Ryan Specialty Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ryan Specialty Group Bundle

What is included in the product

Strategic assessment of Ryan Specialty across BCG matrix quadrants, including investment and divestment suggestions.

Printable summary optimized for A4 and mobile PDFs to help communicate the matrix.

Delivered as Shown

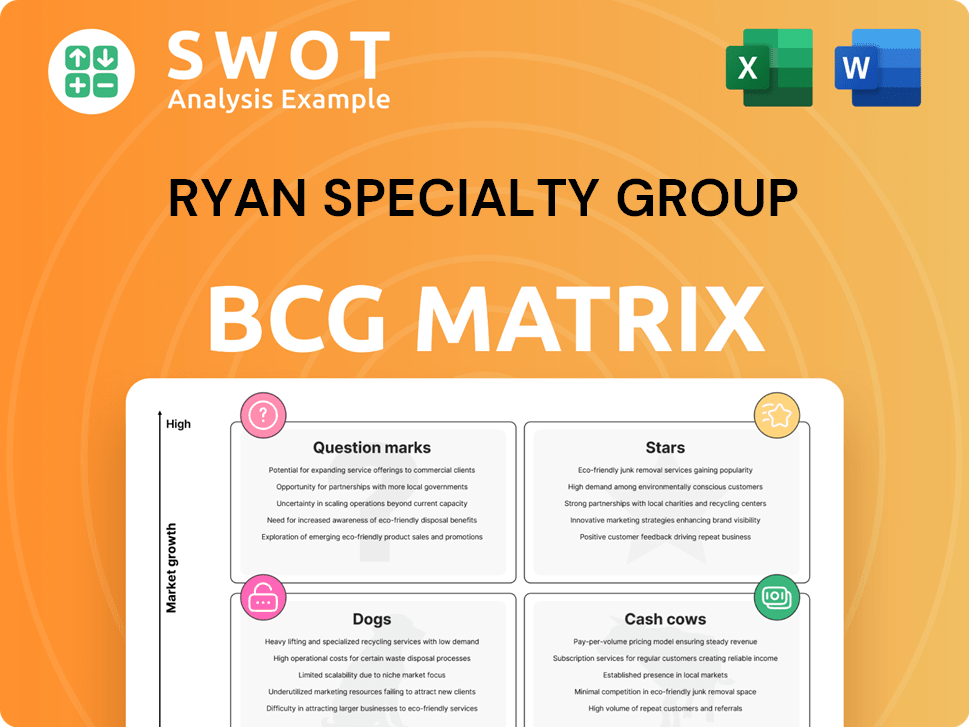

Ryan Specialty Group BCG Matrix

This preview showcases the complete Ryan Specialty Group BCG Matrix report you'll gain access to instantly after buying. It's the final, fully formatted document, ready for your strategic review and application, no hidden content.

BCG Matrix Template

Ryan Specialty Group's BCG Matrix helps visualize its diverse offerings. We see potential "Stars" in high-growth, high-share areas. "Cash Cows" likely fuel the firm's stability. Some offerings might be "Question Marks," needing careful resource allocation. Others could be "Dogs," requiring strategic decisions. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Ryan Specialty Group exemplifies strong organic growth, a key characteristic of a "Star" in the BCG matrix. The company reported an impressive 11% organic revenue growth in Q4 2024. This strong performance, with a 12.8% increase for the full year, reflects effective market penetration.

Ryan Specialty Group's strategic acquisitions have been a key growth driver. The company's moves consistently add revenue and expand its market reach. In 2024, seven acquisitions are expected to contribute over $265 million in revenue. These moves solidify its industry leadership.

Ryan Specialty Group is a market leader in specialty insurance, particularly in the high-growth excess and surplus (E&S) sector. This dominant position allows the company to set premium rates and maintain consistent margins. Specializing in complex risks, Ryan Specialty further strengthens its market standing. In Q3 2024, the company's organic revenue growth was 18.1%, demonstrating its strong market presence.

Expansion in Delegated Authority

Ryan Specialty Group has actively expanded its delegated authority segment via strategic acquisitions and internal growth. This approach allows the company to capitalize on the substantial E&S premiums within the delegated authority market. The firm's ability to attract top talent and provide operational support further bolsters its market position. In 2024, Ryan Specialty's focus on this segment is expected to contribute significantly to its overall revenue growth.

- Delegated authority represents a significant portion of E&S premiums.

- Ryan Specialty's acquisitions and internal development bolster its presence.

- Attracting top talent and support strengthens its position.

- Focus on the segment is expected to contribute to revenue growth in 2024.

Excellent Underwriting Capabilities

Ryan Specialty Group's (RSG) underwriting strength is a key asset, particularly through Ryan Specialty Underwriting Managers International Limited (RSUMI) and Ryan Specialty Netherlands B.V. (RSN). Their success stems from skilled underwriters, internal underwriting teams, and strong ties with top-rated insurers. This diversified approach to programs lowers the risk associated with relying on a single partner, ensuring stable performance. In 2024, RSG's focus on specialized insurance solutions helped it maintain its competitive edge.

- RSG's underwriting prowess is key to its market position.

- RSUMI and RSN are central to RSG's underwriting operations.

- Experienced teams and insurer relationships drive success.

- Diversification of programs helps manage risk effectively.

Ryan Specialty Group (RSG) shines as a "Star" in the BCG matrix due to its robust growth and market dominance.

Its stellar performance includes an impressive 12.8% revenue increase in 2024, highlighting its strength. Strategic acquisitions contributed over $265 million in revenue in 2024.

RSG's underwriting strength and focus on delegated authority further solidify its leading market position, driving ongoing success.

| Metric | 2024 Performance | Key Takeaway |

|---|---|---|

| Organic Revenue Growth | 12.8% | Strong market penetration |

| Acquisition Revenue Contribution | $265M+ | Strategic growth driver |

| Market Position | Leading E&S | Dominant industry presence |

Cash Cows

Ryan Specialty's Wholesale Brokerage, under RT Specialty, serves retail brokers. This segment is a cash cow. In 2020, it brought in $673.1 million. RT Specialty's strong performance makes it a reliable revenue source. This stable income stream continues to perform.

RT Binding Authority is a significant player in the insurance market. It leverages local insights and national reach. The segment's revenue stream is consistent, driven by direct submissions. In 2023, Ryan Specialty's Binding Authority had $1.3 billion in gross written premiums.

Ryan Specialty Group's strong, enduring ties with major carriers and retail brokers form its "Cash Cows." This network enables premium pricing and steady margins. In 2024, the top 100 retail brokerage firms drove a substantial portion of organic revenue growth. These relationships are vital for sustained expansion.

Cost Synergies

Ryan Specialty leverages its strong platform and back-office structure to create significant cost synergies. This approach boosts performance at acquired companies and enhances product capabilities. The ACCELERATE 2025 program is designed to save $60 million annually by 2025. These efforts improve cost management and drive operational efficiencies.

- ACCELERATE 2025 program targets $60 million in annual savings.

- Focus on integrating acquired firms for better performance.

- Platform and back-office efficiency drive revenue and cost synergies.

- Enhance product capabilities to meet market demands.

Established Market Presence

Ryan Specialty Group, founded in 2010 by Patrick G. Ryan, is a cash cow due to its strong market presence. Its reputation for innovation and expertise makes it a trusted partner in specialty risk solutions. This established presence supports sustained performance and growth in the insurance market. The company's revenue in 2023 was $2.3 billion, a 27% increase year-over-year.

- Founded in 2010 by Patrick G. Ryan.

- Revenue in 2023: $2.3 billion.

- Year-over-year revenue growth: 27%.

- Trusted partner for specialty risk solutions.

Ryan Specialty's "Cash Cows" include its brokerage and binding authority segments. They are characterized by stable revenue streams and strong market positions. The Wholesale Brokerage, like RT Specialty, generated $673.1 million in revenue in 2020. This robust performance supports sustained growth.

| Segment | Revenue/GWP (Year) | Key Feature |

|---|---|---|

| Wholesale Brokerage | $673.1M (2020) | Stable Revenue |

| Binding Authority | $1.3B GWP (2023) | Consistent, Direct Submissions |

| Overall (2023) | $2.3B Revenue | 27% YoY Growth |

Dogs

Within Ryan Specialty's portfolio, certain programs could struggle. Market shifts or scaling issues can cause underperformance. Turnarounds might need substantial investment, potentially being inefficient. Ongoing analysis is essential to spot and fix these weak spots. For example, in 2024, programs failing to meet a 10% growth target might face review.

Certain areas where Ryan Specialty does business might see slow growth, possibly due to local market issues or rules. These regions may not boost the company's income much, classifying them as dogs in the BCG Matrix. In 2024, consider regions where revenue growth is below the company average of 15%. Decisions are crucial for efficient resource use.

In the Dogs quadrant, Ryan Specialty may see rate deterioration in some property and casualty areas, affecting profits. The 2023 earnings call highlighted challenges like California wildfires. To counter these, ongoing adaptation and innovation are vital. In 2024, the insurance industry faces scrutiny due to rising claims and economic shifts.

Segments with High Competition

Ryan Specialty faces intense competition in certain segments, including the wholesale brokerage market. This can lead to price wars and potential profit margin declines. To stay ahead, the company must focus on unique services and expert knowledge. For 2024, the insurance brokerage industry saw a rise in M&A activity, increasing competition.

- Increased competition from established brokers and insurtech companies.

- Potential for pricing pressure and reduced profitability in highly competitive segments.

- Need for differentiation through specialized services and expert knowledge.

Inefficiently Integrated Acquisitions

Ryan Specialty Group's "Dogs" quadrant includes inefficiently integrated acquisitions, posing risks despite a strong acquisition track record. Poor integration can hinder expected synergies and negatively impact overall performance. Effective planning and execution are crucial for successful integration of acquired businesses. In 2023, Ryan Specialty completed several acquisitions, and future performance depends on how well these are integrated.

- Acquisition integration is key to realizing financial benefits.

- Inefficient integration may lead to increased operational costs.

- Synergy realization rates vary significantly across acquisitions.

- Successful integration requires dedicated resources and oversight.

Dogs in Ryan Specialty's portfolio include underperforming programs and regions with slow growth. These areas may require significant investment or face profit margin declines. Competition and integration challenges intensify issues.

| Category | Details | 2024 Data/Fact |

|---|---|---|

| Underperforming Programs | Programs failing to meet growth targets. | Programs < 10% growth in 2024 face review. |

| Slow Growth Regions | Regions with local market issues. | Regions below 15% revenue growth. |

| Competitive Segments | Intense competition in certain markets. | Rise in M&A activity, increasing competition. |

Question Marks

Ryan Specialty Group could consider emerging tech like cyber insurance or AI risk coverage, which have high growth potential. These areas present uncertainty, needing investment for expertise. In 2024, cyber insurance premiums rose significantly. Strategic partnerships can help navigate these markets, as seen with recent tech-focused acquisitions.

Expanding into new geographies, like Asia or South America, is a 'Question Mark' in Ryan Specialty Group's BCG matrix. These markets offer high growth but demand investment and regulatory navigation. In 2024, insurance market growth in Asia Pacific is projected at 6-8%. Strategic partnerships are key for success. Ryan Specialty's expansion strategy should be backed by thorough market research.

Ryan Specialty's alternative risk solutions, like captives, are a question mark in their BCG Matrix, presenting high growth potential. These services target underserved insureds, offering diversification. In 2024, the alternative risk market saw significant growth, with a 15% increase in captive formations. However, specialized expertise and risk management are crucial for profitability.

Specialty Programs in Nascent Stages

Ryan Specialty Group's "Question Marks" include new Managing General Underwriters (MGUs) and programs targeting emerging risks. These ventures, such as those in life sciences or renewable energy, boast high growth potential but need heavy investment. Success hinges on effectively meeting developing market demands. For instance, in 2024, renewable energy insurance premiums surged, reflecting this trend.

- MGUs and programs focused on nascent risks.

- Significant investment required for product development.

- Market penetration is key to success.

- Success is reliant on emerging market identification.

Innovative Insurance Products

Innovative insurance products represent a question mark within Ryan Specialty Group's BCG matrix. These products target specific industry niches or emerging risks, offering significant growth potential. Success hinges on deep market understanding and tailored solutions. Effective innovation can boost market share and profitability.

- In 2024, the specialty insurance market is projected to reach $100 billion.

- Products like cyber insurance and parametric insurance are seeing rapid growth.

- Ryan Specialty Group's focus on niche markets aligns with this strategy.

- Successful product launches can drive substantial revenue increases.

Ryan Specialty's "Question Marks" often involve high-growth areas needing significant investment. These include new MGUs or products like cyber insurance, focusing on emerging risks and niche markets. In 2024, the specialty insurance market is expected to reach $100 billion, highlighting the potential.

| Aspect | Details | 2024 Data |

|---|---|---|

| MGUs & Programs | Emerging risks and niche markets | Specialty market: $100B |

| Products | Cyber, Parametric | Cyber growth: 20% |

| Investment | Product development | Renewable energy premiums surge |

BCG Matrix Data Sources

The Ryan Specialty Group BCG Matrix leverages financial data, market reports, and industry insights. We incorporate data from public filings & analyst predictions. This ensures dependable positioning.