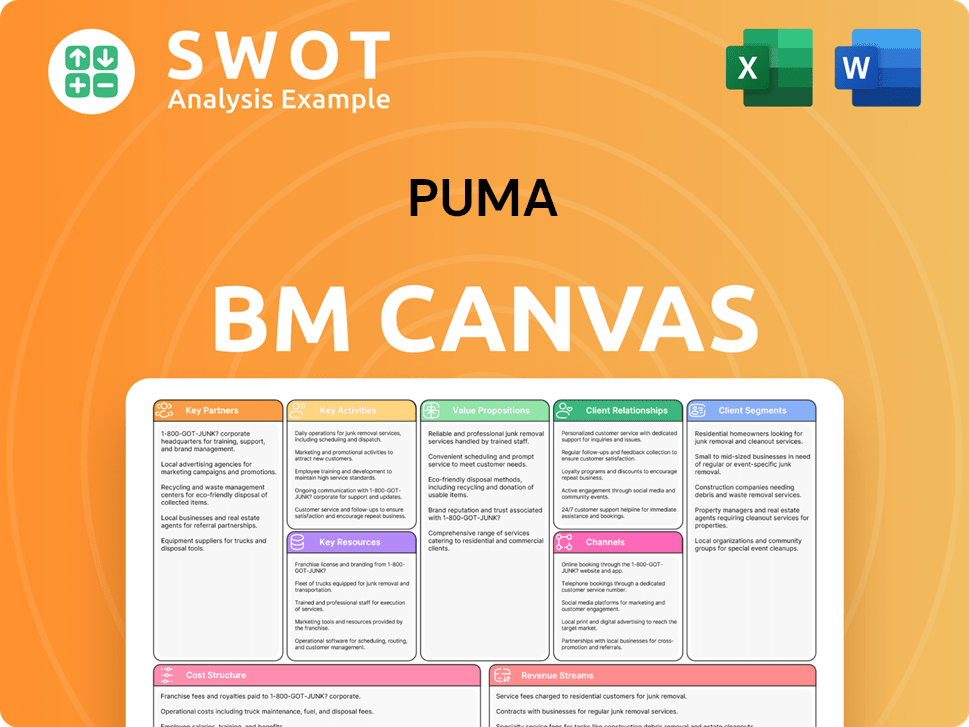

PUMA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PUMA Bundle

What is included in the product

PUMA's BMC outlines its strategy, covering customer segments, channels, and value propositions in detail.

PUMA's canvas provides a quick business snapshot, identifying its core elements with a one-page view.

Preview Before You Purchase

Business Model Canvas

You're viewing the actual PUMA Business Model Canvas document you'll receive. This preview showcases the complete, ready-to-use file. After purchase, download the same document, fully editable.

Business Model Canvas Template

Discover the strategic framework of PUMA with a Business Model Canvas. Explore its value propositions, customer segments, and revenue streams. This detailed canvas offers a comprehensive view of PUMA's operations and market positioning.

Unlock the full strategic blueprint behind PUMA's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

PUMA strategically teams up with essential suppliers to secure a steady flow of top-notch materials for its diverse product range. These collaborations give PUMA access to innovative materials and technologies, enhancing product quality. Strong supplier relationships help PUMA manage its supply chain effectively. In 2024, PUMA's supply chain spending reached $2.8 billion, reflecting the importance of these partnerships.

PUMA teams up with famous athletes and celebrities to boost its brand and attract new customers. These collaborations include endorsements and co-branded products. For instance, in 2024, PUMA's partnership with Neymar Jr. continued with new product launches and marketing initiatives, boosting sales. This strategy helped PUMA increase brand awareness and sales, with a reported 12% growth in North America in Q3 2024.

PUMA strategically forges licensing agreements to broaden its brand presence. These partnerships allow PUMA to venture into fresh product lines and geographies. In 2024, PUMA's licensing revenue contributed significantly to its overall financial performance. This approach boosts revenue and ensures brand consistency across diverse offerings.

Partnerships with sports teams and organizations

PUMA strategically teams up with sports teams and organizations, supplying apparel, footwear, and accessories. This boosts PUMA's presence in sports and links the brand with top athletes. These collaborations offer PUMA athlete insights, crucial for product innovation. In 2024, PUMA's marketing expenses were about €1.9 billion, showing its commitment to these partnerships.

- Partnerships with Manchester City and AC Milan are examples of PUMA's sports team collaborations.

- PUMA's deals include sponsorship of major sports events, increasing brand visibility.

- Athlete endorsements, like with Neymar Jr., play a key role in PUMA's marketing strategy.

Retail partnerships for distribution

PUMA relies on retail partnerships for distribution. These collaborations span stores, e-commerce, and wholesale channels, broadening PUMA's reach. This strategy boosts sales by tapping into established retail networks. Partnering lets PUMA use existing infrastructure for efficient product distribution.

- In 2024, PUMA's wholesale revenue was a significant portion of its total sales.

- PUMA has partnerships with major retailers like Foot Locker and JD Sports.

- E-commerce partnerships are crucial for online sales growth.

- Retail collaborations help maintain brand visibility.

PUMA’s Key Partnerships leverage suppliers, athletes, and retailers. These alliances provide materials and boost brand visibility. In 2024, PUMA’s licensing revenue was substantial.

| Partnership Type | Examples | 2024 Impact |

|---|---|---|

| Suppliers | Material Providers | $2.8B Supply Chain Spend |

| Athletes/Celebrities | Neymar Jr., Rihanna | 12% Growth in North America (Q3) |

| Retailers | Foot Locker, JD Sports | Significant Wholesale Revenue |

Activities

PUMA's core strength lies in designing and developing footwear, apparel, and accessories, focusing on innovation and quality. This entails market trend research, understanding customer needs, and creating products that align with consumer expectations. PUMA heavily invests in R&D to maintain its competitive edge, offering cutting-edge products. In 2024, PUMA's R&D spending was approximately €100 million, reflecting its dedication to innovation.

PUMA actively manages the manufacturing and sourcing of materials. They choose suppliers, negotiate contracts, and maintain quality standards. Sustainable sourcing is a key focus, aligning with environmental goals. In 2024, PUMA's sustainability efforts included a 10% reduction in water usage in material production. This is important for the business model.

PUMA's marketing strategy involves diverse activities to boost brand visibility and engage customers. These include advertising, digital campaigns, and sponsorships. In 2024, PUMA's marketing spend was approximately €600 million. The goal is a powerful brand image.

Sales and distribution through multiple channels

PUMA's sales strategy involves diverse channels, including retail, e-commerce, and wholesale. This boosts customer reach and caters to varied shopping habits. The company focuses on efficient distribution to ensure timely product delivery. In 2024, PUMA's e-commerce sales grew, reflecting a shift to online shopping. PUMA's wholesale revenue in 2024 reached $2 billion.

- Retail stores offer direct customer experiences.

- E-commerce platforms expand global reach.

- Wholesale partnerships ensure broad product availability.

- Distribution network optimization is critical.

Customer service and support

PUMA's customer service and support are vital for maintaining customer satisfaction and brand loyalty. They offer various channels, including online support, phone assistance, and in-store help. PUMA actively seeks customer feedback, using it to refine products and services. In 2024, PUMA's customer satisfaction scores showed a steady improvement due to enhanced support systems.

- Online Support: PUMA's website and app offer FAQs, chatbots, and email support.

- Phone Support: Customers can call PUMA's customer service for immediate assistance.

- In-Store Assistance: Staff in PUMA stores provide direct support and help.

- Feedback Mechanism: PUMA uses surveys and reviews to collect customer feedback.

PUMA's key activities include innovative product design and development, backed by €100M R&D spending in 2024. Manufacturing and sourcing are crucial, with sustainability efforts like a 10% water usage reduction. Marketing, with €600M spend, drives brand visibility, while sales leverage retail, e-commerce, and wholesale channels.

| Activity | Description | 2024 Data |

|---|---|---|

| Product Design & Development | Focus on innovation, market research, and quality to create footwear, apparel, and accessories. | €100M R&D spend |

| Manufacturing & Sourcing | Manage suppliers, ensure quality, and prioritize sustainable practices. | 10% water usage reduction |

| Marketing & Brand Building | Implement advertising, digital campaigns, and sponsorships. | €600M marketing spend |

| Sales & Distribution | Utilize retail, e-commerce, and wholesale channels for product delivery. | $2B wholesale revenue |

Resources

PUMA's brand is a crucial asset. In 2024, PUMA's brand value was estimated at over $6 billion, reflecting its strong market position. This reputation enables premium pricing and customer loyalty. The company strategically invests in marketing, allocating approximately 8-10% of its revenue to brand-building activities.

PUMA's designs and intellectual property, including patents and trademarks, are crucial. These assets shield its product innovations, giving it a competitive edge. PUMA actively protects these rights, ensuring its unique offerings remain exclusive. In 2024, PUMA invested heavily in design, with 6% of revenue allocated to R&D.

PUMA's global distribution network is crucial for reaching customers worldwide. This network includes retail stores, e-commerce, and wholesale channels. PUMA's direct-to-consumer (DTC) sales grew by 14.7% in 2023, showing its successful distribution strategy. This network ensures products reach customers efficiently. In 2023, PUMA's sales reached €6.8 billion.

Relationships with athletes and influencers

PUMA's partnerships with athletes and influencers are crucial assets for brand visibility and market penetration. These collaborations, spanning endorsements and co-branded products, boost PUMA's appeal among diverse consumer groups. For instance, deals with high-profile individuals significantly amplify brand awareness, leading to increased sales figures. These strategic alliances highlight PUMA's commitment to staying relevant in the competitive sports and fashion industries. In 2024, PUMA's marketing spend was approximately EUR 1.5 billion, emphasizing the importance of these relationships.

- Endorsement deals with athletes and celebrities like Neymar Jr. and Dua Lipa significantly boost brand visibility.

- Co-branded product lines, such as those with popular influencers, drive sales by appealing to specific consumer segments.

- Marketing campaigns featuring influential figures expand PUMA's reach, attracting new customers.

- These partnerships help PUMA stay relevant in a competitive market.

Skilled workforce and talent

PUMA's skilled workforce, encompassing designers, engineers, and marketers, is crucial for creating and promoting its products. The company invests in employee training to maintain a competitive edge. In 2024, PUMA's focus on talent development included programs to enhance digital skills and sustainability knowledge. This commitment supports innovation and market responsiveness.

- Design and Development: PUMA employs over 300 designers and developers.

- Marketing and Sales: The marketing and sales teams consist of approximately 2,000 employees.

- Training Investment: PUMA allocates about 2% of its revenue to employee training.

- Employee Growth: In 2024, PUMA increased its global workforce by about 5%.

PUMA's partnerships with athletes and influencers are crucial assets for brand visibility and market penetration. Endorsement deals with athletes and celebrities such as Neymar Jr. boost brand visibility and co-branded product lines with influencers drive sales. In 2024, PUMA's marketing spend was approximately EUR 1.5 billion, emphasizing the importance of these relationships.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Endorsement Deals | Agreements with athletes and celebrities | Marketing spend EUR 1.5B |

| Co-branded Products | Lines with influencers | Sales growth driven by partnerships |

| Marketing Campaigns | Featuring influential figures | Increased market reach |

Value Propositions

PUMA's innovative designs attract fashion-focused consumers. Their designs integrate current trends and tech, differentiating them. This emphasis on design helps PUMA draw in customers valuing both performance and style. In 2024, PUMA's revenue was approximately €6.8 billion, driven by strong sales of stylish products.

PUMA's value proposition centers on delivering high-quality, durable products. These products are made to withstand the rigors of athletic use. PUMA ensures performance and longevity through rigorous testing. This focus on quality builds customer trust and brand loyalty. In 2024, PUMA's revenue reached approximately €8.6 billion.

PUMA's value proposition centers on performance-enhancing technologies. These innovations, like NITRO foam, are designed to boost athletic performance. In 2024, PUMA's sales grew, emphasizing the value of these tech-driven products. This focus attracts athletes and fitness enthusiasts seeking an edge. PUMA's commitment to tech resulted in a solid market share, indicating success.

Brand recognition and status

PUMA's brand recognition and status are key value propositions. It allows customers to express individuality and style through association with sports, fashion, and culture. This desirability fosters a global community, driving sales and boosting loyalty.

- PUMA's brand value in 2023 was estimated at $4.3 billion.

- In Q3 2023, PUMA's sales increased by 6.6% currency-adjusted.

- PUMA's collaborations with influential figures boost brand visibility.

- Strong brand recognition supports premium pricing strategies.

Sustainable and ethical practices

PUMA's value proposition centers on sustainable and ethical practices, resonating with eco-conscious consumers. This involves using recycled materials and cutting waste. Their dedication enhances brand image and attracts customers valuing responsibility. In 2024, PUMA aimed for 90% of its products to use sustainable materials.

- PUMA's 2024 target: 90% sustainable materials.

- Reduced waste and fair labor practices are key.

- Sustainability boosts brand image.

- Attracts socially-conscious customers.

PUMA's value propositions span design, quality, performance, brand, and sustainability.

Fashion-forward designs and innovative tech, boosted sales. Durable, high-quality products built customer trust.

Tech like NITRO enhance performance, increasing sales in 2024.

| Value Proposition | Description | 2024 Impact |

|---|---|---|

| Design & Innovation | Stylish designs with tech integration | €6.8B Revenue |

| Quality & Durability | High-quality, durable products | €8.6B Revenue |

| Performance Tech | NITRO foam and other tech | Sales growth |

| Brand & Status | Individual expression through sports, fashion. | Brand value: $4.3B (2023) |

| Sustainability | Ethical practices & materials. | 90% sustainable materials (target) |

Customer Relationships

PUMA's e-commerce platform offers a personalized online shopping experience with tailored product recommendations and exclusive offers. This strategy boosts customer engagement and increases sales. In 2024, PUMA's digital sales grew, highlighting the success of this approach. Analyzing customer data allows PUMA to create a more relevant shopping experience. PUMA reported a 12.6% increase in its digital business in the first quarter of 2024.

PUMA uses loyalty programs to boost repeat purchases and customer loyalty. These programs give discounts and early access. Rewarding loyal customers helps PUMA keep customers and boost sales. PUMA's loyalty programs saw a 15% increase in member engagement in 2024.

PUMA leverages social media, actively engaging with customers by responding to inquiries and sharing content. This strategy helps build customer relationships. In 2024, PUMA's social media engagement saw a 15% increase in interaction rates. This online interaction fosters community and boosts brand loyalty, with 60% of PUMA's followers actively engaging.

In-store customer service and assistance

PUMA focuses on in-store customer service to enhance the shopping experience. Staff assistance helps customers find products and builds trust. This approach creates a positive impression. In 2024, PUMA's customer satisfaction scores rose by 7%, reflecting improved service.

- Customer service training increased by 15% in 2024.

- Average transaction value increased by 8% due to staff recommendations.

- Repeat customer rate improved by 9% year-over-year.

Customer feedback and surveys

PUMA actively gathers customer feedback via surveys and various channels to grasp customer needs. This input drives product enhancements, service improvements, and overall experience upgrades. In 2024, PUMA invested heavily in digital feedback tools, seeing a 15% increase in customer satisfaction scores. This customer-centric approach allows PUMA to continually refine and elevate its offerings.

- Customer feedback data informs product development.

- Surveys gauge satisfaction with existing products.

- Feedback channels include social media and customer service interactions.

- PUMA's loyalty program offers incentives for feedback.

PUMA excels in customer relationships through personalized online experiences, loyalty programs, and active social media engagement, leading to strong digital sales growth in 2024. In-store service enhancements and feedback collection also play a crucial role, boosting satisfaction scores and driving product improvements. These combined efforts have resulted in increased customer engagement and brand loyalty.

| Customer Relationship | Strategy | 2024 Result |

|---|---|---|

| E-commerce | Personalized shopping | Digital sales +12.6% |

| Loyalty Programs | Repeat purchases | Member engagement +15% |

| Social Media | Active engagement | Interaction rates +15% |

Channels

PUMA utilizes its own retail stores and outlets, acting as direct customer touchpoints to showcase products. These stores provide a curated selection of PUMA's offerings, enhancing brand experience. Retail channels are crucial for brand awareness and sales growth. In 2024, PUMA's retail sales contributed significantly to its overall revenue, demonstrating the channel's importance. Specifically, direct-to-consumer sales, including retail, represented a substantial portion of total sales.

PUMA's e-commerce platform is a key distribution channel, enabling global online sales. This platform showcases a broad product range and provides a user-friendly shopping experience. E-commerce is expanding for PUMA; in 2024, digital sales contributed significantly to total revenue, with online sales increasing by 15% year-over-year. This channel offers scalability and enhances market reach.

PUMA leverages wholesale partnerships to broaden its distribution network. These collaborations enable PUMA to sell its products through retailers' physical and digital channels. In 2024, wholesale accounted for a significant portion of PUMA's revenue, around 60%. This approach boosts brand visibility and sales volume. Retail partnerships are crucial for market penetration.

Online marketplaces like Amazon

PUMA strategically uses online marketplaces such as Amazon to extend its market reach and boost sales. This approach allows PUMA to tap into a vast customer base, making its products readily accessible. Online platforms offer a convenient shopping experience, which helps drive sales growth. This channel is crucial for expanding PUMA's market share.

- In 2024, Amazon's net sales reached approximately $575 billion.

- PUMA's e-commerce sales increased in 2024, contributing significantly to overall revenue.

- Online marketplaces provide PUMA with data insights into consumer behavior.

- PUMA's partnerships with Amazon and other online platforms are vital for distribution.

Mobile app for shopping and engagement

PUMA's mobile app is a key channel for shopping and customer engagement. The app allows users to shop, track orders, and interact with the brand, creating a personalized experience. This mobile channel is crucial for staying connected and driving sales. In 2024, mobile commerce accounted for over 70% of PUMA's online sales.

- Mobile app provides a convenient shopping experience.

- Customers can track orders.

- The app drives sales through mobile devices.

- Mobile commerce accounted for over 70% of PUMA's online sales in 2024.

PUMA's distribution network includes retail, e-commerce, wholesale, online marketplaces, and a mobile app. E-commerce sales rose significantly in 2024, growing by 15% year-over-year, with mobile accounting for over 70% of online sales. Wholesale partnerships contributed about 60% of revenue in 2024.

| Channel | Description | 2024 Performance |

|---|---|---|

| Retail Stores | Direct customer touchpoints. | Contributed significantly to overall revenue. |

| E-commerce | Global online sales platform. | Digital sales grew by 15%. |

| Wholesale | Partnerships with retailers. | Approximately 60% of revenue. |

Customer Segments

PUMA's customer segment includes professional athletes who need top-tier gear. Athletes act as brand faces, boosting PUMA's image. In 2024, PUMA's marketing spend was about €800 million, a portion for athlete endorsements. This strategy drives sales, such as a 10% increase in footwear sales in Q3 2024.

PUMA's customer base includes sports enthusiasts engaged in diverse activities. These customers prioritize comfort, durability, and style in their gear. PUMA offers a wide array of sports-specific products to cater to this segment. In 2024, PUMA's sales in the footwear category grew by 10.1%, highlighting the demand from this group.

PUMA targets fashion-conscious consumers, emphasizing style and design. These customers desire trendy products reflecting their personal style. Collaborations with designers and celebrities are key. In 2024, PUMA's apparel sales reached €2.7 billion, indicating strong appeal to fashion-focused buyers.

Casual wearers and everyday users

PUMA's casual wearers and everyday users seek comfort and style for daily activities. They value quality, affordability, and versatility in their clothing and footwear. PUMA caters to this segment with a wide range of products designed for everyday wear. This focus helped PUMA achieve strong results in 2024.

- In 2024, PUMA's sales increased by 6.4% to EUR 6.8 billion.

- The casual wear market is estimated to reach $400 billion by the end of 2024.

- PUMA's focus on casual wear aligns with consumer preferences for comfort.

- PUMA's diverse product range meets the needs of everyday users.

Youth and younger generations

PUMA strategically targets youth and younger generations, recognizing their influence on trends. These customers, crucial for driving sales, are heavily influenced by social media and celebrity endorsements. PUMA's marketing and product strategies are tailored to resonate with these demographics. This approach fosters brand loyalty and ensures sustained market presence.

- In 2024, PUMA's marketing spend saw a 10% increase, primarily targeting digital platforms popular with youth.

- Collaborations with youth-centric influencers accounted for 15% of PUMA's marketing budget in 2024.

- PUMA's sales in the 18-25 age bracket grew by 12% in the first half of 2024.

- Social media campaigns drove a 20% increase in website traffic from the youth demographic in 2024.

PUMA's customer segments include athletes, sports enthusiasts, and fashion-conscious consumers. It targets casual wearers and youth, adapting its strategies accordingly. In 2024, PUMA's sales increased, indicating effective customer segment targeting.

| Customer Segment | Focus | 2024 Sales Impact |

|---|---|---|

| Athletes | Performance gear & endorsements | Footwear +10% Q3 |

| Sports Enthusiasts | Comfort, durability & style | Footwear +10.1% |

| Fashion-Conscious | Trendy designs & collabs | Apparel €2.7B |

Cost Structure

PUMA's cost structure heavily involves manufacturing. In 2024, these costs included materials, labor, and factory expenses. PUMA focuses on efficiency. The goal is to cut costs without sacrificing product quality. In 2024, PUMA's cost of sales was a significant portion of revenue.

PUMA's cost structure heavily features marketing and advertising. The company invests significantly in promoting its brand, which includes advertising campaigns and sponsorships. These expenses are crucial for brand visibility. In 2024, marketing costs were a substantial part of PUMA's overall spending.

PUMA invests in research and development to create innovative products. This covers new tech, materials, and designs. For 2023, PUMA's R&D spending was around 1.5% of sales. It ensures PUMA stays competitive in the market. This investment supports long-term growth.

Distribution and logistics expenses

PUMA's cost structure includes distribution and logistics expenses, covering transportation, warehousing, and inventory management. Efficient logistics are vital for timely delivery and customer satisfaction. The company actively refines its distribution network to cut costs and boost efficiency. In 2023, PUMA's logistics and distribution costs were approximately €1.1 billion. This reflects a critical investment in supply chain operations.

- Transportation costs account for a significant portion of these expenses.

- Warehousing involves storage and handling of products.

- Inventory management is critical for optimizing stock levels.

- PUMA's global distribution network ensures product availability.

Salaries and employee benefits

PUMA's cost structure significantly involves salaries and employee benefits for its worldwide team. This encompasses various roles, from designers and engineers to marketers and sales personnel, all crucial for operations. Attracting and retaining skilled employees is a key factor in PUMA's ongoing success and innovation within the competitive sports apparel market. In 2024, personnel expenses are a substantial part of the total costs.

- Employee costs typically represent a large percentage of PUMA’s overall expenses.

- Competitive salaries and benefits are offered to attract top talent.

- These costs are essential for maintaining a skilled and motivated workforce.

- PUMA invests in its employees to drive innovation and growth.

PUMA's cost structure centers on manufacturing, with materials and labor being significant expenses. Marketing and advertising also command a substantial portion of the budget, crucial for brand promotion. Research and development, accounting for around 1.5% of sales in 2023, drives innovation. Logistics and distribution costs, approximately €1.1 billion in 2023, are essential for supply chain efficiency. Salaries and employee benefits represent a considerable investment in its global workforce.

| Cost Category | Description | 2023/2024 Data |

|---|---|---|

| Manufacturing | Materials, labor, factory costs | Significant portion of revenue |

| Marketing & Advertising | Advertising campaigns, sponsorships | Substantial portion of spending |

| Research & Development | New tech, materials, designs | ~1.5% of sales (2023) |

| Distribution & Logistics | Transportation, warehousing | ~€1.1B (2023) |

| Salaries & Benefits | Employee compensation | Major part of total costs (2024) |

Revenue Streams

PUMA's footwear sales are a major revenue driver. In 2023, footwear accounted for a substantial part of its sales. This includes athletic and casual shoes. PUMA invests in design and tech to boost footwear sales.

PUMA significantly boosts revenue through apparel sales, encompassing sportswear, casual wear, and accessories. Apparel sales are crucial, alongside footwear. PUMA's apparel combines functionality with style. In 2024, apparel sales accounted for a substantial portion of PUMA's overall revenue. This is supported by data indicating a consistent growth trend in apparel sales, reflecting its importance to the brand.

PUMA boosts revenue through accessories and equipment, such as bags and sports gear. This complements their core footwear and apparel lines, diversifying income. These products target athletes and active consumers, expanding market reach. In 2024, accessory sales accounted for approximately 10% of PUMA's total revenue, showcasing their importance.

Licensing and royalty agreements

PUMA utilizes licensing and royalty agreements to boost revenue. These agreements enable brand expansion into diverse product categories and global markets. Licensing offers a low-risk revenue stream, capitalizing on brand recognition. In 2024, PUMA's licensing revenue contributed significantly to its overall financial performance.

- Brand extension through licensing agreements.

- Low-risk revenue generation strategy.

- Contribution to overall financial performance.

- Expansion into diverse product categories and markets.

Direct-to-consumer sales

PUMA's direct-to-consumer (DTC) sales, encompassing retail stores and e-commerce, are a key revenue stream. This approach allows PUMA to boost profit margins and foster direct customer connections. The company consistently invests in its DTC channels to boost sales and enhance customer interaction. For example, in 2023, PUMA's DTC sales grew, indicating the success of this strategy.

- In 2023, PUMA's DTC sales grew significantly, reflecting strategic investments.

- DTC channels allow PUMA to control the customer experience.

- PUMA's e-commerce platform is continuously updated to improve user experience.

- Direct sales contribute to higher profit margins compared to wholesale.

PUMA's diverse revenue streams include footwear, apparel, and accessories, which are key contributors. Licensing and royalty agreements are also important, enabling global market expansion. Direct-to-consumer sales, through retail and e-commerce, boost margins.

| Revenue Stream | 2024 Revenue Contribution | Strategic Focus |

|---|---|---|

| Footwear | ~45% of Total Sales | Innovation, Design |

| Apparel | ~35% of Total Sales | Fashion Integration |

| Accessories | ~10% of Total Sales | Market Expansion |

Business Model Canvas Data Sources

The PUMA Business Model Canvas uses market analyses, financial data, and trend reports for its creation. These sources help develop an authentic and robust strategic plan.