PriceSmart Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PriceSmart Bundle

What is included in the product

PriceSmart's BCG Matrix analysis identifies strategic actions for each business unit.

Printable summary optimized for A4 and mobile PDFs helps to easily share insights.

Delivered as Shown

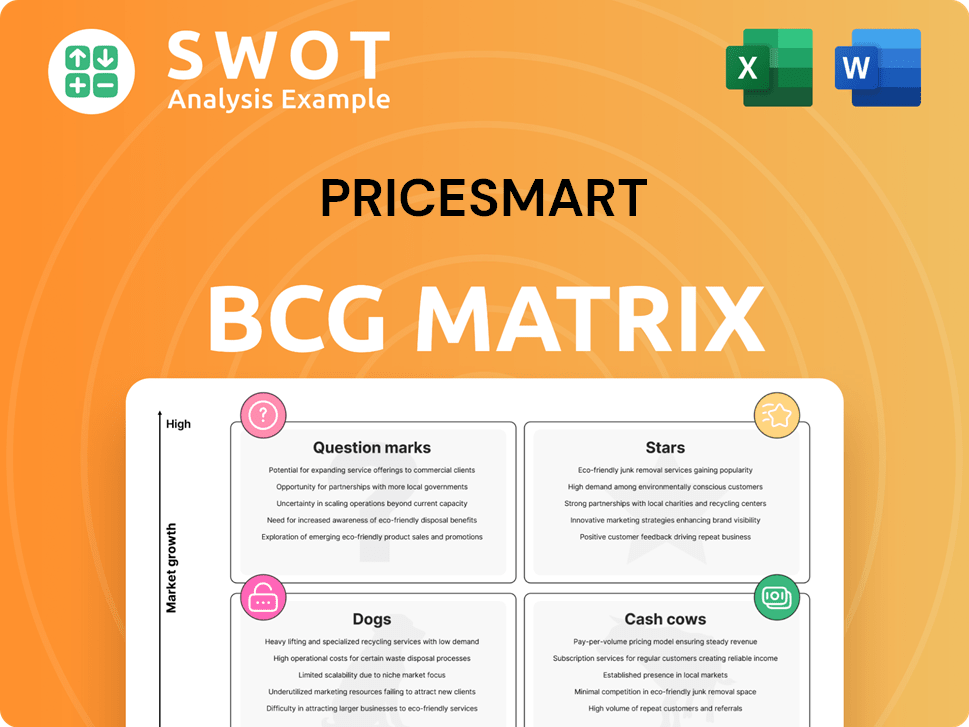

PriceSmart BCG Matrix

The preview shows the complete PriceSmart BCG Matrix you'll receive after purchase. This isn't a demo; it's the full, ready-to-use document for strategic analysis. Download instantly and use this professionally designed file without watermarks. It's perfect for your business planning and presentations.

BCG Matrix Template

PriceSmart's BCG Matrix reveals how its diverse product lines perform in their respective markets. Analyzing products as Stars, Cash Cows, Dogs, or Question Marks, offers a strategic snapshot. This analysis helps identify growth potential and resource allocation priorities. Understanding these placements allows for data-driven investment and product strategies.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

PriceSmart shines with strong operations. They saw a 6.1% rise in comparable sales in Q1 2025, without currency effects. Efficient supply chains and supplier ties help keep prices low. This operational prowess makes PriceSmart a market leader.

PriceSmart's membership strategy shows strong growth. The company's membership base grew to over 1.9 million accounts by Q2 2025. Improved benefits, like optical and pharmacy services, drive membership value. A tiered system, including Platinum, boosted membership income by 13.8% in Q1 2025. This focus builds customer loyalty.

PriceSmart's strategic expansion involves remodeling existing clubs and opening new ones, including planned warehouse clubs in Costa Rica and Guatemala in 2025. In 2024, the company's net sales reached $5.04 billion, up from $4.63 billion the prior year. This growth is fueled by increased market penetration, with expansions enhancing revenue streams. PriceSmart also invests in its distribution network, including a new Guatemalan distribution center.

Effective Capital Allocation

PriceSmart excels in capital allocation, highlighted by its $75 million stock repurchase in Q1 2024, signaling strong confidence. The company's robust financial health, marked by substantial cash reserves and minimal debt, fuels potential aggressive growth. This strategic capital deployment benefits shareholders and preserves financial flexibility. PriceSmart's approach to capital allocation is a key strength.

- $75M Stock Repurchase (Q1 2024)

- Strong Balance Sheet

- Low Debt Levels

- Financial Flexibility

Digital Channel Growth

PriceSmart's digital channel is experiencing substantial growth. Digital sales surged by 19.3% in Q2 2025, reflecting successful tech investments. By February 2025, 63.7% of members had online profiles, and 29.2% made online purchases. This expansion boosts sales and customer interaction.

- Digital channel sales grew by 19.3% in Q2 2025.

- 63.7% of members had online profiles as of February 2025.

- 29.2% of profile holders made online purchases.

- Investments in technology improved online shopping.

PriceSmart's "Stars" are segments with high growth and market share, like digital sales and membership growth. Digital sales rose 19.3% in Q2 2025, and membership accounts exceeded 1.9 million. These areas need investment to maintain momentum, ensuring PriceSmart's future.

| Aspect | Data | Impact |

|---|---|---|

| Digital Sales Growth (Q2 2025) | 19.3% | Revenue boost, customer reach |

| Membership Accounts (Q2 2025) | Over 1.9M | Loyalty, recurring revenue |

| Stock Repurchase (Q1 2024) | $75M | Shareholder value |

Cash Cows

PriceSmart's brand is well-regarded in Latin America and the Caribbean. They're known for quality and competitive pricing. This strong recognition fosters customer loyalty and attracts new members. In 2024, PriceSmart's net sales reached $4.7 billion. This brand strength supports steady cash flow.

PriceSmart's membership structure cultivates strong customer loyalty, driving recurring purchases and predictable revenue. Membership fees, a key revenue stream, saw a 13.8% rise in Q1 2025. The firm's emphasis on member value, with perks like special discounts, boosts long-term membership. This base delivers dependable income with limited promotional expenses.

PriceSmart's extensive product assortment, from groceries to electronics, boosts sales by appealing to varied customer needs. In 2024, this strategy helped PriceSmart achieve a revenue of $4.9 billion. Sourcing both regionally and locally, alongside its distribution network, allows competitive pricing. This approach ensures consistent sales and a solid market position.

Efficient Supply Chain Management

PriceSmart's robust supply chain is key for maintaining competitive prices and healthy cash flow. They're leveraging technology to enhance inventory management, with the Relex platform rollout starting in 2023 and slated for completion by late fiscal 2025. This strategic move helps cut costs and ensures products are always available, boosting profitability. Their efficient supply chain is a significant advantage.

- Relex implementation started in 2023.

- Completion of Relex is expected by the end of fiscal year 2025.

- Improved inventory management lowers costs.

- Supply chain efficiency boosts profitability.

Strategic Geographic Focus

PriceSmart's strategic focus on Latin America and the Caribbean is a key strength, especially with these regions' expected economic growth exceeding that of the U.S. This geographical concentration allows PriceSmart to leverage its market expertise and adaptability. They understand local consumer behavior, offering a competitive edge. This focus is expected to drive strong returns.

- PriceSmart's net sales for fiscal year 2024 reached $5.1 billion, a 7.6% increase.

- Comparable sales grew by 5.2% in fiscal year 2024, reflecting strong performance.

- The company operates 55 warehouse clubs, with 39 in Latin America and the Caribbean.

- Latin America and the Caribbean's GDP growth is projected to be 2.3% in 2024, outpacing the US.

PriceSmart's Cash Cow status reflects its established market presence and financial stability. Steady revenue is driven by strong brand recognition and customer loyalty. The company's focus on operational efficiency and strategic geographic focus in Latin America and the Caribbean supports consistent profitability. This is reflected in the 2024 net sales of $5.1 billion.

| Metric | Value | Year |

|---|---|---|

| Net Sales | $5.1 billion | 2024 |

| Comparable Sales Growth | 5.2% | 2024 |

| Membership Fee Rise (Q1) | 13.8% | 2025 |

Dogs

Certain PriceSmart product lines might struggle with low growth and market share, fitting the "dog" category. These could be items not popular in local markets or facing tough competition. For example, some electronics or niche food items could be struggling. In 2024, PriceSmart reported an overall comparable sales increase of 5.8%. Addressing these poorly performing lines is vital for better resource use.

Warehouse clubs that consistently underperform due to location or operational issues can be seen as dogs. These clubs might need large investments with little growth potential. PriceSmart's financial reports from 2024 show a focus on optimizing underperforming locations. In 2024, PriceSmart's net sales grew, highlighting the importance of efficient operations.

Dogs in PriceSmart's BCG matrix are slow-moving inventory requiring heavy discounts. These items, like outdated electronics, tie up capital. In 2024, PriceSmart's inventory turnover rate was approximately 7 times, indicating efficient management. Strategic markdowns are crucial; for example, a 10% discount can boost sales by 20%.

Outdated or Obsolete Products

Dogs in PriceSmart's BCG matrix include outdated products. These items face declining demand, often requiring clearance sales. Aggressive pricing is crucial to manage excess inventory. Phasing out these products helps maintain a relevant product mix. In 2024, PriceSmart saw a 3% decline in sales for certain outdated electronics.

- Outdated products face declining demand.

- Aggressive pricing is necessary for inventory management.

- Phasing out these products is important.

- PriceSmart experienced a 3% sales decline in outdated electronics in 2024.

Regions with Limited Growth Potential

Certain regions present limited growth prospects for PriceSmart, potentially qualifying as dogs in its BCG matrix. These areas may struggle with economic volatility or political instability, hindering expansion efforts. Careful monitoring and strategic adjustments are crucial to mitigate risks and optimize resource allocation in these markets. Diversifying its geographic presence helps PriceSmart offset the impact of underperforming regions. For example, in 2024, PriceSmart's expansion in Colombia showed slower growth compared to other regions.

- Economic Challenges: Regions with high inflation or currency devaluation.

- Political Instability: Countries with frequent policy changes or social unrest.

- Market Saturation: Areas where PriceSmart faces intense competition.

- Regulatory Hurdles: Regions with complex or restrictive business regulations.

PriceSmart's "dogs" include underperforming product lines with low growth. These items, such as certain electronics, may require strategic markdowns. In 2024, some products saw a 3% sales decline, necessitating inventory management adjustments.

| Category | Details | 2024 Data |

|---|---|---|

| Products | Outdated items, slow-moving goods | 3% sales decline |

| Strategies | Aggressive pricing, clearance sales | Inventory turnover rate: 7x |

| Impact | Reduced profitability, tied-up capital | Overall comparable sales: +5.8% |

Question Marks

PriceSmart's expansion into new markets, including the planned 2025 openings in Costa Rica and Guatemala, fits the question mark category in the BCG matrix. These ventures offer high growth potential but also involve high uncertainty and require substantial investment. PriceSmart needs to carefully manage risks, and adapt its strategies. In 2024, PriceSmart's international net sales increased by 10.8% to $4.8 billion.

The online pharmacy launch in Costa Rica, set for March 2025, positions PriceSmart as a "Question Mark." This new service faces uncertain market acceptance and growth. Expansion plans depend on consumer behavior and regulations. PriceSmart's 2024 revenue was $4.7 billion; success here could boost that.

PriceSmart's sustainability efforts, like waste reduction and eco-friendly products, are question marks. These align with rising consumer demand for green options, but financial impacts are unclear. A strong sustainability commitment could boost brand image and attract eco-minded shoppers. In 2024, green initiatives saw a 15% increase in consumer interest, yet ROI varied widely.

Enhanced E-commerce Capabilities

Enhanced e-commerce capabilities represent question marks in PriceSmart's BCG matrix. PriceSmart continues to invest in its online platforms to boost digital sales. However, the full effect of these investments on overall sales and profitability remains unclear. A seamless online shopping experience is vital for maximizing returns. In fiscal year 2024, digital sales grew by 25% for PriceSmart.

- Digital sales growth of 25% in fiscal year 2024.

- Ongoing investment in online platforms.

- Uncertainty about the long-term impact on profitability.

- Focus on optimizing the online customer experience.

New Membership Tiers or Benefits

Introducing new membership tiers or benefits, like a Platinum option, places PriceSmart in the question mark quadrant. These new offerings aim to attract higher-spending members and boost revenue. Success hinges on delivering substantial value and clearly communicating these benefits to potential members. In 2024, membership income represented a significant portion of PriceSmart's revenue, underscoring the importance of this strategy. Continuous monitoring of membership trends and customer feedback is crucial for optimizing these tiers.

- Membership income is a key revenue driver for PriceSmart.

- New tiers aim to attract high-value members and increase spending.

- Effective communication of benefits is essential for adoption.

- Customer feedback is vital for refining the offerings.

PriceSmart's question marks involve strategic expansions and new services. These initiatives, such as launching an online pharmacy and introducing new membership tiers, carry high growth potential. However, they also come with market uncertainties and the need for significant investment.

| Initiative | Growth Potential | Investment Risk |

|---|---|---|

| New Markets (Costa Rica, Guatemala) | High | High |

| Online Pharmacy Launch | Medium | Medium |

| New Membership Tiers | Medium | Medium |

BCG Matrix Data Sources

PriceSmart's BCG Matrix uses sales figures, market share estimates, and industry growth projections from company reports and market research.