Philips PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Philips Bundle

What is included in the product

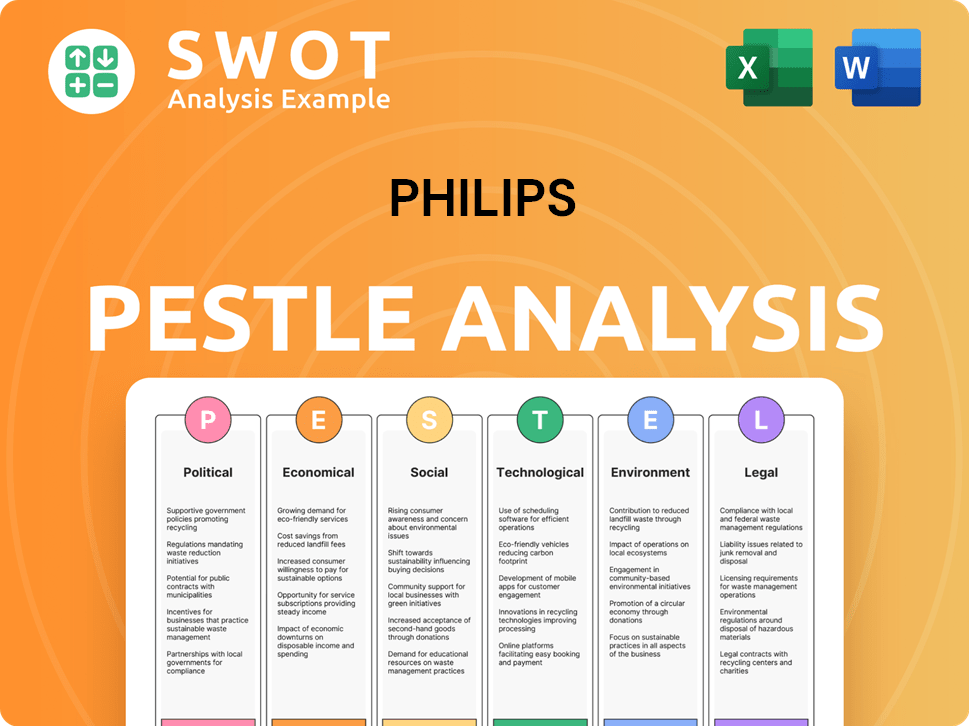

Analyzes how external factors impact Philips using Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Helps identify critical external factors influencing Philips, aiding strategic decision-making and problem-solving.

Preview Before You Purchase

Philips PESTLE Analysis

This Philips PESTLE Analysis preview is the actual document.

See how it breaks down Political, Economic, etc. factors?

That's what you'll download instantly.

It's fully formatted and ready for your use.

Everything displayed here is what you receive.

PESTLE Analysis Template

Navigate Philips' future with a powerful PESTLE analysis, crafted for strategic foresight. Uncover how political, economic, social, technological, legal, and environmental factors shape its trajectory. Identify key opportunities and mitigate potential risks with in-depth insights. Perfect for investors, analysts, and business strategists looking for an edge. Download the full PESTLE analysis now!

Political factors

Philips faces significant impacts from government regulations and healthcare policies. Approvals for medical devices and restrictions on technologies directly affect its operations. Healthcare spending priorities also play a crucial role. For instance, in 2024, the EU approved several new Philips medical devices. These policy shifts demand continuous adaptation in product development and market strategies.

Geopolitical tensions and changes in international trade agreements significantly impact Philips' supply chain. The imposition of tariffs, like those between the US and China, directly affects product costs. For example, in 2024, tariffs are projected to raise the cost of imported components, potentially increasing end-product prices. These adjustments can impact Philips' profit margins and market competitiveness.

Political stability is crucial for Philips, especially in China, a significant market. Recent anti-corruption measures in China have impacted industry demand. Philips' performance in China during 2024 and 2025 will be closely tied to the political climate. Any instability could disrupt operations and sales.

Government Healthcare Spending

Government healthcare spending significantly influences Philips' revenue streams. Higher investment in healthcare infrastructure and technology boosts demand for Philips' medical devices. Conversely, austerity measures or budget reallocations can negatively affect sales. In 2024, global healthcare spending is projected to reach $10.9 trillion, offering opportunities, but varying governmental priorities pose risks.

- US healthcare spending is expected to reach $4.9 trillion in 2024.

- European healthcare spending is projected to grow, with varying rates across countries.

- China's healthcare spending continues to increase, driven by reforms.

Protectionism and Local Content Requirements

Protectionist policies and local content requirements pose challenges for Philips. These measures can increase production costs and limit market access. For instance, in 2024, several countries, including India, have increased tariffs on imported medical devices. Such moves impact Philips' supply chain and profitability. These factors necessitate strategic adjustments.

- India increased import tariffs on medical devices in 2024.

- Local content rules may force Philips to alter manufacturing locations.

- Protectionism can lead to higher operational expenses.

Political factors greatly affect Philips' operations. Healthcare spending and government regulations heavily influence the company’s financial performance. Shifts in trade policies and geopolitical stability add to these impacts.

| Factor | Impact | Data Point |

|---|---|---|

| Healthcare Spending | Demand for Devices | US spent $4.9T on healthcare in 2024 |

| Trade Policies | Product Costs | Tariffs increased costs in 2024. |

| Geopolitical Stability | Sales in Key Markets | China’s anti-corruption measures impact. |

Economic factors

Global economic growth significantly impacts healthcare spending and, by extension, Philips' performance. In 2024, the IMF projected global growth at 3.2%, influencing healthcare budgets worldwide. Slower growth, as seen in the Eurozone's projected 0.8% in 2024, could curb demand for Philips' high-end medical tech. Conversely, robust growth in emerging markets, like India's expected 6.8% in 2024, presents expansion opportunities.

Inflation significantly impacts Philips by raising costs of raw materials and labor. In 2024, the Eurozone's inflation rate averaged around 2.8%, affecting operational expenses. Philips aims to mitigate these pressures. Productivity improvements and strategic pricing are key to preserving profit margins. For example, Philips' gross margin in 2024 was approximately 40%, and they aim to sustain it.

Currency exchange rate volatility significantly affects Philips, given its global presence. For instance, a stronger Euro can make Philips' products more expensive in export markets, potentially reducing sales. In 2024, fluctuations in the EUR/USD exchange rate alone impacted several multinational corporations. Philips must manage currency risks through hedging strategies.

Supply Chain Resilience

Supply chain disruptions remain a key economic factor for Philips, potentially impacting profitability. Despite efforts to build resilience, external shocks can increase production costs and lead to delays. The company's ability to navigate these challenges is crucial for maintaining financial stability. For example, in 2024, logistics costs rose by 7% due to various supply chain issues.

- Increased Production Costs: Rising raw material and transport expenses.

- Product Availability: Potential delays in delivering products to market.

- Impact on Profitability: Reduced margins due to higher operational costs.

- Mitigation Strategies: Diversifying suppliers and improving inventory management.

Healthcare Spending Trends

Healthcare spending trends are crucial for Philips. The shift toward value-based care and digital health technologies impacts market demand and innovation needs. In 2024, global healthcare spending reached approximately $10 trillion. The adoption of digital health is expected to grow significantly. Philips must adapt to these changes.

- Global healthcare spending in 2024: ~$10T.

- Digital health market growth: Significant expansion expected.

Global economic growth directly affects Philips. IMF projected 3.2% growth in 2024, influencing healthcare spending. Slower Eurozone growth (0.8%) curbs demand; India's robust 6.8% presents opportunities.

Inflation raises Philips' costs. Eurozone's ~2.8% inflation in 2024 affects operations. Philips uses productivity, pricing to maintain margins. In 2024, gross margin ~40%, sustaining this is key.

Currency volatility affects Philips' sales, given its global reach. A strong Euro makes products costlier. Philips uses hedging to manage these risks. In 2024, EUR/USD impacted several companies.

| Economic Factor | Impact | 2024 Data/Examples |

|---|---|---|

| Global Economic Growth | Healthcare Spending | IMF: 3.2% (Global), Eurozone: 0.8%, India: 6.8% |

| Inflation | Cost of Goods Sold (COGS) | Eurozone: ~2.8% (Average) |

| Currency Exchange Rates | International Sales | EUR/USD fluctuations affected many |

Sociological factors

Globally, the aging population is growing; by 2024, over 1 billion people are aged 60+. This demographic shift increases chronic diseases like heart disease and diabetes. Philips benefits from this, with its focus on diagnostic imaging and monitoring solutions. In 2023, the global health tech market was valued at over $600 billion, with significant growth expected in connected care and remote patient monitoring.

Patient empowerment and home healthcare are significantly impacting healthcare demands. Philips' personal health and connected care segments align with this shift. The global home healthcare market is projected to reach $496.6 billion by 2024, reflecting strong growth. This trend encourages innovative products and services, as seen in Philips' offerings.

Shifting lifestyles and heightened health consciousness fuel demand for personal health tech. The global wearable medical devices market is projected to reach $38.5 billion by 2025. Preventative care is booming; telehealth adoption grew by 38% in 2024. Philips benefits from this trend by offering health-focused products.

Access to Healthcare

Societal factors significantly influence Philips' market, particularly regarding healthcare access. Disparities in healthcare access between developed and developing countries impact the demand for Philips' products. Its global presence allows it to address these diverse needs. Philips can adapt its offerings to suit different healthcare infrastructures. Addressing healthcare access issues is crucial for the company's growth.

- In 2024, the global medical devices market was valued at $550 billion.

- Approximately 30% of the world's population lacks access to essential healthcare.

- Philips' sales in emerging markets accounted for 40% of its revenue in 2024.

- The company invested $1.8 billion in R&D in 2024, partly to improve healthcare access.

Cybersecurity and Data Privacy Concerns

As Philips expands its digital health offerings, it faces growing societal concerns around cybersecurity and data privacy. The healthcare sector is a prime target for cyberattacks, with a 2024 report by IBM indicating that healthcare data breaches cost an average of $10.93 million. This necessitates robust security measures in Philips' devices and services to protect sensitive patient information. Data privacy regulations, such as GDPR and HIPAA, require strict compliance, influencing product design and data handling practices.

- Healthcare data breaches cost an average of $10.93 million (IBM, 2024).

- GDPR and HIPAA regulations mandate strict data protection.

Societal factors are pivotal in Philips' market strategy, especially regarding healthcare access and data security. Approximately 30% of the world's population lacks access to essential healthcare services. Emerging markets accounted for 40% of Philips’ revenue in 2024, showcasing its global influence. Digital health offerings bring cyber risk.

| Aspect | Impact | Data Point (2024) |

|---|---|---|

| Healthcare Access | Disparities affect demand | Philips' emerging market revenue: 40% |

| Cybersecurity | Risk of breaches | Healthcare data breach cost: $10.93M |

| Data Privacy | Regulation compliance | GDPR, HIPAA regulations |

Technological factors

Continuous advancements in medical imaging, including AI-enabled systems, are crucial for Philips' Diagnosis and Treatment business. These innovations are pivotal for maintaining competitiveness. The global medical imaging market, valued at $28.9 billion in 2024, is projected to reach $40.2 billion by 2029, growing at a CAGR of 6.8%. Philips invested €752 million in R&D in Q1 2024, reflecting its commitment.

The healthcare sector is rapidly adopting AI and data analytics. Philips is strategically positioned to capitalize on this, with the global AI in healthcare market projected to reach $61.6 billion by 2028. This growth offers Philips opportunities to innovate its offerings, as investments in digital health solutions are increasing.

Technological advancements fuel connected care. Philips leads in remote monitoring and telehealth, vital for patient care. The global telehealth market is projected to reach $225 billion by 2025. Philips' focus on these technologies aligns with market trends. This improves patient outcomes and streamlines healthcare delivery, key for Philips' strategy.

Innovation in Personal Health Technology

Technological advancements significantly influence Philips, especially in personal health. Innovation in wearable sensors and connected health platforms is driving the consumer-focused health products market. The global wearable medical devices market is projected to reach $35.8 billion by 2025. This growth is fueled by increasing demand for remote patient monitoring and personalized healthcare solutions. Philips is well-positioned to capitalize on these trends.

- Market growth: The wearable medical devices market is expected to reach $35.8 billion by 2025.

- Consumer shift: Increased focus on remote patient monitoring and personalized healthcare.

Adoption of Digital Health Platforms

The rise of digital health platforms and electronic health records is reshaping healthcare data management, boosting demand for interoperable systems. Philips is positioned to benefit from this trend, with the global digital health market projected to reach $604.5 billion by 2027. This shift necessitates investments in secure data storage and analysis tools. This will also influence the company's product development and strategic partnerships.

- Global digital health market expected to reach $604.5 billion by 2027.

- Increased demand for interoperable systems and software solutions.

Technological advancements drive Philips' growth. Innovations in AI-enabled medical imaging, valued at $28.9B in 2024, and the digital health market, projected to $604.5B by 2027, are crucial. Philips invests heavily in R&D, allocating €752M in Q1 2024 to maintain competitiveness.

| Technological Area | Market Value (2024) | Projected Market Value |

|---|---|---|

| Medical Imaging | $28.9 billion | $40.2B by 2029 |

| AI in Healthcare | - | $61.6B by 2028 |

| Telehealth | - | $225B by 2025 |

Legal factors

Philips faces rigorous medical device regulations globally. Gaining approvals, like from the FDA, is crucial for market entry. In 2024, the FDA approved 200+ Philips medical devices. Deviations lead to recalls; in 2023, Philips recalled over 1,000,000 devices. Staying compliant impacts sales and reputation.

Philips, as a medical device maker, contends with product liability risks. These risks are amplified by its sleep and respiratory device recalls. The company has faced significant litigation, including a $1.1 billion settlement in 2024. These legal issues directly affect Philips' financials.

Philips must comply with stringent data protection regulations. GDPR and HIPAA mandate careful handling of patient data.

Non-compliance can lead to hefty fines, impacting financial performance. For example, in 2024, GDPR fines averaged over €100,000 per violation.

These laws affect product design and data management strategies. Maintaining patient trust is also crucial.

Failure to protect data can damage Philips' reputation and market value. The global healthcare IT market is projected to reach $421.3 billion by 2025.

Adhering to these laws is essential for market access and sustainability.

Intellectual Property Laws

Philips heavily relies on intellectual property (IP) to safeguard its innovations. Patents and trademarks are crucial for protecting its health technology advancements. In 2024, Philips invested significantly in R&D, with over €1.8 billion allocated to protect its innovations. This investment supports a broad portfolio of patents and trademarks. IP protection ensures Philips' competitive edge.

- Philips holds over 60,000 patents worldwide.

- In 2024, the company filed for approximately 1,500 new patents.

- Trademark registrations are also vital for brand protection.

- IP enforcement is a key element of Philips' legal strategy.

Healthcare Compliance and Anti-Corruption Laws

Philips faces stringent healthcare compliance rules globally, including the U.S. Foreign Corrupt Practices Act (FCPA) and similar laws in Europe. These laws mandate transparent interactions with healthcare professionals to prevent bribery and ensure fair market practices. Non-compliance can lead to significant penalties, including financial fines and reputational damage, affecting the company's market value. In 2024, the healthcare sector saw a 15% increase in compliance investigations.

- FCPA fines in 2024 averaged $200 million.

- Philips' revenue in 2024 was approximately EUR 18.2 billion.

- Healthcare compliance costs increased by 10% due to stricter regulations.

Legal factors significantly affect Philips’ operations.

They must adhere to medical device regulations, data protection, and IP laws. In 2024, non-compliance resulted in hefty fines. The healthcare sector saw increased compliance investigations.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| Medical Device Regulations | Market Entry, Recalls | FDA approved 200+ devices; 1M+ devices recalled |

| Product Liability | Litigation, Financials | $1.1B settlement |

| Data Protection | Fines, Reputation | GDPR fines averaged €100k+ |

Environmental factors

Environmental sustainability and the circular economy are gaining traction in healthcare, impacting medical device design and lifecycle management. Philips is responding with initiatives. In 2024, Philips aimed for 100% of its new product designs to be eco-designed. This includes using recycled materials. By 2025, they target increasing the use of recycled plastics to 25% in their products.

Healthcare facilities are energy-intensive, increasing demand for efficient solutions. Philips provides energy-saving equipment and lighting. Globally, healthcare accounts for ~4% of carbon emissions. Philips' focus on energy efficiency aligns with the growing need for sustainable healthcare. In 2024, investments in green healthcare tech are expected to rise by 15%.

Philips faces waste management challenges due to medical device disposal. Regulations are tightening globally. The EU's WEEE Directive impacts its operations, requiring device recycling. In 2023, the global medical waste management market was valued at $15.8 billion. It's projected to reach $22.8 billion by 2028, highlighting the financial stakes.

Climate Change Impact on Health

Climate change poses significant health risks globally, potentially increasing demand for healthcare technologies. Rising temperatures and extreme weather events can exacerbate respiratory illnesses and infectious diseases. This could boost demand for Philips' respiratory care and diagnostic imaging solutions. These changes may influence healthcare spending and public health priorities.

- WHO estimates climate change could cause 250,000 additional deaths per year between 2030 and 2050.

- The global healthcare market for climate-related health solutions is projected to reach billions by 2030.

- Philips' revenues in 2024 were around 18.2 billion EUR.

Environmental Standards in Supply Chain

Environmental standards are increasingly critical, impacting Philips' supply chain. Philips must collaborate with suppliers to enforce sustainable practices, reducing its environmental footprint. This includes monitoring carbon emissions and waste management. A recent study showed that 70% of consumers prefer brands with strong environmental commitments.

- Philips aims for 100% renewable energy use by 2025 in its operations.

- The company is focused on reducing its carbon footprint by 50% by 2025.

- Philips is committed to sustainable packaging for all its products.

Philips addresses environmental factors through eco-design and waste reduction. By 2025, the company aims for 25% recycled plastics and 100% renewable energy use. These efforts align with growing consumer preference for sustainable brands, and focus on emission reductions of 50% by 2025.

| Area | Initiative | Target/Impact |

|---|---|---|

| Eco-Design | New product design | 100% eco-designed by 2024, Recycled plastics (25% by 2025) |

| Energy Efficiency | Equipment & lighting solutions | Increased demand for energy-saving equipment. |

| Waste Management | Device recycling | $22.8B global market by 2028 |

PESTLE Analysis Data Sources

The analysis integrates data from the World Bank, IMF, governmental agencies, and market research reports. Insights on policies and markets are data-driven.