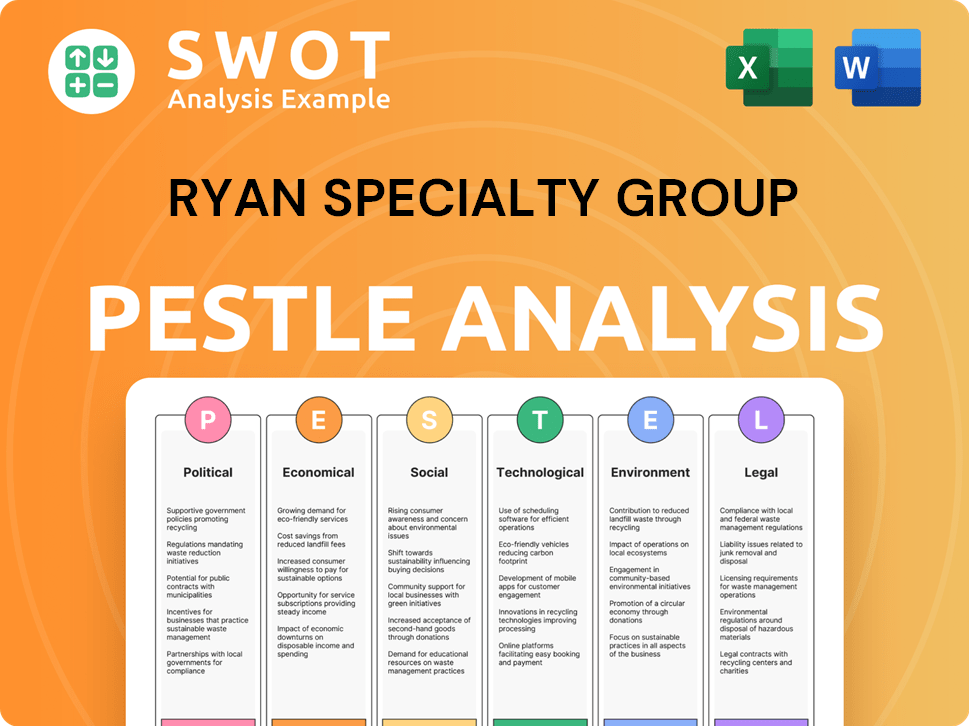

Ryan Specialty Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ryan Specialty Group Bundle

What is included in the product

Assesses external macro-environmental forces affecting Ryan Specialty Group across Political, Economic, etc., factors.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview the Actual Deliverable

Ryan Specialty Group PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

This PESTLE analysis for Ryan Specialty Group details key external factors.

It covers political, economic, social, technological, legal, & environmental aspects.

The preview's format & information are the same in the purchased document.

Get immediate access after buying; this is your final deliverable.

PESTLE Analysis Template

Uncover how external factors shape Ryan Specialty Group's success. Our PESTLE Analysis reveals key insights into political, economic, social, technological, legal, and environmental forces impacting the company. Understand regulatory pressures and market opportunities that could influence their future. This comprehensive analysis offers a strategic edge. Download the complete report now for expert intelligence and actionable data.

Political factors

Ryan Specialty Group faces substantial government regulation across the insurance industry. Regulations impact capital needs, consumer safeguards, and market conduct, influencing its financial results. Compliance with shifting regulatory environments is vital for sustained operations.

Geopolitical tensions, political polarization, and civil unrest globally boost demand for political risk insurance, a Ryan Specialty Group specialty. These events introduce market uncertainty, impacting underwriting and risk assessment. The frequency of global elections adds to instability. In 2024, political risk insurance premiums are projected to reach $3.5 billion, a 7% rise from 2023.

Changes in trade policies and sanctions significantly affect global supply chains, which are vital for international businesses. These shifts can boost demand for insurance covering supply chain and political risks. For example, in 2024, global trade disruptions cost businesses an estimated $2.5 trillion. This environment presents challenges for Ryan Specialty Group's clients.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly impact economic conditions, directly influencing the insurance market. Infrastructure projects, like those supported by the Infrastructure Investment and Jobs Act, boost demand for construction insurance. Conversely, budget cuts can decrease demand for certain insurance types. For instance, in 2024, U.S. infrastructure spending is projected to increase by 8%.

- Infrastructure spending creates demand for construction-related insurance.

- Austerity measures can reduce demand for some insurance types.

- U.S. infrastructure spending is projected to increase by 8% in 2024.

Industry-Specific Political Advocacy

Political factors significantly affect Ryan Specialty Group (RSG) through industry-specific advocacy. Lobbying efforts by insurance groups shape legislation and regulations impacting RSG indirectly. For instance, in 2024, the insurance industry spent over $200 million on lobbying. Successful advocacy can lead to favorable policies. Conversely, failures could create challenges for RSG's operations and profitability.

- Lobbying expenditures by the insurance sector.

- Impact of policy changes on RSG's business model.

- Regulatory environment influencing RSG's growth.

- Political risks associated with legislative outcomes.

Political dynamics significantly impact Ryan Specialty Group. Government regulations in the insurance industry affect operations and financial results. Global instability and political risk drive demand for specialty insurance. Trade policies and government spending further shape the insurance landscape.

| Political Factor | Impact | Data (2024 est.) |

|---|---|---|

| Government Regulation | Compliance costs; market conduct | Insurance industry lobbying: $200M+ |

| Geopolitical Risks | Demand for political risk insurance | Political risk premium: $3.5B (+7%) |

| Trade Policy | Supply chain insurance demand | Global trade disruption cost: $2.5T |

Economic factors

Inflation can increase claim costs for insurers, potentially squeezing Ryan Specialty Group's profits. Interest rate changes directly impact the investment income, a crucial part of their revenue stream. In 2024, the Federal Reserve held interest rates steady, influencing market dynamics. Fluctuations in these rates can significantly affect Ryan Specialty Group's financial performance.

Economic growth significantly influences the insurance sector. In 2024, the U.S. GDP growth was around 3%, boosting insurance demand. Recessionary pressures, as seen in late 2023, can prompt businesses to cut insurance, impacting revenue. Market forecasts for 2025 indicate a moderate growth of 2.5%, which could stabilize insurance demand.

The insurance market is intensely competitive, with many companies vying for business. This includes established insurers, reinsurers, and newer InsurTech firms. This competitive landscape influences pricing strategies. For instance, in 2024, the global insurance market was valued at approximately $6.7 trillion.

Availability of Capital

The availability of capital in insurance and reinsurance significantly affects underwriting capacities, especially for specialized risks. Capital fluctuations directly impact pricing and the types of risks insurers can cover. For Ryan Specialty Group, securing sufficient capital is critical for its operational effectiveness. In 2024, the insurance market saw a 5-10% increase in capital. This trend influences the company's strategic decisions.

- Capital levels in the insurance market are expected to remain relatively stable through 2025.

- Increased capital may lead to more competitive pricing in certain segments.

- Ryan Specialty Group focuses on maintaining relationships with capital providers.

- The company's access to capital directly influences its ability to expand.

Currency Exchange Rates

Ryan Specialty Group's international operations make it susceptible to currency exchange rate volatility. These fluctuations can affect the translation of foreign revenues and expenses into its reporting currency, the U.S. dollar. For instance, if the U.S. dollar strengthens, the value of revenues earned in other currencies may decrease when converted. Conversely, a weaker dollar can boost the reported value of international earnings. These currency impacts can directly influence the company's reported financial performance.

- In 2024, the EUR/USD exchange rate fluctuated significantly, impacting companies with European operations.

- Changes in exchange rates can lead to gains or losses on foreign currency transactions.

Inflation, impacted by Fed actions, affects claim costs and investment income. Economic growth, projected at 2.5% in 2025, drives insurance demand. Competition in the $6.7 trillion global market influences pricing. Stable capital levels and currency fluctuations impact Ryan Specialty.

| Economic Factor | Impact on Ryan Specialty | 2024/2025 Data Points |

|---|---|---|

| Inflation | Affects claim costs and investment income. | 2024 CPI: ~3.1%; Fed held rates steady. |

| Economic Growth | Influences insurance demand. | 2024 US GDP: ~3%; 2025 forecast: ~2.5%. |

| Capital Availability | Affects underwriting capacity and pricing. | Insurance market capital increase in 2024: 5-10%. |

Sociological factors

Societal shifts impact insurance needs. An aging population and evolving family structures, like those seen in the U.S., where the median age is around 39 years in 2024, affect demand. Changing work patterns, with the rise of remote work, influence risk profiles. Ryan Specialty Group adapts its services to these changes, potentially impacting its revenue of $2.5 billion in 2023.

Public perception of risk influences insurance demand. Cyber threats and environmental liabilities are growing concerns. Ryan Specialty Group can capitalize on this with specialized insurance. In 2024, cyber insurance premiums rose significantly due to increased attacks. Environmental liability claims also saw a rise, creating opportunities.

Social inflation significantly impacts insurance costs, driven by factors such as litigation and larger payouts. This affects the profitability of insurance programs, a key concern for Ryan Specialty Group. Recent data shows a rise in claim severity, with commercial auto liability seeing increases. In 2024, industry experts predict further increases in social inflation.

Customer Expectations and Preferences

Customer expectations are shifting towards personalized insurance solutions, digital interactions, and clear communication, which impacts how Ryan Specialty Group operates. To stay competitive, the company must adapt by prioritizing investments in technology and customer-focused strategies. These changes are driven by a desire for more tailored services and easier access to information.

- Digital adoption in insurance continues to rise, with online sales projected to reach $250 billion by 2025.

- Customer satisfaction scores are 15% higher for companies offering personalized insurance products.

Talent Availability and Workforce Trends

Ryan Specialty Group (RSG) faces talent challenges. The insurance sector needs specialized skills, especially in underwriting. Flexible work and continuous upskilling are crucial for attracting and keeping employees. The U.S. insurance workforce is aging, with a talent gap. 2024-2025 trends show a rise in remote work and demand for digital skills.

- Specialized skills are needed.

- Workforce trends impact RSG.

- Aging workforce creates a gap.

- Remote work is rising.

Sociological factors influence insurance demand and the operational needs of Ryan Specialty Group (RSG).

Customer expectations, like digital access, drive the need for tech investments.

RSG must adapt to talent shortages in underwriting, offering flexible work and skills training.

| Factor | Impact | Data |

|---|---|---|

| Digital Adoption | Increases insurance sales, impacting RSG | Online sales projected to reach $250B by 2025 |

| Customer Preferences | Demands personalized solutions, influencing strategies | Satisfaction up 15% for personalized products |

| Talent Challenges | Impacts RSG's operational effectiveness | Aging workforce and demand for digital skills |

Technological factors

Data analytics and AI are revolutionizing insurance. They enable better risk assessment and fraud detection. In 2024, AI spending in insurance reached $10.3B. Ryan Specialty can leverage these tools to improve customer service and create new products. This could lead to a 15% increase in operational efficiency.

Digital transformation and InsurTech are reshaping the insurance sector. Ryan Specialty Group must adopt digital tools to stay competitive. In 2024, the InsurTech market was valued at over $10 billion. Collaborations with InsurTech firms could boost efficiency and innovation. Embracing these changes is crucial for future growth.

Cybersecurity threats are escalating, impacting businesses and individuals alike. This surge fuels the demand for cyber insurance, a key area for Ryan Specialty Group. The global cybersecurity market is projected to reach $345.7 billion by 2025. Ryan Specialty Group must fortify its own defenses to protect its data and systems.

Automation and Process Efficiency

Automation is transforming the insurance sector, and Ryan Specialty Group is positioned to leverage these advancements. Automation can streamline workflows, reducing manual tasks and improving accuracy. This efficiency translates to lower operational costs and quicker turnaround times, enhancing both profitability and client satisfaction. The global insurance automation market is projected to reach $20.7 billion by 2025.

- Automation can reduce claims processing time by up to 50%.

- The use of AI in underwriting can improve risk assessment accuracy by 30%.

- Robotic Process Automation (RPA) can cut operational costs by 20%.

- Automated policy administration can reduce human error by 40%.

Emerging Technologies (e.g., Blockchain, IoT)

Emerging technologies like blockchain and IoT could reshape the insurance industry for Ryan Specialty Group. Blockchain offers increased transaction transparency and security, potentially streamlining claims. IoT data from connected devices can improve risk assessment. The global blockchain market is projected to reach $94.9 billion by 2025. These technologies could lead to more efficient and data-driven insurance solutions.

- Blockchain's market size is expected to hit $94.9B by 2025.

- IoT devices can provide valuable data for risk assessment.

- These technologies can increase efficiency and data-driven solutions.

Data analytics, AI, and automation significantly enhance risk assessment and operational efficiency. AI spending in insurance hit $10.3B in 2024. The insurance automation market is projected to reach $20.7B by 2025. These advancements offer substantial benefits for Ryan Specialty.

Digital tools and InsurTech collaborations are vital for staying competitive, with the InsurTech market valued at over $10 billion in 2024. Cybersecurity, with a market forecast of $345.7 billion by 2025, and technologies such as blockchain ($94.9B market by 2025) and IoT also present opportunities.

| Technology | Impact | Market Size/Projections |

|---|---|---|

| AI in Insurance | Improved risk assessment & efficiency | $10.3B (2024) |

| Insurance Automation | Streamlined workflows & cost reduction | $20.7B (by 2025) |

| Cybersecurity | Protecting Data and Systems | $345.7B (by 2025) |

Legal factors

Ryan Specialty Group navigates a heavily regulated insurance sector. Strict adherence to state, federal, and international laws is crucial. In 2024, the company faced evolving solvency requirements. Market conduct rules directly impact its legal and operational strategies. Changes in regulations can influence its financial obligations.

Contract law and policy interpretation are crucial for Ryan Specialty Group. Legal decisions shape insurance coverage and claims. In 2024, evolving interpretations of "business interruption" clauses, for example, affected claims. Understanding these legal nuances is vital for underwriting and claims handling, influencing profitability.

Ryan Specialty Group must navigate evolving data privacy laws like GDPR and CCPA, which mandate strict data handling practices. Breaching these regulations can lead to substantial fines; for example, GDPR penalties can reach up to 4% of annual global turnover. Maintaining robust data security is crucial to protect sensitive client information and uphold its reputation. In 2024, the global data security market is valued at $180 billion, underscoring the scale of the legal and financial implications.

Antitrust and Competition Law

Antitrust and competition laws are critical for Ryan Specialty Group, especially regarding mergers and market practices. The insurance industry, like others, sees scrutiny to prevent monopolies. Compliance with these laws is essential for Ryan Specialty Group's expansion. The Federal Trade Commission (FTC) and Department of Justice (DOJ) actively monitor the insurance sector.

- In 2024, the DOJ challenged several mergers across various industries.

- Ryan Specialty Group must ensure its market conduct does not stifle competition.

- Focus on fair pricing and transparent dealings is essential.

Tort Law and Liability Trends

Changes in tort law and civil litigation trends significantly affect liability insurance demand and exposure for Ryan Specialty Group. Rising litigation, influenced by evolving legal precedents, boosts demand for specialized insurance products. The U.S. tort system saw an increase in litigation spending, reaching $429 billion in 2023, reflecting higher claim payouts. This impacts Ryan Specialty's underwriting, requiring careful risk assessment.

- Increasing litigation costs and claim severity.

- Growing demand for professional liability insurance.

- Impact of legal precedents on underwriting practices.

- Focus on risk management and specialized insurance solutions.

Legal factors heavily influence Ryan Specialty Group's operations. In 2024/2025, data privacy laws like GDPR and CCPA remain critical, with the global data security market at $180B. Antitrust laws are vital to prevent market monopolies. Evolving tort law trends boost demand for specialized insurance, as seen by $429B U.S. litigation spending in 2023.

| Legal Area | Impact | 2023/2024 Data |

|---|---|---|

| Data Privacy | Compliance Costs, Fines | Data Security Market: $180B (2024) |

| Antitrust | Market Conduct, Mergers | DOJ challenged mergers in various sectors. |

| Tort Law | Liability Demand, Underwriting | U.S. Litigation Spending: $429B (2023) |

Environmental factors

Climate change intensifies extreme weather, increasing insurance claims. The global cost of natural disasters in 2023 was $380 billion. This impacts Ryan Specialty's property and casualty underwriting. Rising claims costs and coverage availability are key concerns for 2024/2025. Higher risk assessment is crucial.

Evolving environmental regulations and growing concerns about pollution are increasing liabilities for businesses. This trend boosts the demand for environmental liability insurance, a niche where Ryan Specialty Group provides solutions. The global environmental liability insurance market was valued at $13.5 billion in 2023 and is projected to reach $20.3 billion by 2030, growing at a CAGR of 6.0% from 2024 to 2030.

ESG considerations are significantly impacting the insurance industry. Investors are increasingly prioritizing ESG factors, with ESG-focused assets reaching $40.5 trillion globally by the end of 2024. Ryan Specialty Group, as a major player, needs to address sustainability to attract investment and maintain a positive public image. Regulatory changes, such as those proposed by the SEC, also push companies to disclose ESG data, influencing operational and investment strategies.

Resource Scarcity and Supply Chain Impacts

Environmental factors like resource scarcity and ecosystem disruptions pose significant risks to supply chains. Such issues can trigger business interruptions, increasing demand for specialized insurance. Ryan Specialty Group, for example, could see increased demand for coverages related to these risks. The World Economic Forum highlights that over half of global GDP is moderately or highly dependent on nature.

- Increased insurance demand due to supply chain disruptions.

- Ryan Specialty Group's potential to provide relevant insurance coverages.

- Over half of global GDP is dependent on nature.

Public Awareness and Environmental Activism

Public awareness of environmental issues is growing, fueled by media coverage and advocacy. This heightened awareness prompts more scrutiny of companies' environmental practices. Environmental advocacy groups are becoming more active, potentially leading to increased legal and regulatory pressures. This impacts the types of risks that need insurance coverage, especially for companies like Ryan Specialty Group that deal with risk transfer.

- Global ESG assets reached $40.5 trillion in 2022, showing rising investor interest.

- The US saw a 25% increase in environmental litigation cases from 2020 to 2023.

- Environmental fines and penalties in the EU increased by 15% in 2024.

Environmental factors significantly affect Ryan Specialty Group. Extreme weather, costing $380B in 2023, drives up insurance claims. Evolving environmental regulations boost demand for niche insurance, with the market projected at $20.3B by 2030. Growing ESG focus, reaching $40.5T in assets by 2024, influences operations and investment strategies.

| Environmental Factor | Impact | 2024/2025 Data/Projection |

|---|---|---|

| Climate Change | Increased claims; risk assessment | Natural disaster costs in 2023: $380B |

| Environmental Regulations | Increased demand for insurance | Global liability market: $20.3B by 2030 (CAGR: 6.0%) |

| ESG Considerations | Impact on investment and operations | ESG-focused assets: $40.5T globally by end of 2024 |

PESTLE Analysis Data Sources

The PESTLE analysis uses a combination of financial reports, regulatory databases, and market research. Data is sourced from reputable industry publications, government reports, and economic forecasts.