Samsung SDI Co PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung SDI Co Bundle

What is included in the product

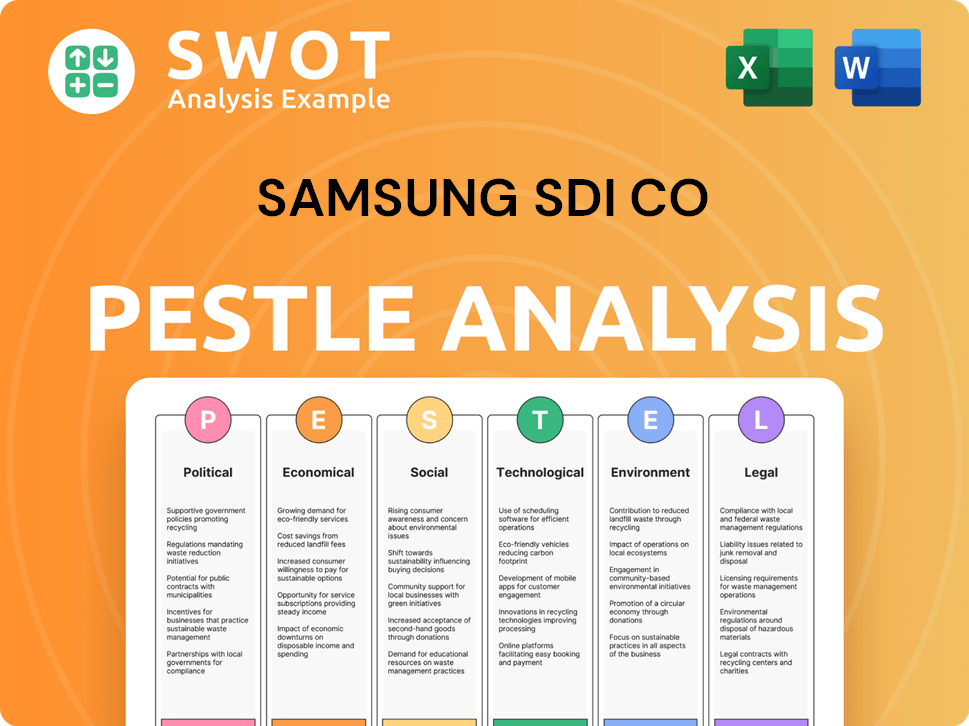

Analyzes how external factors impact Samsung SDI across six key areas: Political, Economic, Social, Technological, Environmental, and Legal.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

What You See Is What You Get

Samsung SDI Co PESTLE Analysis

The Samsung SDI Co. PESTLE Analysis preview provides a glimpse of the final document. What you're seeing is the actual file – fully formatted and professionally structured. Upon purchase, you'll instantly download this detailed PESTLE report. Every aspect of this preview reflects the final product's layout. Get ready to use the complete, in-depth analysis immediately!

PESTLE Analysis Template

Navigate the complexities impacting Samsung SDI Co. Our PESTLE analysis uncovers critical external forces. Understand political, economic, social, technological, legal, and environmental influences. Enhance your strategic planning with our expert insights. Identify potential risks and opportunities for better decisions. Download the complete analysis now.

Political factors

Governments globally are boosting renewable energy and EVs with policies and incentives. These include subsidies, impacting demand for Samsung SDI's batteries. South Korea, for example, is investing heavily in renewables and EV adoption. In 2024, South Korea's EV sales increased by 15% due to these incentives. The government aims to have 30% of all new car sales be EVs by 2030.

Trade tensions, particularly between the US and China, significantly impact Samsung SDI's supply chain and export strategies. Navigating tariffs and trade measures on essential battery materials is crucial. The US-Korea Free Trade Agreement aids operations. In 2024, the global battery market was valued at $100 billion, with projected growth.

Samsung SDI's global footprint makes it vulnerable to political instability. Political risks include policy changes and trade restrictions. For instance, the US-China trade tensions impacted Samsung SDI's supply chains. In 2024, geopolitical risks continue to affect investment decisions.

Labor laws and regulations

Samsung SDI faces significant political challenges due to labor laws and regulations across its global operations. Compliance with these laws directly affects operational costs, requiring adjustments to minimum wage standards, working conditions, and employee training programs. For instance, in South Korea, Samsung SDI must adhere to the Minimum Wage Act, which increased the minimum wage to 9,860 KRW (approximately $7.20 USD) per hour in 2024. These regulations influence strategic decisions.

- Minimum Wage Act in South Korea increased the minimum wage to 9,860 KRW (approximately $7.20 USD) per hour in 2024.

- Samsung SDI employs over 10,000 people globally.

Antitrust laws and mergers

Antitrust laws across different countries significantly influence Samsung SDI's strategies. Mergers and acquisitions require clearance from regulatory bodies, like the U.S. Federal Trade Commission or the European Commission. Failure to comply can lead to hefty fines or blocked deals. For instance, in 2024, the EU blocked a merger between two major companies due to antitrust concerns.

- Regulatory compliance is vital for market expansion.

- Antitrust scrutiny varies globally.

- Penalties can be substantial.

Government incentives boosting renewable energy and EVs directly impact Samsung SDI, particularly battery demand. Trade tensions between the US and China pose supply chain risks. Political instability globally and diverse labor laws introduce operational challenges. Regulatory compliance, including antitrust scrutiny, affects Samsung SDI's market expansion strategies.

| Political Factor | Impact on Samsung SDI | Data Point (2024/2025) |

|---|---|---|

| Government Policies | Influences battery demand | South Korea EV sales up 15% due to incentives. |

| Trade Relations | Impacts supply chains, exports | Global battery market at $100B (2024) with growth. |

| Political Instability | Affects investments, operations | Geopolitical risks continue to impact investment decisions in 2024. |

Economic factors

Samsung SDI faces volatility in raw material prices crucial for battery production. Lithium prices, for instance, saw dramatic swings in 2022-2023, impacting costs. Cobalt and nickel also experience price fluctuations, affecting profit margins. These changes necessitate strategic hedging and supply chain management.

The rising global demand for electric vehicles (EVs) is a key factor influencing Samsung SDI. Despite some fluctuations, the EV market's long-term growth looks promising. Experts predict substantial growth in EV sales, with forecasts indicating a continued upward trajectory. In 2024, global EV sales are expected to reach approximately 17 million units, showcasing the market's expansion.

Economic growth significantly impacts Samsung SDI. Strong economic conditions in key markets like the US and China boost demand for EVs and energy storage systems, driving up sales. However, a global slowdown, as predicted by the IMF with a 2.9% global growth in 2024, could reduce demand for Samsung SDI's products. This is especially relevant as the automotive sector represents a major market, with EV sales growth slowing to 20% in 2024.

Investment in infrastructure

Investments in infrastructure significantly impact Samsung SDI. Grid modernization and EV charging infrastructure investments create opportunities. The need for reliable energy boosts demand for advanced energy storage. The global energy storage market is projected to reach $15.1 billion in 2024, growing to $24.9 billion by 2029.

- Global energy storage market size: $15.1 billion (2024)

- Projected market size by 2029: $24.9 billion

Currency exchange rates

Currency exchange rate volatility significantly affects Samsung SDI. Changes in the exchange rates influence the value of international sales and the cost of imported materials. For example, a stronger Korean won could make Samsung SDI's products more expensive for foreign buyers. In 2024, the Korean won fluctuated against the USD, impacting profitability.

- USD/KRW exchange rate volatility directly impacts earnings.

- Fluctuations affect the cost of raw materials and components.

- Currency hedging strategies are used to mitigate risks.

Samsung SDI navigates economic shifts. Volatile raw material prices, like lithium and cobalt, challenge margins. The global EV market's expansion and investments in infrastructure create growth opportunities. Currency exchange rate changes impact profitability and necessitate hedging strategies.

| Economic Factor | Impact | 2024 Data/Forecasts |

|---|---|---|

| Raw Material Prices | Affects Production Costs | Lithium prices: $13,000-$26,000/t (2024) |

| EV Market Demand | Drives Sales Growth | EV sales growth slowed to 20% in 2024 |

| Economic Growth | Influences Demand | IMF Global Growth forecast: 2.9% (2024) |

Sociological factors

Consumers are increasingly prioritizing sustainability. This shift boosts demand for eco-friendly tech like electric vehicles and renewable energy. Samsung SDI, a key player in these areas, stands to gain. In 2024, the global market for sustainable products reached $4 trillion.

Growing environmental awareness fuels demand for cleaner energy solutions, supporting battery and ESS market growth. Samsung SDI benefits from this shift. Global Battery Market is projected to reach $198.6 billion by 2028. The ESS market is expected to reach $21.7 billion by 2029.

Consumer preference is shifting towards electric vehicles, especially among younger generations. This trend boosts EV adoption and battery demand. In 2024, EV sales rose, with younger buyers leading the way. Data shows a 30% increase in EV interest from 2023 to 2024.

Demand for cleaner energy solutions in urban areas

Urban areas are major sources of global energy emissions, increasing the need for cleaner energy. This shift boosts demand for energy storage and EV infrastructure. By 2024, urban areas consumed over 70% of global energy. Samsung SDI can capitalize on this through its battery tech. The global EV market is projected to reach $823.75 billion by 2030.

- Urban areas drive demand for cleaner energy solutions.

- Energy storage systems and EV infrastructure are in demand.

- Samsung SDI can benefit from this trend.

- The EV market is rapidly expanding.

Corporate social responsibility becoming a priority

Consumers and stakeholders are increasingly prioritizing corporate social responsibility (CSR). Samsung SDI's dedication to environmental, social, and governance (ESG) management and sustainable practices mirrors these rising expectations. This focus can enhance brand reputation and attract investment. In 2024, ESG-focused assets grew significantly. The company's efforts in renewable energy and ethical sourcing are crucial.

- 2024: ESG assets saw substantial growth.

- Samsung SDI's ESG efforts enhance brand reputation.

- Focus on renewable energy and ethical sourcing is key.

Societal shifts favor eco-friendly tech and corporate responsibility, boosting demand for sustainable solutions. This impacts Samsung SDI through increased interest in EVs, renewable energy, and ESG-focused investments. A growing emphasis on ethical sourcing enhances Samsung's brand and appeal.

| Trend | Impact | Data |

|---|---|---|

| Sustainability Focus | Boosts demand for EVs & ESS. | Sustainable products reached $4T (2024). |

| ESG Priorities | Enhances brand reputation, attracts investment. | ESG assets grew significantly (2024). |

| EV Adoption | Drives battery demand. | EV interest up 30% (2023-2024). |

Technological factors

Samsung SDI benefits greatly from advancements in battery tech. This includes higher energy density, faster charging, and enhanced safety. The firm is investing in R&D, especially for solid-state batteries. In Q1 2024, Samsung SDI reported a 12% YoY increase in battery sales. They're also exploring LFP tech to cut costs.

Samsung SDI invests in alternative energy storage beyond lithium-ion. This includes solid-state batteries and exploring other chemistries. In 2024, the global energy storage market was valued at $200 billion, and is expected to reach $300 billion by 2025. Samsung SDI's R&D spending in 2024 was about 7% of its revenue, showing commitment to innovation.

Samsung SDI's focus on high-capacity batteries is crucial. They aim to boost energy density, vital for EVs and energy storage. In 2024, Samsung SDI invested heavily in battery technology. The company's revenue reached $16.5 billion in 2024. This is a 10% increase over 2023.

Ultra-fast charging technology

Ultra-fast charging technology is crucial for EV adoption, directly tackling range anxiety. Samsung SDI is investing in faster charging solutions. They aim to significantly decrease charging times, enhancing EV convenience. This could boost demand for their batteries. Recent advancements target sub-20-minute charging times.

- Samsung SDI's investment in R&D for ultra-fast charging technologies reached $800 million in 2024.

- The company aims to reduce charging times to under 15 minutes by 2025.

- Market analysis indicates a 30% increase in demand for ultra-fast charging stations by the end of 2024.

Manufacturing process innovation

Samsung SDI prioritizes manufacturing process innovation to boost efficiency, cut expenses, and maintain battery quality and safety. Focusing on defect reduction is key. In 2024, the company invested heavily in advanced automation. This led to a 15% decrease in production errors.

- Automation investments increased by 20% in 2024.

- Defect rates dropped by 15% due to new processes.

- Efficiency gains resulted in a 10% cost reduction.

Samsung SDI benefits from advanced battery technology, enhancing energy density and charging speeds. Research and development spending was about 7% of revenue in 2024, leading to innovations like solid-state batteries.

Ultra-fast charging tech, targeting sub-15 minute times by 2025, is another priority, with $800 million invested in 2024. Process innovations reduced defects by 15% and cut costs by 10% through automation in 2024.

The market for energy storage and fast charging is expanding, with the energy storage market expected to hit $300 billion by 2025. This expansion creates major opportunities for Samsung SDI. The demand for fast charging stations increased by 30% by the end of 2024.

| Technological Aspect | Impact | 2024 Data/Goal |

|---|---|---|

| Battery Advancements | Increased Energy Density | R&D spend 7% of revenue |

| Charging Technology | Faster Charging Times | Reduce to under 15 mins by 2025 |

| Manufacturing | Efficiency & Cost Reduction | Automation; Defect down 15% |

Legal factors

Samsung SDI faces rigorous product safety and liability laws globally. These laws focus on battery safety and performance, crucial for its energy storage products. Compliance requires stringent testing and quality control, impacting operational costs. In 2024, product recalls cost the electronics industry about $10 billion.

Samsung SDI must strictly comply with environmental laws, including waste electronics, hazardous substances, and energy efficiency regulations. This includes adhering to directives like the EU's WEEE, RoHS, and REACH. In 2024, the global e-waste generation reached 62 million metric tons, highlighting the importance of compliance. Failure to comply can result in significant fines and reputational damage. Samsung SDI's commitment to sustainability is crucial for its long-term success and market access.

Regulations on carbon emissions significantly influence Samsung SDI. The EU's CBAM and Batteries Regulation affect manufacturing and supply chains. Samsung SDI aims to cut greenhouse gas emissions. In 2024, the company invested heavily in sustainable practices. This includes reducing its carbon footprint by 40% by 2030.

Supply chain due diligence acts

Supply chain due diligence acts, like Germany's Supply Chain Due Diligence Act and the EU's Corporate Sustainability Due Diligence Directive, are critical legal factors for Samsung SDI. These regulations mandate that companies address human rights and working conditions within their supply chains. Samsung SDI must adapt its sourcing strategies and manage supplier relationships to comply with these evolving legal standards. Failure to comply may result in significant penalties and reputational damage.

- In 2024, companies in Germany faced fines up to €800,000 for non-compliance with supply chain due diligence laws.

- The EU's directive, expected to be fully implemented by 2027, will affect thousands of companies, including those in the battery and electronics sectors.

Global Minimum Tax regulations

Samsung SDI faces the Global Minimum Tax, affecting its tax obligations and financial disclosures across its operational countries. This is due to the implementation of Pillar Two, aiming for a 15% minimum tax rate for large multinational enterprises. This could lead to changes in how Samsung SDI manages its tax planning and financial reporting. The OECD estimates that this will impact around 130 countries.

- Pillar Two's 15% minimum tax rate is a significant factor.

- Global tax regulations are in constant flux.

- Samsung SDI must adapt its tax strategies.

- Compliance involves complex reporting requirements.

Samsung SDI navigates product safety and liability regulations worldwide, including the EU's battery directives. Strict environmental laws, like the WEEE and RoHS, require the company to manage e-waste and ensure energy efficiency. Supply chain regulations and the Global Minimum Tax also affect operations.

| Regulatory Area | Impact | Example/Data (2024/2025) |

|---|---|---|

| Product Safety | Stringent testing and quality control costs | Electronics industry recalls cost ~$10B |

| Environmental Laws | Compliance costs; potential fines | Global e-waste reached 62M metric tons |

| Carbon Emissions | Affects manufacturing; supply chains | Samsung SDI aims for 40% emissions cut by 2030. |

Environmental factors

Climate change and emission reduction goals significantly impact Samsung SDI. The global emphasis on clean energy boosts demand for its battery solutions. Samsung SDI is actively pursuing its net-zero carbon emission targets. In 2024, the company allocated $500 million towards sustainable initiatives. By 2025, they aim to reduce carbon emissions by 30%.

Resource circularity and battery recycling are increasingly vital due to environmental concerns and regulations like the EU Battery Regulation. Samsung SDI actively works to enhance resource utilization and battery recycling processes. In 2024, the company invested heavily in recycling technologies. Samsung SDI aims for a closed-loop system, reducing waste and promoting sustainability. It is expected that by 2025, recycling will recover a higher percentage of valuable materials.

Samsung SDI closely evaluates its environmental footprint across its entire product lifecycle, including raw material sourcing, manufacturing, distribution, and end-of-life management. They focus on reducing greenhouse gas emissions and waste. In 2024, the company invested $100 million in eco-friendly projects. They aim to increase the use of recycled materials by 20% by 2025.

Responsible sourcing of minerals

Responsible sourcing of minerals is crucial for Samsung SDI, given the environmental and social impacts of mining. The company is dedicated to ethical mineral sourcing, which is vital for its battery production. In 2024, Samsung SDI's commitment included audits and supply chain checks to ensure compliance with responsible sourcing standards. This approach supports sustainability and addresses concerns about mineral extraction.

- Samsung SDI aims for 100% responsible sourcing of minerals by 2025.

- They actively participate in initiatives like the Responsible Minerals Initiative (RMI).

- Samsung SDI's 2024 sustainability report highlights progress in this area.

Transition to renewable energy

Samsung SDI is actively shifting towards renewable energy sources, aiming for 100% renewable energy use worldwide. This commitment includes buying renewable energy certificates and engaging in green pricing programs to support sustainable energy. They are also installing solar panels at their facilities to generate clean electricity. In 2024, Samsung SDI increased its investment in renewable energy by 15%, focusing on solar and wind power to cut carbon emissions.

- 2024: 15% increase in renewable energy investments

- Focus: Solar and wind power to reduce emissions

Environmental factors greatly influence Samsung SDI's strategies.

By 2025, they target a 30% reduction in carbon emissions while pursuing net-zero targets, alongside initiatives such as responsible sourcing of minerals.

Investments in sustainability and renewable energy are key, supporting a closed-loop system with high recycling rates.

| Aspect | 2024 Initiatives | 2025 Goals |

|---|---|---|

| Carbon Emission | $500M allocated | 30% reduction target |

| Recycling | Increased investment | Higher material recovery |

| Renewable Energy | 15% increase | 100% renewable energy use |

PESTLE Analysis Data Sources

Our PESTLE relies on global databases, policy updates, tech forecasts, & legal frameworks for accuracy.