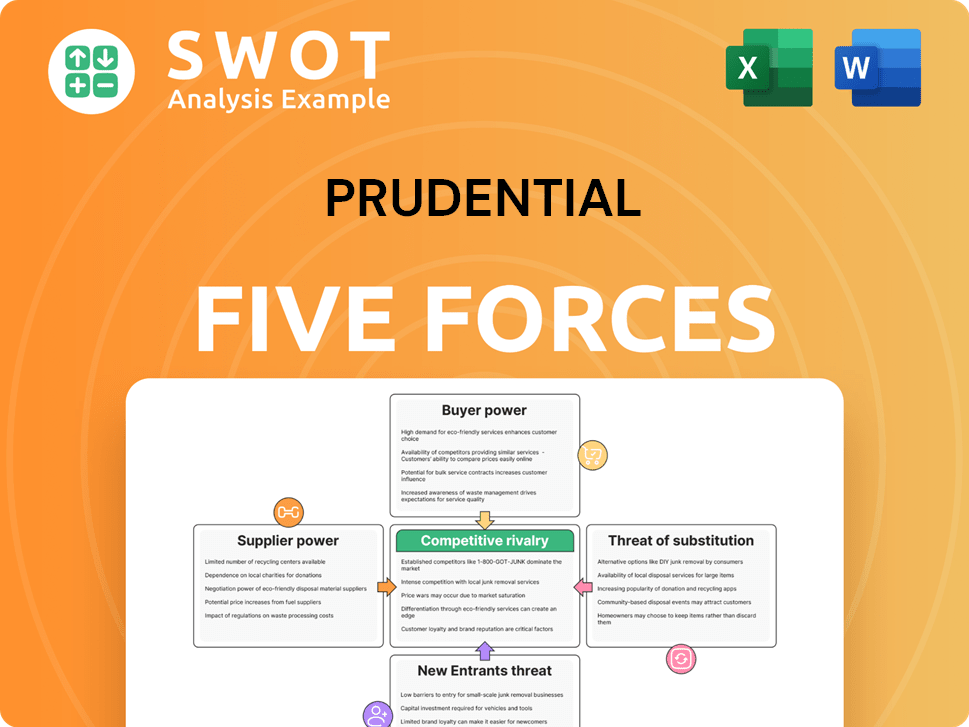

Prudential Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prudential Bundle

What is included in the product

Analyzes Prudential's competitive position, considering rivals, buyers, and the threat of new entrants.

Easily swap data and customize each force, ensuring the analysis stays relevant.

Preview Before You Purchase

Prudential Porter's Five Forces Analysis

This preview reveals the complete Prudential Porter's Five Forces analysis. You're seeing the identical, professionally crafted document you'll download immediately after purchase.

Porter's Five Forces Analysis Template

Prudential's industry landscape is shaped by the interplay of five key forces. Rivalry among existing firms, like competitors in the insurance and investment industries, is a significant factor. The bargaining power of buyers, including individual and institutional clients, also affects profitability. The threat of new entrants, considering regulatory hurdles, is moderate. Supplier power, mainly from financial services providers, is notable. Finally, the threat of substitutes, such as alternative investment options, adds another layer of complexity. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Prudential’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Prudential's supplier power is moderate. Key suppliers, especially tech and reinsurance firms, are concentrated. Prudential relies on these suppliers. However, alternatives do exist, which limits suppliers' power.

Reinsurance costs influence supplier power because they are essential for risk management. Prudential needs to balance these costs with sufficient coverage, affecting its profitability. In 2024, the reinsurance market saw prices increase by 10-20%, significantly impacting insurers. This increase reflects the higher bargaining power of reinsurers.

Prudential's dependence on technology vendors grants suppliers bargaining power. This is a critical factor in the financial services industry. In 2024, tech spending accounted for about 15% of operating expenses. Prudential can manage vendor relationships to reduce this power. Exploring in-house tech solutions can also help to mitigate supplier influence.

Data Providers

Data providers, such as those offering market analysis and economic forecasts, hold moderate bargaining power. Prudential needs accurate data for informed decisions. Prudential can negotiate contracts and diversify its data sources to reduce dependence. In 2024, the cost of financial data services has increased by about 7%.

- Negotiate favorable contract terms with data providers.

- Explore alternative data sources to diversify.

- Ensure data accuracy and reliability through due diligence.

- Monitor pricing trends in the data services market.

Actuarial Services

For Prudential, actuarial services are crucial, yet supplier power is moderate. While these specialized services are essential, multiple providers exist, creating competition. Prudential can leverage this to manage costs effectively. According to the U.S. Bureau of Labor Statistics, the median annual wage for actuaries was $113,990 in May 2023. This competitive landscape helps Prudential negotiate favorable terms.

- Multiple providers limit supplier power.

- Competition helps control costs.

- Actuaries' median wage in 2023 was $113,990.

- Prudential can maintain service quality.

Prudential faces moderate supplier power. Key tech and reinsurance suppliers have some leverage due to their concentration and essential services. However, Prudential can mitigate this by diversifying suppliers and negotiating contracts to reduce costs.

| Supplier Type | Impact on Prudential | Mitigation Strategies |

|---|---|---|

| Reinsurers | High cost, essential coverage. 2024 prices up 10-20% | Negotiate terms, explore alternatives |

| Tech Vendors | Significant expense, critical services. 15% of OPEX in 2024. | Vendor management, in-house tech solutions |

| Data Providers | Essential for decisions. 7% cost increase in 2024. | Contract negotiation, data source diversification |

| Actuarial Services | Essential expertise. 2023 median wage: $113,990. | Leverage competition among providers |

Customers Bargaining Power

Price sensitivity is high among Prudential's customers in Asia and Africa, boosting buyer power. To compete, Prudential must offer competitive pricing. For example, in 2024, insurance penetration rates in emerging markets like India and Indonesia remained below 5%, highlighting price as a key factor. Prudential's ability to balance pricing and profitability is crucial.

Insurance products are becoming commodities, boosting customer power. Prudential must differentiate to lessen price sensitivity. In 2024, industry reports showed a rise in consumers comparing insurance costs, emphasizing commoditization. Tailored solutions and value-added services are key for Prudential to compete effectively. This strategy helps offset the price-driven focus of today's market.

The surge in digital channels amplifies customer choice and access to information, strengthening their bargaining power. Prudential must bolster its digital platforms and customer service to stay ahead. In 2024, digital insurance sales rose, indicating customer preference. Prudential's digital initiatives, such as improved online portals, are key to retaining customers. By focusing on digital experience, Prudential can counter rising buyer power.

Switching Costs

Switching costs significantly impact customer bargaining power. When customers can easily switch providers, their power increases. Prudential faces this challenge, particularly in segments with low switching costs, like certain insurance products. To counter this, Prudential needs to foster strong customer relationships and offer exceptional service. This helps build loyalty and reduce customer churn, which is crucial for maintaining profitability.

- Industry average customer churn rate for insurance is around 5-10% annually.

- Prudential's customer retention efforts include personalized services and digital tools.

- Customer satisfaction scores (e.g., Net Promoter Score) are key metrics to monitor loyalty.

- Loyalty programs and bundled services can also increase switching costs.

Financial Literacy

Financial literacy is on the rise, and this gives customers more power. They can now better compare insurance products and negotiate with companies like Prudential. In 2024, studies showed a 15% increase in online insurance comparison tools usage. Prudential must prioritize clear communication to maintain a competitive edge.

- Increased financial literacy enables informed decisions.

- Customers can easily compare Prudential's offerings.

- Transparency and education build customer trust.

- Justifying pricing becomes crucial.

Customer power is high due to price sensitivity and commoditization. Digital channels increase customer choice, boosting their bargaining power. High switching costs and rising financial literacy also play a role.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Insurance penetration <5% in emerging markets. |

| Commoditization | Increased | Online comparison tool usage up 15%. |

| Digital Channels | Enhanced Choice | Digital insurance sales rose significantly. |

Rivalry Among Competitors

Market saturation in Asia, particularly in life insurance, heightens competition. Prudential needs to differentiate its products and services to stay competitive. For instance, the life insurance market in China saw a 13% increase in premiums in 2024, intensifying rivalry. This means Prudential must innovate to capture market share. Prudential's 2024 strategic plans should prioritize unique offerings.

Aggressive pricing can significantly intensify competitive rivalry, pressuring Prudential's profit margins. To stay competitive, Prudential must carefully balance its pricing strategies. According to 2024 reports, intense price wars in the insurance sector have led to a 5-10% decrease in average profit margins. Prudential needs to offer value-added services.

Digital disruption significantly impacts Prudential's competitive landscape. Fintech companies are intensifying rivalry by offering innovative financial products and services. Prudential needs to invest heavily in technology and innovation to stay competitive. In 2024, the fintech market was valued at over $150 billion, highlighting the need for strategic tech investments.

Consolidation Trends

Consolidation in the insurance sector intensifies rivalry, leading to stronger, more competitive entities. Prudential faces heightened competition, requiring strategic adaptation. The trend is evident, with mergers and acquisitions reshaping the industry. Prudential must evaluate its market position, potentially seeking alliances or acquisitions to stay competitive. In 2024, the global insurance market was valued at approximately $6.5 trillion, highlighting the stakes involved.

- Mergers and acquisitions in the insurance industry increased by 15% in 2024.

- The top 10 insurance companies control over 60% of the global market share.

- Strategic alliances can reduce operational costs by up to 20%.

- Companies with strong digital capabilities saw a 25% increase in customer acquisition.

Regulatory Changes

Regulatory changes can significantly reshape the competitive landscape, potentially intensifying rivalry within the insurance sector. Prudential needs to monitor and adapt to new regulations, like those related to solvency or data privacy. Failing to do so could erode its market position.

- In 2024, the National Association of Insurance Commissioners (NAIC) updated its model laws.

- These changes often lead to increased compliance costs for companies.

- Prudential's ability to innovate and respond quickly is crucial.

- Adaptability is key to maintaining a competitive edge.

Competitive rivalry intensifies in Asia's saturated life insurance market, pushing Prudential to differentiate. Aggressive pricing strategies by competitors can squeeze profit margins, necessitating a focus on value-added services. Digital disruption from fintech firms and consolidation within the sector further heighten competition, requiring strategic tech investments and market adaptation.

| Factor | Impact on Prudential | 2024 Data |

|---|---|---|

| Market Saturation | Need for Differentiation | China's life insurance premiums rose 13% |

| Pricing Pressure | Margin Squeeze | Profit margins decreased by 5-10% |

| Digital Disruption | Tech Investment Required | Fintech market valued at $150B+ |

SSubstitutes Threaten

Alternative investment options, including mutual funds and ETFs, present a moderate threat to Prudential. In 2024, the assets under management (AUM) in ETFs reached approximately $8 trillion, indicating their growing popularity. Prudential needs to highlight the distinct advantages of its insurance products, such as the protection and long-term security they offer. For example, the life insurance industry generated about $800 billion in premiums in 2023, showcasing the continued demand for such offerings.

Emerging fintech solutions, like those from Robinhood and Acorns, provide simplified financial products, heightening the threat of substitutes for traditional insurers like Prudential. These platforms offer streamlined services, attracting customers with ease of use and lower fees; for instance, in 2024, Robinhood reported over 23 million funded accounts. Prudential must innovate and integrate technology, as the fintech market grew to $137.4 billion in 2023, to match the convenience and accessibility of these alternatives, or risk losing market share.

Government programs, such as Social Security and Medicare, serve as substitutes for certain insurance products. These programs can reduce the demand for private insurance, especially in areas like retirement and healthcare. In 2024, Social Security benefits increased by 3.2%, impacting the need for some retirement products. Prudential should strategically offer products that complement, not directly compete with, these government initiatives. This approach helps in navigating the competitive landscape effectively.

Self-Insurance

The threat of substitutes in the insurance industry includes self-insurance, where large companies manage their own risks, potentially cutting out the need for Prudential's services. To counter this, Prudential must offer specialized risk management solutions tailored to these larger clients. For instance, in 2024, self-insured employers covered about 60% of U.S. workers. This underscores the need for Prudential to provide comprehensive, value-added services.

- Self-insurance reduces demand for Prudential's standard products.

- Customized risk management is a key retention strategy.

- Approximately 60% of U.S. workers are under self-insured plans.

- Prudential needs to offer value-added services.

Savings Accounts

Savings accounts and other savings vehicles present a threat to Prudential's life insurance products. Consumers might choose these alternatives, especially if they prioritize savings over insurance coverage. To counter this, Prudential must emphasize the combined benefits of life insurance: financial protection and a savings component. Highlighting these dual advantages is crucial for maintaining competitiveness. In 2024, the average interest rate on savings accounts was around 0.46%, while life insurance offers protection plus potential investment growth.

- Savings accounts provide alternatives for those prioritizing savings.

- Prudential must stress both protection and savings benefits.

- Life insurance offers protection and investment growth.

- Focus on the combined value proposition.

Substitutes like ETFs and fintech platforms pose a moderate threat to Prudential. In 2024, ETFs held about $8 trillion in AUM, indicating growing popularity. Prudential must innovate and integrate technology. The fintech market size was $137.4 billion in 2023.

| Threat | Substitute | 2024 Data |

|---|---|---|

| Moderate | ETFs | $8T AUM |

| High | Fintech | $137.4B (2023 market) |

| Low | Government Programs | 3.2% SS increase |

Entrants Threaten

High capital requirements are a substantial hurdle for new entrants, lessening the threat to Prudential. Prudential's robust financial foundation, with a market capitalization exceeding $30 billion as of late 2024, provides a significant advantage.

Stringent regulatory hurdles and licensing requirements significantly limit new entrants into the insurance industry. Prudential, with its long-standing presence, has extensive experience navigating these complex regulations. This expertise acts as a substantial barrier to entry, protecting Prudential from new competition. The cost and time required to comply with these rules create a considerable disadvantage for newcomers, as demonstrated by the $2.3 billion in regulatory compliance costs reported by the insurance industry in 2024.

Prudential's established brand recognition and customer loyalty significantly deter new entrants. The company's strong brand presence in Asia and Africa offers a substantial competitive advantage. Prudential's brand value was estimated at $14.9 billion in 2024. This solid reputation and existing customer base make it challenging for newcomers to gain market share. New entrants face the difficulty of competing with Prudential's well-regarded brand.

Distribution Networks

Establishing robust distribution networks presents a formidable barrier to entry. Prudential benefits from its established agency and bancassurance channels. These existing networks offer a competitive edge by ensuring market reach. The significant investment required to replicate such networks deters new competitors.

- Prudential's agency network includes approximately 130,000 agents across Asia as of 2024.

- Bancassurance partnerships provide access to millions of customers through bank branches.

- Building a comparable distribution system could cost billions of dollars and take several years.

- New entrants face challenges in securing regulatory approvals for distribution.

Economies of Scale

Economies of scale significantly impact the threat of new entrants for Prudential. Established players like Prudential benefit from lower costs per unit due to their large-scale operations, creating a barrier. This advantage allows Prudential to offer more competitive pricing and services, making it harder for newcomers to gain market share. New entrants face challenges in matching Prudential's operational efficiency and pricing strategies.

- Prudential's revenue in 2023 was approximately $50.4 billion.

- The company has a substantial global presence, operating in numerous countries.

- Prudential's size enables it to spread its fixed costs over a larger customer base.

- New entrants often struggle to compete with the established scale and efficiency of companies like Prudential.

The threat of new entrants to Prudential is moderate due to high barriers to entry.

These barriers include substantial capital requirements, stringent regulations, and established brand recognition. Prudential's existing distribution networks and economies of scale further protect its market position.

| Barrier | Impact on Prudential | 2024 Data |

|---|---|---|

| Capital Requirements | Reduces threat | Market cap over $30B |

| Regulations | Limits entrants | Compliance costs $2.3B |

| Brand Recognition | Deters newcomers | Brand value $14.9B |

Porter's Five Forces Analysis Data Sources

Our Prudential analysis leverages data from financial reports, market research, regulatory filings, and economic databases to assess the insurance industry.