PepsiCo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PepsiCo Bundle

What is included in the product

Analyzes PepsiCo's competitive position, exploring industry forces like rivals, suppliers, and buyers.

Quickly highlight key risks and opportunities with interactive color-coding.

What You See Is What You Get

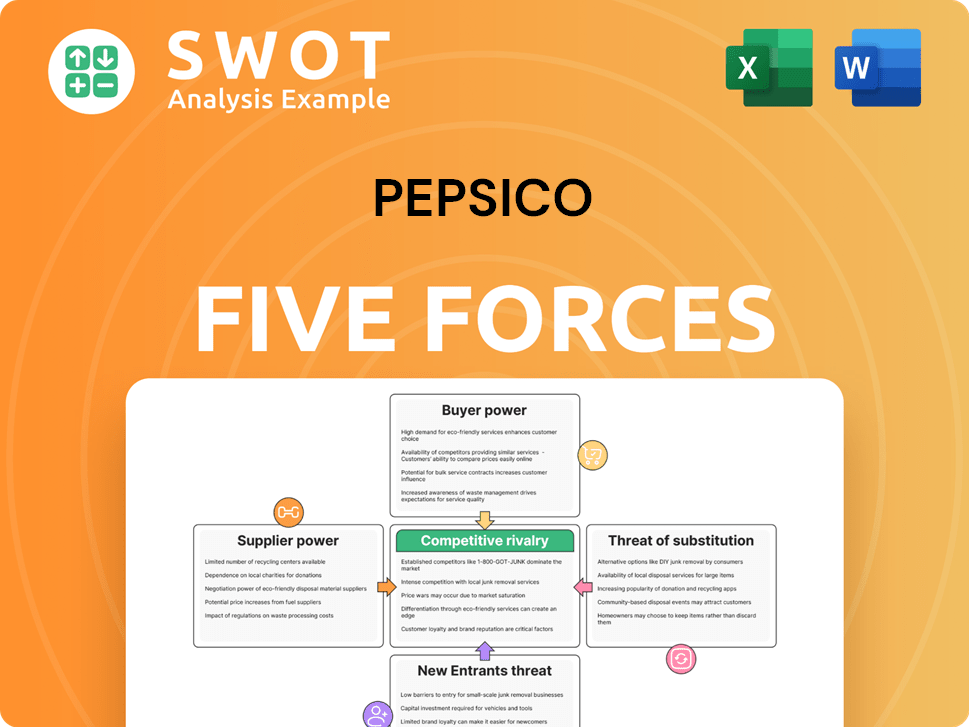

PepsiCo Porter's Five Forces Analysis

This preview showcases PepsiCo's Porter's Five Forces analysis in its entirety. The document assesses competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. It provides a clear understanding of PepsiCo's industry landscape. The analysis you see here is the exact same one you'll receive upon purchase.

Porter's Five Forces Analysis Template

PepsiCo faces considerable competition within the beverage and snack industries, shaping its strategic landscape. The threat of new entrants is moderate, given the established brand power and distribution networks. Buyer power is significant, with consumers having numerous product choices. Supplier power, primarily agricultural, presents some cost volatility. The intensity of rivalry is fierce, dominated by Coca-Cola and other major players. Substitute products, like water and healthier snacks, exert further pressure.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand PepsiCo's real business risks and market opportunities.

Suppliers Bargaining Power

PepsiCo's supplier power is generally weak. The company's strong financial health enables it to negotiate favorable terms. A broad supplier base and readily available resources also limit supplier influence. PepsiCo's suppliers' limited ability to integrate forward further weakens their bargaining position.

PepsiCo faces abundant supply in the food and beverage industry. Suppliers are numerous and often offer undifferentiated products, such as sugar and packaging. This abundance reduces supplier power. For example, the global sugar market in 2024 saw production exceeding 175 million metric tons.

Suppliers generally lack forward integration, lessening their leverage over PepsiCo. This means they're less likely to become direct competitors. PepsiCo's extensive supply chain, including diverse agricultural suppliers, further dilutes individual supplier power. In 2024, PepsiCo's cost of goods sold was approximately $39.5 billion, demonstrating its significant purchasing power.

Moderate Supplier Size

PepsiCo faces moderate bargaining power from suppliers. Individual suppliers, being of moderate size, can't strongly dictate terms. PepsiCo's vast global operations and significant sales volume position it as a key customer for many suppliers. This dynamic provides PepsiCo with leverage in negotiations. For example, in 2024, PepsiCo's cost of goods sold was approximately $40 billion, indicating its substantial purchasing power.

- Moderate supplier size limits their influence.

- PepsiCo's scale ensures favorable terms.

- Strong purchasing power.

- Cost of goods sold in 2024.

Long-Term Contracts

PepsiCo's long-term contracts with suppliers, like those for potatoes and corn, are a key strategy. These agreements help stabilize supply chains, which is crucial for consistent production. In 2024, PepsiCo's cost of goods sold was significantly impacted by raw material prices, highlighting the importance of these contracts. This approach reduces the immediate impact of supplier negotiations and price fluctuations.

- Secures supply: Ensures a steady flow of essential raw materials.

- Price stability: Contracts often include agreed-upon pricing terms.

- Risk mitigation: Reduces vulnerability to market volatility.

- Operational efficiency: Supports predictable production schedules.

PepsiCo's supplier power is generally weak due to its size and market position. The company's substantial purchasing power enables favorable terms in negotiations. In 2024, PepsiCo's cost of goods sold was approximately $40 billion.

| Factor | Impact | 2024 Data |

|---|---|---|

| Supplier Size | Moderate to small; limited influence | Many suppliers lack significant leverage |

| Purchasing Power | Strong; ability to negotiate favorable terms | Cost of Goods Sold: ~$40B |

| Supply Availability | Abundant, undifferentiated products | Global Sugar Production: >175M metric tons |

Customers Bargaining Power

Consumers wield significant power over PepsiCo. Switching costs are low; alternatives are readily available. This is evident in the beverage market, where brands constantly compete. Data from 2024 shows a highly competitive landscape.

PepsiCo's customers have low switching costs due to the availability of numerous beverage and snack alternatives. This accessibility significantly influences consumer behavior. For instance, in 2024, the global non-alcoholic beverage market, where PepsiCo competes, was valued at approximately $1.2 trillion. This creates a competitive landscape, empowering consumers with choice.

Consumers wield considerable power due to easy access to product information. This transparency allows for informed decisions when choosing snacks and beverages. For example, in 2024, online sales of food and beverages represented a significant portion of the market, with consumers actively comparing brands. This heightened information access boosts their ability to negotiate terms and influence industry practices.

Substitute Availability

Customers have numerous choices beyond PepsiCo's offerings. The availability of substitutes, such as juices, teas, and sports drinks, is high. These products, including healthier options, give customers the flexibility to switch easily. This impacts PepsiCo's ability to set prices and maintain market share.

- Healthier alternatives are growing, with the global market for functional beverages projected to reach $172.8 billion by 2024.

- PepsiCo's North America Beverages unit saw a slight volume decline in Q3 2023, reflecting shifts in consumer preferences.

- The rise of private-label brands also increases customer bargaining power by offering cheaper alternatives.

Price Sensitivity

Customers' price sensitivity significantly impacts PepsiCo's pricing strategies. This sensitivity restricts the company's ability to raise prices, as consumers may switch to cheaper alternatives. The availability of substitutes like private-label brands further limits PepsiCo's pricing power. For example, in 2024, the global beverage market saw increased price competition, pressuring companies like PepsiCo to balance profitability with consumer affordability.

- Price increases can lead to decreased sales volume.

- Consumers often choose lower-priced options.

- Substitute products provide viable alternatives.

- Competitive pricing is crucial for market share.

Consumers’ influence on PepsiCo is substantial due to readily available alternatives and low switching costs.

The competitive beverage market, valued at $1.2 trillion in 2024, amplifies this power.

Healthier options and price sensitivity further constrain PepsiCo's pricing and market share.

| Factor | Impact | Data (2024) |

|---|---|---|

| Switching Costs | Low | Numerous beverage and snack alternatives |

| Market Size | High competition | Global non-alcoholic beverage market ~$1.2T |

| Price Sensitivity | Restricts Pricing | Increased price competition |

Rivalry Among Competitors

PepsiCo contends with intense competition, particularly from consumer goods giants. Consumers can easily switch brands, intensifying rivalry. With numerous competitors, constant innovation and marketing are crucial. In 2024, PepsiCo's marketing expenses were substantial, reflecting this competitive pressure.

PepsiCo operates in a highly competitive landscape, with rivals constantly innovating and marketing. The company battles global giants like Coca-Cola and numerous local food and beverage firms. For instance, in 2024, Coca-Cola's marketing expenses reached $4.5 billion, intensifying the competition. This aggressive environment demands continuous adaptation.

Low switching costs amplify competitive rivalry for PepsiCo. Consumers easily swap between brands, increasing competition. This ease of switching intensifies the pressure on PepsiCo. For instance, the global soft drink market was valued at $440 billion in 2024. The ease of switching keeps prices competitive.

Numerous Competitors

The consumer goods industry's high concentration of firms intensifies rivalry. PepsiCo faces stiff competition from many companies. Coca-Cola, Keurig Dr Pepper, and Unilever are just a few rivals. In 2024, PepsiCo's revenue reached approximately $91.47 billion, highlighting the scale of competition.

- Coca-Cola's 2024 revenue was around $46 billion.

- Keurig Dr Pepper's 2024 revenue was approximately $14 billion.

- Unilever's 2024 revenue stood at roughly $60 billion.

Marketing and Branding

PepsiCo's competitive strategy heavily relies on effective marketing and branding to maintain its market position. The company uses targeted marketing campaigns to promote existing products and introduce new ones, staying relevant to consumers. Its robust marketing programs, packaging, and brand development are key to its competitive success. PepsiCo's advertising spend in 2023 was approximately $4.3 billion, demonstrating its commitment to brand building.

- Advertising spending of $4.3 billion in 2023.

- Focus on targeted marketing campaigns.

- Brand development and packaging are crucial.

- Introduction of new products.

PepsiCo's competitive landscape is fierce, with rivals like Coca-Cola. Consumers easily switch brands, fueling competition. Intense marketing, as seen with PepsiCo’s and Coca-Cola's hefty ad spends, is essential. The $440 billion soft drink market in 2024 highlights the stakes.

| Metric | PepsiCo (2024) | Coca-Cola (2024) |

|---|---|---|

| Revenue | $91.47B | $46B |

| Marketing Spend (2024) | Significant | $4.5B |

| Market Share (Global Soft Drink) | Competitive | Competitive |

SSubstitutes Threaten

The threat of substitutes is considerable for PepsiCo. Consumers can easily switch to alternatives like Coca-Cola or other beverages. These substitutes are readily available, perform well, and have low switching costs. In 2024, Coca-Cola's net revenue reached $46 billion, highlighting the strong competition PepsiCo faces.

The threat of substitutes for PepsiCo is significant due to the high performance of alternatives. Consumers are moving towards healthier options like water, juices, and unsweetened beverages. In 2024, the global bottled water market was valued at over $300 billion, showing strong consumer preference. This shift impacts PepsiCo's sales of sugary drinks and snacks.

Consumers can easily switch to substitutes due to low switching costs, a significant threat for PepsiCo. The ease of switching to alternatives like other beverages or snacks puts pressure on PepsiCo. This can erode market share if consumers find better value elsewhere. For example, the average cost to switch brands of soda is minimal, with prices often similar across competitors. PepsiCo's revenues in 2024 were approximately $91.5 billion, and competition from low-cost substitutes can impact profitability.

High Availability of Substitutes

PepsiCo faces significant threats from readily available substitutes. Consumers can easily switch to healthier beverages like water, juices, and coffee. The snack market also offers many alternatives, including fresh produce and other snack brands. This high availability of substitutes puts pressure on PepsiCo's pricing and marketing. For instance, in 2024, the global bottled water market was valued at over $300 billion, showing strong consumer preference shifts.

- Switching to healthier beverages is easy, impacting soft drink sales.

- The snack market offers numerous alternatives like fresh produce.

- PepsiCo faces pressure to maintain competitive pricing and marketing.

- The bottled water market's value in 2024 was over $300 billion.

Health and Wellness Trends

The health and wellness trend poses a threat to PepsiCo. Rising awareness of health issues, especially linked to high sugar intake, steers consumers away from sugary drinks and snacks. This shift challenges PepsiCo's traditional product lines. The company faces pressure to innovate and adapt to changing consumer preferences to stay competitive.

- In 2024, the global health and wellness market was valued at over $7 trillion.

- The consumption of low-sugar and sugar-free beverages has increased by 15% in the last year.

- PepsiCo's revenue from healthier products grew by 10% in 2024.

- Consumers are increasingly choosing alternatives with less sugar.

PepsiCo faces considerable threats from substitutes like water, juices, and various snacks. Consumers can easily switch to these alternatives, driven by health trends and diverse market offerings. The bottled water market alone was valued at over $300 billion in 2024, showing strong consumer shifts. This pressures PepsiCo to innovate and compete on price.

| Substitute Type | Market Size (2024) | Impact on PepsiCo |

|---|---|---|

| Bottled Water | $300B+ | Reduces soda sales |

| Juices/Health Drinks | $150B+ | Challenges sugary drinks |

| Various Snacks | $600B+ | Increases competition |

Entrants Threaten

PepsiCo encounters a moderate threat from new entrants. Consumer switching costs are low, but high brand development costs are a barrier. New companies struggle to compete with PepsiCo’s strong brand. PepsiCo's net revenue in 2023 was over $91 billion, reflecting its market dominance. This financial strength makes it harder for new entrants.

Low switching costs in the beverage industry mean consumers can readily swap brands, heightening disruption risk. New firms find it easier to lure customers away due to these low costs. For example, in 2024, the rise of new energy drink brands shows how easily consumers switch. This dynamic pressures established companies like PepsiCo to innovate and maintain brand loyalty. PepsiCo's marketing spend in 2024 reflects this focus.

PepsiCo faces a moderate threat from new entrants due to existing customer loyalty. In 2023, brand loyalty varied: Pepsi at 72%, Frito-Lay at 81%, and Gatorade at 68%. This loyalty provides a barrier, but it's not impenetrable. New brands can still gain market share through innovation and aggressive marketing.

High Brand Development Costs

High brand development costs are a significant barrier for new competitors. These costs make it hard to compete with established brands like PepsiCo. PepsiCo's brand strength, including its marketing spend, is a major advantage. New entrants struggle to match this, limiting their market entry.

- PepsiCo's marketing expenses in 2024 were approximately $3.5 billion.

- New brands require substantial investment to build brand recognition.

- Successful brand building involves consistent advertising and promotion.

- PepsiCo's global brand value is estimated at over $20 billion.

Capital Requirements

The food and beverage industry, particularly at PepsiCo's scale, demands substantial capital. A new entrant would face significant financial hurdles. Initial market entry costs for manufacturing infrastructure could range from $500 million to $1 billion, as of 2024. This financial burden serves as a considerable barrier, deterring potential competitors.

- Manufacturing Infrastructure Costs: $500M - $1B (2024)

- Capital-Intensive Industry

- Barrier to Entry

PepsiCo faces moderate threat from new entrants, balanced by high costs and brand strength. Low switching costs ease customer movement, increasing the risk of market disruption. High brand development costs and capital needs create barriers. PepsiCo's brand value exceeds $20 billion, bolstering its market position.

| Factor | Impact | Data |

|---|---|---|

| Switching Costs | Low, easy consumer swaps | Reflects consumer flexibility |

| Brand Development Costs | High barrier for new firms | PepsiCo's marketing spend: ~$3.5B (2024) |

| Capital Requirements | Significant investment needed | Manufacturing entry: $500M-$1B (2024) |

Porter's Five Forces Analysis Data Sources

PepsiCo's analysis utilizes financial reports, market studies, and competitive intelligence to evaluate industry forces.