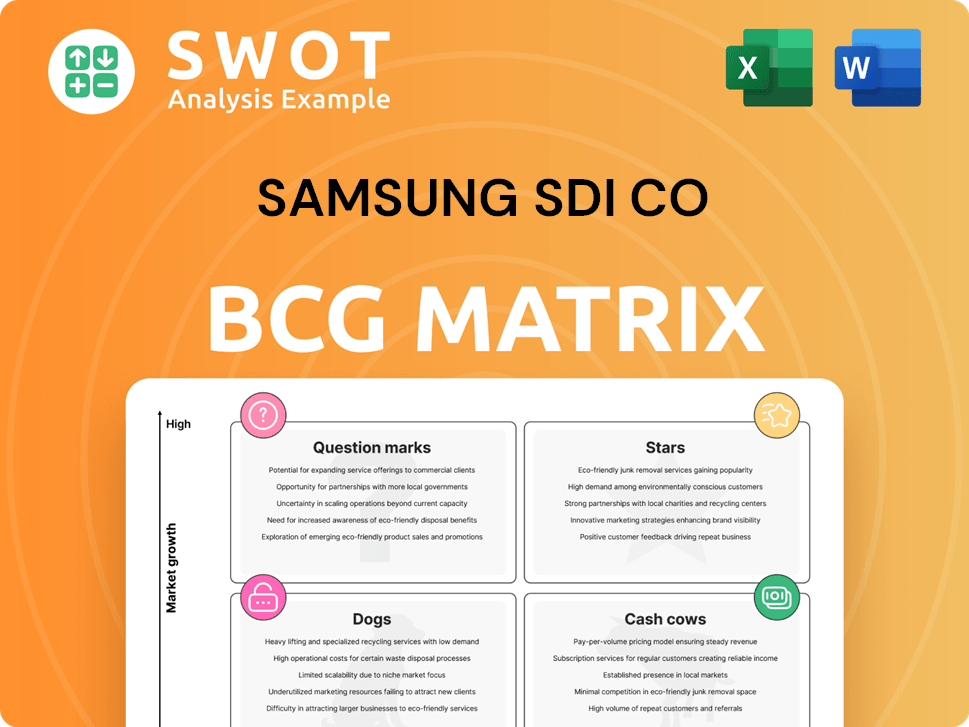

Samsung SDI Co Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung SDI Co Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

Export-ready design for quick drag-and-drop into PowerPoint of Samsung SDI's BCG Matrix.

What You See Is What You Get

Samsung SDI Co BCG Matrix

The preview mirrors the Samsung SDI Co BCG Matrix you'll receive after purchase. This comprehensive report offers a detailed market analysis and strategic insights, ready for immediate application.

BCG Matrix Template

Samsung SDI Co's BCG Matrix reveals its product portfolio's strategic landscape. Analyze the company's strengths and weaknesses within the market. Identifying Stars, Cash Cows, Dogs, and Question Marks is key. This preview scratches the surface of its strategic potential.

The full BCG Matrix offers quadrant-specific insights and actionable recommendations. Uncover the strategic allocation of resources, with a detailed breakdown of its quadrant placements.

Purchase now and get instant access to a beautifully designed BCG Matrix. It offers deep data analysis and ready-to-present formats, helping you plan smarter, faster, and more effectively.

Stars

Samsung SDI's NCA batteries, like the PRiMX680-EV, lead in energy density. These are used in BMW's i4, i5, i7, and iX models; the i5 sales have been successful. The company's focus on NCA tech and partnerships with OEMs like GM and Stellantis is a strategic move. In Q3 2024, Samsung SDI's battery sales saw a 15% increase.

Samsung SDI's ESS solutions, including those for UPS and power, are experiencing substantial growth. Record revenues in 2024 were fueled by North American data center demand. The Samsung Battery Box (SBB) 1.5, with higher energy density, is a key driver. Securing large projects, like the NextEra Energy deal, is a testament to their success.

Samsung SDI's SSB tech is a "Star" in its BCG matrix. Prototypes boast 500 Wh/kg energy density and enhanced safety. A pilot line is active, with mass production slated for 2027. This positions them for significant EV market growth.

Advanced Materials for Semiconductor Manufacturing

Samsung SDI's advanced materials for semiconductor manufacturing is a star in its BCG matrix. This segment benefits from rising demand in the AI sector, driving stable growth. The company focuses on technological advancements and improved business conditions for sustainable expansion. The semiconductor industry's growth and complex chip manufacturing processes further fuel this star's potential.

- Samsung SDI's revenue in 2023 was approximately 22.1 trillion KRW.

- The semiconductor materials market is projected to reach $80 billion by 2024.

- Samsung SDI's investment in R&D in 2023 was about 1 trillion KRW.

P6 Prismatic Batteries

Samsung SDI's P6 prismatic batteries, utilizing NCA cathodes with 91% nickel, target premium EVs. These batteries are expanding in the U.S. market via joint ventures and OEM deals. The P6 is crucial for boosting profitability in Samsung SDI's auto battery sector. In 2024, Samsung SDI reported a 33% increase in EV battery sales.

- NCA cathode batteries are known for high energy density.

- The P6 batteries are key for Samsung SDI's expansion in the U.S. market.

- Strategic partnerships are vital for battery production and sales.

- Samsung SDI aims to increase its market share in the EV battery sector.

Samsung SDI's SSB technology is a "Star". Prototypes have 500 Wh/kg energy density. Mass production is set for 2027, aligning with anticipated EV market growth.

| Feature | Details | Data |

|---|---|---|

| Energy Density (prototype) | SSB Tech | 500 Wh/kg |

| Production Start | SSB Tech | 2027 (Planned) |

| R&D Investment (2023) | Samsung SDI | ~1 trillion KRW |

Cash Cows

Samsung SDI's cylindrical batteries, like the 21700 PRiMX50U-Power, are key for power tools and specialty vehicles. These batteries provide long life and fast charging, securing a strong market position. Despite inventory corrections, this segment is still a steady revenue and cash flow source. For example, in 2024, this segment generated approximately $1.5 billion in revenue.

Samsung SDI, a key player in OLED materials, competes with UDC, DuPont, and LG Chem. The OLED market is growing, fueled by OLED tech in smartphones and TVs. Samsung SDI aims to boost OLED material supply for its major customers. In 2024, the OLED display market was valued at $35.8 billion.

Although Samsung SDI sold its polarizer film business to Wuxi Hengxin Optoelectronic Materials, it was once a cash cow, consistently generating revenue. This strategic divestiture allowed Samsung SDI to concentrate on its core battery and semiconductor material businesses. The sale proceeds, as of late 2024, are earmarked for investments in advanced battery tech and OLED materials. This move reflects a shift toward higher-growth sectors.

Legacy IT Device Batteries

Samsung SDI's legacy IT device batteries represent a Cash Cow within its BCG Matrix. This segment, including batteries for laptops and other traditional devices, generates consistent revenue. While growth is modest compared to electric vehicle (EV) and energy storage system (ESS) batteries, it offers stable cash flow with low investment needs. The focus is on operational efficiency to sustain profitability.

- In 2023, Samsung SDI's revenue from IT device batteries was approximately $1.5 billion.

- The operational profit margin for this segment hovers around 10-12%.

- Market growth is estimated at a steady 2-3% annually.

- Samsung SDI aims to reduce production costs by 5% in 2024.

Partnerships with Established Automakers

Samsung SDI's partnerships with automakers like BMW and Audi are crucial for its "Cash Cow" status. These long-term supply agreements offer a reliable revenue source. Although sales of specific models may vary, the consistent support from these established clients ensures a steady income stream for Samsung SDI. Maintaining and adapting to these key relationships is vital for business stability.

- Samsung SDI reported a 2024 revenue of $16.8 billion, with a significant portion from automotive batteries.

- BMW and Audi are among the top 10 global automakers, ensuring a high demand for batteries.

- Long-term supply agreements typically span 5-7 years, providing revenue predictability.

Samsung SDI's Cash Cows include legacy IT device batteries and partnerships with automakers. These segments generate steady revenue with stable profit margins. While growth is modest, they provide consistent cash flow, crucial for funding investments in high-growth areas. They focus on operational efficiency and maintaining key partnerships.

| Segment | Key Feature | 2024 Revenue (approx.) |

|---|---|---|

| IT Device Batteries | Stable revenue, low investment | $1.5 billion |

| Automotive Partnerships | Long-term supply agreements | Significant portion of $16.8 billion |

| Operational Profit Margin | 10-12% (IT Device Batteries) | N/A |

Dogs

Samsung SDI's power tool battery contracts are facing headwinds, with customer inventory adjustments and decreased demand growth impacting performance. These contracts, potentially classified as "dogs" in the BCG matrix, may consume resources without yielding substantial profits. In 2024, the power tool market saw a 5% decrease in sales, intensifying the need for strategic contract evaluation. The company must consider divestiture or restructuring to boost profitability.

In Samsung SDI's BCG matrix, declining display materials, especially those for LCDs, represent potential "Dogs." Demand and market share are shrinking. LCD materials face reduced profitability as the industry adopts OLED. Samsung SDI should reallocate resources from these segments. In 2024, LCD panel sales decreased by 15% globally.

Dogs in Samsung SDI's portfolio represent early-stage investments with low traction. These may include niche applications or technologies that haven't gained market share. For instance, investments in solid-state battery tech, if underperforming, would fall under this category. In 2024, Samsung SDI allocated $1.5 billion to R&D. A review is crucial to decide if continued funding is viable or if resources should be reallocated.

Small Battery Business (Specific Areas)

Samsung SDI's small battery business faces challenges. Mobile sector inventory adjustments can impact performance. Declining quarterly revenue necessitates strategic realignment. Focus on power tools and specialty vehicles is crucial.

- Q3 2023: Samsung SDI's battery unit saw revenue decline.

- 2024 Forecast: Growth in power tools and EVs expected.

- Strategic Shift: Prioritizing high-growth segments is key.

- Market Dynamics: Adapting to mobile market fluctuations is vital.

Polarizer Films (Prior to Divestiture)

Prior to the divestiture, Samsung SDI's polarizer film business faced strategic adjustments, potentially identifying underperforming segments. This could involve films with dwindling demand or becoming obsolete. The sale aimed to shed these underperforming assets, streamlining operations. In 2024, Samsung SDI might have reevaluated its polarizer film portfolio.

- Strategic realignment to boost profitability.

- Focus on core battery and material businesses.

- Elimination of non-core business segments.

- Enhance resource allocation efficiency.

In Samsung SDI's BCG matrix, "Dogs" include underperforming business segments. Power tool battery contracts may be classified as dogs due to customer inventory issues and diminished growth, with a 5% market sales decrease in 2024. Declining display materials, especially LCDs, also represent dogs, facing reduced profitability amid the OLED shift; LCD panel sales fell 15% globally in 2024.

| Category | 2024 Performance | Strategic Implication |

|---|---|---|

| Power Tool Batteries | 5% Sales Decrease | Evaluate Contract Viability |

| LCD Materials | 15% Sales Decrease | Reallocate Resources |

| Early-Stage Investments | $1.5B R&D Allocation | Assess Funding Viability |

Question Marks

Samsung SDI is strategically investing in Lithium Iron Phosphate (LFP) batteries. This move addresses the soaring demand for affordable and safe batteries. LFP batteries are key for ESS and entry-level EVs.

Samsung SDI is venturing into 46-phi cylindrical batteries, targeting micro-mobility, with mass production slated for early 2025. This strategic move addresses growing market needs. Securing more clients and broader applications could elevate these batteries to a Star status within Samsung SDI's portfolio. Currently, the micro-mobility market is valued at approximately $20 billion globally in 2024.

Samsung SDI's electronic materials division targets next-gen semiconductor materials, aiming at the AI market. These materials, though promising, have a low market share currently. R&D and partnerships are vital for growth, with the global semiconductor market valued at $526.5 billion in 2024. Samsung SDI's investment in this area is a strategic move to capture future market gains.

All-Solid-State Batteries (Early Stage)

Samsung SDI's all-solid-state battery (ASSB) technology is currently classified as a Question Mark in its portfolio. This designation reflects the high potential but also the significant uncertainties associated with its development. Samsung SDI is investing heavily in ASSB, with a pilot line in operation and a target for mass production by 2027. The success of ASSB hinges on overcoming technical hurdles and scaling up production.

- Investment: Samsung SDI has allocated substantial resources to ASSB research and development.

- Timeline: The company aims to commence mass production by 2027.

- Challenges: Technical and manufacturing complexities pose significant challenges.

- Potential: Successful commercialization could transform ASSB into a Star.

Emerging Markets (e.g., India E2Wheelers)

Samsung SDI eyes the Indian E2Wheeler market, a new growth area for small batteries. Success hinges on adapting products, forming partnerships, and handling competition. This aligns with the BCG matrix's question mark quadrant, representing high-growth, low-market-share ventures. The E2Wheeler segment in India is experiencing rapid expansion.

- The Indian electric two-wheeler market is projected to reach $10.5 billion by 2027.

- Samsung SDI faces competitors like LG Energy Solution and CATL.

- Partnerships with local manufacturers are crucial for market penetration.

- Adapting battery technology to withstand India's climate is essential.

Samsung SDI's Question Marks involve high-potential ventures with low market shares. Investments include ASSB, aiming for mass production by 2027. Successful commercialization is crucial. The Indian E2Wheeler market is a key focus, projected at $10.5B by 2027.

| Venture | Status | Market Value (2024) |

|---|---|---|

| ASSB | Question Mark | N/A (Emerging Tech) |

| Indian E2Wheeler | Question Mark | Growing, est. $2B |

| Next-Gen Semiconductor Materials | Question Mark | $526.5B (Semiconductor) |

BCG Matrix Data Sources

The Samsung SDI Co BCG Matrix draws from financial reports, market analyses, and industry forecasts, ensuring accurate, reliable quadrant placement.