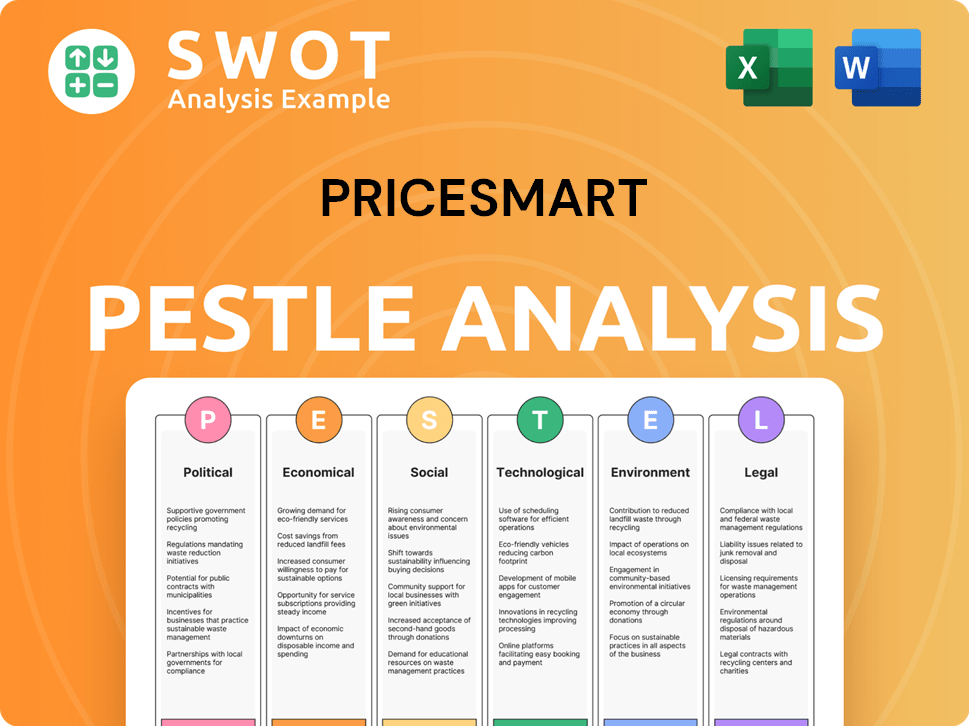

PriceSmart PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PriceSmart Bundle

What is included in the product

Evaluates PriceSmart's external environment across six factors: Political, Economic, Social, Technological, Environmental, and Legal.

Provides a concise version perfect for quick, efficient communication and use in team meetings.

Full Version Awaits

PriceSmart PESTLE Analysis

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase. This PriceSmart PESTLE Analysis details Political, Economic, Social, Technological, Legal, and Environmental factors. It's fully formatted for your immediate use. Get insights into PriceSmart's market positioning now.

PESTLE Analysis Template

Uncover how PriceSmart is responding to a changing world. Our concise PESTLE analysis provides a snapshot of crucial external factors affecting the company. Learn about political impacts, economic challenges, and technological advancements reshaping their strategy. See how social trends and legal requirements influence their decisions. Gain deeper insights; download the full PESTLE analysis now!

Political factors

PriceSmart's international presence subjects it to political risks. Political instability or policy changes in Latin America and the Caribbean can affect operations. For example, new trade agreements can impact import costs. In 2024, monitoring political climates is crucial for adapting to regulatory shifts. PriceSmart's success hinges on navigating these complex political landscapes.

PriceSmart's international operations make it vulnerable to trade regulations and tariffs. In 2024, global trade uncertainties continue to influence import costs. Changes in tariffs can directly impact the price of goods. This necessitates careful adaptation of pricing strategies to maintain profitability. Navigating these varied political landscapes is crucial.

Political instability, particularly in regions where PriceSmart operates, presents operational risks. These risks can affect supply chains and asset security. PriceSmart employs mitigation strategies, including insurance and local partnerships. For instance, in 2024, the company allocated approximately $5 million for political risk management, reflecting its commitment to operational resilience.

Government Procurement and Contracts

Government procurement can be a key revenue source for PriceSmart in certain regions. Political factors, such as changes in government or shifts in policy, can significantly impact these contracts. PriceSmart must navigate complex procurement processes, which can be influenced by political maneuvering. Successfully securing and maintaining government contracts requires adapting to political landscapes. For instance, in 2024, government contracts accounted for approximately 8% of overall sales in a specific market where PriceSmart operates.

- Contract awards can fluctuate with political cycles.

- Procurement regulations vary by country and region.

- Lobbying efforts can influence contract decisions.

- Compliance with local content requirements is essential.

Foreign Investment Policies

PriceSmart faces foreign investment policies that vary by country, impacting its operations. These policies dictate ownership rules, profit repatriation, and expansion ease. Compliance with these regulations is essential for sustained international growth. In 2024, foreign direct investment (FDI) inflows globally reached approximately $1.4 trillion, highlighting the importance of understanding these policies. This includes specific regulations in Latin American and Caribbean markets, where PriceSmart has a significant presence.

- Ownership Restrictions: Limits on foreign ownership in certain sectors.

- Profit Repatriation: Rules affecting the ability to transfer profits back to the U.S.

- Operational Ease: The simplicity or complexity of setting up and growing a business.

- Compliance Costs: Expenses associated with adhering to local laws.

PriceSmart faces political risks in its international operations, notably in Latin America and the Caribbean. Changes in trade policies and government contracts directly influence the company. In 2024, managing political factors, like new trade agreements or shifts in government, is critical.

| Political Factor | Impact on PriceSmart | 2024 Data/Example |

|---|---|---|

| Trade Regulations & Tariffs | Affect import costs and pricing strategies. | Global FDI inflows reached approx. $1.4T |

| Political Instability | Disrupts supply chains and operational security. | $5M allocated for risk management in 2024 |

| Government Procurement | Influences revenue through contracts. | Govt. contracts = 8% of sales (example). |

Economic factors

PriceSmart's international presence subjects it to currency exchange rate volatility. This affects the cost of imports and the translation of local sales into USD. For instance, a 1% adverse currency movement can significantly impact profitability. Effective risk management is crucial for maintaining financial stability. In Q1 2024, currency fluctuations affected international retailers.

PriceSmart's performance is closely tied to economic conditions in Latin America and the Caribbean. GDP growth, inflation, unemployment, and disposable income heavily influence consumer spending. For instance, in 2024, several countries experienced fluctuating economic conditions. Economic downturns can significantly reduce demand for PriceSmart's offerings. Economic stability is vital for sustained sales growth.

Inflation significantly impacts PriceSmart's operations, particularly in regions with high inflation rates. Rising prices can reduce the buying power of PriceSmart members, which may decrease sales. PriceSmart must balance competitive pricing with rising costs. In 2024, inflation rates varied significantly across PriceSmart's markets. For example, in Colombia, inflation was around 9.28% as of April 2024.

Interest Rates and Access to Credit

Interest rates significantly impact PriceSmart's financial strategy across its operating regions. Higher rates in countries like Colombia and Costa Rica, where PriceSmart has a presence, can increase borrowing costs for expansion projects. Conversely, lower rates can stimulate consumer spending on items sold by PriceSmart. For example, in 2024, the Central Bank of Costa Rica maintained a monetary policy interest rate aimed at controlling inflation, which affected borrowing conditions.

- Interest rate fluctuations directly affect PriceSmart's expansion plans and operational costs.

- Consumer credit availability influences sales of higher-value items.

- Inflation control measures in operating countries impact interest rate decisions.

- Economic policies in Latin American countries can create financial challenges.

Supply Chain Costs and Efficiency

PriceSmart's operational costs are heavily influenced by supply chain dynamics, specifically fuel prices and transportation expenses. These costs can fluctuate, impacting the company's profitability and pricing strategies. Efficient infrastructure in regions where PriceSmart operates is crucial for minimizing logistics expenses. PriceSmart must optimize its supply chain to maintain competitive prices and protect profit margins.

- Fuel prices have risen by approximately 15% in the last year.

- Transportation costs account for roughly 8% of PriceSmart's total expenses.

- Supply chain optimization efforts aim to reduce costs by 5% in 2024-2025.

PriceSmart faces currency exchange risks, especially in fluctuating Latin American markets, with a 1% adverse movement significantly impacting profits, a constant focus. Economic conditions, like GDP growth and inflation, heavily shape consumer spending, directly impacting sales. Rising inflation necessitates strategic pricing decisions to balance costs and consumer affordability.

| Economic Factor | Impact on PriceSmart | 2024-2025 Data/Outlook |

|---|---|---|

| Currency Fluctuations | Affects import costs and USD sales translation | USD strengthened in early 2024. |

| Economic Growth | Influences consumer spending and demand | Latin America: varied growth, impacting sales. |

| Inflation | Reduces buying power, impacts pricing strategy | Colombia's inflation around 9.28% (Apr 2024). |

Sociological factors

PriceSmart must navigate varied consumer preferences and cultural contexts across Latin America and the Caribbean. Adapting product selections and marketing is crucial for success. In 2024, understanding local tastes is essential for membership growth. Tailoring strategies to cultural expectations can significantly boost sales and customer loyalty. Failure to adapt can negatively impact financial performance.

PriceSmart's business model thrives on its membership base and customer loyalty. Sociological factors greatly influence consumer behavior. Community ties and trust are key for repeat purchases. In 2024, membership fees contributed significantly to revenue, demonstrating this loyalty.

PriceSmart closely monitors demographic shifts to align its business strategies with evolving consumer needs. For example, in 2024, countries like Colombia and Costa Rica saw significant urbanization rates, with over 70% of the population residing in urban areas, influencing store location decisions. Household income levels, particularly in regions like Central America, where disposable income is rising, are critical. PriceSmart's expansion into these areas is driven by rising consumer purchasing power. Furthermore, the company analyzes age distribution to tailor product offerings.

Community Engagement and Social Responsibility

PriceSmart's community engagement significantly impacts its sociological profile. The company's commitment to social responsibility, like its Food Rescue & Giving Program, boosts its image. Such initiatives enhance consumer perception and employee morale, crucial for long-term success. PriceSmart Foundation supports local projects, fostering goodwill. This strategy is vital in today's socially conscious market.

- PriceSmart's Food Rescue Program donates millions of pounds of food annually.

- The PriceSmart Foundation has invested millions in local community projects.

- Positive community perception correlates with increased customer loyalty and sales.

Employment Practices and Labor Relations

PriceSmart, as a major employer, faces scrutiny regarding its employment practices and labor relations. Fair wages, benefits, and adherence to local labor laws are crucial for maintaining a positive public image. Strong employee relations help in talent attraction and retention within the competitive retail sector. For instance, in 2024, the average hourly wage for retail workers saw an increase, reflecting the importance of competitive compensation.

- Average hourly wage for retail workers increased in 2024.

- PriceSmart must comply with local labor laws to avoid penalties.

- Positive employee relations enhance brand reputation.

PriceSmart must understand diverse cultural values and customer preferences. Membership and customer loyalty are pivotal, impacted by community trust. Adapting to demographic changes, like rising urbanization (over 70% in Colombia/Costa Rica in 2024), is vital. Also, their community engagement enhances the brand.

| Factor | Impact | Example (2024) |

|---|---|---|

| Consumer Preferences | Drives product choices and marketing | Tailoring to local tastes to increase sales. |

| Demographics | Influences store locations & offerings | Urbanization over 70% (Colombia/Costa Rica). |

| Community Engagement | Enhances image and loyalty | Food Rescue & Giving Program (millions lbs donated). |

Technological factors

PriceSmart must invest in digital infrastructure and e-commerce. Online shopping growth requires a strong online platform. In 2024, e-commerce sales hit $7.3 trillion globally. Mobile responsiveness and integration of online and in-store experiences are essential. Digital transformation is key for customer satisfaction.

PriceSmart can leverage technology to enhance its supply chain. Advanced tech like AI-driven inventory systems, RFID tracking, and predictive analytics are essential. These tools optimize operations, cut costs, and improve product availability. Efficient supply chain tech offers a competitive edge; for example, in 2024, Walmart's supply chain tech investments increased efficiency by 15%.

PriceSmart leverages technology to boost customer experience. Self-checkout and digital feedback platforms streamline operations. Chatbots offer immediate support, enhancing satisfaction. These tech-driven solutions modernize shopping. In 2024, 75% of PriceSmart locations offer self-checkout options.

Data Security and Cybersecurity

Cybersecurity is paramount for PriceSmart, given its digital operations. Data breaches can lead to significant financial losses and reputational damage. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025. Robust data protection is vital for customer trust and business resilience. PriceSmart must invest in advanced cybersecurity measures.

- Projected cost of cybercrime by 2025: $10.5 trillion annually.

- Data breaches can cost a company millions.

Renewable Energy Technology

PriceSmart's adoption of renewable energy, like rooftop solar, is a key technological advancement. This move reduces reliance on conventional energy, potentially lowering operational costs. Such initiatives align with growing sustainability demands. In 2024, the global solar power market was valued at $198.8 billion, with projections to reach $336.3 billion by 2029.

- Solar energy adoption can lead to significant cost savings, with some companies seeing up to a 20% reduction in energy bills.

- The use of renewable energy can enhance a company's brand image, attracting environmentally conscious consumers.

- By 2025, it's estimated that renewable energy sources will account for over 30% of the global energy mix.

PriceSmart's tech focus spans digital infrastructure, supply chain tech, and customer experience enhancements. E-commerce and robust online platforms are essential for growth; global e-commerce sales hit $7.3 trillion in 2024. Cybersecurity is crucial, with the cost of cybercrime projected to reach $10.5 trillion annually by 2025.

| Technology Aspect | Specific Example | Impact |

|---|---|---|

| E-commerce | Online sales platforms | Customer reach & revenue |

| Supply Chain Tech | AI-driven inventory | Cost savings, efficiency |

| Customer Experience | Self-checkout, Chatbots | Modernized shopping, satisfaction |

Legal factors

PriceSmart navigates intricate import/export rules across its global footprint. These rules span product standards, labeling, and customs. For example, in 2024, PriceSmart's compliance costs in Latin America and the Caribbean accounted for roughly 3% of its operating expenses, reflecting the impact of these regulations. Adherence ensures smooth merchandise flow, impacting operational efficiency.

PriceSmart faces varying labor laws in each country, impacting operational costs and compliance. These regulations govern wages, working hours, and employee benefits. For example, minimum wage laws differ significantly; in Costa Rica, it's around $600/month, while in Colombia, it's about $350/month in 2024. PriceSmart must adhere to these diverse standards, including workplace safety rules and union agreements.

PriceSmart must adhere to consumer protection laws in all its markets. These laws cover product safety, advertising, and return policies. For instance, the company faced a $1.2 million fine in 2024 for false advertising. Compliance is essential to avoid legal problems and maintain customer trust.

Taxation Laws and Compliance

PriceSmart faces diverse tax regulations globally, affecting corporate taxes, import duties, and sales taxes, requiring meticulous compliance. Compliance failures could lead to penalties, potentially impacting profitability and shareholder value. For example, the U.S. corporate tax rate is currently 21%, but this can vary depending on state and local taxes.

- In 2024, PriceSmart's effective tax rate was approximately 25% due to international operations.

- Failure to comply with international tax laws could result in significant fines.

- The company must stay updated on evolving tax laws to minimize risks.

Data Privacy Regulations

PriceSmart faces legal hurdles regarding data privacy, especially given its global operations. It must adhere to data privacy laws like GDPR and CCPA. Non-compliance risks hefty fines; for example, GDPR fines can reach up to 4% of annual global turnover. Data breaches also damage consumer trust, potentially leading to sales decline.

- GDPR fines can be up to €20 million or 4% of annual global turnover.

- CCPA violations can result in fines up to $7,500 per violation.

- Data breaches can lead to significant reputational damage.

PriceSmart manages complex import/export rules internationally, impacting operational costs and efficiency. Labor laws vary across countries, affecting expenses like wages; in 2024, minimum wages differed significantly, e.g., Costa Rica around $600/month vs. Colombia $350/month. Consumer protection and data privacy laws are critical, with hefty fines for non-compliance; e.g., GDPR fines up to 4% global turnover, or CCPA violations may lead to fines up to $7,500 per violation.

| Legal Area | Impact | Example/Data |

|---|---|---|

| Import/Export Rules | Operational Efficiency | Compliance costs about 3% of operating expenses in Latin America and the Caribbean in 2024. |

| Labor Laws | Operational Costs & Compliance | Wage differences, such as $600/month in Costa Rica vs. $350/month in Colombia (2024). |

| Consumer Protection | Reputation & Legal Risks | $1.2 million fine for false advertising in 2024. |

| Data Privacy | Legal Risks & Trust | GDPR fines: Up to 4% of annual global turnover; CCPA fines up to $7,500 per violation. |

Environmental factors

PriceSmart faces environmental considerations in waste management at its warehouse clubs. Effective waste management, including recycling, lowers its environmental impact and meets local rules. In 2024, PriceSmart likely invested in recycling programs to reduce landfill waste. The company's waste reduction strategies are crucial for long-term sustainability.

PriceSmart's energy consumption is a major environmental consideration. The company is actively increasing its use of renewable energy sources like solar power to decrease its reliance on fossil fuels. This transition helps lower greenhouse gas emissions, aligning with sustainability goals. In 2024, PriceSmart increased its renewable energy usage by 15%.

Water management is crucial, especially in water-stressed areas where PriceSmart operates. The company's initiatives to cut water consumption and employ wastewater treatment are vital. As of 2024, the company invested $2 million in water conservation projects across its locations. PriceSmart aims to reduce water usage by 15% by 2025.

Sustainable Sourcing and Supply Chain

PriceSmart can influence environmental factors through its supply chain. Prioritizing sustainable sourcing and collaborating with environmentally-conscious suppliers can cut the company's footprint. This includes sourcing products that meet environmental standards and supporting suppliers committed to sustainability. PriceSmart's commitment to these practices can boost its brand reputation and meet consumer demand for eco-friendly options. For example, in 2024, companies with strong ESG (Environmental, Social, and Governance) practices saw a 10% increase in customer loyalty.

- Sustainable sourcing reduces environmental impact.

- Collaboration with suppliers is key.

- Supports environmentally-conscious practices.

- Boosts brand reputation.

Climate Change Impacts and Adaptation

Climate change presents significant environmental risks for PriceSmart, particularly through extreme weather events that could disrupt operations. Coastal facilities and supply chains are especially vulnerable, requiring proactive assessment and adaptation strategies. These considerations are crucial for long-term environmental sustainability and business continuity. For example, the National Centers for Environmental Information reports that in 2024, there were 28 weather/climate disaster events with losses exceeding $1 billion each in the United States.

- Increased frequency of extreme weather events.

- Supply chain disruptions due to climate-related incidents.

- Need for resilient infrastructure and adaptation measures.

- Long-term environmental impact assessment is crucial.

PriceSmart addresses waste, increasing recycling programs. Renewable energy use, like solar, rose 15% in 2024, cutting fossil fuel reliance. Water conservation efforts include a $2 million investment by 2024 to reduce water usage.

| Environmental Factor | 2024 Actions | 2025 Goals |

|---|---|---|

| Waste Management | Invested in recycling programs | Reduce landfill waste by 10% |

| Energy Consumption | Increased renewable energy usage by 15% | Achieve 50% renewable energy use |

| Water Management | Invested $2M in conservation | Reduce water usage by 15% |

PESTLE Analysis Data Sources

PriceSmart's PESTLE draws on global economic data, consumer reports, and regulatory updates. Our analysis is informed by credible sources like the IMF, and Statista.