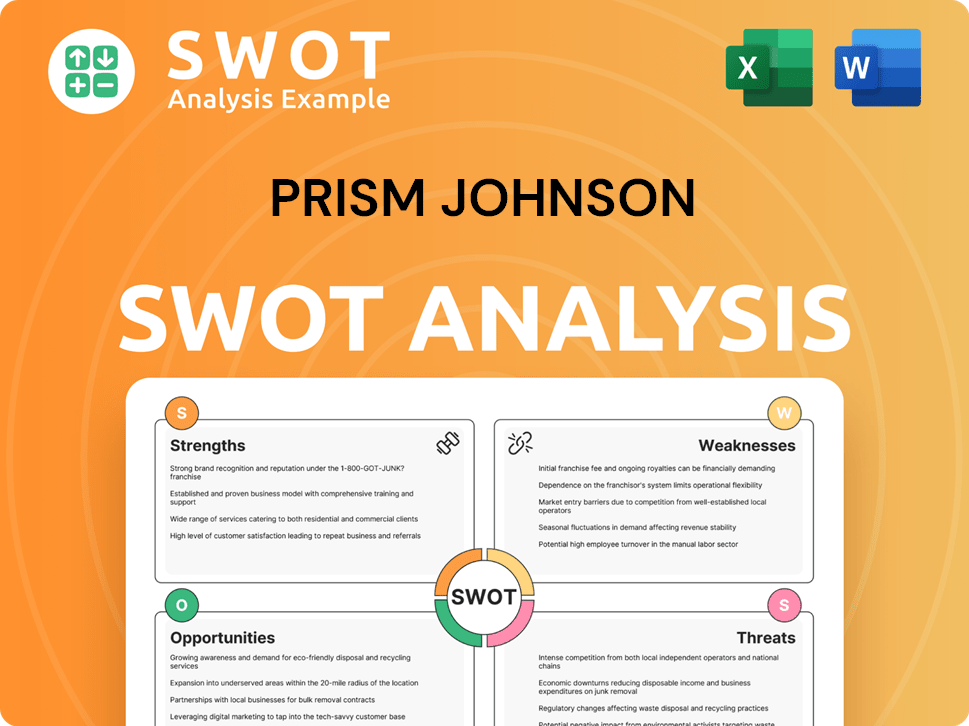

Prism Johnson SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prism Johnson Bundle

What is included in the product

Analyzes Prism Johnson’s competitive position through key internal and external factors.

Simplifies complex strategic data for effortless stakeholder understanding.

Full Version Awaits

Prism Johnson SWOT Analysis

This preview showcases the exact SWOT analysis document you'll receive. Every section below is present in the purchased report, ensuring transparency.

SWOT Analysis Template

Our Prism Johnson SWOT analysis reveals key strengths, like their robust market presence and diversified offerings. However, the analysis also uncovers weaknesses, such as increasing operational costs and competition. We also identify opportunities, including potential for global expansion. Risks include regulatory changes and fluctuating raw material prices.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Prism Johnson's strength lies in its diverse product portfolio. This includes cement, concrete, tiles, bath products, and engineered stone. It reduces reliance on a single segment. This broad range caters to various construction needs. For example, in FY24, the building materials segment contributed significantly to revenue, demonstrating its market power.

Prism Johnson holds a robust market position in central India. They have a substantial manufacturing capacity in the region.

This regional focus gives them a strong presence in Uttar Pradesh, Madhya Pradesh, and Bihar.

In 2024-2025, these states show steady construction growth. This benefits Prism Johnson through localized demand and distribution.

This strategic advantage allows them to efficiently serve key markets. This enhances their competitive edge.

Prism Johnson leverages its established brand presence, particularly through H&R Johnson in tiles, enhancing customer recognition and trust. The company's long-standing presence in the domestic ceramic and vitrified tiles industry solidifies its market position. Furthermore, Prism Johnson's strong presence in the ready-mix concrete (RMC) business across India adds to its brand strength. For FY24, H&R Johnson's revenue stood at ₹2,300 crore, reflecting its market dominance.

Improving Operating Efficiency

Prism Johnson has improved operational efficiency in its Cement and HRJ Divisions. Investments in green energy within the cement division are ongoing. Modernization in the tiles division should boost performance. These efforts aim for cost savings and better operations.

- Cement capacity utilization has increased, reflecting improved efficiency.

- Green energy initiatives are expected to reduce energy costs by 10% by 2025.

- Tile division modernization is projected to increase production output by 15% by 2026.

Healthy Financial Risk Profile and Liquidity

Prism Johnson showcases a healthy financial risk profile and robust liquidity. The company has actively reduced net debt, enhancing its financial stability. This, combined with anticipated profit improvements and solid cash accruals, strengthens its ability to handle debt and fund investments. Prism Johnson's financial health supports its strategic goals and operational efficiency.

- Net Debt Reduction: Prism Johnson has focused on reducing its net debt, improving its financial risk profile.

- Profitability Enhancement: Expected improvements in profitability will further strengthen the company's financial position.

- Strong Cash Accruals: Robust cash accruals ensure the company can meet its debt obligations and fund capital expenditures.

- Financial Stability: These factors contribute to a stronger overall financial position.

Prism Johnson boasts a diversified portfolio, featuring cement, concrete, and tiles. Their strong regional presence in central India supports localized demand, improving efficiency.

The company benefits from a well-established brand, especially through H&R Johnson. Financial stability, marked by net debt reduction, reinforces their capabilities.

Improved operational efficiency in Cement and HRJ Divisions and cost savings through green initiatives enhances financial performance. They are anticipating 10% reduction in energy costs.

| Strength | Details | FY24 Data |

|---|---|---|

| Diverse Portfolio | Cement, Concrete, Tiles, Bath Products | Building Materials Revenue Contribution: Significant |

| Regional Market Position | Strong in Central India (UP, MP, Bihar) | Steady Construction Growth (2024-2025) |

| Brand Strength | H&R Johnson (Tiles), RMC Business | H&R Johnson Revenue: ₹2,300 crore |

| Operational Efficiency | Green Energy, Tile Modernization | Energy Cost Reduction: 10% by 2025 |

| Financial Stability | Net Debt Reduction, Cash Accruals | Financial Health: Strong |

Weaknesses

Prism Johnson's profitability faces risks from fluctuating input costs, including raw materials, power, and fuel. Rising expenses, such as those for coal and pet coke, can squeeze operating margins, as experienced in past financial periods. The company's ability to fully pass these increased costs to consumers is often constrained by competitive market pressures. For example, in fiscal year 2024, raw material costs accounted for about 45% of the total expenses.

Prism Johnson faces cyclicality, as the building materials sector fluctuates with economic cycles. Demand is tied to infrastructure and housing, making revenue and profitability vulnerable. Price cycles, driven by capacity additions, can further pressure earnings. For instance, in 2023-24, construction material prices saw volatility.

Prism Johnson faces fierce competition from both organized and unorganized firms in the building materials market. This rivalry limits its pricing power and ability to protect profit margins. For instance, the construction materials market in India is highly fragmented, with smaller players often undercutting prices. This is particularly challenging when raw material costs increase, as seen in 2023-2024, impacting profitability.

Subdued Profitability in HRJ Division

The H&R Johnson (HRJ) division's subdued profitability is a key weakness. Aging plants contribute to higher fixed costs, impacting operational efficiency. Fluctuations in gas prices also squeeze operating margins, affecting overall profitability. While modernization is underway, HRJ lags behind other segments.

- FY24 revenue for HRJ was ₹2,345 crore, with an operating margin of 11.2%.

- The company invested ₹150 crore in HRJ modernization in FY24.

- Gas price volatility has increased operating costs by 3-5% in the last year.

Dependence on Economic Conditions in India

Prism Johnson's performance is significantly vulnerable to India's economic health. Economic downturns or reduced construction sector demand directly affect its financials. The company's revenue growth is heavily reliant on the nation's GDP trajectory. A sluggish economy presents a major obstacle to its expansion plans.

- India's GDP growth in 2024 is projected around 6.5-7%, influencing Prism Johnson's outlook.

- The construction sector contributes significantly to India's GDP, impacting Prism Johnson's sales.

- Interest rate fluctuations in India affect project financing and demand.

Prism Johnson's weaknesses include profit margin vulnerability due to volatile input costs like raw materials. Its dependence on cyclical building material demand linked to infrastructure and housing causes earnings volatility. The company struggles with intense market competition, impacting pricing power. Also, HRJ division's subdued profitability and economic sensitivity pose challenges.

| Weakness | Impact | FY24 Data |

|---|---|---|

| Input Cost Volatility | Margin Squeezing | Raw material costs: ~45% of expenses. |

| Cyclicality | Demand Fluctuation | Construction sector growth: 6.5-7% (est.) |

| Market Competition | Reduced Pricing Power | HRJ Revenue: ₹2,345 crore, Op. Margin 11.2% |

| HRJ Profitability | High fixed costs | ₹150 cr investment in modernization in FY24. |

Opportunities

The Indian construction materials sector is poised for growth, fueled by infrastructure investments and government initiatives. This expansion creates avenues for Prism Johnson to boost sales and revenue. In 2024, the infrastructure sector in India witnessed a 10% growth, indicating strong potential. Prism Johnson can capitalize on this trend by expanding its market reach and product offerings.

Prism Johnson is strategically increasing premium product offerings. This focus enhances profitability, especially in cement and tiles. For instance, premium tiles sales grew by 15% in FY24. This shift towards higher-margin products is expected to boost overall financial performance. It's a key driver for improved revenue realization in 2024/2025.

Prism Johnson can capitalize on the growing green energy market. Investments in solar and wind power can improve cost efficiencies and reduce reliance on traditional fuels. The commissioning of new renewable energy capacity contributes to cost savings. India's renewable energy capacity reached 181.63 GW as of February 2024, offering significant opportunities.

Expansion and Modernization Projects

Prism Johnson's ongoing expansion and modernization projects present significant opportunities. These initiatives, including the new tiles unit in West Bengal, are designed to boost production capacity. They also aim to enhance operational efficiencies, which should drive future earnings. For instance, the company invested ₹350 crore in its tiles business in FY24.

- Increased production capacity

- Improved operational efficiencies

- Enhanced future earnings growth

- Strategic investments in key areas

Scaling Up Asset-Light Franchise Model in RMC

Prism Johnson is expanding its asset-light franchise model in the RMC sector, focusing on cost savings and market expansion. This strategy boosts profitability and extends market reach without heavy investment. The asset-light model allows for quicker scaling and reduced financial risk. In 2024, RMC revenue grew, reflecting the model's success.

- Asset-light model enhances scalability.

- Cost rationalization improves margins.

- Market reach expands without major capex.

- RMC revenue growth in 2024.

Prism Johnson benefits from India’s booming construction market, supported by robust government spending. This fuels opportunities to increase sales and revenue. Strategic shifts towards premium product offerings drive higher profitability and financial performance, with premium tiles sales rising. Expansion and modernization projects, like the new tiles unit, enhance production and operational efficiencies, aiming for future earnings growth.

| Opportunity | Details | Data |

|---|---|---|

| Market Growth | Benefit from Infrastructure spending | Infrastructure sector grew 10% in 2024 |

| Premium Products | Increase profitability through higher-margin sales | Premium tiles sales grew 15% in FY24 |

| Renewable Energy | Cost savings by investing in green energy | India's renewable energy capacity: 181.63 GW as of Feb 2024 |

| Expansion Projects | Increase production capacity and efficiency | ₹350 crore invested in tiles business in FY24 |

| Asset-Light Model | Improve scalability, margins, and market reach. | RMC revenue growth in 2024. |

Threats

Unexpected rises in fuel expenses, like petcoke and coal, are a key threat to Prism Johnson's profits. These fluctuations can directly influence operational margins. Although the company is pursuing green energy, its impact may be limited. In 2024, fuel costs represented a significant portion of the total expenses.

Prism Johnson faces heightened competition due to new cement capacity. Companies are expanding, especially in Central India, increasing supply. This surge could pressure prices and market share. In 2024, cement production capacity grew by 8-10% nationally. Demand must keep pace to avoid these negative impacts.

An economic downturn in India or reduced demand in the housing and infrastructure sectors could significantly impact Prism Johnson. These sectors are crucial for building material consumption, and any slowdown would directly affect sales and revenue. In fiscal year 2024, the construction sector in India experienced fluctuations, with growth rates varying quarter by quarter.

Regulatory Changes

Regulatory changes pose a significant threat to Prism Johnson. Alterations in GST rates or new environmental regulations directly impact operational costs. For instance, changes in GST on construction materials can affect profit margins. Stricter environmental norms might necessitate investments in cleaner technologies. These factors can increase expenses and reduce competitiveness.

- GST rates on cement, a key material, have fluctuated, impacting profitability.

- Environmental regulations are becoming stricter, requiring investments in sustainable practices.

- Policy changes can lead to supply chain disruptions and increased compliance costs.

Execution Risks of Expansion Projects

Prism Johnson faces execution risks with expansion projects, potentially delaying the realization of expected benefits. This could involve commissioning new manufacturing units or renewable energy plants. Delays in these projects can impact capacity expansion, cost savings, and overall profitability. For instance, project delays have historically led to a 10-15% increase in capital expenditure in the construction industry.

- Delays in project commissioning.

- Increased capital expenditure.

- Impact on capacity expansion.

Prism Johnson contends with volatile fuel costs and rising competition in the cement market. Economic downturns and regulatory shifts pose substantial threats to revenue and profitability. Execution risks, such as project delays, can lead to increased capital expenditure.

| Threat | Impact | Data (2024) |

|---|---|---|

| Fuel Cost Fluctuations | Margin Pressure | Fuel costs made up ~30% of expenses. |

| Increased Competition | Price/Market Share Pressure | Cement capacity grew 8-10%. |

| Economic Downturn | Reduced Sales/Revenue | Construction sector growth fluctuated. |

SWOT Analysis Data Sources

The Prism Johnson SWOT relies on financial reports, market analyses, expert opinions, and industry research, ensuring a data-driven evaluation.