Public Service Enterprise Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Public Service Enterprise Group Bundle

What is included in the product

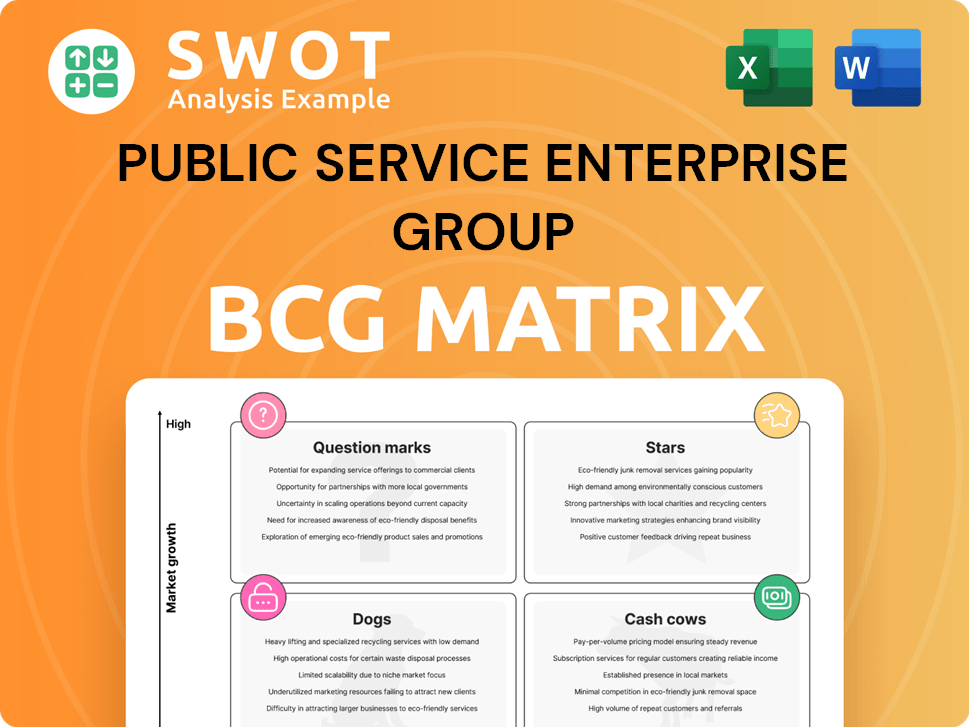

Public Service Enterprise Group's BCG Matrix analysis, detailing strategic recommendations for resource allocation across its portfolio.

One-page BCG Matrix, providing a concise visual representation of PSEG's business units.

Delivered as Shown

Public Service Enterprise Group BCG Matrix

The displayed Public Service Enterprise Group BCG Matrix preview mirrors the document you receive post-purchase. This is the complete, fully-formatted analysis, ready for download and immediate application in your strategic planning.

BCG Matrix Template

Public Service Enterprise Group's (PSEG) BCG Matrix offers a snapshot of its diverse portfolio. Question Marks highlight growth potential, while Stars often lead the way. Cash Cows provide stability, and Dogs require strategic consideration. Understanding these dynamics is crucial for informed decisions. This preview scratches the surface. Get the full BCG Matrix report for detailed quadrant placements and actionable strategies.

Stars

Public Service Enterprise Group's (PSEG) regulated investments are categorized as Stars within the BCG Matrix. PSEG is heavily investing in infrastructure modernization, energy efficiency, and electrification. They have planned capital spending of $3.8 billion for 2025 and $22.5-$26 billion for 2025-2029. This strategy supports a 6%-7.5% compound annual growth in the rate base.

The Clean Energy Future (CEF) programs, like CEF-EE II, are a high-growth area for PSEG. Approximately $2.9 billion is approved for investment in energy efficiency programs. This allows PSEG to invest at customer premises, reducing energy use and emissions. In 2024, demand for cleaner energy solutions continues to rise.

The Nuclear Production Tax Credit (PTC) is a strategic asset for Public Service Enterprise Group (PSEG). This federal PTC offers a dependable income source through 2032 for PSEG's nuclear facilities, which produce carbon-free energy. This support bolsters the competitiveness of PSEG's nuclear plants and helps them to keep running. The PTC offers protection against price drops and potential gains if prices go above the PTC limit. In 2024, PSEG's nuclear fleet benefits significantly from this financial backing.

Electric Transmission and Distribution Performance

PSEG's focus on electric transmission and distribution, especially through PSE&G, is a key strength. Their investments enhance reliability and customer satisfaction, a factor that is crucial for the company's reputation. These efforts are consistently recognized, showcasing their commitment to operational excellence. Ongoing investments in grid infrastructure are vital for a dependable energy supply.

- In 2024, PSE&G invested billions in grid modernization, reducing outage times.

- PSE&G consistently ranks among the top utilities for reliability.

- Customer satisfaction scores reflect positive outcomes from these investments.

- These investments are essential for a resilient grid, capable of handling future energy demands.

Sustainability and ESG Leadership

Public Service Enterprise Group (PSEG) shines as a "Star" in the BCG Matrix due to its strong sustainability and ESG leadership. This focus improves its image and draws in investors keen on responsible investing. PSEG's dedication is clear, having been included in the Dow Jones Sustainability North America Index for 17 years straight. It meets the rising need for sustainable and ethical business operations.

- PSEG's ESG initiatives include significant investments in renewable energy projects, with over $1 billion allocated in 2024.

- The company aims to reduce its carbon emissions by 80% by 2050.

- PSEG's ESG performance has led to a 15% increase in its ESG-focused investor base.

- In 2024, PSEG's sustainability efforts resulted in a 10% improvement in its ESG rating.

PSEG, a Star in the BCG Matrix, prioritizes substantial investments in infrastructure, energy efficiency, and sustainable projects. Planned capital spending is significant: $3.8 billion for 2025 and $22.5-$26 billion for 2025-2029. This boosts PSEG's image, attracting ESG-focused investors, with over $1 billion allocated to renewable projects in 2024.

| Investment Area | 2024 Investment | 2025-2029 Planned Spending |

|---|---|---|

| Grid Modernization | Billions | Included in overall plan |

| Renewable Energy | $1 Billion+ | Part of larger strategy |

| Energy Efficiency Programs | $2.9 Billion Approved | Ongoing |

Cash Cows

PSE&G, New Jersey's leading electric and gas utility, serves around 2.4 million electric and 1.9 million natural gas customers. Its established market position and regulated revenue model ensures a stable cash flow. In 2024, the company saw earnings boosted by approved new electric and gas base distribution rates. This makes PSE&G a solid cash cow within the Public Service Enterprise Group's portfolio.

PSEG's nuclear fleet, with 3,758 MW capacity, is a cash cow. It enjoys a high capacity factor, ensuring consistent cash flow. The fleet benefits from the federal Production Tax Credit (PTC). These assets provide stable, carbon-free baseload power, critical for energy security. In 2024, nuclear generation is a significant cash generator.

The Advanced Metering Infrastructure (AMI) program, with around 2.2 million smart meters installed, boosts efficiency and customer service. This tech enables faster outage response and power restoration. It supports remote monitoring and system control. This leads to cost cuts and better customer features. In 2024, PSEG likely saw operational savings due to AMI.

Pension and Storm Deferral Mechanisms

The adoption of pension and storm expense deferral mechanisms by Public Service Enterprise Group (PSE&G) boosts the predictability of its financial outcomes. These strategies smooth out costs, leading to more stable rates for consumers, a crucial element for maintaining customer satisfaction. The New Jersey Board of Public Utilities (BPU) approved these mechanisms within the distribution base rate case settlement. This move strengthens PSE&G's financial resilience.

- These mechanisms help stabilize rates for customers.

- The BPU approved these mechanisms as part of the distribution base rate case settlement.

- Enhances the financial stability of PSE&G.

High Customer Satisfaction

Public Service Enterprise Group (PSE&G) excels in customer satisfaction, recognized as #1 in the East for residential electric and gas services by J.D. Power. High satisfaction boosts customer retention and lowers acquisition costs, crucial for profitability. Positive experiences enhance PSE&G's brand value and reputation significantly. This solidifies its position as a cash cow.

- J.D. Power awards reflect service quality.

- Customer retention reduces marketing expenses.

- Positive brand image attracts investors.

- High satisfaction supports stable revenue.

PSE&G, a cash cow, consistently generates strong cash flow. Its regulated status and nuclear fleet provide stable revenue. AMI and high customer satisfaction further boost its financial performance. PSEG’s financial health is solid.

| Metric | Data | Year |

|---|---|---|

| Nuclear Capacity | 3,758 MW | 2024 |

| AMI Smart Meters Installed | 2.2 million | 2024 |

| J.D. Power Ranking | #1 East (Residential) | 2024 |

Dogs

Public Service Enterprise Group (PSEG) formerly managed merchant fossil generation, but divested these assets in 2022. These assets struggled amidst slow energy demand, oversupply, and the rise of renewables. The sale led to a $2.7 billion write-off, impacting financial performance. PSEG has exited this 'dog' category, streamlining its focus. In 2024, PSEG is concentrating on regulated utility operations.

In 2024, PSEG exited its offshore wind investments, citing high costs and delays. This strategic shift decreased its exposure to a venture with potentially low returns. The move aligns with PSEG's focus on its core regulated businesses. This decision reflects a trend of reevaluating investments. The company’s stock performance is up 5% YTD.

PSEG Long Island manages LIPA's electric system via contract. The contract's end date is December 2025. Performance reviews are ongoing, with potential metric reductions. Its "dog" status hinges on contract renewal terms and financial viability. The operational budget for 2024 was $3.2 billion.

Energy Holdings (Legacy Leases)

PSEG Energy Holdings (legacy leases) falls into the "Dogs" category of the BCG matrix. These legacy lease investments are likely declining in value due to asset depreciation. The returns are diminishing, making them less strategically important for PSEG's future. For 2024, PSEG's focus is likely on transitioning away from these assets.

- Legacy leases face declining value.

- Returns from these assets are decreasing.

- They are less strategic for future growth.

- PSEG may be divesting from these.

Certain IT System Segments

PSEG Long Island faced IT system segregation challenges, impacting bonus compensation in 2024. This suggests inefficiencies within the IT segment. These issues may hinder operational effectiveness and security, highlighting a critical need for improvement.

- PSEG's 2024 bonuses were affected by IT system issues.

- IT system segregation is essential for operational security.

- Addressing these issues can boost efficiency.

Dogs in PSEG's portfolio include legacy leases and certain contracts that are underperforming or have limited growth potential. These assets are characterized by declining values and decreasing returns, reducing their strategic importance. PSEG is likely focusing on divesting from or restructuring these less profitable segments in 2024.

| Category | Description | 2024 Status |

|---|---|---|

| Legacy Leases | Declining asset value, decreasing returns. | Transitioning away from these assets. |

| Offshore Wind | High costs, delays. | Exited investments, shifted focus. |

| PSEG Long Island (LIPA Contract) | Contract nearing expiration in December 2025. | Performance under review, operational budget $3.2B. |

Question Marks

Energy storage represents a Question Mark for PSEG. It's a high-growth, low-share market for the company. PSEG aims to reach 188 MW of energy storage on Long Island by 2028, exceeding its 2025 goal. Strategic investments and partnerships are crucial for growth in this area.

Public Service Enterprise Group (PSEG) is strategically investing in electric vehicle (EV) infrastructure, recognizing its potential for growth. Despite the sector's expansion prospects, its current market share remains modest. PSEG prioritizes residential charging solutions to optimize system load and time-of-day (TOD) rates. To boost EV adoption and program participation, enhanced engagement and outreach initiatives are essential. According to the U.S. Department of Energy, EVs accounted for about 7% of the U.S. light-duty vehicle sales in 2023.

Public Service Enterprise Group (PSEG) is exploring managed charging programs, a "Question Mark" in its BCG Matrix. These programs aim to shape electric vehicle charging habits, benefiting both the grid and the environment. As of late 2024, these initiatives are nascent, requiring further investment. PSEG's 2024 investments in grid modernization totaled $1.6 billion, with managed charging representing a smaller, but growing, portion.

Building Decarbonization Initiatives

Public Service Enterprise Group (PSEG) is assessing building decarbonization initiatives to boost the shift from fossil fuels to electric solutions. These efforts focus on incentivizing the switch in buildings, a promising but nascent area. PSEG's initiatives need more development and capital to achieve substantial market impact. In 2024, the building sector accounted for roughly 40% of U.S. energy consumption.

- Building decarbonization is still in its early stages.

- Significant investment is needed for market growth.

- The focus is on transitioning from fossil fuels to electricity.

- The building sector has a large carbon footprint.

Potential Data Center Partnerships

Data center partnerships could potentially increase Public Service Enterprise Group's (PSEG) margins, however, the benefits are constrained. PSEG is experiencing a rise in interest from large load and data center clients. The degree to which these partnerships will boost PSEG's growth is still unclear, presenting both possibilities and challenges. It's essential to carefully evaluate the strategic implications of these partnerships.

- Margin Enhancement: Partnerships could improve profitability.

- Customer Demand: Growing interest from large clients.

- Growth Uncertainty: The impact on PSEG's growth is unknown.

- Strategic Evaluation: Partnerships require careful assessment.

Managed charging programs are a Question Mark for PSEG, in a nascent stage with potential. These programs aim to influence EV charging behavior for grid and environmental advantages. PSEG's grid modernization investments totaled $1.6 billion in 2024, including a portion for managed charging.

| Aspect | Details | Data |

|---|---|---|

| Goal | Influence EV charging | Improve grid and environment |

| Investment (2024) | Grid modernization | $1.6 billion |

| Status | Nascent | Requires more investment |

BCG Matrix Data Sources

The PSEG BCG Matrix is fueled by SEC filings, market research, and expert forecasts. We integrate financial data, sector trends, and performance metrics.