Prudential Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prudential Bundle

What is included in the product

Strategic evaluation of Prudential's business units based on market growth & share.

Dynamically visualize business unit performance, offering strategic clarity for informed decision-making.

Preview = Final Product

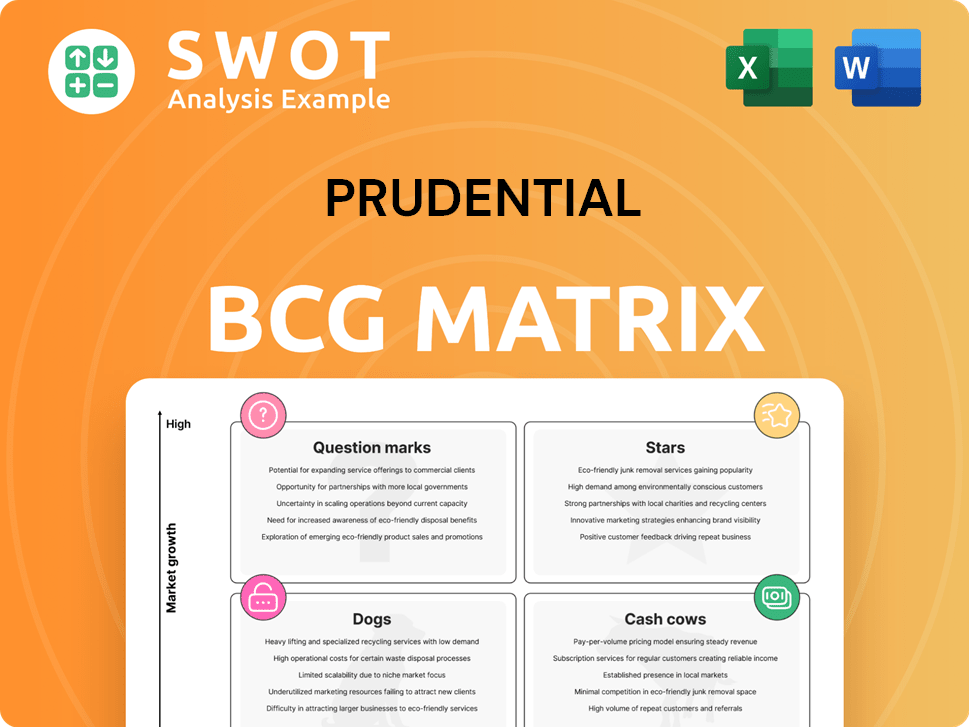

Prudential BCG Matrix

The BCG Matrix preview mirrors the document you'll receive post-purchase. It’s a fully-formed strategic tool, ready for immediate application, with no differences between the preview and the final download. This professional-grade report is instantly accessible, offering clarity and actionable insights for your business strategy. You can use it without any extra steps after your purchase is confirmed.

BCG Matrix Template

Prudential's BCG Matrix provides a snapshot of its diverse offerings. This strategic tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks. You're seeing a glimpse of Prudential's competitive landscape. Knowing this can help predict future company moves and financial performance. Uncover Prudential's market positioning in detail. Purchase the full BCG Matrix for actionable strategies and a comprehensive market overview.

Stars

Prudential's Health and Protection (H&P) products are thriving, especially through bancassurance. The company's emphasis on quality new H&P business positions it as a star performer. This strategy boosts new business margins and APE sales. In 2024, H&P sales significantly contributed to overall growth.

Prudential shines in Asia, holding top spots in key markets like Hong Kong. Their success stems from a robust multi-channel approach, aiming to capture Asia's long-term growth. They focus on recruiting top talent and boosting agent productivity. In 2024, Prudential's Asian business saw significant growth, reflecting its strong market position.

Prudential is investing in digital transformation to boost efficiency and customer service. Investments in digital platforms like PRUForce are improving operations. Partnering with Google Cloud helps manage medical inflation. These moves aim to drive future growth, shown by a 6% increase in new business profit in 2024.

Strategic Bancassurance Partnerships

Prudential's strategic bancassurance partnerships are flourishing, especially in Asia. The bancassurance channel saw robust growth, with new business profit increasing significantly. Key partnerships, like those with Standard Chartered and UOB, are pivotal. These collaborations are vital for expanding distribution networks.

- In 2024, Prudential's partnership with UOB contributed significantly to its growth in Southeast Asia.

- Bancassurance accounted for a substantial portion of new business sales in several key markets, reflecting its importance.

- The Malaysian market, with partnerships like Bank Simpanan Nasional, shows strong potential for continued expansion.

- These alliances enable Prudential to access a broader customer base.

Capital Management and Shareholder Returns

Prudential's focus on capital management is evident through its shareholder-friendly actions. The company is actively returning value to shareholders. This is achieved via share buybacks and increased dividends.

Prudential's strategy is quite clear in its commitment to return value to shareholders.

The company's initiatives include a $2 billion share buyback program. As of March 14, they have completed $1,045 million in buybacks. The program is expected to finish by the end of 2025.

A significant 13% rise in the total dividend for 2024 demonstrates their dedication. This capital management approach boosts shareholder returns.

- Share buyback program: $2 billion total, $1,045 million completed by March 14.

- Program completion: Expected by the end of 2025.

- 2024 Dividend increase: 13%.

Prudential's "Stars," including H&P and Asian markets, show high growth and market share. These segments benefit from strategic investments in digital platforms and bancassurance partnerships. Capital management initiatives, like buybacks, drive shareholder value.

| Star Category | Key Initiatives | 2024 Impact |

|---|---|---|

| H&P Products | Focus on quality and bancassurance. | Significant contribution to growth. |

| Asian Markets | Multi-channel approach, top talent recruitment. | Strong market position and sales growth. |

| Shareholder Value | Share buybacks and dividends. | 13% dividend rise for 2024. |

Cash Cows

Prudential's established insurance policies generate steady revenue. The in-force business, along with asset management, produced $2,642 million in operating free surplus during 2024. This stable income stream supports Prudential's operations. Effective management of this portfolio is crucial for shareholder returns.

Eastspring, Prudential's asset management arm, is a cash cow. It generates steady fee income from its substantial assets under management. Funds under management grew to $258.0 billion, boosted by market gains and inflows. Retail investors are returning to higher-margin equity funds due to improved market dynamics.

Prudential's long-term savings products thrive in Asia and Africa, generating steady revenue. They offer accessible financial solutions, especially wealth management and retirement planning. In 2024, Prudential's Asian business saw strong growth. The company focuses on meeting the needs of higher-income markets.

Diversified Distribution Network

Prudential's diverse distribution network is a key strength, ensuring widespread market access and consistent sales. They've strategically built premier agency forces and cultivated strong bank partnerships. In 2024, Prudential's focus remained on enhancing its agency channel through quality recruitment. This diversified strategy minimizes dependence on a single distribution method, bolstering resilience.

- Agency sales are a significant part of Prudential's distribution.

- Bank partnerships offer access to a different customer segment.

- Diversification helps to weather market fluctuations.

- Recruitment efforts aim to strengthen the agency channel.

Strong Capital Position

Prudential's robust financial health is a key strength. The company boasts a substantial free surplus ratio, reported at 234%, and a GWS shareholder surplus over GPCR of $15.9 billion. This strong capital base allows Prudential to navigate market fluctuations effectively. It also supports shareholder returns through dividends and share buybacks.

- Free surplus ratio: 234%

- GWS shareholder surplus over GPCR: $15.9 billion

- Supports dividend payouts and share buybacks

Prudential's cash cows, like established insurance and asset management, consistently generate substantial revenue. Eastspring, its asset management arm, benefits from significant assets under management, contributing to a steady income stream. Their strong performance is supported by a robust distribution network and solid financial health.

| Metric | Value | Year |

|---|---|---|

| Operating Free Surplus | $2,642 million | 2024 |

| Eastspring AUM | $258.0 billion | 2024 |

| Free Surplus Ratio | 234% | 2024 |

Dogs

Insurance products with dwindling market share, like certain term life policies, often become Dogs. These face challenges due to shifting consumer demands or intense rivalry. For example, in 2024, some life insurance segments saw a 5% decrease in new policy sales. Prudential may need to rethink or drop these offerings. Continuous monitoring, using data like quarterly sales reports, is vital to spot and fix underperforming products, ensuring resources are allocated effectively.

Underperforming joint ventures, akin to dogs in the Prudential BCG Matrix, fail to deliver desired results. These ventures might need restructuring or closure, especially if they don't align with strategic objectives. For instance, a 2024 study showed that 15% of joint ventures underperformed, leading to significant financial losses. Careful evaluation is key to redirecting resources efficiently.

Geographic areas facing economic or political instability often become "dogs" in the Prudential BCG Matrix. These regions may demand reduced investment or a strategic overhaul to mitigate risks. For instance, areas experiencing significant inflation, like Argentina, with a 211.4% inflation rate in 2023, might be classified as dogs. Regular assessment of regional performance is crucial for sound investment decisions.

Legacy IT Systems

Legacy IT systems can indeed be considered "dogs" within Prudential's BCG Matrix, as they often drain resources without yielding substantial returns due to their inefficiency. Modernizing the IT infrastructure is crucial for boosting operational performance. Prudential's strategic investments in technology are key to driving future growth and efficiency. The company allocated over $1 billion to technology and digital initiatives in 2024.

- Outdated systems slow down processes and impede innovation, acting as a drag on profitability.

- Upgrading IT infrastructure can lead to significant cost savings and improved service delivery.

- Prudential’s focus on tech investments aims to enhance customer experience and operational agility.

- Inefficient systems lead to higher operational costs, potentially impacting the bottom line.

Products Facing Regulatory Challenges

Insurance products can become "dogs" in the Prudential BCG Matrix if they face mounting regulatory challenges. Compliance costs and increased scrutiny can severely impact profitability. Adapting swiftly to regulatory changes is crucial for risk mitigation. Proactive engagement with regulators can help navigate these evolving landscapes. For example, in 2024, the U.S. insurance industry spent approximately $35 billion on regulatory compliance.

- Compliance Costs: The U.S. insurance industry spent roughly $35 billion on regulatory compliance in 2024.

- Impact on Profitability: Regulatory issues can decrease profitability.

- Risk Mitigation: Adapting to changes is key to reducing risks.

- Regulatory Engagement: Proactive communication with regulators is important.

Underperforming investment products, classified as "dogs" within the Prudential BCG Matrix, experience diminished returns. These products might struggle to stay competitive, resulting in low profitability. Continuous assessment and strategic adjustments are crucial for maintaining a healthy financial portfolio.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Investment Performance | Poor returns, low growth | Average returns for "dogs" are ~2-3% |

| Market Position | Declining market share | Sales decrease around 7% |

| Financial Health | Reduced profitability | Profit margins are 1-2% |

Question Marks

New market entrants, particularly in Asia and Africa, represent high growth opportunities for Prudential, but also come with considerable investment demands and inherent uncertainties. Expansion into these new territories necessitates meticulous planning and execution to navigate diverse regulatory landscapes and consumer preferences. Prudential's strategic investments in these regions are crucial for gaining market share and establishing a robust presence. For example, Prudential's 2024 expansion efforts focused on strengthening its presence in Southeast Asia, with significant investments in digital platforms to reach new customer segments.

Innovative insurance solutions are a question mark in Prudential's BCG matrix, focusing on new products for evolving customer needs. These require significant marketing and education. Success hinges on understanding customer preferences and adapting. In 2024, the insurance industry saw a shift towards personalized products, with over 60% of consumers valuing tailored options.

AI integration in insurance creates opportunities and uncertainties. Prudential should invest in AI while managing risks. Addressing integration challenges is crucial. In 2024, AI in insurance saw a 30% growth in market size. Ethical considerations remain key.

Digital Health Initiatives

Prudential's digital health initiatives are question marks, requiring careful monitoring. These investments, like partnerships with Google Cloud, aim to improve health outcomes. The effectiveness of these strategies needs constant evaluation to ensure value. Prudential is focusing on digital health to enhance customer experience.

- Prudential's investments in digital health solutions are substantial, with a focus on partnerships.

- Partnerships with tech companies like Google Cloud are pivotal for driving innovation in healthcare, as of early 2024.

- These initiatives aim to improve health outcomes while also managing costs effectively.

- The success of these strategies is under constant evaluation.

Expansion into New Customer Segments

Venturing into new customer segments with customized insurance products is a "question mark" for Prudential. This strategy necessitates a deep understanding of the distinct needs and preferences of these new groups. Successful market entry hinges on a customer-centric approach, building trust and loyalty. Prudential's ability to adapt and tailor its offerings will determine its success.

- Prudential's focus on expanding into high-growth markets, like those in Asia, reflects this strategic consideration.

- In 2024, Prudential reported strong sales growth in its Asian markets, indicating the potential of this strategy.

- Customer-centricity is key to success, requiring understanding of local market dynamics and consumer behavior.

- Tailoring products and services is crucial for capturing new customer segments.

Prudential's "question marks" include innovative insurance, AI integration, digital health, and new customer segments. These areas require significant investment and pose high uncertainty. Success hinges on customer understanding and strategic adaptation, like digital health and new product lines. The focus is on growth with careful risk management.

| Area | Strategic Implication | 2024 Data Point |

|---|---|---|

| Innovative Insurance | Adapt and tailor | 60% consumers value tailored options |

| AI Integration | Manage risks, Invest | 30% AI market size growth |

| Digital Health | Monitor effectiveness | Partnerships with Google Cloud |

| New Segments | Customer-centric approach | Strong sales growth in Asian markets |

BCG Matrix Data Sources

This Prudential BCG Matrix utilizes public financial statements, market research, and competitor analysis for precise and dependable assessments.