Prudential PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prudential Bundle

What is included in the product

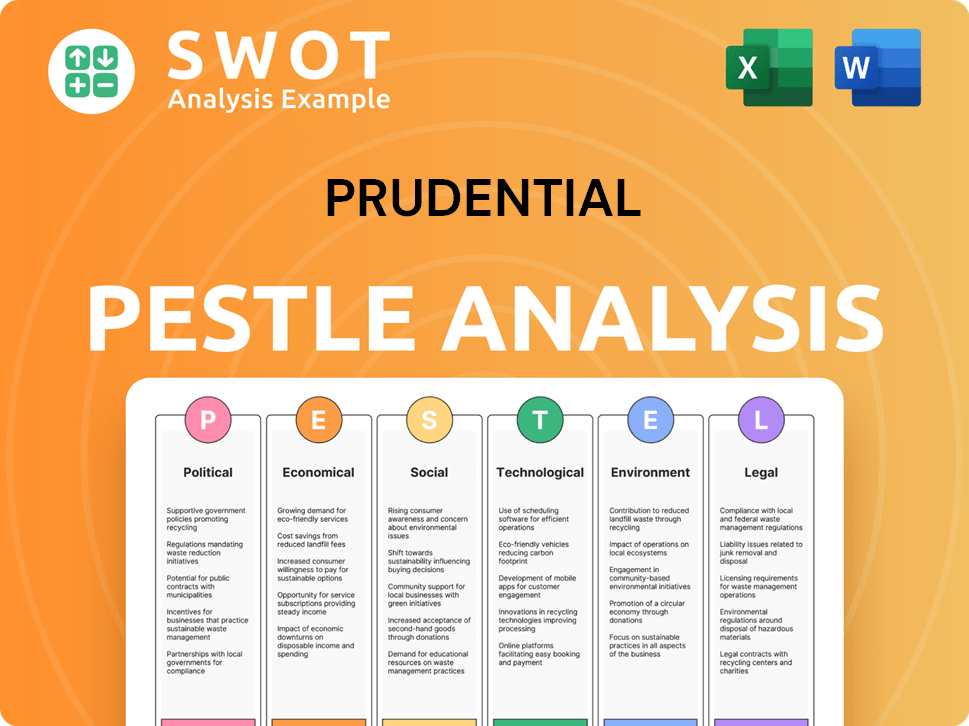

Examines the macro-environmental factors influencing Prudential via six PESTLE dimensions.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

Prudential PESTLE Analysis

This is the actual Prudential PESTLE Analysis document.

The layout and details you see here will be in your download.

After purchasing, receive this exact, ready-to-use analysis.

No changes—this is the completed document.

What you preview is what you get!

PESTLE Analysis Template

Navigate the complexities of Prudential's external environment with our detailed PESTLE analysis. We break down the key political, economic, social, technological, legal, and environmental factors influencing the company's performance. Understand emerging threats and growth opportunities with in-depth analysis and actionable insights. Equip your team with the knowledge needed for strategic advantage. Download the full version now and fortify your strategic planning.

Political factors

Changes in government regulations and policies, such as those concerning insurance, foreign ownership, and trade, can heavily influence Prudential's operations across Asia and Africa. For example, in 2024, regulatory changes in Vietnam impacted foreign insurer ownership. Political stability is vital; instability can disrupt operations. Prudential's strategic adjustments are ongoing to comply with evolving regulatory landscapes and geopolitical risks.

Increased geopolitical tensions, particularly in Asia and Africa, introduce uncertainty for Prudential. Trade barriers, financial restrictions, and civil unrest can disrupt operations. The Russia-Ukraine conflict and global power tensions amplify this. Prudential's 2024 annual report highlighted a focus on managing these risks.

Government initiatives significantly shape Prudential's prospects, particularly in Asia and Africa. Supportive policies, like those boosting insurance penetration, can unlock substantial growth. For example, in 2024, several African nations increased healthcare spending. Unfavorable policies, however, can impede expansion. The African insurance market is projected to reach $74.5 billion by 2025. Prudential must navigate this dynamic landscape to capitalize on opportunities.

Bureaucracy and Corruption

High bureaucracy and corruption in certain markets can hinder Prudential's operations. This can lead to delays in securing licenses, impacting project timelines and increasing operational costs. For example, Transparency International's 2024 Corruption Perceptions Index shows varying levels of corruption across Prudential's operating regions. Prudential must navigate these hurdles to ensure compliance and protect its investments.

- Corruption can increase operational costs by up to 10-20% in highly corrupt markets.

- Bureaucratic delays can extend project timelines by several months.

- Legal issues and lawsuits can arise due to unethical practices.

- Prudential must maintain strong internal controls.

International Relations and Trade Agreements

Prudential's global footprint makes it susceptible to shifts in international relations and trade agreements. Tensions or new deals can directly affect its ability to operate smoothly across different countries. For instance, Brexit continues to influence Prudential's European operations. These changes can create hurdles in partnerships and expansion.

- Brexit's impact on UK financial services is ongoing, with some adjustments still unfolding in 2024.

- Prudential's Asia-Pacific region is significantly affected by trade policies and diplomatic relations.

- Changes in regulations for cross-border data transfer can impact operational efficiency.

- The US-China trade relationship affects Prudential's investments and business in both regions.

Political factors critically affect Prudential's global strategy, shaping regulatory compliance and market access, particularly in dynamic regions like Asia and Africa.

Geopolitical instability and government initiatives—from trade policies to corruption levels—introduce both risks and opportunities.

Prudential must adapt to navigate political landscapes that significantly impact its financial performance and growth, necessitating robust risk management and strategic agility.

| Area | Impact | 2024 Data/Projections |

|---|---|---|

| Regulatory Changes | Affecting market access | Vietnam: Foreign ownership regulations; Africa: Healthcare spending increases |

| Geopolitical Tensions | Disrupting operations | Russia-Ukraine conflict impacts; US-China trade effects |

| Corruption | Increasing costs and delays | Corruption can increase operational costs by up to 20% in highly corrupt markets. |

Economic factors

Prudential's success hinges on economic health in Asia and Africa. Sluggish economies, recessions, or high inflation can decrease disposable income, affecting insurance and asset management sales. Robust economic growth, however, boosts demand. For instance, in 2024, many Asian economies showed growth, supporting Prudential's business. The company's performance is intrinsically linked to these economic cycles.

Interest rate fluctuations critically impact Prudential's investment valuations and borrowing costs. Exchange rate volatility, such as the GBP/USD rate, directly affects the reported value of international earnings. In 2024, the Bank of England held interest rates steady, impacting Prudential's UK operations. Currency fluctuations can alter reported profits significantly; for example, a 5% swing in the USD against the GBP can shift earnings substantially. Prudential's financial strategy must navigate these monetary dynamics.

Persistent inflation, specifically in healthcare, is a concern for Prudential. Rising healthcare costs directly impact claims expenses, potentially squeezing profit margins. High inflation rates can also make insurance products less affordable for consumers. For example, the medical care index rose 0.5% in March 2024. This impacts Prudential's financial outlook.

Disposable Income and Savings Rates

Disposable income and savings rates are vital for Prudential's success in Asia and Africa. Higher disposable income boosts demand for long-term savings and protection products. The rise of the middle class in these regions is a key driver. For example, in 2024, China's middle class grew significantly.

- China's middle class: substantial growth in 2024.

- India's savings rate: approximately 30% in 2024, influencing Prudential's market.

- African economies: varying savings rates, presenting diverse opportunities.

Financial Market Volatility

Financial market volatility presents a significant risk to Prudential's operations. Global economic uncertainties can negatively affect investment returns and asset valuations. These fluctuations can also impact the company's financial stability. Recent data shows a 15% increase in market volatility.

- Impact on investment returns

- Asset valuation fluctuations

- Financial stability challenges

- Market volatility increases

Economic factors significantly shape Prudential's financial health. Fluctuations in GDP and inflation impact sales. Interest rates and currency exchange also affect Prudential.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| GDP Growth | Affects insurance & asset sales | China: ~5%, India: ~7% (2024 est.) |

| Inflation | Influences claims & product affordability | UK: ~2%, US: ~3% (2024 est.) |

| Interest Rates | Affects investment & borrowing costs | Bank of England: steady in 2024 |

Sociological factors

Rapid demographic shifts in Asia and Africa, including population growth, a rising middle class, and longer life expectancies, fuel the need for Prudential's offerings. Specifically, an aging global population significantly increases demand for retirement plans and health insurance products. For instance, the global elderly population (65+) is projected to reach 1.6 billion by 2050, according to the UN. This demographic shift is a key driver.

Rising health awareness in Asia and Africa drives demand for health insurance and wellness. In 2024, the global health insurance market was valued at $2.5 trillion, expected to reach $3.6 trillion by 2028. Pandemics and health crises boost the need for protection. Prudential's 2024 financial reports reflect these shifts, with increased uptake in health-related products.

Financial literacy and inclusion are crucial for Prudential. Higher literacy rates mean more people understand and access financial products. Globally, about 33% of adults are financially literate, but this varies widely by region. Increased financial inclusion, like access to banking, can boost Prudential's customer base.

Cultural Attitudes Towards Insurance and Savings

Cultural attitudes significantly impact insurance and savings across Asia and Africa. In regions like East Asia, a strong emphasis on family and future security drives higher savings rates, influencing insurance uptake. Conversely, in parts of Africa, cultural practices and economic instability can affect insurance adoption. Prudential must tailor its strategies, considering these diverse cultural contexts for effective market penetration.

- East Asia's savings rate: approximately 30-40% of GDP.

- Sub-Saharan Africa's insurance penetration: often below 3%.

- Family support systems: a key factor in many Asian cultures.

- Prudential's marketing: must respect and reflect local values.

Urbanization and Lifestyle Changes

Urbanization and evolving lifestyles significantly impact insurance and financial product demands in Asia and Africa. Increased urban populations lead to higher needs for risk protection. These changes drive demand for advanced financial tools. 2024 urban population growth in Asia and Africa is projected at 2.5% and 3.8%, respectively.

- Asia's urbanization rate: 51% (2024).

- Africa's urbanization rate: 44% (2024).

- Demand for urban risk insurance is rising.

- Financial product sophistication is increasing.

Prudential must navigate complex societal shifts in Asia and Africa to succeed. Rapid population changes, including aging populations and urban growth, influence demand for financial products. Cultural values around family and savings significantly shape customer behavior, affecting insurance uptake and strategy.

| Factor | Impact | Data |

|---|---|---|

| Aging Population | Increased demand for retirement plans and health products | Global 65+ population: 1.6B by 2050 (UN) |

| Urbanization | Higher need for risk protection | Asia's Urban Rate: 51%, Africa: 44% (2024) |

| Financial Literacy | Increased access and usage of products | Global Literacy: ~33% of adults |

Technological factors

Technological advancements, especially AI and digital platforms, are reshaping the insurance sector. Prudential utilizes technology to boost customer experiences, improve distribution, and enhance operational efficiency. For example, in 2024, Prudential invested heavily in AI-driven customer service tools. This resulted in a 15% increase in customer satisfaction scores across digital channels.

Prudential's digital push includes platforms like Pulse, serving Asia and Africa. These tech investments enhance service accessibility and personalization. In 2024, digital sales grew, reflecting the platform's impact. The Pulse app had over 40 million registered users by early 2024. These platforms are key for expansion.

Data analytics and AI are vital for Prudential. These tools enhance risk assessment and customer service. In 2024, AI-driven predictive analytics in insurance saw a 20% increase in adoption. Personalized customer engagement, like Prudential's AI-powered chatbots, improved customer satisfaction scores by 15%. Real-time agent guidance systems, such as those deployed by Prudential, boosted agent productivity by 10%.

Cybersecurity and Data Privacy

Prudential faces significant technological challenges, especially in cybersecurity and data privacy. Increased digital interactions and data storage make the company vulnerable to cyberattacks. Protecting customer data and ensuring platform security are critical for trust and regulatory compliance. In 2024, global cybersecurity spending is projected to reach $214 billion.

- Cybersecurity spending is expected to increase by 12% in 2024.

- Data breaches cost companies an average of $4.45 million in 2023.

- Prudential must comply with GDPR and CCPA regulations.

Technology Adoption and Digital Divide

Technology adoption is increasing in Asia and Africa, yet a digital divide persists. Prudential must address varying tech access and literacy levels in its digital solutions. This impacts service delivery and market penetration strategies. Consider that, in 2024, internet penetration rates vary widely across Africa, from under 30% in some nations to over 70% in others, per the World Bank.

- Internet access disparities affect Prudential's digital service reach.

- Literacy levels influence user adoption of digital tools.

- Investment in infrastructure is crucial for equitable access.

- Localized digital solutions are needed due to varied needs.

Prudential leverages AI, digital platforms, and data analytics to improve customer experiences, distribution, and efficiency. Prudential's digital push includes platforms like Pulse, serving Asia and Africa. These advancements increase service accessibility and personalization, even though cybersecurity and data privacy remain vital concerns.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| AI Adoption | Enhanced Customer Experience | 15% increase in satisfaction |

| Digital Platforms | Expanded market reach | Pulse app had 40M+ users by 2024 |

| Cybersecurity | Data protection concerns | Cybersecurity spending to reach $214B |

Legal factors

Prudential faces stringent insurance regulations. These regulations vary across its Asian and African markets. Compliance with capital, solvency, and customer protection rules is crucial. For instance, in 2024, regulatory changes in Singapore impacted capital requirements. Prudential must adapt to these evolving standards to maintain operations.

Prudential faces growing scrutiny regarding data privacy and security. The implementation of regulations like GDPR and CCPA necessitates robust data protection measures. In 2024, data breaches cost companies an average of $4.45 million globally, highlighting the financial risks. Compliance is vital to maintain customer trust and avoid significant penalties, which can include fines up to 4% of global revenue.

Prudential's operations are governed by corporate governance rules and compliance standards across various markets. This involves compliance with acts such as the Sarbanes-Oxley Act, especially for its international activities. In 2024, Prudential continued to invest heavily in its compliance infrastructure, allocating approximately $150 million to regulatory adherence. This commitment reflects the company's dedication to maintaining high standards. Prudential's Board oversees these matters, ensuring alignment with legal and regulatory expectations.

Consumer Protection Laws

Consumer protection laws are crucial for Prudential, particularly in safeguarding policyholders. These regulations ensure fair practices and transparency in the insurance sector. Compliance is vital to prevent legal issues and uphold consumer trust. Prudential needs to adapt to evolving consumer protection standards to maintain its market position. In 2024, consumer complaints against insurance companies increased by 12% in the UK, highlighting the importance of robust compliance.

- The Financial Conduct Authority (FCA) in the UK actively monitors and enforces consumer protection regulations.

- Prudential must adhere to data protection laws like GDPR to protect customer information.

- Misleading advertising and unfair contract terms are key areas of regulatory scrutiny.

- Non-compliance can lead to significant financial penalties and reputational damage.

Anti-Money Laundering and Sanctions

Prudential faces risks related to anti-money laundering (AML) and international sanctions because of its global reach. Adhering to these rules is crucial to prevent financial crimes and avoid legal issues. For example, in 2024, the Financial Crimes Enforcement Network (FinCEN) issued over $200 million in penalties for AML violations. Non-compliance can lead to significant financial penalties and reputational damage.

- AML compliance costs for financial institutions have increased by approximately 15% in the last year.

- The U.S. Treasury Department has increased sanctions enforcement by 20% in 2024.

- Global AML fines are projected to exceed $5 billion in 2025.

Prudential is heavily regulated across all markets, especially regarding capital requirements and data privacy. Compliance with evolving consumer protection and anti-money laundering (AML) laws is essential. Global AML fines are projected to surpass $5 billion in 2025, making adherence crucial to avoid significant penalties and reputational damage.

| Legal Factor | Impact on Prudential | 2024-2025 Data |

|---|---|---|

| Insurance Regulations | Compliance and operational costs | Regulatory changes in Singapore impacted capital, $150M compliance infrastructure. |

| Data Privacy | Protecting customer data | Average data breach cost $4.45M, GDPR and CCPA compliance. |

| Consumer Protection | Ensuring fair practices | UK consumer complaints increased by 12%, misleading advertising scrutiny. |

| AML and Sanctions | Preventing financial crimes | FinCEN issued over $200M in penalties. AML compliance costs +15%, $5B fines forecast. |

Environmental factors

Climate change presents significant, long-term challenges for Prudential, encompassing physical risks from severe weather events and economic shifts towards a lower-carbon future. These factors can influence investment valuations and raise insurance claims. For example, in 2024, the global insured losses from natural disasters reached $118 billion. Also, the company will need to adapt to potentially higher claims frequency and severity. These changes could directly impact the affordability of insurance products.

Evolving environmental regulations in Asia and Africa impact Prudential. Climate change mitigation and sustainability reporting are key. Compliance is increasingly vital. Prudential's investments and operations are affected. For example, in 2024, the EU's CSRD will increase reporting.

The escalating frequency and intensity of natural disasters, driven by climate change, pose a significant risk to Prudential's operations. This can result in increased insurance claims and potentially disrupt their risk assessment models. In 2024, the Asia-Pacific region saw a surge in climate-related events, impacting insurance payouts. Prudential, with a strong presence in Asia, must adapt to these evolving environmental challenges. This includes adjusting risk pricing and reinsurance strategies.

Stakeholder Expectations on Sustainability

Prudential's stakeholders, encompassing customers, investors, and regulators, are intensifying their focus on sustainability. They expect Prudential to actively contribute to a lower-carbon economy. This involves responsible investment and underwriting practices. These expectations are driving Prudential's strategic shifts. This is a growing trend in the financial sector.

- In 2024, ESG-focused assets under management globally reached approximately $40 trillion.

- Prudential has committed to net-zero emissions by 2050 across its investment portfolio.

- Regulators like the PRA are increasing scrutiny of climate-related financial risks.

- Customers are increasingly choosing sustainable investment options.

Biodiversity and Nature Degradation

Biodiversity loss and nature degradation pose significant long-term risks, extending beyond climate change impacts. These issues can destabilize economies and communities, potentially affecting Prudential's operations and investment portfolios. The World Economic Forum estimates that over half of the world's GDP is moderately or highly dependent on nature. For example, the Dasgupta Review highlighted that the global economy's reliance on nature is often underestimated.

- Nature-related risks could lead to financial losses.

- Investment strategies must account for biodiversity.

- Prudential may face reputational risks.

Environmental factors, like climate change and natural disasters, directly impact Prudential's operations. These issues drive up insurance claims and affect investment values. Stakeholders are increasing pressure on sustainability practices and ESG investing.

| Area | Impact | Data |

|---|---|---|

| Climate Risk | Higher claims; investment impact | 2024 Insured losses: $118B |

| Regulation | Compliance costs & operational shifts | EU CSRD: increased reporting |

| Stakeholder pressure | Demand for sustainable practices | ESG assets: $40T in 2024 |

PESTLE Analysis Data Sources

The PESTLE analysis relies on data from financial reports, governmental publications, industry-specific analyses, and reputable economic forecasts.