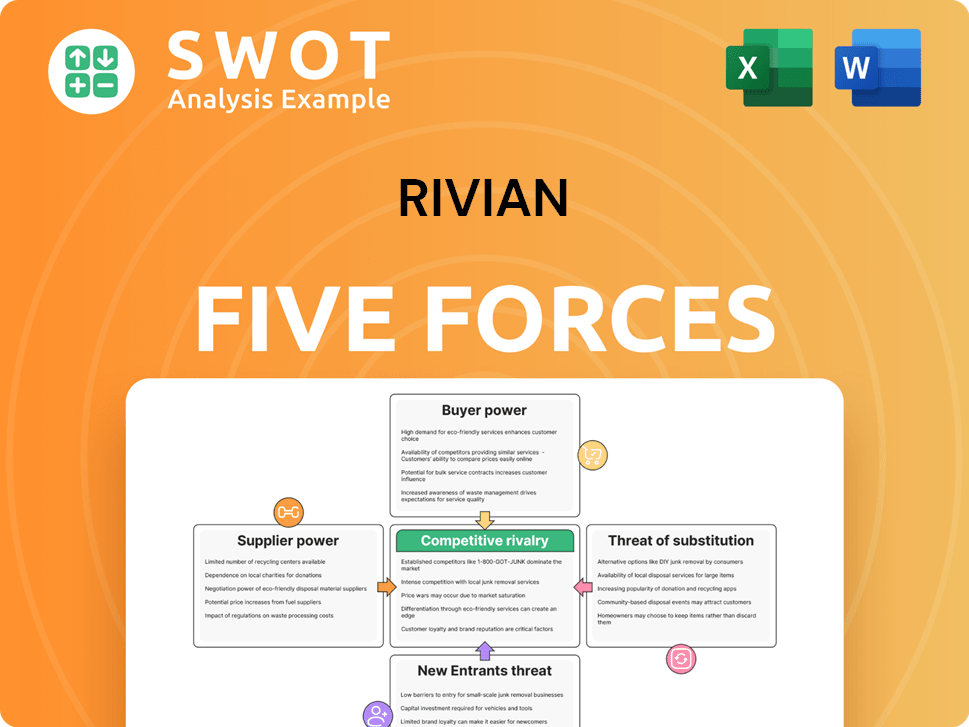

Rivian Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rivian Bundle

What is included in the product

Identifies disruptive forces, emerging threats, and substitutes that challenge market share.

Customize pressure levels to highlight threats and opportunities facing Rivian.

Preview Before You Purchase

Rivian Porter's Five Forces Analysis

This is the complete Rivian Porter's Five Forces analysis document. The preview mirrors the full version you’ll download immediately upon purchase, no alterations. It offers a thorough examination of the competitive landscape. You'll receive the exact analysis you're currently viewing. The format and information remain consistent.

Porter's Five Forces Analysis Template

Rivian's success hinges on navigating a complex EV landscape. The threat of new entrants, like legacy automakers, is significant, fueled by substantial investment. Buyer power is moderate, as consumer choice increases. Supplier power, particularly for batteries, poses a challenge. Substitutes, namely internal combustion engine vehicles, remain a factor. Competitive rivalry is high, due to established players and startups.

Ready to move beyond the basics? Get a full strategic breakdown of Rivian’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Rivian faces considerable supplier power, especially for EV-specific parts. Battery, electric motor, and electronics suppliers wield influence due to their specialized tech and high capital needs. Rivian's dependence on these suppliers increases risk. In 2024, battery costs alone represent a significant portion of EV manufacturing expenses, impacting Rivian's profitability. This dependence is a key factor in the company's cost structure.

Rivian faces supplier power challenges due to raw material price volatility. Lithium, cobalt, and nickel price fluctuations directly impact battery production costs, potentially squeezing profit margins. Suppliers of these critical materials can exert significant pricing pressure. For instance, lithium prices saw substantial swings in 2024. Securing long-term contracts and diversifying suppliers are crucial strategies to mitigate these risks.

Rivian faces significant supplier power due to the limited number of battery providers. In 2024, companies like CATL and LG Chem dominate the EV battery market. This gives suppliers leverage to set prices. High battery costs, representing a large portion of EV expenses, directly affect Rivian's profitability. To mitigate this, Rivian is investing in its own battery production, aiming for cost control.

Supplier Power 4

Supplier power is a significant factor for Rivian, especially due to concentration in key technologies. Some suppliers hold patents or proprietary tech, like battery management systems. This gives them an edge, increasing their bargaining power over Rivian. To counter this, Rivian might need to invest heavily in its own research and development.

- Battery costs accounted for a significant portion of Rivian's manufacturing expenses in 2024.

- The company might invest heavily in R&D, with figures potentially reaching hundreds of millions of dollars annually.

- Rivian's ability to secure favorable supply deals directly impacts its profitability.

- Alternative technology development is crucial for reducing dependency on single suppliers.

Supplier Power 5

Supplier power significantly impacts Rivian, especially concerning labor costs. Labor shortages and wage increases in manufacturing can hike supplier prices, affecting Rivian's production costs. Suppliers in regions with lower labor costs may offer Rivian a competitive edge. Automating manufacturing can also help mitigate the impact of labor costs.

- In 2024, the manufacturing sector saw labor costs rise by 4.2%, impacting supplier pricing.

- Rivian's reliance on specific battery suppliers, like those in China, exposes it to geopolitical risks affecting supply chains.

- Automation investments in the automotive industry increased by 15% in 2024, aiming to reduce labor dependency.

- The average hourly wage for manufacturing workers is $28.61 as of Q4 2024, influencing supplier costs.

Rivian's supplier power is influenced by concentrated EV component markets and material costs. Battery suppliers hold significant leverage due to specialized tech and limited competition, impacting profitability. Raw material price swings, like those seen with lithium in 2024, further challenge Rivian. Mitigating supplier power requires long-term contracts and diversifying suppliers.

| Aspect | Impact on Rivian | Data (2024) |

|---|---|---|

| Battery Costs | High impact on profitability | Batteries: up to 50% of EV cost |

| Raw Materials | Price Volatility | Lithium prices: fluctuated ±30% |

| Supplier Concentration | Limited Choices | Top 3 battery makers: 70% market share |

Customers Bargaining Power

Buyer power is significant in the EV market. Customers are price-sensitive due to higher EV costs; in 2024, the average EV price was ~$53,000. Rivian must justify its pricing. Financing and incentives are key; Rivian offered up to $7,500 federal tax credit in 2024.

Customers hold significant power in the EV market, with numerous choices available. The competition is intensifying, featuring diverse models from various manufacturers. Because switching costs are low, customers can easily choose alternatives if Rivian's offerings fail to satisfy. In 2024, EV sales increased, yet Rivian faces challenges in a crowded field. Differentiating through unique features and brand is key to success.

Customer bargaining power is shaped by government incentives. In 2024, federal tax credits offered up to $7,500 for new EVs, influencing buyer decisions. Changes to these incentives directly affect demand; for example, California's rebates also impact Rivian. Rivian should lobby for favorable policies to support EV adoption, which are crucial for maintaining sales.

Buyer Power 4

Buyer power in Rivian's market is influenced by brand perception. Customer reviews heavily impact purchasing decisions, especially in the luxury EV market. Negative reviews can significantly deter potential buyers and hurt sales. A strong brand reputation through quality and service is crucial for Rivian's success.

- Rivian's 2024 sales figures are crucial for assessing buyer power.

- Positive customer reviews directly correlate with higher sales.

- Brand perception influences customer willingness to pay a premium.

- Competition from established brands increases buyer choices.

Buyer Power 5

Buyer power is high in the electric vehicle market because switching costs are low. Consumers can easily move between brands. This gives buyers significant leverage. Rivian must focus on customer loyalty to retain customers.

- EV market competition is intensifying, with new models and brands emerging.

- Rivian's sales in Q1 2024 were 1,358 vehicles, a decrease from Q4 2023.

- Customer satisfaction and brand loyalty are crucial for Rivian's long-term success.

- Rivian's ability to differentiate itself through service and features is key.

Customer bargaining power significantly impacts Rivian. High EV prices, averaging ~$53,000 in 2024, make buyers price-sensitive. Numerous competitors amplify customer choices. Brand perception and reviews greatly influence purchase decisions.

| Factor | Impact on Rivian | Data (2024) |

|---|---|---|

| Price Sensitivity | High | Average EV price ~$53,000 |

| Competition | Increased Buyer Choice | Tesla, Ford, GM models |

| Brand Perception | Influences Sales | Customer reviews impact sales |

Rivalry Among Competitors

The electric vehicle (EV) market is fiercely competitive, with established giants like Tesla and Ford battling against newcomers. This rivalry forces companies to aggressively compete on pricing, pushing for the best deals to attract customers. Innovation becomes critical as companies race to offer superior features and technology to differentiate themselves. Rivian must carve out a unique market position to succeed.

Tesla's strong market position presents a major challenge. Tesla's market share in the EV market was around 60% in 2024. Rivian must differentiate itself to succeed. Focusing on adventure vehicles could be a strategic advantage. Rivian's Q1 2024 production was 13,980 vehicles.

Competitive rivalry in the EV market is intensifying as traditional automakers like Ford and GM aggressively enter the space. These established companies are pouring billions into EV development, with Ford planning to invest over $50 billion in EVs by 2026. This influx of competition challenges Rivian's market share, requiring rapid innovation and strategic adaptation to stay competitive. Rivian's ability to compete depends on its technological advancements and customer satisfaction.

Competitive Rivalry 4

The EV market sees escalating rivalry. New startups are frequently emerging, intensifying competition for Rivian. This necessitates staying ahead through innovation and differentiation. Strategic moves like partnerships or acquisitions become crucial for survival. In 2024, EV sales are projected to reach $800 billion globally, fueling this rivalry.

- Numerous EV startups are entering the market.

- Competition is increasing due to diverse technologies.

- Rivian must innovate to maintain a competitive edge.

- Strategic actions like partnerships are essential.

Competitive Rivalry 5

Competitive rivalry in the EV market is intensifying, leading to growing pricing pressures. Rivian faces the challenge of maintaining its premium pricing while competing with more affordable EV models. This requires a strategic balance to stay relevant. To compete, Rivian can cut production costs and improve financing options. In 2024, Tesla's price cuts and new models from competitors like Ford and GM increased market competition.

- Tesla's price cuts in 2024 affected the entire EV market.

- Rivian's production costs are a key area for improvement.

- Offering competitive financing options can boost sales.

- Ford and GM's new EV models add to the competitive landscape.

The EV market's competitive intensity is high, fueled by numerous startups and established automakers. This leads to constant pricing pressures, as companies like Tesla cut prices, increasing competition. Rivian must improve financing options. To stay competitive in 2024, Rivian can cut production costs and offer competitive financing.

| Metric | 2024 Data | Impact on Rivian |

|---|---|---|

| Tesla Market Share | ~60% | Strong competition |

| Ford EV Investment | Over $50B by 2026 | Increased rivalry |

| Global EV Sales (Projected) | $800B | Heightened competition |

SSubstitutes Threaten

Gasoline-powered vehicles pose a significant threat to Rivian. They remain a dominant substitute, particularly where charging infrastructure is lacking. In 2024, gasoline vehicles still accounted for a large portion of the market. Their lower upfront costs attract many consumers. Rivian must tackle range anxiety to compete effectively.

Hybrid vehicles present a substitute for Rivian's EVs, offering a middle ground for consumers hesitant about fully electric options. These vehicles combine gasoline and electric power, addressing range concerns. In 2024, hybrid sales increased, showing continued consumer interest, potentially impacting Rivian's market share if they don't emphasize their EVs' advantages. Rivian should showcase their all-electric vehicles' superior performance to counter this threat.

The threat of substitutes for Rivian is moderate. Alternative transportation methods, such as public transit, ride-sharing, and micromobility, offer competition, particularly in cities. These options might be more economical or practical for some consumers. Rivian must concentrate on customers desiring its vehicles' unique features and experiences. In 2024, the global ride-sharing market was valued at over $100 billion, showing the scale of the substitution threat.

Threat of Substitution 4

Hydrogen fuel cell vehicles (HFCVs) present a growing threat to Rivian. HFCVs, though still developing, could rival electric vehicles (EVs). They offer quick refueling and extended ranges, potentially attracting customers. Rivian must track HFCV advancements and adjust its approach.

- HFCV sales in 2024 are projected to be a small fraction of the EV market, but growth is expected.

- Refueling infrastructure is a key challenge for HFCVs, with limited stations currently available.

- Rivian's battery technology and charging infrastructure are key differentiators against potential HFCV competition.

- Partnerships and investments in hydrogen technology could be a strategic move for Rivian.

Threat of Substitution 5

The threat of substitutes for Rivian stems from evolving consumer preferences. If consumers favor smaller, more economical vehicles or prioritize environmental sustainability over Rivian's adventure-focused models, demand could wane. To stay competitive, Rivian must adapt and provide diverse vehicle choices. This includes potentially expanding its product line to appeal to a broader audience.

- Consumer interest in EVs is growing, with sales up significantly in 2024.

- The used EV market offers more affordable alternatives.

- Tesla's Model Y and other SUVs compete directly.

- Government incentives also influence consumer choices.

The threat of substitutes for Rivian includes gasoline vehicles, hybrids, public transport, and hydrogen fuel cell vehicles (HFCVs).

Gasoline vehicles, although declining, continue to dominate the market, particularly where charging infrastructure is lacking. Hybrids offer a compromise, and public transport provides cheaper options in urban areas.

In 2024, the global ride-sharing market exceeded $100 billion, highlighting the substitution threat. HFCVs pose a future challenge, with expected growth despite infrastructure limitations.

| Substitute | 2024 Market Status | Key Considerations |

|---|---|---|

| Gasoline Vehicles | Dominant, but declining | High upfront cost; infrastructure availability |

| Hybrid Vehicles | Growing; increasing consumer interest | Addresses range anxiety; combines fuel efficiency |

| Public Transport/Ride-sharing | Significant, especially in cities | Cost-effectiveness; urban convenience |

| Hydrogen Fuel Cell Vehicles (HFCVs) | Emerging; small but growing | Quick refueling; infrastructure challenges |

Entrants Threaten

The threat of new entrants in the EV market is moderate, largely due to high capital requirements. Building an EV company demands massive investments in R&D, production plants, and charging networks. In 2024, Rivian's existing facilities and funding, bolstered by over $10 billion in investments, give it an edge against new competitors. New entrants face substantial hurdles.

Established automakers present a formidable challenge. They possess manufacturing prowess, expansive distribution networks, and strong brand recognition. Regulatory hurdles further complicate the entry for new players. Rivian must emphasize its distinctive brand and cutting-edge technology to gain a competitive edge. In 2024, the automotive industry saw over $2 trillion in revenue.

The threat of new entrants in the EV market is significantly influenced by technological advancements. Companies aiming to compete must possess or gain access to the latest battery technology, software, and autonomous driving systems. Rivian's dedication to adventure vehicles and innovative technology, such as their in-house developed Enduro drive unit, creates a substantial barrier to entry. In 2024, Rivian produced 57,232 vehicles, showing its ability to scale. However, the competitive landscape is fierce, with established automakers and new ventures constantly innovating.

Threat of New Entrants 4

The threat of new entrants in the automotive industry is a significant factor. This sector is heavily regulated, with stringent safety and emission standards that new companies must meet. Rivian faces substantial regulatory hurdles and compliance costs. Rivian's existing experience provides a competitive advantage. This advantage includes navigating complex requirements like those for vehicle safety and environmental impact.

- Regulatory compliance costs can be substantial, potentially reaching hundreds of millions of dollars.

- New entrants must meet various safety standards, including those set by the National Highway Traffic Safety Administration (NHTSA).

- Emission standards, such as those set by the Environmental Protection Agency (EPA), require significant investment in technology and testing.

- Rivian's compliance with these regulations offers a competitive edge.

Threat of New Entrants 5

The threat of new entrants in the electric vehicle (EV) market is significant, particularly due to the high barriers to entry. Access to charging infrastructure is a crucial factor for EV adoption, making it a key challenge for new companies. New entrants face the need to invest heavily in building their own charging networks or forming partnerships to compete effectively. Rivian's charging solutions and strategic partnerships give it a competitive edge in this area.

- Rivian's market capitalization as of May 2024 is approximately $10.9 billion.

- The company has been actively expanding its charging network.

- Partnerships can lower the financial burden and increase the speed of infrastructure development.

- The EV market is expected to grow significantly in the coming years, attracting more entrants.

The threat of new entrants in the EV market is moderate. High capital needs and regulatory hurdles create substantial barriers. Rivian's existing infrastructure and partnerships provide a competitive advantage.

| Factor | Details | Impact |

|---|---|---|

| Capital Requirements | Billions needed for R&D, production, and charging. | High barrier |

| Regulatory Compliance | Safety, emission, and other standards. | Increased costs |

| Charging Infrastructure | Critical for adoption, expensive to build. | Competitive edge |

Porter's Five Forces Analysis Data Sources

The Rivian analysis synthesizes information from financial statements, market research, and industry publications for competitive insights. These sources include company reports, SEC filings, and automotive market data.