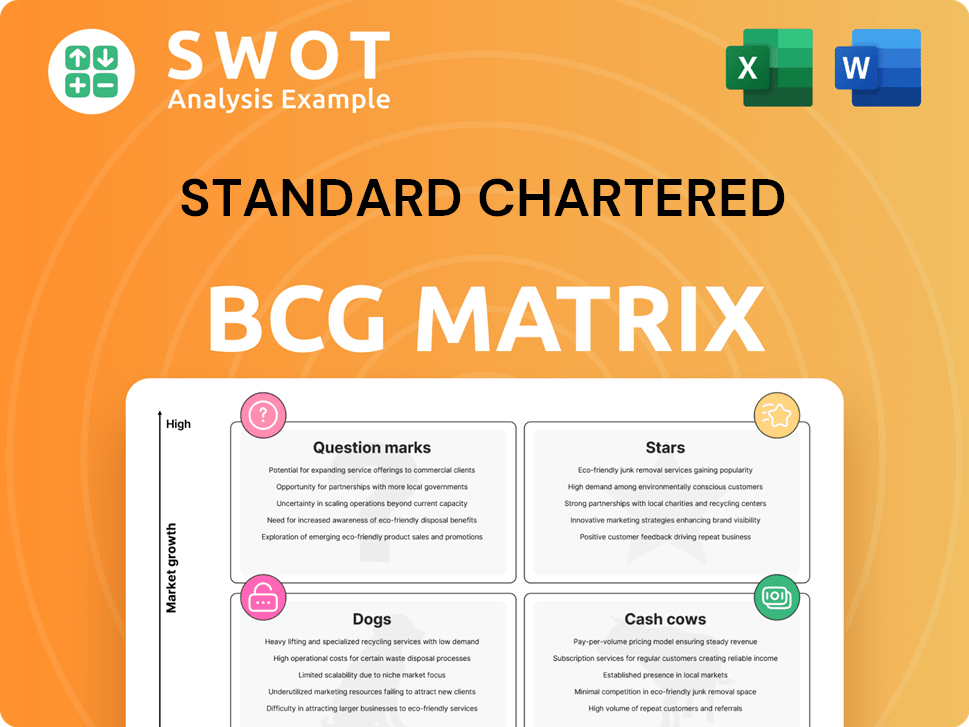

Standard Chartered Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Standard Chartered Bundle

What is included in the product

Analysis of Standard Chartered's business units using the BCG Matrix model.

Printable summary optimized for A4 and mobile PDFs, makes sharing the data easy.

Delivered as Shown

Standard Chartered BCG Matrix

The BCG Matrix preview mirrors the purchased document. Expect a comprehensive analysis-ready file upon purchase, exactly as seen, with no hidden content or alterations.

BCG Matrix Template

Standard Chartered’s BCG Matrix offers a snapshot of its product portfolio’s market position. Identifying Stars, Cash Cows, Dogs, and Question Marks provides strategic clarity. Understanding these quadrants reveals growth potential and resource allocation needs. This brief overview hints at crucial investment and divestment strategies. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Standard Chartered's wealth solutions, including investment products and bancassurance, are booming. In 2024, these solutions saw a significant year-on-year increase, fueled by affluent clients. The bank is strategically investing in this area to boost client acquisition. This focus aims to significantly increase wealth solutions-related income, positioning it as a key revenue driver.

Standard Chartered is pivoting towards corporate and investment banking, prioritizing major businesses and multinational clients. This strategy involves capital structuring, debt markets, and financial advisory services, aiming for significant growth. Government and institutional partnerships are key, driving bigger transactions and cross-border deals. In 2024, the bank's corporate and institutional banking income rose, indicating progress.

Standard Chartered is boosting its digital banking using AI to enhance customer experience. This includes AI-driven FX insights and improved mobile apps. In 2024, digital transactions surged, reflecting its growing customer base and commitment to digital innovation. The bank's digital strategy is key for long-term expansion.

Sustainable Finance Initiatives

Standard Chartered's sustainable finance initiatives shine brightly, aligning with its strategic focus. The bank aims to mobilize $300 billion in sustainable finance by 2030. This commitment drives investment in renewable energy and green infrastructure. It positions Standard Chartered as a leader in the low-carbon transition.

- Mobilized $62.6 billion in sustainable finance between 2020 and 2023.

- Targets include financing renewable energy projects.

- Focus on climate-positive initiatives.

- Supports a low-carbon economy transition.

Emerging Market Expansion

Standard Chartered's BCG Matrix highlights strong positions in emerging markets. The bank strategically expands in Asia, Africa, and the Middle East, aiming for growth. Their initiatives include India, where a large part of their social assets are. This focus reflects the bank's strategic direction for future growth.

- 2024: Standard Chartered saw increased income from Asia, a key emerging market.

- India's market share is crucial for Standard Chartered's expansion strategy.

- The bank invests heavily in digital banking across emerging markets.

- Standard Chartered's strategy emphasizes sustainable finance in emerging economies.

Stars represent high-growth, high-market-share businesses, a prime target for investment.

Standard Chartered's digital and wealth solutions, along with sustainable finance, are prime examples.

These sectors showed robust growth in 2024, positioning them as "Stars".

| Sector | 2024 Growth | Strategic Implication |

|---|---|---|

| Digital Banking | Surge in Transactions | Continued Investment |

| Wealth Solutions | Significant YoY Increase | Client Acquisition Focus |

| Sustainable Finance | $62.6B Mobilized (2020-2023) | Low-Carbon Transition Leader |

Cash Cows

Transaction banking at Standard Chartered functions as a cash cow, generating consistent revenue. It offers essential services like trade finance and cash management. This segment helps to stabilize overall profitability. In 2024, transaction banking accounted for a significant portion of the bank's income, with a steady growth of 5%.

Standard Chartered's Global Markets division is a strong performer, boosting overall revenue through trading in fixed income and foreign exchange. The division's robust financial market income is a significant contributor, acting as a key cash cow. In 2024, this division generated approximately $3.5 billion in revenue, demonstrating its financial strength.

Standard Chartered's mortgage and loan products are cash cows, providing consistent revenue. These offerings target individuals and businesses, ensuring a stable income source. In 2024, the bank's loan portfolio generated significant interest income, contributing to its financial stability. Effective management and competitive rates are key to their enduring profitability.

Deposit Accounts

Deposit accounts are central to Standard Chartered's retail operations, offering a reliable funding source. These accounts consistently generate income through interest and fees. The bank’s deposit base is key to its financial stability. In 2024, Standard Chartered's total customer deposits reached approximately $400 billion. Attracting and retaining deposits is crucial for sustaining financial health.

- Stable funding base for operations.

- Consistent revenue generation.

- Important for financial health.

- Customer deposits in 2024: ~$400B.

Wealth and Retail Banking (Mass Market)

Standard Chartered's mass retail banking remains a cash cow, despite a focus on affluent clients. This segment generates stable revenue and acts as a feeder for future high-net-worth clients. In 2024, retail banking contributed significantly to the bank's overall profits. The bank strategically reshapes this business to cultivate a robust base of potential affluent and international clients.

- Steady income from mass market.

- Serves as a pipeline for future affluent clients.

- Strategic reshaping for client base growth.

- Significant contribution to overall profits.

Standard Chartered's diverse cash cows provide robust financial stability. Key segments like transaction banking, global markets, and retail banking consistently generate revenue. Their loan portfolio and deposit accounts further strengthen the bank. These areas ensure a reliable income stream.

| Cash Cow | Contribution | 2024 Data |

|---|---|---|

| Transaction Banking | Essential services | 5% growth |

| Global Markets | Trading income | $3.5B revenue |

| Customer Deposits | Funding base | ~$400B |

Dogs

Non-core retail banking operations at Standard Chartered are categorized as dogs in the BCG matrix. These units may not fit with the bank's affluent client focus. They might need hefty investments but yield low returns. In 2024, Standard Chartered is restructuring its mass retail business. This involves attracting future affluent clients and possibly divesting underperforming retail units.

Underperforming geographies in Standard Chartered's BCG Matrix are those that consistently lag behind the bank's core markets. These areas may struggle with economic downturns or limited growth prospects. For instance, in 2024, certain regions might show lower returns compared to the bank's key markets. Standard Chartered regularly re-evaluates its geographic presence to maximize resource use and boost profitability. In 2024, the bank's net profit was $3.05 billion.

Legacy IT systems at Standard Chartered, characterized by high maintenance costs and limited functionality, fall into the "Dogs" category of the BCG Matrix. These outdated systems impede innovation, affecting the bank's competitiveness. Standard Chartered is actively investing in digital transformation to replace these systems. In 2024, the bank allocated a significant portion of its $3.5 billion technology budget to modernizing its infrastructure, aiming for improved efficiency.

Commodities Trading (Potentially)

In the Standard Chartered BCG matrix, commodities trading, especially in high-emission sectors, could be classified as "Dogs" due to increasing sustainability focus. These areas face heightened regulatory and reputational risks. Standard Chartered aims to cut financed emissions, which may lead to reduced involvement in certain commodity trades. For example, in 2024, the bank's sustainability-linked loan portfolio grew significantly.

- Regulatory scrutiny is increasing, particularly in Europe.

- Reputational risks are significant for high-emission activities.

- Standard Chartered is actively reducing financed emissions.

- Sustainability-linked lending is a growing area.

Small and Medium Enterprise (SME) Lending (in specific low-growth regions)

In low-growth regions, SME lending can be dogs. These portfolios may show low returns and need significant management. Standard Chartered might streamline or reallocate resources. If these loans don't align with strategic goals, they're dogs. The bank's focus is on essential services like healthcare and education.

- SME lending in low-growth areas often yields low returns.

- These require intensive management, impacting profitability.

- Standard Chartered may consider streamlining or reallocating resources.

- Alignment with strategic goals is crucial for portfolio decisions.

Legacy IT systems at Standard Chartered are dogs, requiring high maintenance with limited functionality. These systems hinder innovation and competitiveness. Standard Chartered is modernizing its tech infrastructure with a $3.5 billion budget in 2024.

| Category | Details | Financial Impact (2024) |

|---|---|---|

| IT Modernization Budget | Investment in upgrading outdated IT systems. | $3.5 billion |

| Net Profit | Standard Chartered's overall profitability. | $3.05 billion |

| Tech Budget Allocation | Percentage allocated to infrastructure. | Significant portion |

Question Marks

Standard Chartered's digital asset custody initiatives are question marks in its BCG matrix. These ventures, with high growth prospects, face uncertain market share. Success hinges on regulatory navigation and client adoption. The bank's Luxembourg expansion and digital asset services highlight this category. In 2024, the crypto market cap hit $2.6T; Standard Chartered's moves are strategic.

New sustainable finance products, like green bonds, are question marks within Standard Chartered's BCG matrix. These require substantial investment and marketing to establish market presence. Success hinges on demand and regulatory backing. Standard Chartered aims to mobilize $300 billion in sustainable finance by 2030, backing these initiatives. The bank's 2024 strategy focuses on scaling sustainable products.

Partnerships with fintech firms, like Standard Chartered's collaboration with Linklogis for supply chain finance, fit the "Question Marks" quadrant. These ventures aim to boost digital banking, but success hinges on integration and market acceptance. In 2024, fintech collaborations are booming, with investments reaching billions globally. However, the return on investment remains uncertain.

Expansion into New Wealth Management Segments

Expanding into new wealth management segments, like mass affluent clients, is a question mark in the BCG matrix. These segments offer high growth potential but begin with a low market share. Standard Chartered aims to cultivate future affluent clients through its mass retail business transformation. Attracting and keeping these clients needs specialized products and services. This approach aligns with strategies used by other financial institutions.

- Mass affluent segment is growing, with assets projected to reach $70 trillion globally by 2024.

- Tailored services can increase client retention rates by up to 20%.

- Standard Chartered's wealth management AUM increased by 15% in 2023.

- The cost of acquiring a new affluent client can be high, averaging $5,000-$10,000.

Cross-Border Payment Solutions (Specific to New Markets)

In Standard Chartered's BCG Matrix, new cross-border payment solutions, particularly in emerging markets, are categorized as question marks. These solutions could significantly enhance payment efficiency, but they face challenges like regulatory complexities and strong competition. Standard Chartered actively participates in initiatives such as Nexus, which aims to link domestic instant payment systems globally. This area holds high potential for growth, but its success is uncertain, making it a strategic focus with inherent risks.

- Nexus project aims to connect domestic instant payment systems globally.

- Emerging markets offer significant growth potential for cross-border payments.

- Regulatory hurdles and competition pose challenges.

- Standard Chartered's involvement signifies strategic focus.

Standard Chartered views cross-border payment solutions in emerging markets as question marks in its BCG matrix. These solutions, while promising for efficiency, face regulatory hurdles and stiff competition.

The Nexus project, aimed at connecting global payment systems, is key, with emerging markets showing significant growth potential.

The bank’s strategic focus faces uncertainty, yet its involvement underscores potential. The cross-border payments market is worth $156 trillion.

| Aspect | Details | Impact |

|---|---|---|

| Market Size | $156 Trillion | High Growth Potential |

| Challenges | Regulatory, Competition | Uncertain Success |

| Strategic Focus | Nexus Project | Key Initiative |

BCG Matrix Data Sources

Standard Chartered's BCG Matrix leverages market share & growth data from financial statements, industry reports, and competitive analysis for strategic positioning.