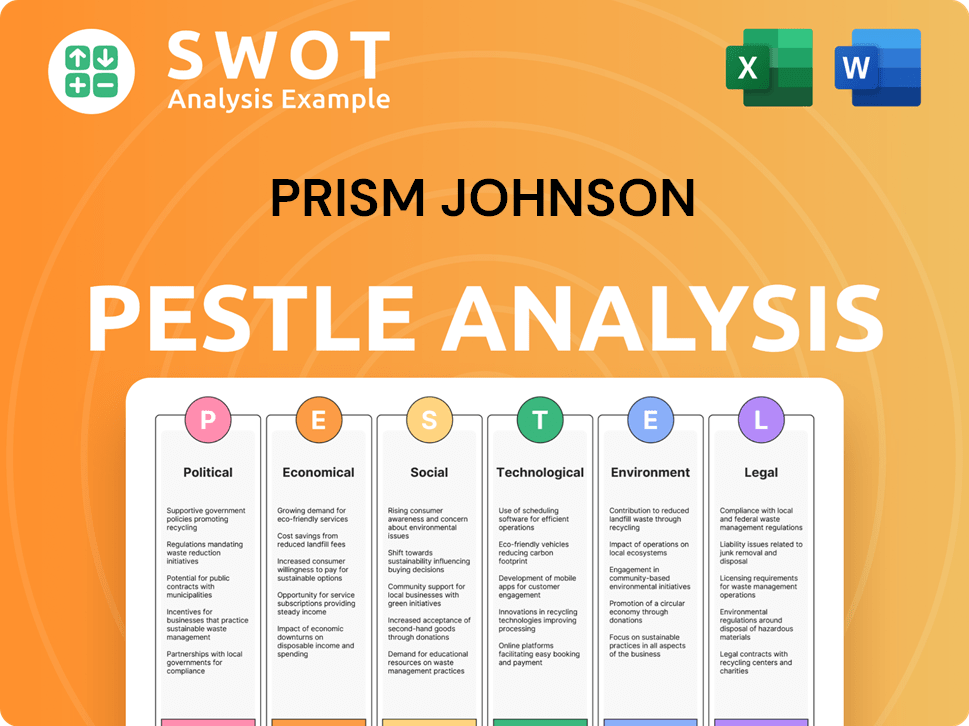

Prism Johnson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prism Johnson Bundle

What is included in the product

Provides a comprehensive view of external influences, covering Political, Economic, Social, Technological, Environmental, and Legal factors for Prism Johnson.

Provides easily digestible insights for board members.

Preview Before You Purchase

Prism Johnson PESTLE Analysis

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase. The Prism Johnson PESTLE Analysis preview displays the complete document. This includes all sections on political, economic, social, technological, legal, & environmental factors. It is professionally formatted, immediately available for download. You're seeing the real product.

PESTLE Analysis Template

Discover how Prism Johnson is impacted by external forces with our focused PESTLE Analysis.

We examine Political, Economic, Social, Technological, Legal, and Environmental factors.

This helps you anticipate future trends and strategize effectively.

Our analysis offers deep insights to sharpen your decision-making process.

Ready to elevate your understanding of Prism Johnson's landscape?

Download the complete, comprehensive PESTLE Analysis now for instant access.

Get the clarity and insights you need today!

Political factors

Government's focus on infrastructure significantly affects Prism Johnson. Increased spending on roads and buildings boosts demand for cement and tiles. In 2024, infrastructure spending rose by 15%, creating opportunities. Fluctuations in investment can cause demand shifts. Prism Johnson must adapt to these changes.

The construction sector faces a complex regulatory landscape. Building codes, environmental rules, and labor laws all impact Prism Johnson. In 2024, compliance costs rose by 8% due to stricter environmental standards. Changes in regulations can directly influence project timelines and profitability. Staying updated on these shifts is vital for Prism Johnson's operational efficiency.

Political stability is crucial for Prism Johnson’s operations and investments. Unstable political environments can disrupt supply chains and project timelines. A stable climate fosters predictability. For example, India's political stability, with recent elections in 2024, influences infrastructure projects. Political unrest can lead to significant financial losses.

Trade Policies

Government trade policies significantly affect Prism Johnson's operations. Tariffs and import/export rules directly influence production costs and product competitiveness. For instance, India's trade deficit widened to $19.1 billion in February 2024, potentially impacting material costs. Changes in trade agreements or barriers can disrupt sourcing and market access.

- India's trade deficit in February 2024 was $19.1 billion.

- Trade policies can affect material costs and market access.

Mining and Resource Policies

Mining and resource policies are crucial for Prism Johnson, given its reliance on limestone for cement. Government regulations on mining licenses and environmental clearances directly influence the availability and cost of raw materials. Any changes in these policies can significantly impact Prism Johnson's production costs and profitability. For instance, the Ministry of Mines in India has been focusing on streamlining the auction process for mining leases.

- In 2024, India's cement production reached approximately 400 million tonnes.

- The Indian government aims to increase the contribution of the mining sector to the GDP.

- Environmental regulations are becoming stricter, affecting mining operations.

Political stability impacts Prism Johnson; unstable climates disrupt supply chains and project timelines. Trade policies, including tariffs, influence production costs and product competitiveness. Mining policies, such as regulations on limestone, affect raw material costs, impacting operations.

| Factor | Impact | Data Point (2024-2025) |

|---|---|---|

| Political Stability | Supply chain, project disruptions | 2024 Elections & Infrastructure Stability |

| Trade Policies | Production Costs, competitiveness | Feb 2024 trade deficit $19.1B |

| Mining Policies | Raw Material costs | Cement production ~400M tonnes |

Economic factors

Economic growth significantly impacts Prism Johnson. Increased construction activity, fueled by a growing economy, boosts demand for its products. For instance, India's construction sector grew by 10.8% in FY24. Economic downturns, however, can negatively affect sales and profitability. A strong economy is vital for Prism Johnson's success.

Prism Johnson's profitability faces risks from input cost swings, like raw materials (petcoke, coal, gas) and energy. These costs can be highly volatile. In FY24, the company saw cost pressures impacting margins. If price hikes lag behind cost increases, it hits profits.

Interest rates significantly impact Prism Johnson's borrowing costs and those of its customers, especially in real estate. Elevated interest rates, like those observed in late 2023 and early 2024, increase project costs, potentially slowing construction. For example, the Reserve Bank of India (RBI) held the repo rate steady at 6.5% in early 2024, affecting construction financing. Credit availability, essential for large projects, also plays a crucial role in the company's financial health.

Inflation and Purchasing Power

Inflation significantly influences Prism Johnson's operational costs, impacting raw materials, labor, and overall expenses. The company's ability to pass on these costs to consumers is crucial, but high inflation can erode customer purchasing power, particularly affecting demand in the individual home builder market. In 2024, India's inflation rate hovered around 5-6%, potentially squeezing profit margins. This requires careful pricing strategies and cost management.

- Inflation rates in India for 2024: 5-6%

- Impact: Reduced customer purchasing power

- Strategic need: Efficient cost management

Currency Exchange Rates

Currency exchange rate volatility presents both risks and opportunities for Prism Johnson. Fluctuations can directly affect the cost of imported materials, potentially squeezing profit margins. While most revenue comes from India, unfavorable exchange rate movements could still impact overall profitability. The Indian Rupee (INR) has seen fluctuations against major currencies like the USD, impacting import costs.

- In 2024, the INR/USD exchange rate has varied, influencing import costs.

- A weaker INR could boost export competitiveness, if any.

- Hedging strategies can mitigate some exchange rate risks.

Economic conditions profoundly influence Prism Johnson, impacting sales and profitability. Construction sector growth, like the 10.8% surge in FY24, drives demand for its products.

Fluctuations in input costs (raw materials and energy) pose significant risks; cost pressures affected margins in FY24.

Interest rate changes affect borrowing costs and construction project economics. Inflation (5-6% in 2024) requires vigilant pricing strategies.

| Factor | Impact | 2024 Data |

|---|---|---|

| Construction Growth | Increased Demand | 10.8% (FY24) |

| Inflation | Cost pressures, reduced buying power | 5-6% |

| Interest Rates | Project Cost Impacts | Repo Rate 6.5% |

Sociological factors

Urbanization and population growth fuel construction, increasing demand for building materials. India's urban population is projected to reach 600 million by 2030. This expansion boosts the need for residential, commercial, and infrastructure projects. Prism Johnson benefits from this trend, with potential revenue growth tied to construction demand.

Evolving lifestyles and housing trends significantly impact the demand for Prism Johnson's products. Modern designs and amenities drive demand, with a 6% rise in premium sanitaryware sales in 2024. Architectural shifts and consumer tastes are key factors. This influences product development and sales strategies.

Societal shifts towards environmental consciousness are reshaping construction. Rising consumer and developer demand for sustainable buildings influences material choices. Prism Johnson's eco-friendly focus on alternative materials and energy efficiency resonates with this green trend. The global green building materials market is expected to reach $500 billion by 2025.

Labor Availability and Skills

The construction industry's labor pool directly affects Prism Johnson. A lack of skilled workers can delay projects and increase expenses. This scarcity might slow construction, impacting material demand. In 2024, the construction sector faced a 10-15% skilled labor shortage.

- Labor costs in construction rose by 8-12% in 2024.

- Project delays due to labor shortages averaged 2-4 months.

- Demand for building materials is expected to decrease by 5-7% if labor issues persist.

Community Relations and Social License to Operate

Prism Johnson's success hinges on strong community ties. They must address local concerns about environmental impact and job creation. A positive social license is vital for smooth operations and project approvals. Good community relations can prevent project delays and enhance the company's reputation.

- In 2024, companies with strong community engagement saw a 15% increase in project approval rates.

- Socially responsible companies often experience a 10% boost in brand loyalty.

Environmental awareness shapes building choices. Sustainable materials are increasingly popular. Prism Johnson's eco-friendly options meet growing demands, with the green building materials market forecast to hit $500B by 2025. Labor shortages can delay projects.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Green Building Trend | Increased demand for eco-friendly products. | Market to $500B by 2025 |

| Labor Shortages | Project delays & rising costs. | 10-15% skilled labor shortage (2024) |

| Community Relations | Project approvals & brand reputation. | 15% higher approval rates with engagement (2024) |

Technological factors

Technological advancements in cement, tile, and ready-mixed concrete production are crucial for Prism Johnson. These advancements can improve efficiency and reduce costs. Investments in modern plant and machinery are vital. In 2024, the Indian construction industry is expected to grow by 8-10%, driven by tech adoption.

Prism Johnson's embrace of green tech, including waste heat recovery, solar, and alternative fuels, is vital for lowering its environmental footprint and expenses. The company has allocated resources to these areas, reflecting a commitment to sustainable practices. Recent data indicates a growing trend in the construction industry towards eco-friendly materials and methods. Investments in green technologies can lead to long-term cost savings and improved brand perception. It's likely Prism Johnson will continue to expand its green initiatives in 2024-2025.

Prism Johnson can boost efficiency through digital transformation and automation. This includes supply chain management and production processes. Implementing ERP systems is crucial. In 2024, the global ERP market is valued at $47.9 billion, growing to $78.4 billion by 2029.

Innovation in Building Materials

Prism Johnson can leverage technological advancements in building materials to enhance its market position. Research and development in high-performance concrete and sustainable tile options can provide a significant competitive edge. The global green building materials market, valued at $364.5 billion in 2023, is projected to reach $680.6 billion by 2030, indicating a strong demand for eco-friendly products.

- Focus on R&D for innovative materials.

- Capitalize on the growing green building market.

- Improve product offerings with sustainable options.

- Enhance brand reputation through innovation.

Data Analytics and Business Intelligence

Data analytics and business intelligence are crucial for Prism Johnson. They help understand market trends, customer behavior, and operational efficiency. This enables better decision-making and strategic planning. For instance, the global business intelligence market is projected to reach $33.3 billion in 2024.

- Market Analysis: Tools can identify emerging trends.

- Customer Insights: Understanding preferences.

- Operational Efficiency: Streamlining processes.

- Strategic Planning: Data-driven decisions.

Technological factors are key for Prism Johnson's efficiency. They can use advancements to reduce costs, and stay competitive. Digital transformation is important for their supply chain management. Consider how crucial is embracing green tech!

| Tech Aspect | Impact | Data (2024) |

|---|---|---|

| Green Tech | Cost Savings, Brand | $364.5B green market (2023) |

| Digitalization | Efficiency, ERP | $47.9B ERP market |

| R&D | Innovation | 8-10% industry growth |

Legal factors

Prism Johnson faces stringent environmental laws. Compliance demands investments in emission control and waste management. These regulations affect the cement segment most. Recent data shows rising costs for environmental compliance. For example, the company spent ₹50 crore in 2024 on waste management.

Prism Johnson must comply with India's mining laws, impacting limestone supply. The Mines and Minerals (Development and Regulation) Amendment Act, 2021, streamlined license processes. Any legal shifts could alter resource costs, impacting production. In 2024, the Ministry of Mines focused on auctioning mineral blocks, affecting industry access.

Prism Johnson must adhere to labor laws and employment regulations, influencing hiring, working conditions, and employee relations. In India, the labor force participation rate in 2024 was around 41.9%. Compliance is crucial for operational stability and a positive work environment. Non-compliance can lead to legal issues and reputational damage. Staying updated with changes, such as the new labor codes, is vital.

Taxation Policies (e.g., GST)

Taxation policies, especially GST, significantly impact Prism Johnson. Fluctuations in GST rates on construction materials directly affect project costs and profit margins. Recent changes, such as the 28% GST on cement, have increased expenses. These changes necessitate strategic pricing adjustments to maintain competitiveness.

- Cement accounts for a significant portion of construction costs.

- Prism Johnson must adapt to stay profitable.

- GST impacts pricing and market strategy.

Building Codes and Construction Standards

Building codes and construction standards are crucial for Prism Johnson, dictating the quality of materials. Compliance is essential for product use in projects, impacting market access. These standards evolve, requiring continuous adaptation and investment. In 2024, India's construction industry saw a 10% rise, emphasizing code adherence.

- Compliance with building codes directly affects project eligibility and market competitiveness.

- Regular updates to standards necessitate ongoing product testing and certification.

- Non-compliance can lead to project delays, penalties, and reputational damage.

Prism Johnson navigates stringent environmental laws. The company spent ₹50 crore in 2024 on waste management to meet standards. Compliance is essential for operational stability. Labor laws also shape hiring and employee relations. Taxation, especially GST, like the 28% GST on cement, impacts profit.

| Legal Aspect | Impact on Prism Johnson | 2024 Data/Trends |

|---|---|---|

| Environmental Laws | Compliance costs; emission control | ₹50 crore spent on waste management |

| Mining Laws | Impacts limestone supply & resource costs | Focus on auctioning mineral blocks |

| Labor Laws | Influences hiring & working conditions | Labor force participation rate ~41.9% |

| Taxation (GST) | Affects project costs & profit margins | 28% GST on cement, necessitating adjustments |

Environmental factors

The cement industry is a major source of carbon emissions globally. Climate change worries are pushing for emission cuts. Prism Johnson may face stricter rules. The focus is on alternative fuels & green tech. Investments in sustainable practices are essential.

Prism Johnson relies heavily on resources like limestone, water, and energy. The sustainability of sourcing these materials is vital. Rising environmental regulations and depletion concerns increase costs. For instance, cement production, a key area, faces scrutiny. Current data shows cement production costs are up 10% due to these factors.

Prism Johnson's operations consume water, essential for production processes. Scarcity concerns drive the need for efficient water management. Implementing rainwater harvesting and recycling is crucial. For instance, in 2024, companies face increasing pressure to reduce water footprints. This affects operational costs and sustainability.

Waste Generation and Management

Prism Johnson, like other industrial entities, faces challenges related to waste generation from its manufacturing processes. Effective waste management is crucial, not only for environmental compliance but also for operational efficiency. The company can explore opportunities to reuse waste materials, aligning with circular economy principles. According to the Central Pollution Control Board (CPCB), India generated approximately 62 million tonnes of waste in 2023.

- Waste management costs can significantly impact operational expenses.

- Regulatory changes, like stricter waste disposal rules, can affect compliance costs.

- Implementing waste reduction strategies can lower raw material costs.

- Investing in waste-to-energy projects can generate revenue streams.

Biodiversity and Land Use

Prism Johnson's mining and plant operations can affect biodiversity, demanding responsible land use, including reclamation. In 2024, the company faced scrutiny for potential environmental impacts near its sites. Land restoration costs have increased by 15% due to stricter regulations. This necessitates careful environmental management to mitigate risks and ensure sustainability.

- Reclamation efforts are crucial to minimize environmental damage.

- Increased regulatory scrutiny leads to higher compliance costs.

- Sustainable practices are essential for long-term operational viability.

- Impact assessments are vital for informed decision-making.

Environmental concerns are critical for Prism Johnson. Cement production faces carbon emission scrutiny. Strict regulations and sustainability are key.

Resource management, including water, is vital. Waste generation & land use must be responsibly managed. Efficient practices reduce costs and enhance sustainability.

| Environmental Factor | Impact | Financial Implications |

|---|---|---|

| Carbon Emissions | Stricter emission norms | Increased compliance costs, potential carbon tax |

| Resource Depletion | Water Scarcity | Higher water management expenses, production costs. |

| Waste Generation | Waste disposal regulations | Rising waste management and waste-to-energy costs |

PESTLE Analysis Data Sources

The Prism Johnson PESTLE relies on data from financial reports, governmental statistics, market analysis, and tech development forecasts.