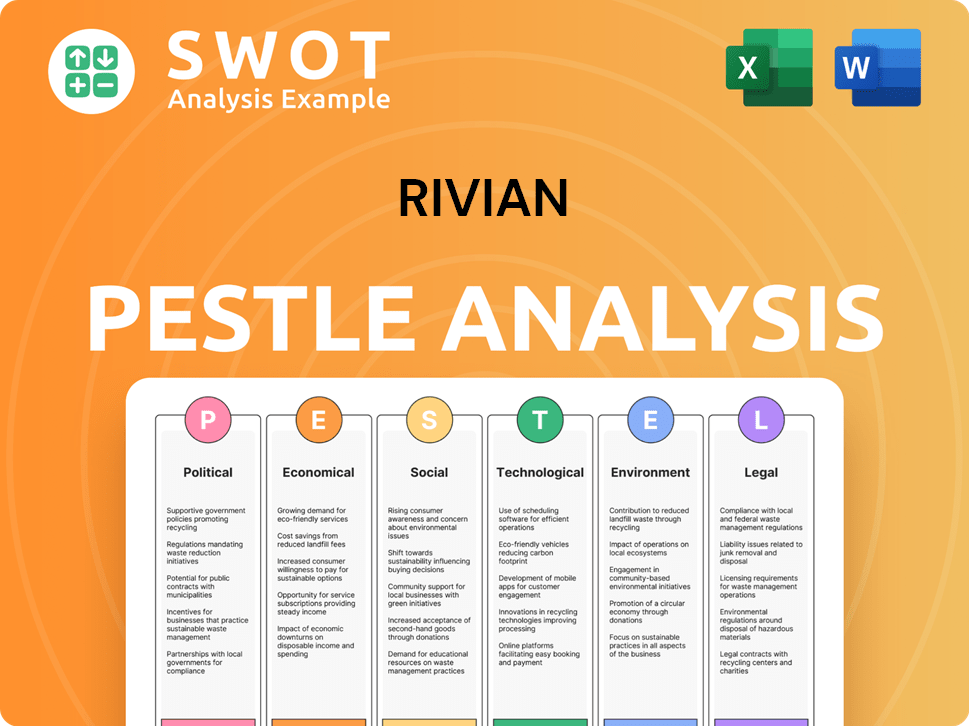

Rivian PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rivian Bundle

What is included in the product

Analyzes external macro-environmental factors shaping Rivian. Includes political, economic, social, tech, environmental, & legal insights.

Provides concise, actionable insights, streamlining complex external factors into manageable data for agile strategic decisions.

What You See Is What You Get

Rivian PESTLE Analysis

We're showing you the real product. The Rivian PESTLE analysis preview accurately reflects the full report. After purchase, you’ll instantly receive this exact file. The content is completely formatted and immediately ready to use.

PESTLE Analysis Template

Explore how Rivian's future is being shaped by external factors. This PESTLE analysis dives deep into political, economic, social, technological, legal, and environmental forces.

Understand key trends impacting Rivian’s growth and risks, revealing insights vital for any investor or analyst.

Our report breaks down complex issues, presenting them clearly and concisely.

You'll gain a strategic edge and make informed decisions in this dynamic EV market.

For detailed actionable intelligence, download the complete PESTLE analysis now.

Political factors

Government incentives, like tax credits, heavily influence Rivian's sales and production expenses. The Inflation Reduction Act of 2022 offers significant benefits, boosting demand. However, shifts in policies or stricter emissions rules pose risks. For example, in Q1 2024, Rivian delivered 13,588 vehicles, benefiting from these incentives.

Trade policies significantly influence Rivian. Tariffs on imported components, like batteries, directly affect production costs and profitability. Rivian's reliance on global supply chains makes it vulnerable to shifts in trade dynamics. Geopolitical tensions and trade disputes can disrupt market access and sourcing. For instance, in 2024, tariffs on EV components fluctuated by up to 15% impacting profit margins.

Political stability and support for EVs are crucial. Government incentives, like tax credits, significantly boost EV adoption. In 2024, the US government continues offering significant tax credits, influencing consumer choices. Policies supporting charging infrastructure also directly benefit Rivian. Shifts in political priorities could alter these incentives, affecting Rivian's market position.

Lobbying and Policy Advocacy

Rivian actively lobbies for EV-friendly policies. In 2023, Rivian spent $1.2 million on lobbying. This influences regulations and supports infrastructure. Favorable policies boost EV adoption.

- 2023 Lobbying: $1.2M.

- Focus: EV infrastructure.

- Impact: Regulatory environment.

- Goal: Boost EV adoption.

Government Fleet Procurement

Government fleet procurement presents a crucial political factor for Rivian. Government agencies could become substantial customers for electric vehicles, mirroring the existing partnership with Amazon. Securing government contracts can ensure a steady revenue stream and increase production. In 2024, the U.S. government aimed to electrify its fleet, offering Rivian a chance to participate. This could significantly boost Rivian's sales and market presence.

- 2024: U.S. government plans to electrify federal fleet.

- Partnership with Amazon offers a model for government deals.

- Stable revenue from government contracts can aid production volume.

Political factors greatly influence Rivian's operational landscape, impacting sales through government incentives. Trade policies and tariffs can significantly affect production costs. In 2024, Rivian benefits from tax credits like the Inflation Reduction Act, driving consumer demand.

| Factor | Details | Impact |

|---|---|---|

| Government Incentives | Tax credits, emission rules | Boost demand, affect production cost |

| Trade Policies | Tariffs on EV components | Affect profitability, global supply chain |

| Lobbying | 2023: $1.2M spent; Focus: EV infra | Influences regulations and policy |

Economic factors

Consumer spending is crucial for Rivian. In 2024, US consumer spending grew, but interest rates and inflation remain concerns. High rates can curb demand for expensive items like EVs. A robust economy boosts sales; downturns hurt. In Q1 2024, US GDP growth slowed to 1.6%.

Fluctuations in fuel prices significantly impact consumer behavior. High gasoline prices boost EV appeal, potentially increasing Rivian demand. In early 2024, average U.S. gas prices were around $3.50 per gallon. This could drive interest in Rivian's electric trucks and SUVs. Rising fuel costs make EVs more financially attractive.

The availability of vehicle financing significantly impacts Rivian's sales. Favorable interest rates and accessible credit make Rivian vehicles more affordable. In Q1 2024, the average interest rate on new car loans was around 7%. This affects consumer purchasing power. Reduced credit availability could hinder sales volume.

Raw Material Prices

Raw material prices are crucial for Rivian, significantly affecting its production costs and profitability. The cost of lithium, cobalt, and nickel, essential for EV batteries, directly impacts Rivian's financial health. For instance, lithium prices saw wild swings in 2024, influencing EV manufacturing costs. These fluctuations in commodity prices can lead to financial uncertainty for the company.

- Lithium prices surged in 2022, then stabilized in 2023-2024.

- Cobalt prices are influenced by supply chain dynamics.

- Nickel prices are subject to market volatility.

- Rivian's profitability is tightly linked to raw material costs.

Investment in Green Technology

Economic factors significantly shape Rivian's trajectory, particularly concerning green technology investments. Government incentives, like tax credits and subsidies, directly affect Rivian's financial health, influencing its capacity for innovation and expansion. The EV market's growth, fueled by these incentives, creates both opportunities and challenges for Rivian. Access to capital and investor confidence are also heavily influenced by the overall economic climate and trends in green investments.

- U.S. government allocated $7.5 billion for EV charging infrastructure in 2024.

- Global green bond issuance reached $487 billion in 2023, a 15% increase year-over-year.

- Rivian's Q1 2024 revenue was $881 million, a 82% increase year-over-year.

Economic indicators heavily influence Rivian's performance, with consumer spending and interest rates directly impacting vehicle demand. Raw material costs, like lithium, play a critical role in production expenses and profitability.

Government incentives for green technology, alongside broader economic trends, affect Rivian's access to capital and innovation capabilities. US GDP grew 1.6% in Q1 2024.

Fuel prices and vehicle financing terms also have significant impacts on consumer behavior and affordability, impacting the attractiveness of Rivian's EVs. Q1 2024 saw an average interest rate of about 7% on new car loans.

| Factor | Impact | 2024 Data/Trend |

|---|---|---|

| GDP Growth | Consumer Spending | US GDP grew 1.6% in Q1 2024. |

| Interest Rates | Vehicle Affordability | Avg. new car loan rate approx. 7% in Q1 2024. |

| Fuel Prices | EV Demand | Avg. gas price ~$3.50 per gallon early 2024. |

Sociological factors

Consumers are increasingly concerned about climate change, boosting demand for EVs. Rivian's sustainable approach aligns with this trend. In 2024, EV sales grew, with sustainability influencing purchase decisions. Rivian's eco-friendly brand gains a competitive edge. The global EV market is projected to reach $823.8 billion by 2030.

Owning an EV, especially a premium brand like Rivian, can be a status symbol. This signals tech-savviness and environmental consciousness. In 2024, EV sales increased, showing this trend's impact. Rivian's brand perception benefits from this status-driven market segment, influencing purchasing decisions. Data from Q1 2024 shows a 12% rise in EV adoption among affluent consumers.

Rivian's "adventure vehicle" image taps into the growing outdoor recreation and active lifestyle trends. This strategy allows Rivian to connect with consumers who value experiences. In 2024, outdoor recreation spending hit $900 billion, indicating significant market interest. This positioning helps Rivian build a strong brand around these activities.

Urbanization and Transportation Needs

Urbanization significantly affects transportation demands. Rivian's expansion into smaller vehicles like the R2 and R3 caters to urban dwellers. This strategic shift aligns with growing urban populations and their need for compact, efficient vehicles. Rivian's moves reflect the evolving market, as urban areas expand. The global urban population is projected to reach 6.7 billion by 2050, according to the UN.

- Projected urban population growth by 2050: 6.7 billion people.

- R2 and R3 models: designed to meet urban consumer needs.

- Strategic shift: Rivian's adaptation to urban market demands.

Technological Adoption Rates

Technological adoption rates significantly influence Rivian's market success. Societal acceptance of EVs and charging infrastructure is critical. Consumer embrace directly affects Rivian's growth trajectory. Rapid adoption can boost sales; slow acceptance poses challenges. Consider these points:

- EV sales in 2024 reached 1.2 million, a 50% increase.

- Public charging stations grew 40% in 2024, totaling 60,000.

- Government incentives and subsidies are crucial for adoption.

- Technological advancements, like faster charging, boost acceptance.

Societal values strongly influence EV demand and brand perception. Growing eco-consciousness boosts interest in sustainable brands like Rivian. Premium EVs, including Rivian, function as status symbols, affecting buying choices.

| Aspect | Data Point | Impact |

|---|---|---|

| EV Sales Growth | 2024: 50% increase to 1.2M units | Positive, increased adoption |

| Affluent Consumer Adoption | Q1 2024: 12% rise in EVs | Favorable, signals premium brand status |

| Outdoor Recreation Spending | 2024: $900B | Positive, supports adventure vehicle image |

Technological factors

Continuous improvements in battery tech, like energy density and charging speed, are crucial. Rivian invests in its battery systems and new cell tech. In early 2024, advancements led to longer ranges and reduced charging times. These innovations aim to lower EV production costs. The goal is to enhance both vehicle performance and affordability.

The automotive industry is increasingly focused on advanced driver-assistance systems (ADAS) and autonomous driving. Rivian's technological capabilities in this area are critical. In 2024, the autonomous vehicle market was valued at approximately $18.4 billion. Successful integration of these technologies can boost Rivian's vehicle safety and competitiveness. By 2030, the market is projected to reach $62.1 billion.

Software and connectivity are crucial in today's vehicles. Rivian's tech platform is a key technological element. In Q1 2024, Rivian delivered 1,358 vehicles, reflecting its software-driven capabilities. Over-the-air updates and infotainment enhance the user experience.

Manufacturing Technology and Automation

Manufacturing technology and automation are pivotal for Rivian. These advancements boost efficiency, cut costs, and increase production volume. Rivian's focus on optimizing its facilities is vital for growth. The company aims to produce 21,000 vehicles in 2024.

- Rivian's Normal, IL plant has a production capacity of 150,000 vehicles annually.

- Automation can reduce labor costs and increase production speed.

- By Q1 2024, Rivian produced 13,980 vehicles.

Charging Infrastructure Technology

The advancement of charging infrastructure technology is crucial for electric vehicle (EV) adoption, directly impacting consumer convenience and range anxiety. Rivian's investments in its proprietary charging network, including the Rivian Adventure Network, are critical. Their exploration of renewable energy integration at charging stations highlights a commitment to sustainability and cost efficiency. As of late 2024, Rivian had deployed over 100 charging sites across North America.

- Rivian Adventure Network aims for 3,500+ chargers by the end of 2025.

- Plans to incorporate renewable energy at charging stations.

- Focus on DC fast-charging technology for quicker charging times.

Technological factors are critical for Rivian’s success, particularly in battery tech. They aim to enhance range, charging times, and cost-effectiveness. ADAS and autonomous driving advancements boost safety and market competitiveness; the autonomous vehicle market was valued at $18.4B in 2024. Software, connectivity, and manufacturing automation also significantly affect their performance and production capacity.

| Technological Area | Key Factor | 2024 Status/Target |

|---|---|---|

| Battery Technology | Energy Density & Charging Speed | Ongoing Improvements & Investments |

| ADAS & Autonomous Driving | Vehicle Safety & Tech Integration | Market valued at $18.4B |

| Software & Connectivity | Over-the-Air Updates & Infotainment | 1,358 vehicles delivered (Q1 2024) |

Legal factors

Rivian faces stringent vehicle safety standards, differing across regions. Compliance ensures legal sales and consumer confidence. In 2024, the National Highway Traffic Safety Administration (NHTSA) data showed significant safety improvements in EVs. Meeting these standards is crucial for market access. Non-compliance can lead to recalls and financial penalties, impacting Rivian's profitability.

Emissions standards and environmental regulations are crucial for Rivian. They must comply with California's CARB standards to sell vehicles. These standards affect vehicle design and manufacturing. In 2024, CARB's Advanced Clean Cars II rule continues to shape EV development. Rivian faces costs related to compliance.

Rivian heavily relies on patents and trademarks to safeguard its innovations. Securing intellectual property rights is key for its long-term growth. In 2024, Rivian's legal costs for IP protection were approximately $50 million. This expenditure ensures its unique technologies and designs remain exclusive.

Consumer Protection Laws

Rivian faces legal obligations regarding consumer protection, covering vehicle sales, warranties, and service standards. Compliance is crucial for customer satisfaction and avoiding legal challenges. The National Highway Traffic Safety Administration (NHTSA) has issued recalls for Rivian vehicles, highlighting the importance of adherence to safety regulations. Consumer Reports data shows varying reliability ratings for electric vehicles, underscoring the need for robust consumer protection.

- NHTSA has issued recalls for Rivian vehicles.

- Consumer Reports data shows varying reliability ratings for EVs.

International Trade Laws and Agreements

International trade laws and agreements are crucial for Rivian's global strategy. These regulations affect the import of components and export of vehicles. For instance, the USMCA agreement impacts trade with Canada and Mexico. In 2024, Rivian aimed to expand into Europe, facing tariffs and trade barriers. Navigating these laws is key for supply chain efficiency and cost management.

- USMCA: Facilitates trade with Canada and Mexico.

- EU Trade: Presents tariff and regulatory hurdles.

- Global Expansion: Requires compliance with diverse trade laws.

- Supply Chain: Affected by import/export regulations.

Rivian's legal landscape involves vehicle safety, environmental, intellectual property, consumer protection, and international trade regulations. Non-compliance with vehicle safety standards, such as those monitored by the NHTSA, can result in recalls. Patent and trademark protection costs, essential for Rivian’s IP, were roughly $50M in 2024.

Compliance with environmental rules is a must to access certain markets, impacting vehicle design. International trade laws, including agreements like USMCA, are key for managing Rivian's global supply chain.

These regulations and legal obligations affect Rivian's operations, costs, and global market strategies.

| Legal Factor | Impact | 2024 Data/Examples |

|---|---|---|

| Vehicle Safety | NHTSA Recalls, Compliance | Safety improvements in EVs reported by NHTSA, with recalls affecting compliance and confidence |

| Emissions & Environment | Compliance costs; Market access | CARB's Advanced Clean Cars II shapes EV development and manufacturing processes. |

| Intellectual Property | Patent protection & litigation costs | Roughly $50M spent on IP in 2024 |

| Consumer Protection | Sales, warranty and service standard adherence. | Consumer Reports provide EVs’ reliability ratings. |

| International Trade | Tariffs, Trade barriers and trade law adherance. | USMCA (Canada, Mexico), and EU trade influence global strategy, particularly in market entry. |

Environmental factors

Climate change is a major global concern, pushing the shift towards electric vehicles. Rivian's EV production directly tackles transportation emissions. The transportation sector accounts for roughly 27% of U.S. greenhouse gas emissions as of early 2024. Rivian's focus aligns with emission reduction goals.

Environmental factors significantly influence Rivian. Manufacturing processes' environmental impact, including energy use and waste, is crucial. Rivian focuses on reducing its carbon footprint and using recycled materials. In 2024, sustainable manufacturing practices are increasingly vital for brand perception and regulatory compliance. Rivian's strategy aligns with growing consumer demand for eco-friendly products.

The environmental impact of battery production and disposal is significant for EV companies like Rivian. Rivian is actively working on battery recycling initiatives to minimize environmental harm. The company aims to use recycled materials in its battery production. Data from 2024 shows an increase in battery recycling rates, though still low.

Responsible Sourcing of Materials

Responsible sourcing of materials is a key environmental factor for Rivian. The company focuses on sustainable supply chains to minimize environmental and social impacts, especially for battery materials. This includes ensuring ethical sourcing of lithium, nickel, and cobalt. Rivian aims to reduce its carbon footprint through responsible material procurement.

- Rivian is committed to achieving net-zero emissions by 2040.

- In 2024, Rivian's battery packs used responsibly sourced materials.

- The company is working with suppliers to trace materials and ensure ethical practices.

Renewable Energy Integration for Charging

The environmental advantages of electric vehicles (EVs) are amplified when charged using renewable energy. Rivian's strategic focus on building a charging network that incorporates renewable sources supports environmental sustainability. This approach not only lessens the carbon footprint associated with EV charging but also strengthens Rivian's commitment to eco-friendly practices. Investments in renewable energy infrastructure are vital for Rivian's long-term environmental and financial success.

- By 2024, renewable energy accounted for about 22% of total U.S. energy consumption.

- Rivian aims to power its Adventure Network with 100% renewable energy.

- The global renewable energy market is projected to reach $1.977 trillion by 2030.

Rivian faces significant environmental pressures linked to climate change, notably focusing on reducing emissions in the transportation sector, which accounted for roughly 27% of U.S. greenhouse gas emissions by early 2024.

Sustainable manufacturing, particularly reducing carbon footprint, is vital, aligning with rising consumer demand. Responsible sourcing, like ethical lithium acquisition, minimizes environmental harm, essential for Rivian’s commitment.

Rivian's emphasis on renewable energy for its charging network further supports sustainability efforts. By 2024, renewable energy made up approximately 22% of U.S. total energy consumption, driving investments for long-term success.

| Key Environmental Aspects | Impact | 2024/2025 Data |

|---|---|---|

| Emission Reduction | Focus on reducing transportation emissions | Transportation emissions in the U.S. 27% |

| Sustainable Manufacturing | Minimizing carbon footprint and waste | Growing consumer demand for eco-friendly products |

| Renewable Energy | Powering charging networks | Renewable energy in the U.S. - 22% |

PESTLE Analysis Data Sources

This PESTLE Analysis uses credible industry reports, financial news outlets, government data, and academic publications for current insights.