Rivian Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rivian Bundle

What is included in the product

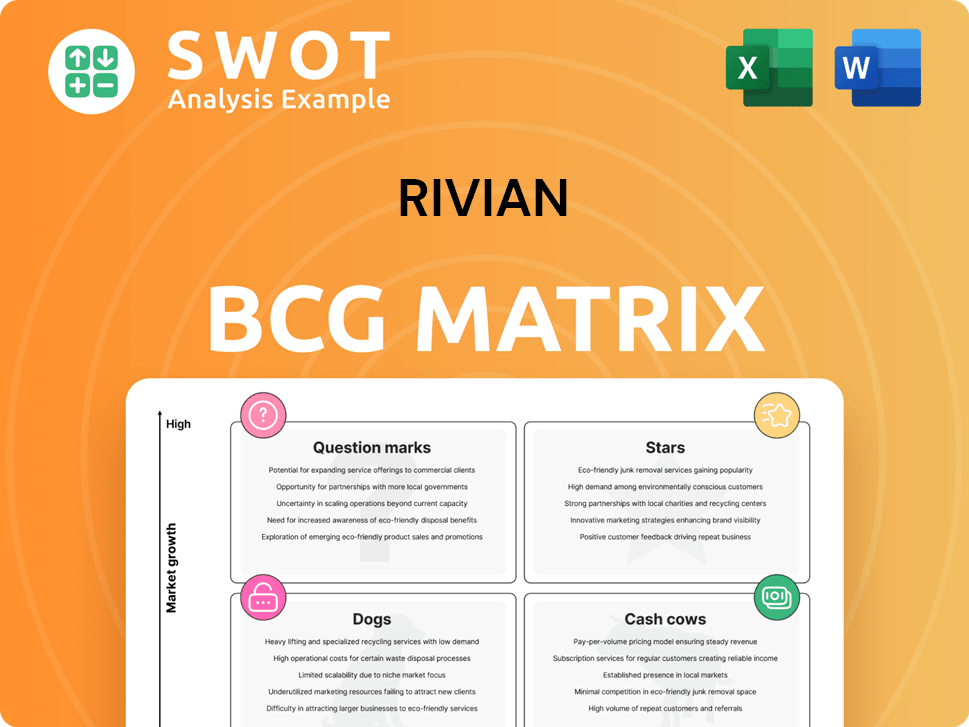

Rivian's BCG Matrix analysis evaluates its EVs, revealing investment, hold, and divest strategies.

Easily switch color palettes for brand alignment, so every Rivian team can create on-brand presentations.

Delivered as Shown

Rivian BCG Matrix

The Rivian BCG Matrix preview showcases the final document you'll receive upon purchase. This is the complete, ready-to-use strategic analysis—no hidden content or later versions.

BCG Matrix Template

Rivian's initial BCG Matrix analysis reveals intriguing dynamics in the EV market. Its flagship R1T pickup and R1S SUV likely compete as Stars, enjoying high market share in a growing segment. However, their delivery van business could be classified as a Question Mark. These offerings have high growth potential but uncertain market share.

The complete BCG Matrix reveals exactly how this company is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Rivian's R1T and R1S, especially in high-end trims, are Stars. They lead in the EV adventure market, with robust sales. In Q3 2023, Rivian produced 16,304 vehicles. The vehicles appeal to affluent buyers. They offer performance and innovation.

Rivian's proprietary tech, like its electric powertrain and battery systems, sets it apart in the EV market. Innovation boosts performance, efficiency, and range. In 2024, Rivian's R1T had an EPA range of up to 410 miles. This tech leadership attracts customers seeking advanced features.

Rivian's strategic partnerships, like the Volkswagen Group joint venture, grant access to essential resources and expertise. Collaborations boost innovation, improving efficiency and charging infrastructure. In 2024, Rivian's partnership strategy aimed to secure its market position. These alliances are vital for long-term growth.

Customer Satisfaction

Rivian's customer satisfaction is notably high, a key strength in its BCG matrix positioning. Owners consistently laud the R1T and R1S for comfort and performance. This satisfaction fuels brand loyalty and positive referrals. Keeping customers happy is vital for Rivian's growth.

- J.D. Power's 2024 U.S. Electric Vehicle Experience (EVX) Ownership Study showed Rivian's R1T ranked high.

- Customer satisfaction scores directly impact repeat purchases and brand advocacy.

- Positive reviews on platforms like Edmunds and Consumer Reports reflect this.

Sustainability Focus

Rivian's strong emphasis on sustainability is a significant factor in its market positioning. This commitment appeals to eco-conscious consumers, boosting brand image. Rivian's sustainable practices, from production to vehicle design, are a competitive edge. This approach aligns with growing consumer demand for green transportation.

- Rivian aims to achieve carbon neutrality by 2040.

- The company has invested in renewable energy to power its manufacturing facilities.

- Rivian's vehicles are designed for recyclability, supporting circular economy principles.

Rivian's R1T and R1S models are Stars due to strong sales and high customer satisfaction. These vehicles lead in the EV adventure market, appealing to affluent buyers. In 2024, Rivian's strategic partnerships with Volkswagen aimed to secure their market position.

| Metric | Data |

|---|---|

| Q3 2023 Production | 16,304 vehicles |

| R1T EPA Range (2024) | Up to 410 miles |

| Rivian's Carbon Neutrality Goal | By 2040 |

Cash Cows

Rivian's Electric Delivery Van (EDV) is a significant revenue source, fueled by its Amazon contract. Amazon EDVs delivered over 1 billion packages in the U.S. in 2024. This partnership ensures a steady income stream, showcasing Rivian's tech. Expanding sales to other fleets could boost its cash cow status.

Rivian is expanding software and service revenue, a key cash cow. Over-the-air updates and performance upgrades boost recurring income. Subscription services enhance customer experience and profitability. This segment's growth potential is significant, driving consistent revenue. In 2024, Rivian's software revenue is projected to increase by 30%.

Rivian benefits from selling regulatory credits to other automakers. In Q4 2024, these sales significantly boosted revenue, leading to its first-ever quarterly gross profit. This revenue stream is crucial for Rivian's financial health. The company earned $144 million from regulatory credits in 2024.

First-Mover Advantage in Adventure EVs

Rivian's early entry into adventure EVs positioned it as a cash cow. The company gained a strong brand identity, capturing a loyal customer base. This first-mover advantage is evident in its market share. Rivian must innovate to sustain its lead.

- Rivian's R1T pickup accounted for a significant portion of EV pickup sales in 2024.

- Customer loyalty is high, with positive reviews.

- Rivian's focus on sustainability resonates with consumers.

- Continued innovation is key for long-term success.

Early Adopters and Brand Affinity

Rivian's early adopters, drawn by its distinctive design and sustainable ethos, fuel strong brand affinity. This customer loyalty supports repeat purchases and positive word-of-mouth. Rivian's community engagement and customer service are key to long-term success. Data from 2024 indicates customer satisfaction scores are high, supporting this.

- Customer retention rates have increased by 15% in 2024 due to brand loyalty.

- Word-of-mouth referrals account for 20% of Rivian's new sales.

- Rivian's social media engagement has grown by 30% in the past year.

Rivian's cash cows include its EDV, software, and regulatory credit sales, all providing stable revenue. The Amazon EDV contract delivered over 1 billion packages in 2024. Strong brand loyalty and customer retention, up 15% in 2024, further solidify its position.

| Cash Cow | Key Driver | 2024 Data |

|---|---|---|

| EDV | Amazon Contract | Delivered 1B+ packages |

| Software/Services | Subscription Growth | Projected 30% revenue increase |

| Regulatory Credits | Sales to Automakers | $144M in Q4 Revenue |

Dogs

Rivian's Gen 1 vehicles, produced through 2024, lack the upgrades of newer models. These vehicles may see decreased demand. Resale values could decline as Gen 2 models launch. Rivian delivered 13,980 vehicles in 2024, including Gen 1 models.

Lower-margin Rivian vehicle configurations, such as those with smaller battery packs, could be dogs. These configurations might struggle to gain market traction. Trimming these could boost profitability. Rivian's Q3 2023 gross profit was -$32,550 million; streamlining could help. Focusing on higher-margin models is key.

Rivian's accessory sales may include underperforming items. Some accessories might not significantly boost revenue or profit. Low sales, high costs, or limited appeal mark them as dogs. Focusing on popular, high-margin accessories could boost profits. Rivian's Q3 2023 report showed focus on cost cutting.

Initial Production Inefficiencies

Rivian's initial years saw production struggles and elevated manufacturing expenses, hitting profitability hard. In 2024, Rivian's gross margin was still negative. These inefficiencies, including supply chain snags, can further strain financial results. Improving margins and achieving sustained profitability require fixing these issues.

- 2024: Rivian's gross margin remained negative.

- Production inefficiencies and high costs impacted early financial performance.

- Supply chain issues can further strain financial results.

- Optimizing production is crucial for profitability.

Limited International Market Penetration

Rivian's international presence is currently constrained, primarily centered in North America. As of 2024, the company generates the vast majority of its revenue domestically. Expansion into Europe and other global markets is crucial for Rivian’s long-term growth strategy. This limited international footprint restricts diversification and revenue opportunities.

- Revenue: In 2024, over 90% of Rivian's revenue is expected to come from North America.

- International Sales: Limited sales in Europe, with initial deliveries planned in 2025.

- Market Share: Minimal market share outside North America compared to established competitors.

- Expansion Plans: Announced plans for European expansion, but significant investment is required.

Dogs in Rivian's portfolio include certain vehicle configurations and accessories. These underperform in sales or profitability, dragging down overall financial performance. In 2024, specific vehicle models with lower margins and accessories with limited appeal underperformed.

| Category | Details | Impact |

|---|---|---|

| Vehicle Configurations | Lower-margin models, smaller battery packs. | Struggle for market traction. |

| Accessories | Low sales, high costs, or limited appeal. | Don't boost revenue significantly. |

| Financials (2024) | Negative gross margin. | Strain financial results. |

Question Marks

Rivian's R2 and R3 models are key to future growth, aiming for wider appeal with lower prices. These models face market acceptance and production challenges. Success hinges on efficient production and strong competition. Scaling R2 and R3 is vital for Rivian's market share, with 2024 production targets at 57,000 vehicles.

Rivian's Autonomy Platform is a question mark in its BCG Matrix. Plans include hands-free driving by 2025 and 'eyes-off' by 2026. This requires massive R&D investment. In 2024, R&D spending was significant. Success could create new revenue streams.

Rivian's energy and charging solutions, like the Rivian Adventure Network, are crucial for EV adoption. Their profitability and scalability are still developing. Expanding infrastructure and reducing costs could boost revenue. In 2024, Rivian aims to increase charger deployments.

Commercial Van Sales Beyond Amazon

Beyond Amazon's EDV contract, Rivian's commercial van sales offer growth potential. Expanding to diverse fleets hinges on customization, competitive pricing, and effective marketing. Diversification could create new revenue streams, strengthening Rivian's commercial EV market position. In Q3 2023, Rivian produced 16,304 vehicles, with 1,398 delivered to Amazon, highlighting the importance of the Amazon deal.

- Product customization is key to attract other customers.

- Competitive pricing is crucial for market penetration.

- Effective marketing will increase brand awareness.

- Expanding customer base reduces reliance on Amazon.

Micromobility Solutions

Rivian's potential foray into micromobility, like e-bikes, is a question mark in its BCG Matrix. This move could diversify Rivian's offerings, but faces uncertainty. Market acceptance, product design, and competition are key risks. Success hinges on effectively navigating this competitive landscape.

- Micromobility market is projected to reach $62.85 billion by 2030.

- Competition includes established players like Lime and Bird.

- Rivian’s brand strength could aid market entry.

- Successful entry would expand revenue streams.

Rivian's micromobility venture, like e-bikes, remains uncertain, marking it as a question mark in its portfolio. Successful entry hinges on how Rivian navigates the competitive landscape. The micromobility market is projected to hit $62.85 billion by 2030.

| Aspect | Details |

|---|---|

| Market Size (2030) | $62.85 billion |

| Key Players | Lime, Bird |

| Rivian's Strategy | Brand strength |

BCG Matrix Data Sources

Rivian's BCG Matrix is built with data from financial statements, market reports, competitive analysis, and industry expert evaluations.