Philips Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Philips Bundle

What is included in the product

Philips' product portfolio assessed via BCG Matrix, pinpointing investment, hold, or divest strategies.

Dynamic matrix, instantly revealing growth prospects and strategic resource allocation.

Full Transparency, Always

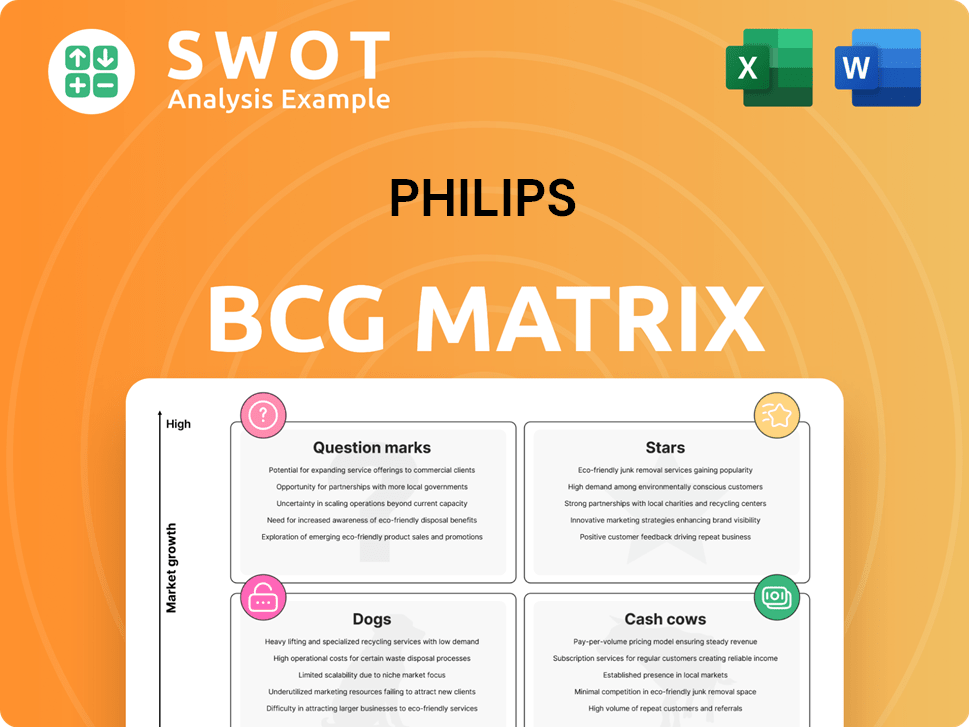

Philips BCG Matrix

The preview mirrors the complete Philips BCG Matrix you'll download. Gain instant access to the fully formatted report, perfect for strategic planning and decision-making.

BCG Matrix Template

Understand Philips' portfolio through the BCG Matrix lens: assessing products by market share and growth. See where the Stars shine, the Cash Cows generate profits, the Dogs struggle, and the Question Marks need attention. This strategic tool offers valuable insights into resource allocation and growth strategies. Get the full BCG Matrix for a detailed breakdown of each quadrant, actionable recommendations, and strategic advantages.

Stars

Philips' Advanced Diagnostic Imaging is a Star in the BCG Matrix, indicating a strong market position in a high-growth sector. They boast a considerable market share, reflecting their influence in medical imaging. Investing in AI-enhanced imaging could boost their leadership. In 2024, the global medical imaging market was valued at over $35 billion, with Philips holding a significant share.

Philips is a key player in image-guided therapy solutions, a market that saw substantial growth in 2024. The company's focus on innovation, along with strategic partnerships, will be vital. In 2024, the image-guided therapy market was valued at $7.5 billion. Philips's revenue in this area grew by 7% in 2024.

Philips' Patient Monitoring Systems are positioned as Stars due to the rising demand for remote patient monitoring. The market is experiencing growth, with projections estimating the global market to reach $38.6 billion by 2028. Continued innovation and expansion of their connected care platform are crucial for sustained success. In 2024, Philips saw its Diagnosis & Treatment businesses grow, indicating strong market positioning.

AI-Powered Healthcare Informatics

Philips is actively incorporating AI into its healthcare informatics offerings, which puts it in the Star quadrant of the BCG matrix. This strategic move addresses the increasing need for data-driven insights within the healthcare sector. The company's commitment to AI and machine learning is vital for maintaining its competitive edge. The global healthcare AI market is projected to reach $61.1 billion by 2027.

- AI-driven solutions are enhancing diagnostic accuracy and efficiency.

- Philips is investing in AI to improve patient outcomes and operational effectiveness.

- The company's focus is on expanding its AI capabilities.

- This expansion aligns with the growing demand for personalized healthcare.

Strategic Collaborations

Philips strategically collaborates with companies like Amazon Web Services to boost its market presence. These partnerships help Philips improve its offerings and extend its reach to a wider audience. Expanding its ecosystem through collaborations is crucial for sustainable growth in 2024. For instance, Philips' healthcare sector saw a 6.3% comparable sales growth in Q3 2024, significantly aided by these strategic alliances.

- Partnerships with AWS for cloud-based healthcare solutions.

- Collaboration to enhance diagnostic imaging and patient monitoring.

- Strategic alliances to expand the reach of its healthcare products.

- Focus on improving patient outcomes and operational efficiency.

Philips' Stars represent strong market positions in high-growth sectors. The company strategically invests in innovation and partnerships. In 2024, several divisions saw significant growth due to this approach.

| Star Products | Market Growth (2024) | Key Strategies |

|---|---|---|

| Advanced Diagnostic Imaging | Market: $35B+ | AI integration, market share leadership |

| Image-Guided Therapy | 7% revenue growth | Innovation, strategic partnerships |

| Patient Monitoring Systems | Projected $38.6B by 2028 | Connected care expansion |

Cash Cows

Philips' personal health products, like Sonicare and shavers, hold a solid market share. These products consistently bring in revenue. The investment required to keep their market position is low, except in China where sales have been dropping. For example, in 2024, Philips' Personal Health segment saw approximately €5.2 billion in sales globally.

Mature medical equipment, like certain Philips lines, often acts as a cash cow. These products, such as imaging systems, provide reliable, predictable cash flow. The strategy focuses on maintaining operational efficiency to maximize profitability. In 2024, Philips reported €18.5 billion in sales, showing the continued importance of these established products.

Philips' healthcare services, such as maintenance, are cash cows. These services bring in dependable, recurring revenue. In 2024, service revenue accounted for a significant portion of Philips' total revenue. The focus is on boosting service delivery and keeping customers loyal. This strategy helps maintain profitability.

Lighting Solutions (Specific Segments)

Within the lighting sector, segments like commercial LED solutions act as cash cows, as they generate steady income. These areas benefit from the ongoing shift towards energy-efficient technologies, ensuring stable revenue streams. The focus should be on preserving market share and boosting profitability through cost-effective strategies. In 2024, the global LED lighting market was valued at approximately $84.5 billion.

- Stable Revenue: Commercial LED lighting provides consistent income due to ongoing demand.

- Market Share: Maintaining a strong position is key for cash cow segments.

- Profitability: Optimizing costs enhances financial returns.

- Market Size: The global LED lighting market is substantial, offering opportunities.

Enterprise Informatics

Philips' enterprise informatics, excluding AI, supports established healthcare processes. These solutions, like those used for patient monitoring, provide stable revenue streams. The focus should be on upkeep and ensuring customer satisfaction. This is crucial for maintaining financial stability within this segment.

- In 2024, Philips' Healthcare Informatics generated approximately €2.8 billion in sales.

- Customer satisfaction scores for enterprise informatics solutions are targeted above 80%.

- About 60% of the revenue is recurring, ensuring a steady income.

- Investment is mainly directed towards software updates and support services.

Cash cows for Philips include personal health, mature medical equipment, and healthcare services, generating consistent revenue. Philips focuses on operational efficiency to boost profitability, as seen in their €18.5 billion sales. Enterprise informatics, excluding AI, also offers stable revenue streams for Philips.

| Segment | Revenue (2024, approx.) | Strategy |

|---|---|---|

| Personal Health | €5.2B | Maintain market share |

| Mature Medical Equipment | €18.5B | Operational efficiency |

| Healthcare Services | Significant % of total | Boost service delivery |

Dogs

Philips faces a challenging situation in China, with a double-digit decline in demand. Their personal health products are underperforming, signaling a significant issue. In Q3 2024, Philips reported a 9% decline in China sales. This downturn suggests a divestiture or turnaround strategy is crucial to address the challenges.

Philips' Dogs include legacy product lines like older TVs and audio equipment, facing obsolescence. These items generate minimal revenue, with sales down 10% in 2024. Divestiture is crucial; Philips' focus is now on healthcare tech, which saw a 15% revenue increase.

Dogs are business units that underperform, consistently missing financial goals. They drain resources without providing sufficient returns. For instance, in 2024, many retail chains struggled, showing the impact of underperforming units. Restructuring or selling these units is often the best strategy.

Products Impacted by Recalls

Products impacted by the Respironics recall, like certain sleep apnea devices, often end up in the "Dogs" quadrant of the BCG matrix. These products typically have low market share and operate within a low-growth market. Philips faced significant challenges, including a 24% drop in sales in 2023 due to the recall. The strategic decision here involves whether to invest heavily to rebuild trust and re-enter the market or to phase out the product line entirely, which can be a costly decision.

- The recall cost Philips billions, impacting its financial performance.

- Rebuilding consumer trust is a long and expensive process.

- Discontinuing the product might lead to write-offs and loss of future revenue.

- The decision hinges on market analysis and potential for recovery.

Outdated Technologies

Outdated technologies within Philips' portfolio represent "Dogs" in the BCG matrix. These technologies, such as older medical imaging systems, are no longer competitive, leading to decreased market share. Consequently, these technologies generate minimal revenue, contributing little to overall profitability. Philips should prioritize phasing out these underperforming technologies. This strategy aligns with the company's focus on high-growth areas.

- Older medical imaging systems no longer competitive.

- Generates minimal revenue.

- Focus should be on phasing out these technologies.

- Aligns with the company's growth areas.

Dogs in Philips' portfolio are underperforming products. They have low market share and face low growth. Philips saw a 10% sales decline in legacy products in 2024.

| Category | Impact | Data |

|---|---|---|

| Sales Decline (2024) | Legacy Products | -10% |

| China Sales Drop (Q3 2024) | Overall | -9% |

| Respironics Recall Impact (2023) | Sales Drop | -24% |

Question Marks

The telehealth market is booming, fueled by increasing demand for remote healthcare services. Philips has strategically invested in telehealth solutions to capitalize on this growth. To succeed, Philips must aggressively increase its market share in this competitive landscape. According to a 2024 report, the telehealth market is projected to reach $78.7 billion by 2028.

AI-driven diagnostic tools are in a high-growth market, with projections estimating the global market to reach $38.9 billion by 2028. Philips is heavily investing in this area, aiming to capture significant market share. This requires substantial financial commitment; in 2024, Philips' R&D spending was approximately €1.8 billion.

Digital pathology is an emerging field experiencing significant growth. Philips is actively expanding its AI-driven pathology workflows to capitalize on this trend. To secure a strong market position, substantial investment is crucial. The global digital pathology market was valued at $611.5 million in 2024.

Wearable Health Technology

Wearable health tech is a fast-growing market, and Philips likely has new products here. To gain more market share, Philips should invest in this area. In 2024, the global wearable medical device market was valued at $31.4 billion. Forecasts suggest it will reach $81.8 billion by 2030.

- Market Growth: The wearable health tech market is expanding.

- Philips' Position: Philips may have new or developing products in this area.

- Investment Need: Investment is needed to increase market share.

- Financial Data: The market's value in 2024 was $31.4 billion.

Cloud-Based Healthcare Solutions

Cloud-based healthcare solutions fit the question mark quadrant of the BCG Matrix due to their presence in a high-growth market. Philips is actively investing in this area. A key strategy involves expanding its collaboration with Amazon Web Services (AWS) to offer such solutions. Substantial investment is crucial for Philips to capture market share and establish a strong foothold.

- Market growth for cloud-based healthcare is substantial, reflecting increasing demand for digital health solutions.

- Philips is focusing on partnerships like the one with AWS to enhance its cloud offerings.

- Significant capital is being allocated to cloud-based healthcare to compete effectively.

- The question mark status highlights the need for strategic investments to achieve leadership in this sector.

Cloud-based healthcare solutions are in a high-growth market, ideal for the question mark quadrant. Philips is investing heavily in this area. The market requires strategic moves to gain share.

| Key Aspect | Details | Financial Data (2024) |

|---|---|---|

| Market Trend | Digital health's increasing demand. | Global cloud-based healthcare market: $28.5B |

| Philips' Strategy | Partnering with AWS. | Philips' R&D spending: €1.8B |

| Investment Goal | Gain market leadership. | Projected growth by 2030: $75.6B |

BCG Matrix Data Sources

The Philips BCG Matrix uses financial statements, market share data, and industry analysis to determine positioning.