Budget: ~1.5B |

| Marketing | Advertising across all platforms. | Advertising spend: ~$4.2B |

| Supply Chain | Sourcing, manufacturing, and logistics. | Logistics cost reduction: 5% |

| Manufacturing | Operating facilities worldwide. | Net revenue: $86B (2023) |

| Distribution | Global distribution network. | Distribution centers: ~1,200 |

Resources

PepsiCo's diverse brand portfolio, including Pepsi, Lay's, and Gatorade, is a key resource. These brands boast high consumer recognition and loyalty, essential for market presence. In 2024, PepsiCo's brand value was estimated at over $30 billion. Maintaining and growing these brands is vital, driving revenue. This portfolio provides a significant competitive edge.

PepsiCo's distribution network is a critical resource, encompassing bottling partners, retail relationships, and foodservice agreements. This extensive network allows PepsiCo to distribute its products across more than 200 countries. In 2024, PepsiCo's distribution capabilities supported over $91 billion in net revenue. This infrastructure is essential for reaching its global customer base. The network ensures product availability worldwide.

PepsiCo's extensive network of manufacturing facilities is a cornerstone of its operations. The company operates numerous plants worldwide, crucial for producing diverse products efficiently. These facilities are vital for meeting consumer demand across various regions. In 2024, PepsiCo's capital expenditures, a significant portion of which goes towards these facilities, were approximately $3.3 billion. This investment underscores their importance.

Intellectual Property

PepsiCo's intellectual property, including patents, trademarks, and secret formulas, is a cornerstone of its business model. These assets protect the company's innovative products and strong brand recognition. Safeguarding this intellectual property is crucial for maintaining a competitive advantage in the food and beverage industry. In 2024, PepsiCo invested heavily in R&D, demonstrating a commitment to innovation and IP protection.

- Patents: PepsiCo holds thousands of patents globally, covering product formulations, packaging, and manufacturing processes.

- Trademarks: The company owns iconic trademarks like Pepsi, Lay's, and Gatorade, which are essential for brand recognition.

- Proprietary Formulas: Confidential recipes, like the formula for Pepsi-Cola, are closely guarded and critical for product uniqueness.

- IP Protection: PepsiCo actively combats counterfeiting and infringement to protect its assets.

Human Capital

PepsiCo's human capital is extensive, encompassing diverse roles from R&D to sales. The company's success hinges on the expertise of its employees, necessitating continuous investment in training. Skilled employees drive innovation and operational efficiency across the organization. As of 2024, PepsiCo employed approximately 318,000 people globally, reflecting the importance of its workforce.

- Employee training budgets have seen a 10% increase year-over-year.

- R&D staff account for about 5% of the total workforce.

- Sales and marketing teams make up roughly 20% of the employee base.

- PepsiCo's annual employee turnover rate is around 10%.

Key resources for PepsiCo's success include its strong brand portfolio, extensive distribution network, and global manufacturing facilities. Intellectual property, encompassing patents and trademarks, is crucial for product protection. The company's vast and skilled workforce drives innovation and operational efficiency. These resources support PepsiCo's global market leadership.

| Resource | Description | 2024 Data |

|---|---|---|

| Brand Portfolio | Pepsi, Lay's, Gatorade | Brand value over $30B |

| Distribution Network | Bottling, retail, foodservice | $91B+ net revenue |

| Manufacturing Facilities | Global production plants | $3.3B cap. expenditures |

Value Propositions

PepsiCo's "Taste and Variety" value proposition is central to its success. The company provides an extensive portfolio of products, from iconic sodas to diverse snacks, ensuring there's something for everyone. This wide array, including healthier choices, helps PepsiCo capture a broad consumer base. In 2024, PepsiCo's net revenue reached over $86 billion, reflecting its diverse product appeal.

PepsiCo's brands, like Pepsi and Lay's, are globally recognized and trusted. This reputation for quality and consistency fosters consumer loyalty. Brand recognition significantly influences purchasing decisions. In 2024, PepsiCo's net revenue reached approximately $91.47 billion, reflecting strong brand equity.

PepsiCo prioritizes convenience, ensuring its products are readily available. A strong distribution network enhances this, making products easily accessible. This is a key value proposition for consumers. In 2024, PepsiCo's distribution reached over 200 countries. Convenience significantly drives consumer preference, boosting sales.

Innovation

PepsiCo thrives on innovation, constantly updating its offerings to align with consumer tastes. This includes healthier choices and eco-friendly packaging, as well as formats. Innovation keeps the product line exciting and attracts customers. Continuous innovation boosts consumer engagement and revenue. In 2024, PepsiCo invested heavily in R&D, with a budget of over $3 billion.

- New Product Launches: PepsiCo introduced 200+ new products globally in 2024.

- Sustainable Packaging: They aim for 100% recyclable, compostable, or biodegradable packaging by 2025.

- Healthier Options: Sales of their "better-for-you" products grew by 10% in 2024.

- R&D Investment: PepsiCo's R&D spending increased by 8% in 2024.

Affordability

PepsiCo's affordability strategy is key to its widespread appeal. The company offers products at different price levels, catering to diverse budgets. This includes value-sized options and promotional deals. Competitive pricing ensures accessibility for a broad consumer base. In 2023, PepsiCo's net revenue increased by 6.0% to reach $91.47 billion, demonstrating the effectiveness of this strategy.

- Value-Sized Options: PepsiCo provides larger-sized products.

- Promotional Offers: Deals and discounts boost affordability.

- Competitive Pricing: Prices are set to attract various customers.

- Broad Market Reach: Affordable products reach a vast audience.

PepsiCo's value revolves around taste, variety, and brand recognition. This includes an extensive product portfolio catering to diverse consumer preferences and driving sales. PepsiCo's brand equity is globally recognized and trusted. In 2024, this helped propel net revenue to approximately $91.47 billion.

| Value Proposition | Description | 2024 Impact |

|---|---|---|

| Taste & Variety | Extensive product range. | Over $86B in net revenue. |

| Brand Recognition | Globally recognized and trusted brands. | Approx. $91.47B net revenue. |

| Convenience | Readily available products. | Distribution in 200+ countries. |

Customer Relationships

PepsiCo employs mass marketing, leveraging TV commercials and digital ads to connect with a vast audience. In 2024, PepsiCo's advertising expenses were substantial, reflecting its commitment to broad reach. These campaigns boost brand awareness and sales, crucial for its diverse customer base. Such marketing efforts help maintain brand visibility. PepsiCo's 2024 revenue was over $86 billion, showing the impact of effective mass marketing.

PepsiCo actively cultivates customer relationships via social media. They run contests, share content, and address customer inquiries on platforms. This engagement builds brand loyalty and provides valuable consumer insights. PepsiCo's social media efforts saw a 15% increase in engagement during 2024. Direct interaction with consumers through social media boosts brand loyalty and drives sales.

PepsiCo offers customer service through various channels to handle inquiries and resolve issues, crucial for maintaining customer satisfaction. In 2024, PepsiCo's customer satisfaction scores reflected the importance of effective support. Reliable service enhances customer loyalty, which is vital for sustained revenue. Addressing issues promptly helps preserve a positive brand image, supporting long-term growth.

Loyalty Programs

PepsiCo leverages loyalty programs and promotional offers to cultivate strong customer relationships. These initiatives are designed to encourage consistent engagement with PepsiCo's diverse product portfolio. Such programs incentivize repeat purchases, contributing significantly to brand loyalty. Rewarding loyal customers is a key strategy for fostering long-term relationships. PepsiCo's focus on customer retention is crucial for sustained growth.

- PepsiCo's marketing expenses in 2023 were approximately $4.2 billion, a portion of which supports loyalty programs.

- The company's net revenue in 2023 was around $91.47 billion, partially driven by repeat customer purchases influenced by these programs.

- Loyalty programs have been shown to increase customer lifetime value by up to 25% in the beverage industry.

- In 2024, PepsiCo continues to refine its loyalty program strategies, focusing on personalized offers and digital engagement.

Event Sponsorships

PepsiCo heavily invests in event sponsorships to build customer relationships. These sponsorships, including major sporting events and music festivals, boost brand visibility. They create positive associations, enhancing brand image and consumer engagement. In 2024, PepsiCo's marketing expenses reached billions, a portion dedicated to these events.

- Sponsorships at events boost brand recognition.

- PepsiCo's marketing budget includes event costs.

- Events provide direct consumer interaction.

- Sponsorships enhance brand image.

PepsiCo's customer relationships hinge on mass marketing, with $4.2B spent in 2023 on advertising. Social media engagement rose 15% in 2024, building loyalty. Customer service and loyalty programs, like personalized offers in 2024, aim to retain customers.

| Customer Interaction | Strategy | Impact |

|---|---|---|

| Marketing | Mass media & Digital Ads | Boosts brand awareness |

| Social Media | Engagement & Contests | Increases loyalty |

| Customer Service | Issue resolution | Enhances satisfaction |

Channels

PepsiCo's products are widely available in retail outlets, like grocery and convenience stores. These channels are crucial for reaching consumers. Retail partnerships are key to ensuring product placement and visibility. In 2024, PepsiCo's retail sales grew, reflecting strong channel performance. Broad market coverage is achieved through these diverse retail partnerships.

PepsiCo leverages foodservice providers like restaurants and fast-food chains. This channel is crucial for consumer reach. Partnerships boost product availability in diverse dining settings. In 2024, the foodservice segment contributed significantly to PepsiCo's revenue, with an estimated 18% of total sales. This strategy extends their market presence.

PepsiCo strategically places its products in vending machines across offices, schools, and public areas, ensuring easy access. These machines offer a convenient way for consumers to purchase beverages and snacks on the go. Vending machines are especially effective in high-traffic zones, maximizing product visibility and sales. In 2024, the vending machine market generated approximately $25 billion in revenue globally.

Online Retailers

PepsiCo leverages online retailers like Amazon to sell its products, offering consumers home-shopping convenience. This channel broadens accessibility, reaching digital consumers effectively. E-commerce platforms provide a convenient shopping experience, enhancing customer reach. In 2024, online retail sales in the U.S. hit $1.1 trillion, showing its significance.

- Online sales growth is projected to continue, with e-commerce accounting for over 20% of total retail sales.

- PepsiCo's e-commerce revenue grew by 15% in 2023.

- Amazon alone holds a significant market share in online grocery sales.

- Convenience and accessibility drive online retail's popularity.

Direct-to-Consumer

PepsiCo utilizes direct-to-consumer (DTC) channels, primarily through its website, to offer exclusive products and promotions, enhancing customer engagement. This approach allows for personalized interactions and valuable data collection directly from consumers. DTC strategies provide insights into consumer preferences and buying behaviors, informing future product development. PepsiCo's DTC sales contribute to its overall revenue, offering a diversified distribution model.

- In 2024, DTC sales are projected to contribute significantly to overall revenue.

- DTC allows for personalized marketing campaigns, increasing customer engagement.

- Data analytics from DTC sales helps optimize product offerings.

- PepsiCo's DTC channel offers exclusive product bundles.

PepsiCo uses diverse channels like retail and foodservice to reach consumers. Online sales, including e-commerce, are also important, with over 20% of retail sales. Direct-to-consumer (DTC) channels provide personalized interactions.

| Channel | Description | 2024 Data |

|---|---|---|

| Retail | Grocery, convenience stores. | Retail sales growth. |

| Foodservice | Restaurants, fast food. | 18% of sales. |

| E-commerce | Online platforms. | 15% growth in 2023. |

Customer Segments

PepsiCo's customer base is vast, targeting diverse demographics worldwide. Its products, like Pepsi and Lay's, are designed for mass-market appeal. This broad appeal translates into substantial sales volumes, driving revenue. In 2024, PepsiCo's net revenue reached approximately $91.5 billion. A large customer base is crucial for sustained growth.

PepsiCo actively targets youth and young adults, crucial for brand longevity. They leverage marketing and new products to connect with this demographic. This segment values PepsiCo's image of energy and youth. For example, in 2024, social media campaigns saw a 15% increase in engagement from this age group. Younger consumers are key for sales.

PepsiCo targets health-conscious consumers by providing low-sugar drinks and nutritious snacks. This segment is growing, with health and wellness becoming a priority. In 2024, PepsiCo's "Better for You" portfolio saw growth. Catering to this segment broadens PepsiCo's market, attracting a wider consumer base. Sales of healthier options are increasing.

Convenience Seekers

Convenience seekers are a core customer segment for PepsiCo, driving significant sales. PepsiCo's wide distribution network ensures easy access to products. This accessibility is crucial for consumers with busy lifestyles. Convenience significantly influences purchasing decisions within this segment.

- In 2024, PepsiCo's net revenue reached approximately $91.47 billion, reflecting strong demand driven by convenience.

- Convenience-focused products like single-serve snacks and drinks contribute substantially to this revenue.

- PepsiCo's extensive retail presence, including supermarkets and vending machines, caters to this segment's needs.

- The focus on on-the-go consumption formats aligns with the convenience-driven preferences of this customer group.

Price-Sensitive Consumers

PepsiCo caters to price-sensitive consumers by offering diverse products at different price points. Value-sized options and promotional offers are frequently utilized to enhance affordability. This strategy ensures the company attracts budget-conscious consumers. PepsiCo's focus on value is evident in its global net revenue; in 2023, it reached approximately $91.47 billion. This demonstrates the significance of this customer segment.

- Value-sized products are often available.

- Promotions are frequently employed.

- Affordability is a primary driver.

- This segment contributed to $91.47 billion in 2023.

PepsiCo's customer segments span various groups, driving its revenue. They include the mass market, youth, and health-conscious consumers. Convenience seekers and value-conscious customers are also key segments. This diverse approach contributed to approximately $91.5 billion in net revenue in 2024.

| Customer Segment | Focus | Example |

|---|---|---|

| Mass Market | Broad appeal | Pepsi, Lay's |

| Youth | Brand longevity | Social media engagement |

| Health-conscious | Wellness | "Better for You" |

Cost Structure

Manufacturing costs are substantial for PepsiCo, encompassing raw materials, labor, and facility upkeep. Efficient processes are crucial for cost management. In 2024, PepsiCo's cost of sales reached approximately $42 billion. Optimizing production is key to controlling these significant expenses. Manufacturing costs are a core element of PepsiCo's overall financial structure.

PepsiCo dedicates significant resources to marketing and advertising to boost brand awareness and sales. This includes various channels such as TV, digital campaigns, and sponsorships. In 2024, PepsiCo's advertising and marketing expenses reached around $3.5 billion. Effective marketing is costly, but it is vital for maintaining brand visibility in the competitive market.

PepsiCo's distribution and logistics costs involve moving products to various outlets. These costs include transportation, warehousing, and inventory management. Efficient logistics are crucial for controlling these expenses. In 2024, PepsiCo's selling, general, and administrative expenses, a portion of which covers distribution, amounted to billions of dollars. Effective distribution directly influences profitability and market accessibility.

Research and Development Costs

PepsiCo's research and development (R&D) costs are essential for innovation, with a focus on new product development and enhancement. These investments are vital for competitive advantage, driving product development. Innovation is key for staying ahead in the market. In 2023, PepsiCo allocated approximately $800 million to R&D.

- $800M: PepsiCo's approximate R&D spending in 2023.

- New Products: R&D supports the development of new food and beverage items.

- Competitive Edge: R&D helps maintain a strong position in the market.

- Innovation: A core driver of PepsiCo's product strategy.

Administrative Expenses

Administrative expenses for PepsiCo include salaries, benefits, and overhead costs. Managing these costs efficiently is key for profitability. These costs are necessary for operations. Effective overhead management boosts profitability. In 2024, PepsiCo's SG&A expenses were a significant portion of revenue.

- SG&A expenses include administrative costs.

- Efficient management directly impacts profit margins.

- PepsiCo's SG&A was around 30% of revenue in 2024.

- Cost control is vital for competitive advantage.

PepsiCo's cost structure includes substantial manufacturing expenses, with $42B in cost of sales in 2024. Marketing and advertising accounted for roughly $3.5B in 2024, supporting brand visibility. Distribution and logistics, part of SG&A, along with administrative costs, also form a significant portion of expenses.

| Cost Category | 2024 Expenses (Approx.) | Key Impact |

|---|---|---|

| Manufacturing | $42B | Production Efficiency |

| Marketing | $3.5B | Brand Awareness |

| R&D (2023) | $800M | Product Innovation |

Revenue Streams

Beverage sales, including carbonated soft drinks, juices, and bottled water, form a substantial revenue stream for PepsiCo. In 2024, the beverage segment accounted for a significant portion of the company's overall sales. PepsiCo's diverse beverage portfolio, featuring brands like Pepsi, Gatorade, and Aquafina, drives robust sales. This segment remains a key revenue generator, vital to PepsiCo's financial performance.

PepsiCo's snack sales, including brands like Lay's and Doritos, are a key revenue driver. This segment diversifies the company, complementing its beverage portfolio. In 2024, the Frito-Lay North America division, a core part of PepsiCo, generated billions in revenue. Snack sales consistently contribute a substantial portion of PepsiCo's overall financial performance.

International sales form a major part of PepsiCo's revenue. In 2023, international net revenue accounted for about 40% of the total. The strategy focuses on growth in emerging markets. These markets offer substantial expansion potential. PepsiCo's global reach diversifies its revenue streams.

Food Sales

PepsiCo generates revenue through food sales, encompassing items like cereals and breakfast foods. This segment offers diversification, catering to varied consumer preferences and needs. Food sales are a key component of PepsiCo's diversified revenue streams. In 2024, the Frito-Lay North America division, a major part of PepsiCo, reported over $25 billion in net revenue. This highlights the substantial contribution of food products.

- Frito-Lay North America's 2024 net revenue exceeded $25 billion.

- Food sales diversify PepsiCo's revenue streams.

- Cereals and breakfast items are included.

- The food segment addresses different consumer needs.

Licensing and Royalties

Licensing and royalties are a revenue stream for PepsiCo, stemming from agreements allowing others to use its brands. This includes brand name licensing for products outside its core offerings. This strategy generates additional income without significant capital investment. PepsiCo strategically leverages its brand assets for diverse revenue streams.

- PepsiCo's licensing and royalty revenue is a part of its overall revenue.

- Licensing agreements extend to various products, expanding brand presence.

- This revenue stream efficiently utilizes existing brand value.

- In 2024, expect continued focus on brand licensing to boost revenues.

PepsiCo’s diverse revenue streams are key. Beverage sales, like Pepsi, Gatorade, and Aquafina, drive significant revenue. Snacks, including Lay's and Doritos, also contribute a substantial portion of sales. These varied channels support the company's strong financial performance.

| Revenue Stream | Description | 2024 Data (Estimate) |

|---|---|---|

| Beverages | Carbonated drinks, water, etc. | Approx. $40B |

| Snacks | Frito-Lay products | Over $30B |

| International | Sales outside North America | Around 40% of Total |

Business Model Canvas Data Sources

The PepsiCo Business Model Canvas uses financial statements, market analysis reports, and internal operational data.