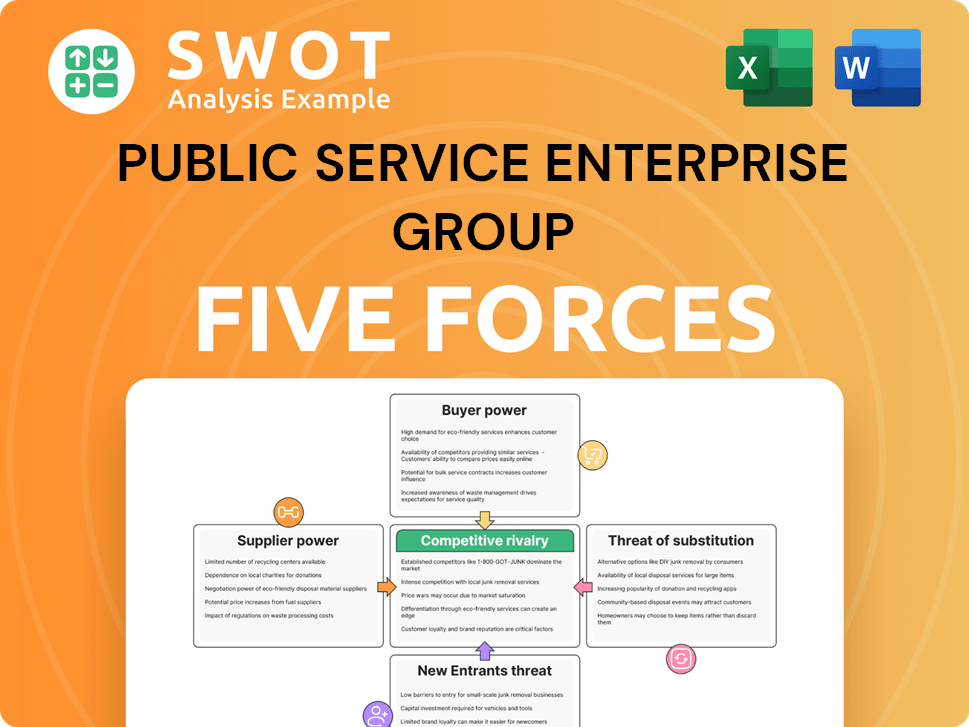

Public Service Enterprise Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Public Service Enterprise Group Bundle

What is included in the product

Analyzes PSEG's competitive position by evaluating market dynamics and external forces.

Customize pressure levels based on new data for PSEG's market.

What You See Is What You Get

Public Service Enterprise Group Porter's Five Forces Analysis

This Public Service Enterprise Group (PSEG) Porter's Five Forces analysis preview provides a complete view.

You are seeing the exact, fully formatted document you will download immediately upon purchase.

No edits or further formatting are needed, as this is the final analysis.

The document presented is what you’ll receive—ready for your immediate review and use.

This preview showcases the comprehensive, ready-to-use PSEG analysis you will own.

Porter's Five Forces Analysis Template

Public Service Enterprise Group (PEG) operates in a dynamic utility sector, shaped by unique competitive pressures. Supplier power is moderately concentrated, influenced by infrastructure needs. Buyer power is tempered by regulation and essential services. The threat of new entrants is low, due to high capital costs. Substitute products pose a limited threat, given the nature of electricity. Competitive rivalry among existing players is intense.

Unlock key insights into Public Service Enterprise Group’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

PSEG depends on suppliers for natural gas and equipment. High supplier concentration gives them pricing power, raising PSEG's costs. For example, if a few firms control gas pipelines, PSEG faces limited negotiation leverage. In 2024, natural gas prices have fluctuated significantly, impacting PSEG's expenses.

Fluctuations in natural gas and fuel prices significantly affect PSEG Power's profitability. Suppliers, controlling these resources, hold considerable power, especially during high demand or supply disruptions. For example, in 2024, natural gas prices saw volatility. PSEG uses hedging to manage this risk. The ability to secure favorable supply terms impacts financial outcomes.

PSEG relies on specialized equipment and technology for its operations, making it vulnerable to vendor bargaining power. If few vendors supply these essentials, costs for maintenance, upgrades, and new projects could rise. In 2024, PSEG invested significantly in grid modernization, which depends on these vendors. For example, in 2024, PSEG's capital expenditures were approximately $3.3 billion, a portion of which went to these vendors.

Regulatory compliance costs

Suppliers aiding Public Service Enterprise Group (PSEG) in regulatory compliance, especially for environmental standards, hold considerable bargaining power. These suppliers often offer specialized technologies and services, and the costs can be significant. PSEG's expenses related to environmental compliance were around $490 million in 2024. Government policies also influence the dynamics.

- Compliance costs for PSEG were approximately $490 million in 2024.

- Specialized technologies and services for compliance give suppliers leverage.

- Government regulations and policies impact supplier-buyer relationships.

- Environmental standards compliance is a key area.

Labor market dynamics

The labor market significantly influences Public Service Enterprise Group's (PSEG) operational costs. Skilled labor, particularly in areas like nuclear energy, is a critical resource. Labor costs are directly influenced by the availability of expertise and union agreements. Rising labor costs can squeeze profit margins, impacting project economics and overall financial performance.

- In 2024, the average hourly wage for power plant operators in the US was around $45.

- Unionization rates in the utility sector can be above 50%, influencing wage negotiations.

- PSEG's 2023 operating expenses included significant labor costs, reflecting the importance of effective labor management.

- Shortages in specialized skills, like nuclear engineers, can increase recruitment and training costs.

Suppliers of natural gas and specialized equipment significantly impact PSEG's costs. High supplier concentration, like in gas pipelines, enhances their pricing power. For example, PSEG's grid modernization efforts in 2024, costing approximately $3.3 billion, heavily relied on these vendors. Compliance costs, around $490 million in 2024, also create supplier leverage.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Natural Gas Prices | Influences PSEG Power's Profitability | Volatility impacted expenses |

| Equipment Vendors | Affects maintenance and project costs | Grid modernization spend ~$3.3B |

| Compliance Suppliers | Impacts environmental costs | Compliance costs ~$490M |

Customers Bargaining Power

Residential customers of Public Service Enterprise Group (PSEG) have minimal individual bargaining power. Although, their combined reactions to price shifts or service issues can influence PSEG’s image and regulatory ties. Customer happiness remains critical, especially with over 2.3 million residential customers in 2024. PSEG's success hinges on keeping these customers satisfied.

Large industrial and commercial customers are significant energy consumers. They can negotiate rates with PSEG, enhancing their bargaining power. In 2024, PSEG's commercial sales were substantial. Energy efficiency programs further reduce demand, impacting pricing.

Governmental bodies and regulatory agencies, acting as influential customers, shape pricing and service standards for Public Service Enterprise Group (PSEG). These entities ensure fair practices, significantly influencing PSEG's strategic decisions. Regulatory decisions can notably impact revenue; for example, in 2024, regulatory changes affected PSEG's rate base and allowed returns.

Energy efficiency programs

The growing embrace of energy-efficient tech and habits curbs total energy demand. This trend empowers customers by giving them more say in how they use energy, which could lead to lower energy bills, indirectly boosting their bargaining power. For instance, in 2023, the U.S. saw residential energy consumption drop, partly due to these efficiencies. This shift lets customers negotiate better deals or switch providers more easily.

- Reduced demand from energy efficiency programs diminishes the power of energy providers.

- Customers gain leverage through options like solar panels and smart thermostats.

- Energy-saving practices lower bills, impacting customer spending on energy.

- The ability to control energy use increases customer influence.

Customer switching costs

In deregulated markets, like those PSEG operates in, customers have the freedom to switch energy providers. This ability to choose significantly increases customer power, pushing PSEG to be highly competitive with its pricing and the quality of services offered. Low switching costs make it easier for customers to move to a competitor, which means that PSEG must prioritize customer retention strategies to maintain its market share. For instance, in 2024, the average customer churn rate in the US retail energy market was around 15%.

- Deregulated markets increase customer choice.

- Low switching costs enhance customer power.

- PSEG must focus on retention.

- Churn rate is a key metric.

Customer bargaining power varies significantly for Public Service Enterprise Group (PSEG). Residential customers have limited power individually, but collective responses matter. Commercial and industrial clients can negotiate rates, enhancing their influence. Regulatory bodies significantly shape pricing and service standards.

Energy efficiency trends and market deregulation further empower customers. Deregulation allows switching providers, boosting customer leverage in competitive markets. This intensifies PSEG's need to prioritize customer retention.

| Customer Segment | Bargaining Power | Impact on PSEG |

|---|---|---|

| Residential | Low individually, high collectively | Influences image, regulatory ties |

| Commercial/Industrial | High | Negotiates rates, impacts revenue |

| Regulators | Very High | Sets pricing, service standards |

Rivalry Among Competitors

PSEG competes with other utilities, particularly for large industrial clients. Competition is fierce; utilities vie for customer acquisition and retention. Superior service and novel offerings are vital for PSEG's differentiation. In 2024, PSEG's operational excellence initiatives aim to improve service reliability and customer satisfaction, crucial for competitive advantage.

Independent power producers (IPPs) present significant competition to PSEG Power. IPPs, utilizing diverse technologies and cost structures, intensify market rivalry. In 2024, wholesale electricity prices fluctuated, affecting PSEG's profitability. PSEG must strategically manage its generation portfolio to compete effectively.

The rise of renewable energy significantly intensifies competition for PSEG. Solar and wind power providers offer alternatives, attracting customers seeking sustainable options. PSEG faces the challenge of integrating renewables into its portfolio to remain competitive. In 2024, renewable energy's market share grew, increasing rivalry. PSEG needs to adapt to maintain its position.

Market deregulation impacts

Market deregulation significantly impacts PSEG's competitive environment. Deregulation in energy markets welcomes new competitors, intensifying rivalry. This can trigger price wars, potentially squeezing PSEG's profit margins. PSEG must adjust its strategies to stay competitive. The company's 2023 operating revenues were approximately $12.8 billion.

- Increased competition from new entrants.

- Potential for price wars and margin compression.

- Need for strategic adaptation by PSEG.

- Focus on operational efficiency and customer service.

Technological advancements

Technological advancements significantly impact competitive rivalry in the energy sector. New technologies like smart grids and energy storage are reshaping the industry, with early adopters gaining an edge. PSEG needs to prioritize innovation to remain competitive. The company's investments in grid modernization and renewable energy projects are crucial. For example, PSEG invested approximately $1.8 billion in infrastructure projects in 2023.

- Smart grid technologies enhance efficiency.

- Energy storage solutions improve reliability.

- Innovation requires substantial capital expenditure.

- Staying ahead demands continuous adaptation.

PSEG faces fierce competition from utilities and IPPs, with market deregulation and renewable energy further intensifying rivalry. This competitive landscape can lead to price wars and margin compression, demanding strategic adaptation and operational efficiency. In 2024, the energy market saw fluctuating wholesale prices, affecting profitability.

| Aspect | Impact | PSEG Response |

|---|---|---|

| New Entrants | Increased competition | Strategic adaptation |

| Price Wars | Margin compression | Focus on efficiency |

| Renewables | Shift in market | Portfolio integration |

SSubstitutes Threaten

Energy conservation, driven by both consumers and businesses, presents a direct threat to PSEG by reducing the need for its services. Government initiatives and public awareness campaigns, like those promoting the use of energy-efficient appliances, further amplify this substitution risk. In 2024, residential energy efficiency spending is projected to reach approximately $20 billion. To mitigate this, PSEG can offer energy management solutions.

The threat of substitutes for Public Service Enterprise Group (PSEG) includes on-site generation. Customers can opt for solar panels or combined heat and power systems, diminishing their need for PSEG's grid. In 2024, the U.S. residential solar market grew, impacting traditional utilities. PSEG has the opportunity to provide distributed generation solutions. This strategic move can help the company to stay competitive.

Alternative energy sources pose a growing threat. Renewables like solar and wind offer electricity alternatives to fossil fuels. Their cost-effectiveness is improving, increasing substitution risk. In 2024, solar and wind generated ~14% of US electricity. PSEG must diversify its portfolio to adapt.

Fuel switching

The threat of substitutes for Public Service Enterprise Group (PSEG) includes fuel switching by large industrial customers. These customers can opt for alternatives like natural gas or oil based on market prices. This ability to switch reduces their reliance on PSEG's electricity and gas services, increasing competition. PSEG must ensure competitive pricing to retain these customers.

- In 2024, natural gas prices have fluctuated, impacting fuel choices.

- Oil prices also play a role, with industrial users weighing costs.

- PSEG must maintain competitive rates to avoid losing customers.

- The flexibility of industrial customers poses a constant challenge.

Demand response programs

Demand response programs pose a threat to PSEG by incentivizing customers to cut energy use during peak times. These programs act as substitutes for PSEG's electricity supply, reducing demand. PSEG can participate in these programs, offering customers financial incentives to lower consumption. This shifts the traditional supply-demand dynamic. In 2024, the U.S. demand response capacity reached 30,000 MW.

- Reduced need for traditional supply.

- Customer participation as a key factor.

- Financial incentives drive behavioral changes.

- Impact on peak load management.

The threat of substitutes significantly challenges Public Service Enterprise Group (PSEG). Energy conservation reduces demand. On-site generation and alternative energy sources present viable alternatives. Fuel switching by industrial customers further intensifies competition.

Demand response programs incentivize reduced energy use. This creates a substitution effect. PSEG must adapt to maintain competitiveness.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Energy Efficiency | Reduced demand | $20B residential spending |

| On-site Generation | Grid independence | US residential solar growth |

| Renewables | Alternative power | ~14% US electricity |

Entrants Threaten

The energy industry demands substantial upfront capital for infrastructure. Constructing power plants, transmission lines, and distribution networks presents a significant financial hurdle. This high initial investment shields PSEG from easy market entry. In 2024, the average cost to build a new nuclear power plant exceeded $11 billion, highlighting this barrier.

Public Service Enterprise Group (PEG) faces regulatory hurdles as a significant barrier. The energy sector's strict regulations demand extensive permits, delaying market entry. Compliance costs, including those for environmental standards, are substantial. These regulatory demands make it difficult for new competitors to emerge. In 2024, the sector saw increased scrutiny, raising entry costs.

PSEG and other established utilities enjoy significant economies of scale. These advantages include lower per-unit costs in generation, transmission, and distribution. New entrants face high infrastructure costs, making it difficult to compete on price. In 2024, PSEG's operational efficiency, due to its scale, helped maintain competitive pricing.

Access to technology

New entrants in the energy sector face significant hurdles, especially concerning technology. Access to advanced energy technologies and specialized expertise is essential for effective competition. PSEG, with its established infrastructure and technological investments, holds a clear advantage. New companies often struggle with these high entry barriers. This advantage is further seen in 2024, with PSEG's capital expenditures reaching $3.2 billion, including significant tech upgrades.

- Technological Expertise: PSEG benefits from years of experience and a skilled workforce.

- Investment Advantage: PSEG's capital expenditures in 2024 are projected at $3.2 billion.

- Barriers to Entry: New entrants must overcome steep technological and financial challenges.

- Competitive Edge: PSEG's established tech base provides a strong competitive advantage.

Brand recognition and customer loyalty

PSEG benefits from strong brand recognition and customer loyalty, a significant barrier for new entrants. New companies face substantial marketing and customer acquisition costs to compete. PSEG's established reputation is a valuable asset, built over decades of service. This brand strength makes it difficult for new firms to gain market share.

- PSEG serves approximately 2.3 million electric customers and 1.9 million gas customers.

- Customer acquisition costs can be high in the energy sector.

- PSEG's brand is associated with reliability and trust.

- New entrants must overcome established customer relationships.

Threat of new entrants for PSEG is moderate due to high barriers. Significant capital investment, such as the 2024 average of $11B+ for new nuclear plants, restricts entry. Strict regulations also pose hurdles.

| Barrier | Description | 2024 Data |

|---|---|---|

| Capital Costs | High infrastructure investment. | $11B+ avg. nuclear plant cost |

| Regulations | Extensive permits and compliance. | Increased sector scrutiny |

| Economies of Scale | Lower per-unit costs. | PSEG's operational efficiency |

Porter's Five Forces Analysis Data Sources

Our analysis utilizes annual reports, regulatory filings, industry news, and market data from sources like S&P Capital IQ.