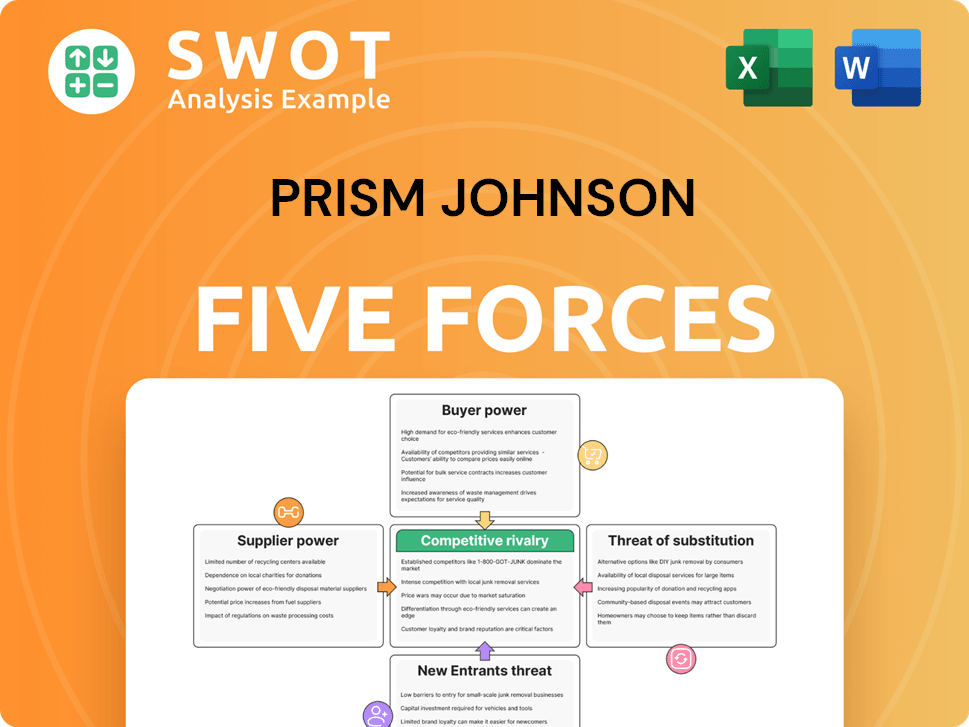

Prism Johnson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prism Johnson Bundle

What is included in the product

Analyzes competitive forces, supplier/buyer power, and new entrant threats, tailored for Prism Johnson.

Customize each force's intensity, helping you quickly spot vulnerabilities and opportunities.

Same Document Delivered

Prism Johnson Porter's Five Forces Analysis

This preview reveals the full Prism Johnson Porter's Five Forces analysis. You're seeing the complete, final document. After purchase, you'll instantly receive this exact, ready-to-use file. It's professionally written and comprehensively formatted. No edits or extra steps are needed.

Porter's Five Forces Analysis Template

Prism Johnson faces competitive pressures shaped by supplier bargaining power, buyer influence, and the threat of new entrants and substitutes. The intensity of rivalry among existing competitors also plays a crucial role. Understanding these forces is critical for assessing Prism Johnson's profitability and long-term sustainability within its industry. This analysis offers a glimpse into the complex dynamics at play.

Ready to move beyond the basics? Get a full strategic breakdown of Prism Johnson’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The bargaining power of cement suppliers for Prism Johnson is moderate. The industry has a relatively concentrated supplier base. This concentration allows suppliers some control over pricing. Prism Johnson needs strong supplier relationships to counter this. In 2024, major cement producers like UltraTech and ACC control a significant market share, impacting supplier power.

The availability of raw materials such as limestone, gypsum, and fly ash significantly impacts supplier power in Prism Johnson's operations. If these materials are scarce, suppliers gain more leverage, potentially increasing prices and reducing Prism Johnson's profitability. Prism Johnson should focus on diversifying its raw material sources. For example, in 2024, the cost of cement production increased by 5-7% due to raw material price hikes, emphasizing the importance of securing reliable supply chains.

Switching costs significantly influence supplier power; these encompass expenses and effort to change suppliers. High switching costs amplify supplier influence. Prism Johnson, for instance, faced challenges in 2024 due to specialized materials. Aiming to standardize requirements and find alternative suppliers can mitigate these costs. Prism Johnson's 2024 reports showed that diversifying suppliers reduced material costs by 7%.

Impact of transportation costs

Transportation costs are a key factor in the price of raw materials like cement and aggregates for Prism Johnson. Suppliers closer to the company's plants may have a pricing advantage due to lower shipping expenses. Effective logistics and strategic plant locations are essential for minimizing the impact of these costs on supplier bargaining power. For instance, in 2024, transportation costs accounted for approximately 10-15% of the total cost for cement manufacturers.

- Proximity to plants helps reduce transportation expenses.

- Logistics optimization is crucial for cost control.

- Transportation costs can significantly affect supplier pricing.

- In 2024, transportation costs for cement were 10-15%.

Supplier integration potential

The potential for suppliers to integrate forward significantly impacts their bargaining power within the building materials market. If suppliers, such as cement or steel producers, can establish their own distribution networks or directly sell to end-users, they pose a greater threat to companies like Prism Johnson. This forward integration reduces Prism Johnson's control over its supply chain and potentially increases costs. Prism Johnson needs to proactively monitor supplier activities, assessing their strategic moves and any expansions.

- In 2024, the global construction industry saw a 5% rise in raw material costs, impacting supplier-related bargaining.

- Companies like Ultratech Cement have expanded their retail presence, indicating forward integration strategies.

- Prism Johnson's strategy should involve long-term contracts and diversifying suppliers.

- Supplier concentration, where a few suppliers dominate, elevates their bargaining power.

The bargaining power of suppliers for Prism Johnson is moderate. Suppliers' influence is shaped by concentration and raw material availability. High switching costs and forward integration potential also affect supplier leverage.

| Factor | Impact | 2024 Data |

|---|---|---|

| Supplier Concentration | Higher power if fewer suppliers | UltraTech/ACC control significant market share |

| Raw Material Costs | Affects profitability | 5-7% production cost increase |

| Switching Costs | High costs increase supplier power | Specialized material challenges |

Customers Bargaining Power

Customer concentration significantly impacts bargaining power in construction. Major developers often wield considerable influence due to their bulk purchasing. For example, in 2024, large real estate firms accounted for over 60% of construction material sales. Prism Johnson should diversify its customer base. This strategy helps to mitigate the risk of being overly dependent on a small number of large buyers, which can lead to unfavorable pricing terms.

Individual home builders show high price sensitivity, especially in competitive areas. Their price negotiation directly influences Prism Johnson's profits. By offering value-added services, Prism Johnson can reduce price pressures. In 2024, the construction materials market saw a 7% price fluctuation. Differentiated products can also help retain margins.

The availability of substitutes significantly impacts customer power. If alternative building materials are readily available, customer bargaining power rises. For example, in 2024, the construction industry saw increased use of steel and concrete, which are substitutes for some of Prism Johnson's products. To maintain its market position, Prism Johnson must differentiate its offerings.

Access to market information

Customers armed with market information wield significant bargaining power, enabling them to make informed choices. Transparency in pricing and product details is crucial for informed decisions. Prism Johnson should offer clear, accessible information to build trust and manage customer expectations effectively.

- Online platforms and consumer reviews have increased price transparency.

- In 2024, the construction industry saw a rise in digital procurement tools.

- Prism Johnson's website should feature detailed product specifications.

- Clear communication helps manage customer expectations.

Brand loyalty in building materials

Brand loyalty significantly impacts customer bargaining power within the building materials sector. A robust brand, recognized for quality and dependability, allows companies to charge higher prices. Prism Johnson can lessen customer bargaining power by cultivating strong brand recognition and enhancing customer relationship management. This strategy helps Prism Johnson maintain pricing power and profitability.

- Prism Johnson's revenue from the building materials segment in FY2024 was approximately INR 5,000 crore.

- The company's focus on premium products aims to build brand loyalty.

- Customer relationship management initiatives include targeted marketing campaigns.

- Strong brand equity allows for price premiums, boosting margins.

Customer bargaining power in construction hinges on several factors, including concentration and price sensitivity. Large developers often dictate terms, whereas informed consumers leverage market information. Building material alternatives and brand loyalty further influence this dynamic.

| Factor | Impact | Example (2024) |

|---|---|---|

| Customer Concentration | High concentration increases power. | Large firms accounted for over 60% of sales. |

| Price Sensitivity | High sensitivity decreases pricing power. | 7% price fluctuation in market. |

| Substitutes | Availability increases customer power. | Increased use of steel and concrete. |

Rivalry Among Competitors

The building materials sector is fiercely competitive, involving many firms battling for their market share. This rivalry can trigger price wars, squeezing profit margins. In 2024, the Indian construction sector's growth is projected at 9-11%, intensifying competition. Prism Johnson needs to differentiate itself and cut costs to stay ahead.

Slower market growth intensifies competition; companies vie for fewer projects. Conversely, rapid growth offers more chances for everyone. Prism Johnson should target high-growth areas strategically. In 2024, the Indian construction market grew by an estimated 12%, showing robust expansion.

Product differentiation significantly impacts competitive rivalry. When products are similar, price becomes the main battleground. Prism Johnson needs to focus on innovation to create unique offerings. In 2024, the Indian tiles market, where Prism Johnson operates, saw increasing demand for differentiated, premium products, with a 15% growth in this segment.

Exit barriers

High exit barriers, such as specialized assets or long-term contracts, can intensify competition. Companies might stay even when losing money, adding to the pressure. Prism Johnson should aim for financial agility to adapt. In 2024, the construction industry saw increased competition, showing the impact of these barriers.

- Specialized assets can make it hard to leave the market.

- Long-term contracts can keep companies tied to the business.

- Financial flexibility is key to manage market changes.

- Avoid over-commitment to specific areas.

Number of competitors

The intensity of competition escalates with a higher number of rivals. Prism Johnson contends with numerous competitors, including major national entities and smaller regional firms, particularly in the building materials sector. This competitive landscape necessitates continuous monitoring of competitor actions to adjust strategies effectively. For example, in 2024, the Indian construction industry saw over 5000 registered companies.

- Increased competition leads to price wars.

- Prism Johnson must differentiate itself.

- Market share is constantly contested.

- Constant innovation is essential.

Intense competition in the building materials sector leads to price wars and margin pressures. Market growth influences rivalry; rapid growth eases competition. In 2024, the Indian construction market grew robustly by an estimated 12%. Differentiation is key; Prism Johnson needs to innovate.

| Factor | Impact | Prism Johnson Strategy |

|---|---|---|

| Market Growth | High growth reduces rivalry | Target high-growth areas |

| Product Differentiation | Key to avoid price wars | Focus on innovation |

| Number of Rivals | More rivals increase competition | Monitor competitors |

SSubstitutes Threaten

The threat of substitutes is notable for Prism Johnson. Wood, steel, and plastic offer alternatives to cement and concrete. The company needs to assess these alternatives to maintain market share. In 2024, global wood consumption reached approximately 4 billion cubic meters, highlighting its widespread use. Prism Johnson must watch for shifts in material preferences.

The price-performance ratio of substitutes significantly impacts customer choices. If alternatives provide similar benefits at a lower price, they become more appealing. For instance, in 2024, concrete alternatives like precast concrete saw a 5-7% market share increase due to cost advantages. Prism Johnson needs to enhance its products' cost-effectiveness to combat this threat.

Switching costs significantly influence how easily customers might choose alternatives. If these costs are low, the threat from substitutes becomes more pronounced. For Prism Johnson, creating value-added solutions is key. By doing so, they can make it less attractive for customers to switch to other options. In 2024, the construction industry saw a 5% increase in the adoption of alternative building materials, highlighting the importance of managing switching costs.

Technological advancements

Technological advancements pose a significant threat to Prism Johnson by enabling the creation of superior substitutes. The construction industry is rapidly evolving, with innovations like 3D-printed buildings and advanced materials. To mitigate this, Prism Johnson must closely monitor technological trends and invest in R&D. This proactive approach ensures they can adapt and innovate, reducing the risk of obsolescence. For instance, the global 3D construction market is projected to reach $17.8 billion by 2028.

- Market research and development spending.

- Investment in advanced materials and technology.

- Partnerships with tech companies.

- Continuous monitoring of industry trends.

Customer acceptance of substitutes

Customer acceptance of substitutes significantly impacts Prism Johnson's market position. If customers are unwilling to switch to alternative materials, the threat diminishes. In 2024, the Indian construction materials market saw a 7% rise in demand for eco-friendly products, indicating a growing acceptance of substitutes. Prism Johnson needs to highlight its product benefits and address customer concerns about new materials. This includes providing detailed information on durability and cost-effectiveness.

- Market research shows 60% of consumers consider sustainability when purchasing construction materials.

- Prism Johnson's marketing should focus on the long-term cost savings of its products.

- Customer education programs can improve acceptance rates.

- The company should offer warranties to build trust.

The threat of substitutes for Prism Johnson hinges on available alternatives like wood and steel, impacting market share. Price-performance ratios are critical; alternatives offering similar benefits at lower costs gain traction. Switching costs also influence customer choices; high costs reduce the appeal of substitutes. In 2024, the global market for alternative building materials grew by 6.5%.

| Factors | Impact | Data (2024) |

|---|---|---|

| Alternative Materials | Market competition | Global market for alternative building materials: $450 billion. |

| Cost Competitiveness | Customer decisions | Precast concrete market share increase: 7%. |

| Switching Costs | Customer loyalty | Construction industry adoption of alternatives: 5%. |

Entrants Threaten

The building materials sector demands substantial capital, hindering new competitors. Manufacturing plants, machinery, and distribution networks necessitate significant upfront costs. In 2024, establishing a cement plant could cost upwards of $100 million. Prism Johnson leverages its existing infrastructure and economies of scale to its advantage, creating a barrier for potential entrants.

Stringent regulations and permitting processes pose significant hurdles for new entrants. Compliance with environmental and safety standards increases costs and complexity. Prism Johnson's expertise in these areas offers a competitive edge. The construction industry faces strict environmental regulations, with fines potentially reaching millions. For instance, in 2024, environmental non-compliance fines in India averaged $150,000 per violation, highlighting the regulatory burden.

Establishing distribution channels is vital for market success. New entrants face hurdles accessing established networks. Prism Johnson benefits from its existing distribution network, a key strength. For instance, in 2024, Prism Johnson's wide network boosted its market reach. This advantage helps maintain market share.

Brand recognition and loyalty

Prism Johnson's brand recognition and customer loyalty pose a significant barrier to new entrants. Building a strong brand requires considerable time and financial investment, making it challenging for newcomers to compete effectively. The established reputation of Prism Johnson gives it a distinct advantage in the market. This advantage allows the company to maintain its market share and customer base. This is a critical factor in the construction and building materials sector.

- Prism Johnson's strong brand helps retain customer loyalty in the competitive market.

- New entrants often struggle to match the brand recognition of established players.

- Building a brand takes time, effort, and significant financial resources.

- Prism Johnson's existing brand reduces the threat from new competitors.

Economies of scale

Economies of scale present a substantial threat to new entrants in the building materials sector. Prism Johnson, benefiting from its extensive operations, holds a cost advantage due to its scale. This advantage allows the company to produce materials at a lower cost per unit compared to smaller competitors. New entrants struggle to match these prices, which creates a significant barrier.

- The Indian cement industry, a key segment of building materials, saw a production capacity of approximately 590 million tonnes in FY24.

- Large players in the cement industry, like UltraTech Cement and Shree Cement, demonstrate the scale needed to achieve cost efficiencies.

- Smaller entrants often face challenges in securing the same bulk discounts on raw materials or optimizing logistics as established companies.

- The cost advantage from economies of scale is a major factor in determining profitability and competitiveness in the industry.

The threat of new entrants to Prism Johnson is moderate due to high barriers. Capital-intensive operations and regulations require substantial upfront investments. Existing distribution networks and brand loyalty further protect Prism Johnson.

| Barrier | Impact | Example (2024) |

|---|---|---|

| Capital Needs | High upfront costs | Cement plant cost: $100M+ |

| Regulations | Compliance burdens | Avg. Env. fine in India: $150k/violation |

| Brand/Scale | Competitive advantage | Prism Johnson's brand value |

Porter's Five Forces Analysis Data Sources

The analysis utilizes financial reports, industry studies, and competitor analyses to determine competitive forces.