PriceSmart Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PriceSmart Bundle

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to the specific company.

Understand strategic pressure instantly with a powerful spider/radar chart.

Preview Before You Purchase

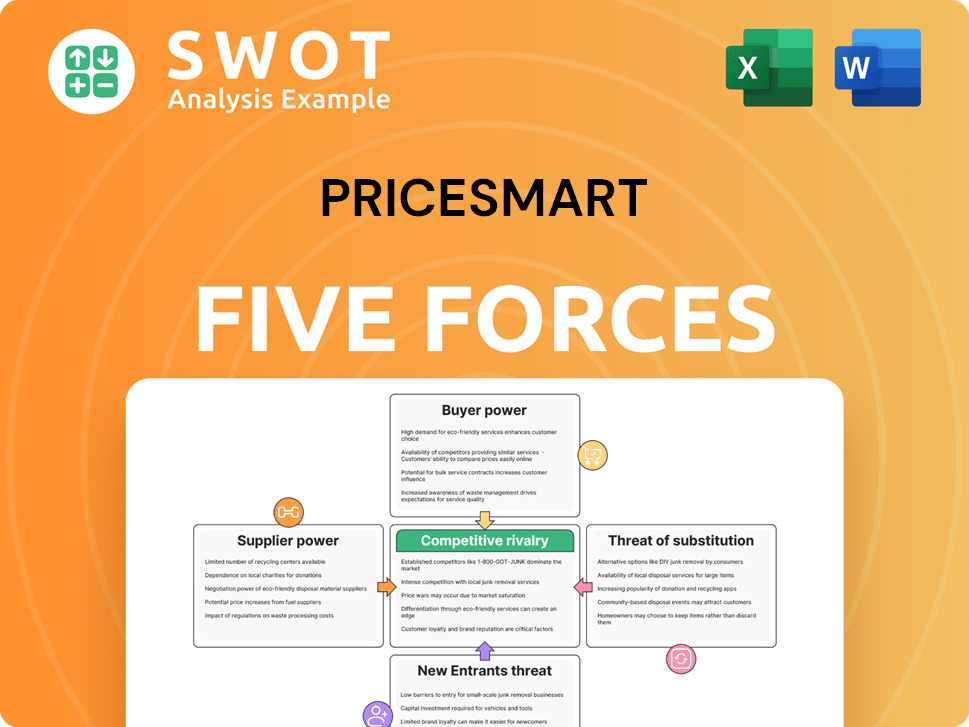

PriceSmart Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This PriceSmart Porter's Five Forces analysis delves into industry rivalry, buyer power, supplier power, threats of substitution, and new entrants. It examines how these forces shape PriceSmart's competitive landscape. The analysis provides valuable insights into PriceSmart's market positioning and strategic challenges.

Porter's Five Forces Analysis Template

PriceSmart operates within a competitive landscape shaped by various forces. Examining the threat of new entrants, the bargaining power of buyers, and the intensity of rivalry is crucial. Analyzing supplier power and the threat of substitutes completes the picture.

These forces collectively determine PriceSmart's profitability and strategic positioning. Understanding them enables informed decision-making for investors and strategists alike.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore PriceSmart’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

PriceSmart's strategy involves sourcing from a diverse supplier base, which limits the bargaining power of individual suppliers. This approach is evident in their ability to negotiate favorable terms. For instance, in 2024, PriceSmart's cost of goods sold was approximately $4.7 billion, reflecting efficient sourcing. This diversification helps maintain competitive pricing.

PriceSmart benefits from standardized product offerings. The company sources goods like bulk foods and household items from various vendors. This setup limits supplier power. For example, in 2024, PriceSmart's cost of goods sold was approximately $5.5 billion, showing diverse sourcing.

The availability of substitutes also helps. PriceSmart can switch suppliers easily. This flexibility keeps supplier bargaining power low. The company's reliance on multiple vendors, as seen in its annual reports, supports this.

PriceSmart's substantial sales volume directly translates into considerable purchasing power. In 2024, PriceSmart's revenue reached approximately $5 billion. This scale enables the company to negotiate favorable terms with suppliers. These suppliers depend on PriceSmart's sizable orders. Therefore, PriceSmart maintains strong leverage in price negotiations.

Supplier competition

The competition among suppliers in PriceSmart's operating regions significantly diminishes their bargaining power. Suppliers aggressively vie for access to PriceSmart's extensive customer base, creating a competitive environment. This rivalry compels suppliers to offer more favorable terms and lower prices to PriceSmart. For instance, in 2024, PriceSmart reported a 6.5% increase in merchandise sales, demonstrating its strong position to negotiate with suppliers.

- Increased sales volume strengthens PriceSmart's negotiation leverage.

- Competitive bidding among suppliers leads to cost efficiencies.

- Favorable terms include pricing, payment schedules, and delivery conditions.

- PriceSmart's large-scale purchasing further enhances its bargaining position.

Backward integration threat is low

PriceSmart's backward integration threat is low, meaning they are unlikely to become their own suppliers. This lack of threat gives suppliers less leverage. Suppliers don't need to offer better terms to prevent PriceSmart from competing. The focus remains on finding the best deals. In 2024, PriceSmart's revenue was approximately $5.3 billion.

- Low Threat: PriceSmart rarely becomes its own supplier.

- Supplier Leverage: Suppliers have less pressure to offer better terms.

- Focus: PriceSmart concentrates on sourcing advantageous deals.

- 2024 Revenue: PriceSmart's revenue reached around $5.3 billion.

PriceSmart's supplier bargaining power is diminished by its strategy of sourcing from a broad supplier base, promoting competitive bidding, and high purchasing volume. In 2024, PriceSmart's cost of goods sold was around $5.5 billion, highlighting efficient sourcing. This approach supports competitive pricing.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Diversified Suppliers | Limits supplier power | $5.5B Cost of Goods Sold |

| High Purchasing Volume | Enhances negotiation leverage | Approx. $5B Revenue |

| Competitive Bidding | Drives cost efficiencies | 6.5% Sales Increase |

Customers Bargaining Power

PriceSmart's members, focused on value, exhibit price sensitivity. This sensitivity amplifies their bargaining power. They can switch or skip purchases if prices aren't competitive. In 2024, PriceSmart's net sales reached $4.9 billion. Maintaining competitive pricing is vital for retaining its customer base.

PriceSmart's membership model cultivates customer loyalty, creating a barrier to switching. Members, having paid for the membership, are less likely to immediately switch. This sunk cost effect encourages repeat purchases at PriceSmart. In 2024, PriceSmart reported a membership renewal rate of approximately 88%, demonstrating this loyalty.

Customers can choose from supermarkets, discount stores, and online platforms. This access to alternatives boosts their bargaining power. If PriceSmart's offerings aren't satisfactory, switching is simple. In 2024, online retail grew, increasing options. This influences PriceSmart's pricing and service strategies.

Information transparency

Customers' bargaining power at PriceSmart is influenced by information transparency. They can easily compare prices and product details online, boosting their decision-making. This access to data allows customers to find better deals, enhancing their negotiating position. With information readily available, customers are empowered to seek competitive pricing. PriceSmart's ability to manage this dynamic is crucial.

- In 2024, online retail sales reached approximately $1.1 trillion in the U.S., emphasizing the importance of price transparency.

- Price comparison websites and apps saw a 20% increase in usage in 2024, showing customers actively seeking information.

- Studies indicate that 70% of consumers check online reviews before making a purchase, impacting their buying decisions.

- PriceSmart's 2024 revenue was approximately $5 billion, highlighting the need to manage customer bargaining power effectively.

Limited product differentiation

PriceSmart's product offerings, while extensive, often lack significant differentiation from competitors. This similarity empowers customers, allowing them to easily switch to alternatives. To counter this, PriceSmart must emphasize convenience and value to retain its customer base effectively. In 2024, the company's focus on these factors contributed to a steady membership renewal rate.

- Membership renewal rate: 88% (2024)

- Average transaction value: $125 (2024)

- Number of stores: 55 (2024)

PriceSmart customers' bargaining power is significant due to price sensitivity and easy access to alternatives. Customers can easily compare prices online, increasing their power. However, the membership model encourages loyalty, somewhat offsetting this. In 2024, online retail sales were about $1.1 trillion.

| Factor | Impact | Data (2024) | |

|---|---|---|---|

| Price Sensitivity | High, due to value focus | Online retail growth | $1.1T |

| Membership Model | Enhances loyalty | Renewal rate | 88% |

| Alternatives | Wide availability | Price comparison app usage increase | 20% |

Rivalry Among Competitors

The retail sector in Latin America and the Caribbean is fiercely competitive. PriceSmart faces pressure to offer competitive prices and high service levels. Established retailers and new entrants intensify this rivalry. In 2024, retail sales in Latin America are projected to reach $1.5 trillion. This dynamic environment demands strategic agility.

PriceSmart directly competes with warehouse clubs, notably Costco, which share a similar business model. This rivalry heightens competition for the same customer base. In 2024, Costco's revenue reached $242.2 billion, reflecting its strong market presence. Price and product selection are primary battlegrounds.

Traditional supermarkets and discount retailers, like Walmart, present major competition to PriceSmart. These competitors sell comparable items and aggressively compete on price, drawing in cost-conscious shoppers. For instance, Walmart's revenue in 2024 reached $648.1 billion, highlighting its vast market presence. This extensive reach amplifies the competitive strain PriceSmart faces.

Localized competition varies

Competitive rivalry for PriceSmart fluctuates significantly depending on the region. Some areas experience intense competition, while others see less pressure. In regions with less competition, PriceSmart can potentially set prices more favorably. However, in highly competitive markets, differentiation and value become essential to maintain market share. For instance, PriceSmart's 2024 revenue was $4.9 billion.

- Market Saturation: The level of competition directly impacts pricing strategies.

- Pricing Power: Less competition provides more flexibility in pricing.

- Differentiation: Crucial in crowded markets to attract customers.

- Local Landscape: Understanding local market dynamics is key.

Focus on membership retention

PriceSmart's competitive strategy heavily relies on keeping its members. They aim to combat rivals by offering extra value to their members. A strong focus on member retention is crucial for profitability. Loyalty programs and special deals are key elements of their strategy.

- PriceSmart reported a membership renewal rate of around 90% in 2023, demonstrating strong member loyalty.

- The company's net sales increased by 10.4% to $4.8 billion in the first half of fiscal year 2024, showing the effectiveness of its strategies.

- PriceSmart's focus on providing value-added services helps in retaining members and building a competitive advantage.

Competitive rivalry significantly impacts PriceSmart's pricing and market share. The company contends with warehouse clubs, supermarkets, and discount retailers. Success depends on regional market dynamics and member retention.

| Aspect | Details | Impact |

|---|---|---|

| Key Competitors | Costco, Walmart, local retailers | High price competition |

| 2024 Revenue (PriceSmart) | $4.9 billion | Reflects competitive pressure |

| Member Retention Rate | Around 90% (2023) | Key to success in rivalry |

SSubstitutes Threaten

Traditional retail stores, such as supermarkets and department stores, present a direct substitute threat to PriceSmart. These stores offer similar product ranges and can match or undercut prices, attracting customers. Their widespread accessibility and convenience make them easily accessible alternatives. In 2024, retail sales in the U.S. were approximately $7 trillion, highlighting the substantial market share of these substitutes.

Online retailers like Amazon are substitutes for PriceSmart. E-commerce offers convenience and competitive prices. In 2024, online retail sales in the US reached $1.1 trillion. This growth poses a threat to physical stores. PriceSmart must compete with this trend.

Discount retailers, including Walmart, pose a significant threat. They offer similar value with wide product ranges at lower prices. These retailers attract cost-conscious consumers, potentially diverting PriceSmart's customer base. For instance, Walmart's 2024 revenue reached approximately $611 billion. This competitive landscape intensifies the substitution risk for PriceSmart.

Wholesale markets

Wholesale markets and local vendors present a threat as substitutes for PriceSmart, especially for bulk purchasers. These alternatives can offer competitive pricing or unique products, potentially drawing customers away. The presence of these options diminishes customer dependence on PriceSmart. In 2024, discount retailers like Costco and Sam's Club, which also operate in the wholesale space, reported strong sales, indicating the ongoing viability of this substitution. The competition from these alternatives necessitates PriceSmart to continually enhance its value proposition.

- Costco's 2024 revenue reached approximately $240 billion.

- Sam's Club's 2024 revenue was around $85 billion.

- Local vendors provide niche products or services.

- Wholesale markets offer bulk purchasing options.

Changing consumer behavior

Changing consumer behavior significantly impacts PriceSmart, as shifts in shopping habits can introduce substitute options. Consumers might favor smaller, more frequent trips over bulk buying, potentially impacting PriceSmart's model. A 2024 study shows a 15% rise in demand for convenience stores. To stay competitive, PriceSmart must adapt its offerings.

- Focus on smaller pack sizes.

- Enhance online presence.

- Offer specialty products.

- Improve in-store experience.

PriceSmart faces substantial substitution threats from various retail sectors. Traditional stores and online retailers compete through product offerings and pricing. Discount stores and wholesale markets offer comparable value. Adapting to evolving consumer preferences is essential.

| Substitute | 2024 Revenue (approx.) | Key Threat |

|---|---|---|

| Traditional Retail | $7 trillion (US) | Accessibility and pricing |

| Online Retail | $1.1 trillion (US) | Convenience and pricing |

| Discount Retailers | Walmart: $611B | Lower prices, broad ranges |

| Wholesale/Local | Costco: $240B, Sam's: $85B | Bulk, niche products |

Entrants Threaten

Establishing a warehouse club like PriceSmart demands substantial upfront capital for infrastructure, inventory, and marketing. This high initial investment acts as a significant barrier, deterring new market entrants. PriceSmart's 2024 capital expenditures were approximately $150 million, highlighting the financial commitment. The need for extensive distribution networks further elevates these capital requirements.

PriceSmart benefits from strong brand recognition and customer loyalty, especially in Latin America and the Caribbean. This established presence makes it difficult for new competitors to gain traction. PriceSmart's brand equity, built over decades, provides a significant advantage. In 2024, PriceSmart's membership renewal rate was around 90% indicating high customer loyalty, a tough hurdle for new entrants.

PriceSmart leverages its large membership and sales volume for economies of scale. New entrants face a cost disadvantage due to difficulty in quickly matching PriceSmart's scale. This advantage allows favorable supplier terms and efficient fixed cost distribution. In 2024, PriceSmart reported over $4.8 billion in revenue, highlighting its scale advantage.

Established supply chain

PriceSmart's established supply chain poses a significant threat to new entrants. Replicating its efficient distribution network and supplier relationships is challenging. The time and resources required to build such a robust system create a substantial barrier. PriceSmart's existing logistical expertise offers a competitive advantage, making it tough for newcomers to compete. In 2024, PriceSmart's cost of goods sold was around 75% of its revenue, showcasing supply chain efficiency.

- Established Supply Chain: PriceSmart's existing network is a major barrier.

- Supplier Relationships: Relationships provide a competitive edge.

- Logistical Expertise: PriceSmart's know-how is a key advantage.

- Financial Data: 2024 Cost of Goods Sold approximately 75%.

Regulatory hurdles

Regulatory hurdles pose a significant threat to new entrants in PriceSmart's market. Navigating complex requirements and obtaining permits across various countries introduces considerable challenges. Compliance with local laws and regulations increases both complexity and expenses, potentially discouraging new competitors from entering the market. Understanding and effectively managing these regulatory obstacles is crucial for any company looking to enter and compete in PriceSmart's operational areas. These challenges can create a barrier, protecting PriceSmart's market position.

- PriceSmart operates in multiple countries, each with unique regulatory environments, as of 2024.

- The costs associated with regulatory compliance can be substantial, impacting profitability for new entrants.

- Regulatory compliance adds complexity to the entry process.

- PriceSmart's established presence helps it navigate these hurdles more efficiently.

New entrants face significant hurdles, including high capital needs, brand recognition challenges, and the need to compete with PriceSmart's scale.

PriceSmart's established supply chain and logistical expertise create further barriers, as replicating these systems demands time and resources.

Regulatory obstacles also impede new entrants, increasing costs and complexity in PriceSmart's diverse operational areas.

| Barrier | Description | Impact |

|---|---|---|

| Capital Requirements | High initial investment for infrastructure. | Discourages new entrants. |

| Brand Recognition | PriceSmart's established presence. | Makes it hard for newcomers to gain traction. |

| Supply Chain | Existing distribution network. | Difficult to replicate efficiently. |

Porter's Five Forces Analysis Data Sources

We leverage annual reports, market research, and financial databases to inform the analysis. This includes company disclosures and industry publications.