Public Service Enterprise Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Public Service Enterprise Group Bundle

What is included in the product

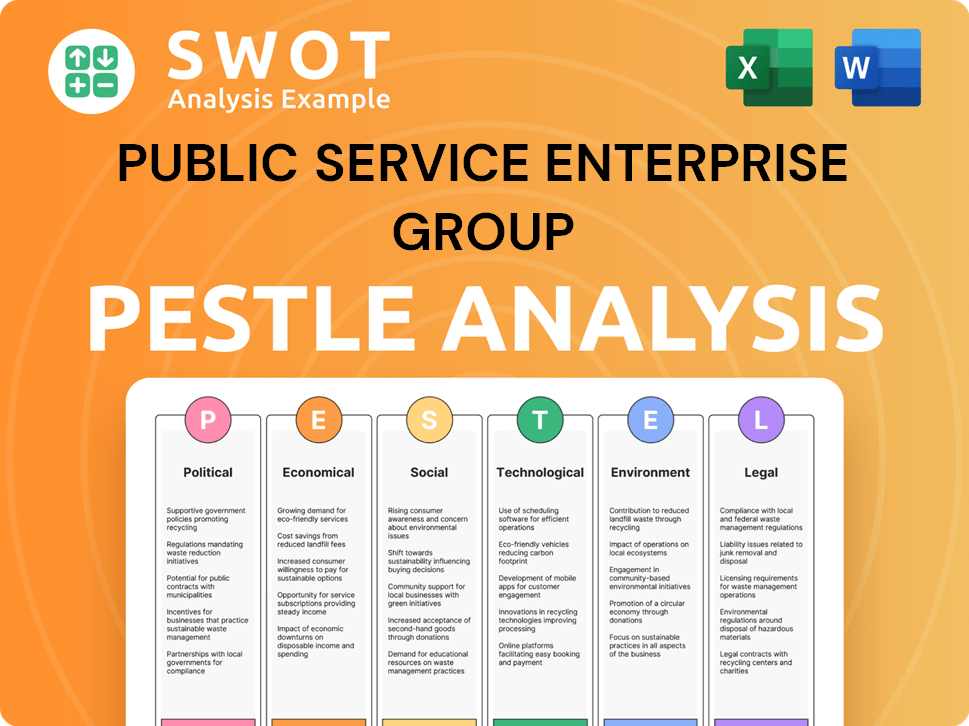

Analyzes external factors shaping Public Service Enterprise Group across Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

Public Service Enterprise Group PESTLE Analysis

This preview showcases the complete Public Service Enterprise Group PESTLE Analysis. The downloaded version mirrors this—every detail.

PESTLE Analysis Template

Navigate the complexities facing Public Service Enterprise Group with our detailed PESTLE analysis. We examine the key external factors—political, economic, social, technological, legal, and environmental—that influence its performance. Understand how regulations, market trends, and social shifts affect PSEG's operations. Gain crucial insights for strategic planning and informed decision-making. Download the complete analysis for in-depth perspectives and actionable strategies.

Political factors

PSEG's operations are heavily influenced by government policies. Clean energy mandates, infrastructure investments, and rate setting directly affect the company. For instance, the Inflation Reduction Act of 2022 includes provisions supporting clean energy, potentially benefiting PSEG. The company spent $3.6 million on lobbying in 2023, reflecting its active political engagement.

Government policies heavily influence PSEG's shift toward clean energy. The U.S. aims for a carbon pollution-free power sector by 2035. Programs like PSE&G's Clean Energy Future, with investments of $3.9 billion, are direct responses to political incentives. These initiatives boost PSEG's renewable energy projects and grid upgrades. This helps them reach decarbonization targets.

Political and regulatory stability is vital for PSEG. Frequent regulatory changes can disrupt long-term planning and investment recovery. PSEG's regulated operations depend on predictable frameworks. For 2024, the US energy sector faces evolving regulations. These include policies on renewable energy and emissions, impacting PSEG's strategies.

Infrastructure Investment Policies

Government policies significantly influence Public Service Enterprise Group (PSEG). Support and funding for infrastructure modernization are key political factors. These policies encourage investment in upgrading infrastructure, enhancing grid reliability, and preparing for extreme weather. PSEG's capital spending plans align with these initiatives, helping provide reliable service. In 2024, PSEG allocated billions to enhance infrastructure.

- Infrastructure spending is projected to increase by 15% in 2025.

- Grants and subsidies for green energy projects will reach $5 billion by Q4 2024.

- The Infrastructure Investment and Jobs Act of 2021 is expected to provide $200 million to PSEG by 2026.

Political Contributions and Lobbying

Public Service Enterprise Group (PSEG) actively engages in political activities to shape policy and foster stakeholder relationships. This involves financial contributions and lobbying designed to support the company's strategic objectives. These efforts aim to align policies with PSEG's operational needs, encouraging investments in critical areas like the economy, environment, and infrastructure.

- In 2023, PSEG spent $2.3 million on lobbying.

- PSEG's PAC contributed $650,000 to federal candidates in the 2024 election cycle.

- Key lobbying issues include energy policy and infrastructure development.

Political factors significantly shape Public Service Enterprise Group's (PSEG) trajectory. Government mandates and incentives heavily influence PSEG’s clean energy strategies. The company’s substantial investments and lobbying efforts reflect its active political engagement. These efforts aim to ensure favorable regulatory environments for its operational objectives.

| Factor | Details | Impact |

|---|---|---|

| Clean Energy Mandates | US aims for carbon-free power by 2035 | $3.9B investment by PSE&G's Clean Energy Future |

| Infrastructure Investment | IIJA to provide $200M to PSEG by 2026 | Aligning spending with government initiatives |

| Lobbying | $2.3M spent in 2023 | Shaping policy and stakeholder relationships |

Economic factors

PSEG's financial success hinges on its capital investments and rate base expansion. Planned infrastructure upgrades and clean energy projects are key. In 2024, PSEG allocated approximately $3.5 billion for capital expenditures. These investments are projected to boost earnings, reflecting a strategic focus on regulated operations.

Fluctuations in energy prices, like natural gas and electricity, affect PSEG Power. Hedging helps, but market prices and capacity prices in PSEG's operating regions influence revenues. In 2024, natural gas spot prices at the Henry Hub averaged around $2.50-$3.00 per MMBtu, impacting generation costs. Electricity prices in PJM, where PSEG operates, also show volatility.

Customer demand fluctuations significantly impact PSEG. Economic growth and electrification trends drive electricity and natural gas needs. Data centers and other large users increase demand, affecting sales. In 2024, PSEG saw a 2% rise in electricity sales. This necessitates infrastructure investment to meet growing needs.

Financing Costs and Interest Rates

Public Service Enterprise Group (PSEG) operates in a capital-intensive industry, making it highly susceptible to financing costs and interest rate fluctuations. Increased financing costs, such as those experienced in 2023 and potentially into 2024, can diminish the advantages of new base rates. This can negatively affect PSEG's overall profitability and financial performance. The Federal Reserve's interest rate decisions have a direct impact, with even small increases affecting borrowing costs significantly. PSEG's financial strategy must carefully consider these factors to maintain profitability.

- In 2023, PSEG reported a net income of $1.5 billion.

- Interest rates rose significantly in 2023, increasing borrowing costs for utilities.

- PSEG’s debt-to-equity ratio and interest coverage ratios are key metrics.

Customer Affordability and Bill Impacts

Customer affordability remains crucial for PSEG, a regulated utility. The company actively manages costs and promotes energy efficiency to keep rates competitive. Recent data shows PSEG's efforts are impactful; for example, in Q1 2024, residential customers saw a modest increase in their bills, reflecting the company's cost-control strategies. PSEG also secured favorable rate case outcomes, further supporting affordable energy access for its customers.

- Q1 2024: Residential bill increase was approximately 2.5%

- Energy efficiency programs saved customers an estimated $50 million in 2023

- PSEG's rate case settlements aim to keep rate increases below the inflation rate

Economic factors like capital investment and rate changes directly affect PSEG's financial health, influencing both earnings and profitability. Fluctuating energy prices, including natural gas, can impact generation costs and revenue streams for the company, so they utilize hedging. Demand variations also significantly impact sales and influence infrastructure investments.

| Factor | Impact on PSEG | 2024/2025 Data Points |

|---|---|---|

| Interest Rates | Increased borrowing costs; affects profitability. | 2024: Federal Reserve rate decisions continue to impact borrowing. |

| Energy Prices | Volatility in natural gas and electricity prices affects revenues. | 2024: Natural gas averaged ~$2.50-$3.00/MMBtu; electricity prices fluctuate. |

| Customer Demand | Drives sales and infrastructure needs. | 2024: Electricity sales increased by 2%. |

Sociological factors

Public perception and customer satisfaction are crucial for PSEG's success. Its ranking in customer satisfaction surveys reflects its service reliability and customer interaction effectiveness. In 2024, J.D. Power's study showed average customer satisfaction scores for utilities. PSEG's performance in these studies directly impacts its brand image and regulatory relationships. High satisfaction fosters trust, vital for a utility like PSEG.

PSEG actively engages in community initiatives, focusing on sustainability and responsible practices. The company invested over $5.5 million in community programs in 2024. This commitment reflects its dedication to local support. PSEG's efforts enhance its reputation and foster positive relationships within the communities it serves. These actions contribute to a stronger social license to operate.

PSEG, as a major employer, faces sociological factors related to its workforce and labor relations. The company must maintain a skilled workforce, which is crucial for operational stability. In 2024, PSEG employed around 13,000 people, reflecting its significant impact on employment. Managing labor relations, especially with unions, is key to avoiding disruptions. Labor costs accounted for a substantial portion of operating expenses, approximately $1.5 billion in 2024.

Public Perception of Energy Sources

Public opinion significantly impacts PSEG's operations, especially concerning energy source acceptance. Nuclear power faces varying public attitudes, influenced by safety concerns and historical events. Renewable energy sources generally enjoy positive perception, yet require infrastructure development that may face local opposition. Public sentiment directly affects policy support and project approvals, influencing PSEG's strategic decisions.

- In 2024, approximately 60% of US adults supported expanding renewable energy, while nuclear energy support varied regionally.

- Community acceptance of infrastructure projects is crucial, with local opposition potentially delaying or halting projects.

- PSEG must address public concerns through transparent communication and community engagement to secure project approvals.

Demographic Trends and Energy Usage Patterns

Demographic shifts significantly influence energy consumption. Increased urbanization and population growth in PSEG's service areas, like New Jersey and Long Island, directly affect energy demand. The adoption of energy-efficient technologies, such as smart home devices, alongside the rise of electric vehicles, are reshaping usage patterns. These trends necessitate strategic grid modernization and updated demand forecasts to ensure reliable service.

- New Jersey's population grew by 2.7% from 2010 to 2020, impacting energy needs.

- EV adoption is rising, with 15% of new car registrations being electric in 2024.

- Smart grid investments are planned to integrate renewables and manage fluctuating demand.

- Energy efficiency programs have saved customers an average of 10% on their bills.

Societal views heavily affect PSEG. Renewable energy enjoys 60% US support, but projects face community hurdles. Demographics like New Jersey's 2.7% growth drive energy demands, alongside EV adoption (15% of new registrations in 2024). PSEG needs smart grid upgrades and customer support for efficient systems.

| Factor | Details | Impact |

|---|---|---|

| Public Opinion | 60% US support renewable; nuclear views vary; projects face local opposition | Policy influence; project approvals |

| Demographics | New Jersey grew 2.7% (2010-2020); 15% EV adoption in 2024 | Demand changes; grid modernization need |

| Technology Adoption | Smart homes and EVs grow, using 10% on average efficiency. | Usage patterns; investment decisions |

Technological factors

PSEG is heavily investing in smart grid technologies, including advanced metering infrastructure (AMI). These upgrades aim to boost grid reliability and quicker outage responses. In 2024, PSEG allocated a significant portion of its capital expenditures to these technologies. This strategic move supports programs such as demand response, enhancing operational efficiency. The company’s investment aligns with broader industry trends towards smarter, more resilient energy networks.

Technological factors significantly shape Public Service Enterprise Group (PSEG). Advancements in solar, offshore wind, and energy storage are key. PSEG invests in these areas to cut emissions. For example, PSEG's solar capacity increased by 10% in 2024. Building decarbonization solutions also play a role. These changes impact PSEG's strategic direction.

Cybersecurity is a significant technological factor for Public Service Enterprise Group (PSEG). With increasing reliance on digital systems, protecting infrastructure from cyber threats is vital. PSEG's 2024 cybersecurity budget was approximately $175 million, reflecting its commitment. In 2024, the energy sector faced a 30% increase in cyberattacks, highlighting the ongoing risk.

Electrification of Transportation and Buildings

The electrification of transportation and buildings significantly impacts Public Service Enterprise Group (PSEG). Increased adoption of electric vehicles (EVs) and electric heating systems boosts electricity demand, necessitating grid upgrades. PSEG has allocated substantial capital expenditures, with $1.6 billion in 2024 and a projected $2.7 billion in 2025, to enhance its infrastructure for this shift. This includes investments in smart grids and renewable energy sources to support the growing load. Moreover, regulatory support, such as the Infrastructure Investment and Jobs Act, provides additional funding for these projects.

- PSEG's 2024 CapEx: $1.6B

- PSEG's 2025 Projected CapEx: $2.7B

- EV adoption drives load growth.

- Grid upgrades are essential.

Operational Technology and System Reliability

Public Service Enterprise Group (PSEG) heavily relies on operational technology (OT) to manage its energy infrastructure, focusing on system reliability. This involves advanced monitoring and control systems to ensure efficient energy distribution. The company invests in OT to minimize downtime and enhance service quality. PSEG's commitment to OT is reflected in its capital expenditures, with significant portions allocated to grid modernization projects.

- PSEG's 2024 capital expenditures are approximately $3.6 billion.

- Grid modernization projects account for a substantial portion of this investment.

- The company aims to reduce outage times through OT enhancements.

- Cybersecurity measures are integrated within OT systems to protect against threats.

Technological advancements significantly influence Public Service Enterprise Group (PSEG). PSEG invested heavily in smart grid technologies to enhance grid reliability and quicker outage responses; allocating a significant portion of its 2024 capital expenditures, with approximately $3.6 billion overall.

PSEG is focusing on solar, offshore wind, and energy storage to reduce emissions and expanding EV infrastructure and OT.

Cybersecurity measures, with a $175 million budget in 2024, are critical to protect digital systems.

| Technology Area | PSEG Initiative | 2024 Investment (Approx.) |

|---|---|---|

| Smart Grid | AMI Upgrades | $1.6B |

| Renewables | Solar, Offshore Wind | ~10% increase in Solar |

| Cybersecurity | Infrastructure Protection | $175M |

Legal factors

PSEG faces stringent energy regulations at all levels. These regulations cover environmental standards, safety protocols, and market operations. For instance, in 2024, PSEG invested heavily in compliance measures, allocating $500 million for environmental projects. Non-compliance can lead to significant penalties, impacting profitability. Furthermore, the company must adapt to evolving rules like the Clean Power Plan, influencing its strategic investments.

As a regulated utility, Public Service Enterprise Group (PSE&G) must get rate and investment recovery approvals from the New Jersey Board of Public Utilities (NJBPU). The NJBPU approved PSE&G's base rate increase in 2024. These approvals affect the company's finances. Regulatory filings are crucial for PSE&G's financial well-being.

PSEG's power generation and infrastructure projects face environmental regulations and permitting needs. These include compliance with the Clean Air Act and Clean Water Act. In 2024, PSEG invested significantly in environmental projects, with $500 million allocated. Changes in environmental laws can affect project timelines and costs, as seen with recent updates to emissions standards.

Legal Proceedings and Litigation

PSEG faces legal challenges inherent to its industry, including environmental compliance and operational disputes. Such litigation can lead to significant financial burdens and impact investor confidence. For example, in 2024, PSEG allocated approximately $200 million for environmental remediation efforts. These legal battles can be costly and time-consuming.

- Environmental regulations and compliance are primary legal concerns.

- Operational disputes, such as contract disagreements, are also possible.

- Litigation can affect PSEG's stock price and credit ratings.

- The company must allocate resources for legal defense and settlements.

Nuclear Regulation and Licensing

PSEG's nuclear operations face rigorous oversight from the Nuclear Regulatory Commission (NRC). Compliance with safety standards and environmental regulations is paramount for all nuclear facilities. License renewals are essential for the continued operation of these plants. The NRC's stringent requirements can lead to significant operational costs and potential disruptions. In 2024, PSEG's nuclear fleet generated approximately 30% of its total electricity.

- NRC regulations dictate operational protocols and safety measures.

- License renewals involve extensive reviews and public hearings.

- Non-compliance can result in fines or plant shutdowns.

- PSEG invested $300 million in nuclear safety upgrades in 2023.

PSEG must comply with evolving environmental laws, requiring significant investments like the $500 million allocated in 2024. The company also faces litigation risks, allocating roughly $200 million for remediation. Nuclear operations require strict adherence to NRC standards.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Environmental Compliance | Cost of compliance & potential penalties | $500M allocated for projects |

| Litigation | Financial burden & reputational risk | $200M for remediation |

| Nuclear Regulations | Operational costs & disruptions | 30% of electricity from nuclear |

Environmental factors

PSEG faces climate change risks, including more intense weather that could damage infrastructure. To combat this, the company is investing in grid hardening. In 2024, PSEG allocated $1.5 billion for infrastructure upgrades to enhance resilience. This is crucial for ensuring reliable service amidst climate change.

PSEG aims for net-zero carbon emissions. This commitment fuels investments in renewable energy. In 2024, PSEG increased its solar capacity. They also plan to retire older fossil fuel plants. These moves align with growing regulatory pressures.

Public Service Enterprise Group (PSEG) incurs substantial expenses for environmental remediation. These costs stem from assessing and cleaning up contaminated sites, particularly former industrial locations like manufactured gas plants. In 2024, PSEG allocated significant funds, with remediation expenses potentially reaching millions annually. These costs directly impact PSEG's financial performance and necessitate careful management.

Waste Management and Resource Conservation

PSEG focuses on waste reduction, recycling, and resource conservation. This includes managing waste from power plants and infrastructure projects. The company aims to minimize environmental impact through sustainable practices. PSEG's initiatives align with growing regulatory pressures and stakeholder expectations regarding environmental stewardship. In 2024, PSEG reported a 15% reduction in landfill waste from its operations compared to 2023.

- Waste reduction targets are part of PSEG’s sustainability goals.

- Recycling programs are in place at various facilities.

- Resource conservation includes water management strategies.

- These efforts support long-term environmental responsibility.

Protection of Natural Habitats and Biodiversity

PSEG's operations must address their impact on natural habitats and biodiversity. This involves implementing practices to minimize environmental harm. For example, in 2024, PSEG invested $150 million in environmental projects. These efforts support habitat preservation. They also promote biodiversity through initiatives like land restoration and wildlife protection.

- 2024: PSEG invested $150M in environmental projects.

- Focus on habitat preservation and land restoration.

- Wildlife protection initiatives are also in place.

PSEG confronts climate change with grid hardening investments. This initiative received a $1.5 billion allocation in 2024 to improve infrastructure resilience. The company aims for net-zero emissions, boosting renewable energy, like expanding solar capacity. Remediation of contaminated sites also incurs costs; expenses reached millions in 2024. PSEG manages waste reduction and recycling, reducing landfill waste by 15% in 2024. Lastly, in 2024 PSEG invested $150M in environmental projects to help protect habitats.

| Environmental Factor | PSEG Initiatives | 2024 Data |

|---|---|---|

| Climate Change | Grid hardening & renewable investments | $1.5B infrastructure upgrades |

| Emissions Reduction | Net-zero target, solar capacity expansion | Increasing solar capacity |

| Environmental Remediation | Cleanup of contaminated sites | Millions spent on remediation |

| Waste Management | Waste reduction & recycling programs | 15% reduction in landfill waste |

| Biodiversity & Habitat Protection | Investments in environmental projects | $150M investment in projects |

PESTLE Analysis Data Sources

PSEG's PESTLE relies on government publications, financial data, market analyses, and industry reports for credible insights.