Standard Chartered PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Standard Chartered Bundle

What is included in the product

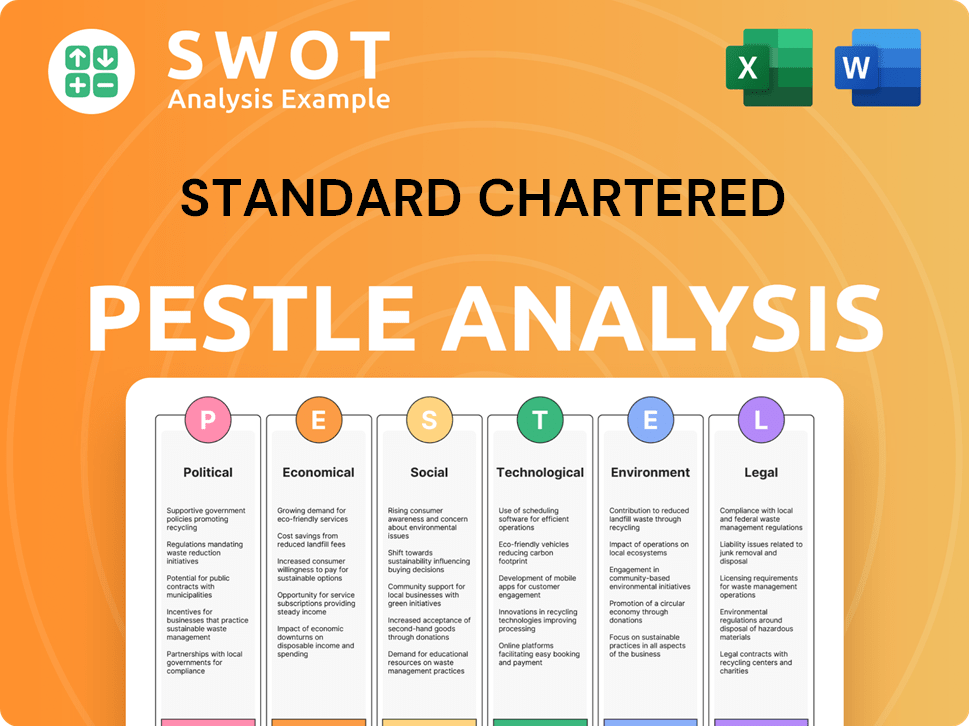

Examines external influences on Standard Chartered: Political, Economic, Social, Tech, Environmental, & Legal.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Same Document Delivered

Standard Chartered PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Standard Chartered PESTLE analysis examines key political, economic, social, technological, legal, and environmental factors. It offers actionable insights relevant to strategic planning. You get the complete, ready-to-use report upon purchase. The displayed analysis is what you'll get.

PESTLE Analysis Template

Navigate the complexities impacting Standard Chartered with our focused PESTLE analysis. Uncover political, economic, social, and technological influences affecting the company's trajectory. This in-depth review identifies key drivers shaping the business environment. Gain strategic foresight into market dynamics and competitive positioning. Enhance your decision-making and stay ahead of industry trends. Get the complete analysis now and unlock crucial insights!

Political factors

Standard Chartered faces geopolitical risks, especially from US-China tensions. Trade wars and disputes can disrupt its operations. In 2024, US-China trade was valued at over $690 billion. These uncertainties affect investment and economic growth. The bank's global presence makes it vulnerable to these shifts.

Standard Chartered's success hinges on government stability in key markets. The UK, Hong Kong, and Singapore, are vital for operations. These regions offer predictable regulatory landscapes, supporting economic growth. In 2024, the UK's political stability is rated highly, with a stable outlook. Hong Kong, despite some uncertainties, maintains a robust financial system. Singapore’s consistent governance further bolsters the bank's prospects.

Standard Chartered faces impacts from shifts in government rules globally. Banking supervision, capital needs, and climate actions are key. For example, the UK's FCA sets strict banking standards. In 2024, climate-related financial risks grew, per the Bank of England. These changes impact costs & compliance.

International Relations and Alliances

Standard Chartered's extensive international presence makes it highly susceptible to global political dynamics. The bank's operations are directly affected by the nature of international relations and strategic alliances. For instance, the evolving relationship between China and various Western nations significantly impacts Standard Chartered's cross-border business. Changes in trade agreements and sanctions policies can either create new market entries or restrict existing ones.

- China's Belt and Road Initiative (BRI) has influenced Standard Chartered's strategic decisions.

- The bank's exposure to geopolitical risks is assessed through regular stress tests.

- Sanctions against Russia have prompted Standard Chartered to reduce its exposure.

- In 2024, Standard Chartered reported a 10% increase in trade finance revenue, reflecting the impact of international trade flows.

Impact of Elections

Major elections, especially in key markets like India and the UK, can significantly impact Standard Chartered. Policy shifts post-election can create both opportunities and challenges for the bank. For instance, changes in tax laws or trade regulations could affect its profitability and operational strategies. The bank closely monitors political developments to adjust its risk assessments and strategic plans accordingly.

- India's 2024 elections saw the BJP retain power, influencing banking regulations.

- The UK's political landscape, with potential shifts in financial regulations, is closely watched.

- Elections in emerging markets can lead to currency fluctuations affecting SCB's earnings.

Political factors significantly influence Standard Chartered. US-China tensions, with $690B trade in 2024, create market uncertainty. Government stability in the UK, Hong Kong, and Singapore supports operations, despite global shifts.

The bank adapts to evolving rules on banking, capital, and climate, facing challenges. Elections in India and the UK affect regulations. The BJP retained power in India's 2024 elections, which influenced banking.

| Political Risk | Impact on SCB | 2024 Data/Example |

|---|---|---|

| US-China Tensions | Trade disruption, market uncertainty | $690B US-China trade |

| Government Stability | Predictable regulatory landscapes | UK stability, Hong Kong robustness |

| Regulatory Changes | Increased costs, compliance needs | BoE: Growing climate financial risks |

Economic factors

Standard Chartered's fortunes hinge on global economic health, especially in Asia, Africa, and the Middle East. The bank's 2024 and 2025 forecasts for GDP growth in these regions are critical. For example, the IMF projects Asia to grow by 4.5% in 2024 and 4.6% in 2025, influencing Standard Chartered's outlook.

Interest rate shifts by central banks like the Federal Reserve and Bank of England impact borrowing costs. In 2024, the Fed held rates steady, while the Bank of England considered cuts. These changes affect loan portfolios and profitability. For example, a 1% rate hike can increase business costs significantly.

Inflation significantly affects consumer purchasing power and business expenses, shaping demand for financial services. In the Eurozone, inflation was 2.4% in March 2024. This can prompt central banks to adjust monetary policy; the ECB held rates steady in April 2024. Rising costs could squeeze Standard Chartered's margins.

Trade Deficits and Currency Fluctuations

Standard Chartered's financial performance is significantly influenced by trade deficits and currency fluctuations. These imbalances and volatility can impact cross-border transactions, affecting the bank's international operations. Exchange rate movements influence the value of assets and liabilities in various currencies, creating financial risks. For instance, in 2024, significant currency volatility in emerging markets where Standard Chartered operates could affect its profitability.

- In 2024, the U.S. trade deficit reached approximately $773 billion, impacting global currency values.

- Fluctuations in the GBP/USD exchange rate, a key currency pair for Standard Chartered, have shown volatility, affecting its earnings.

- The bank's exposure to emerging market currencies, such as the Indian Rupee and Indonesian Rupiah, makes it vulnerable to currency risks.

Fiscal Policies and Government Spending

Fiscal policies, encompassing government spending and taxation, significantly affect economic conditions. For example, increased government spending can boost economic activity, while tax cuts might stimulate consumer spending. Conversely, austerity measures or tax hikes can slow down growth. These policies directly impact the banking sector, influencing lending and investment.

- In 2024, the U.S. federal budget deficit reached approximately $1.7 trillion.

- The UK government announced plans to cut public spending by £22 billion by 2025.

- China's government increased infrastructure spending by 6.8% in Q1 2024.

Economic factors significantly shape Standard Chartered's performance. IMF forecasts for Asia's GDP growth are 4.5% in 2024 and 4.6% in 2025, impacting the bank's strategy. Interest rate changes and inflation rates affect borrowing costs and consumer spending, which the bank has to follow. Currency fluctuations, especially in emerging markets, present both risks and opportunities, influencing the bank's profitability.

| Factor | Impact | Data Point |

|---|---|---|

| GDP Growth (Asia) | Influences Loan Demand | 4.5% (2024) & 4.6% (2025) |

| Interest Rates | Affects Borrowing Costs | Federal Reserve held rates steady in 2024 |

| Inflation | Impacts Consumer Spending | Eurozone: 2.4% (March 2024) |

| Trade Deficit (US) | Affects Currency Values | $773 Billion (2024) |

Sociological factors

Changing demographics significantly impact Standard Chartered. Population growth and urbanization, especially in Asia, drive demand for retail banking. For example, in 2024, the Asia Pacific region saw a 6% increase in demand for digital banking services. Age distribution also matters; an aging population in some markets boosts wealth management needs. This demographic shift influences product development and market strategies.

Consumer behavior is shifting, with digital banking and sustainable finance gaining traction. In 2024, digital banking users grew by 15%, signaling the need for Standard Chartered to enhance its online services. Demand for green financial products increased by 20% in the same year. Adapting to these preferences is crucial for maintaining competitiveness.

Wealth creation trends and distribution across Asia, Africa, and the Middle East are crucial for Standard Chartered. In 2024, Asia's wealth grew, but distribution disparities persist. Africa faces challenges, with uneven wealth spread. The Middle East sees wealth concentration influenced by oil revenues and investments.

Financial Literacy and Inclusion

Financial literacy and inclusion significantly shape Standard Chartered's market opportunities. Higher financial literacy broadens the customer base and influences product demand. Initiatives like the World Bank's Financial Literacy Program in developing nations directly impact SC's potential. Increased financial inclusion also leads to greater demand for digital banking services, a key area for SC's growth. In 2024, approximately 1.4 billion unbanked adults globally present a major target for financial inclusion efforts.

- World Bank's Financial Literacy Program: Impacting developing nations.

- 1.4 billion unbanked adults globally: A significant target.

Social Impact and Community Engagement

Standard Chartered actively engages in social responsibility, impacting its reputation and stakeholder relationships. The bank supports SMEs and provides essential services, reflecting its commitment to community well-being. In 2024, Standard Chartered invested $50 million in sustainable projects, showcasing its dedication. Their initiatives aim to improve financial inclusion, with 10 million people reached in 2024.

- $50 million invested in sustainable projects in 2024.

- Reached 10 million people through financial inclusion initiatives in 2024.

Sociological factors such as demographics and consumer behavior significantly influence Standard Chartered. Digital banking's rise saw a 15% user growth in 2024, shaping its strategy. Financial literacy and inclusion efforts are crucial, with approximately 1.4 billion unbanked globally representing a key market for expansion in 2024. These trends prompt Standard Chartered to adjust its offerings.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digital Banking | Customer adoption | 15% user growth |

| Financial Inclusion | Market opportunity | 1.4B unbanked adults |

| Wealth Trends | Market focus | Asia's wealth grew |

Technological factors

Digital transformation is rapidly reshaping banking. Standard Chartered invests heavily in digital platforms to boost customer experience, efficiency, and service offerings. In 2024, digital banking transactions increased by 25% globally, reflecting this shift. The bank's digital initiatives aim to capture a larger share of the growing digital banking market, projected to reach $18 trillion by 2025.

Standard Chartered is integrating AI and machine learning to enhance services. This includes advanced risk assessment and personalized customer interactions, potentially boosting operational efficiency. In 2024, AI investments in banking reached $15 billion globally, indicating strong growth. However, ethical concerns and data privacy remain significant challenges that need addressing.

Cybersecurity and data protection are critical as Standard Chartered expands digital services. The financial sector faced 3,000 cyberattacks weekly in 2023. In 2024, cybersecurity spending is projected to reach $215 billion globally. Strong measures are vital to protect customer data and maintain trust amid rising threats.

Development of FinTech and Digital Assets

The surge in FinTech and digital assets is reshaping the financial sector. Standard Chartered must embrace partnerships and innovative product development to stay competitive. Global FinTech investments reached $51.7 billion in H1 2024. Digital asset adoption is growing, with Bitcoin's market cap at $1.3 trillion as of April 2024. This requires strategic adaptation.

- FinTech investments hit $51.7B in H1 2024.

- Bitcoin's market cap: $1.3T (April 2024).

- Strategic adaptation is crucial.

Technological Infrastructure and Connectivity

Standard Chartered's digital banking hinges on robust technological infrastructure across its global footprint. Reliable internet connectivity is crucial for providing seamless digital services to its customers. In 2024, Standard Chartered invested significantly in upgrading its digital platforms. The bank's digital transaction volume grew by 25% in the first half of 2024, reflecting the importance of technology. This includes mobile banking apps and online platforms.

- Digital Banking Growth: 25% increase in digital transaction volume (H1 2024).

- Investment in Technology: Significant investment in digital platform upgrades in 2024.

Standard Chartered prioritizes digital innovation and efficiency through significant investments in technological infrastructure and digital platform upgrades. AI and machine learning are integrated to improve services, which aligns with the $15 billion AI investment in banking in 2024. The rise of FinTech requires strategic adaptation; global FinTech investments reached $51.7 billion in H1 2024.

| Technology Aspect | Specific Actions | Financial Impact (2024) |

|---|---|---|

| Digital Banking | Upgrading platforms, mobile apps | 25% increase in digital transactions (H1) |

| AI Integration | Risk assessment, customer interactions | $15B invested in AI in banking |

| Cybersecurity | Protecting customer data | Cybersecurity spending projected to reach $215B |

Legal factors

Standard Chartered faces intricate banking regulations across its global footprint. Compliance with capital adequacy rules, like Basel III, is paramount. In 2024, it faced scrutiny from regulators regarding its risk management frameworks. The bank allocates significant resources to ensure adherence to consumer protection laws and anti-money laundering protocols. The bank's regulatory risk is a key consideration.

Standard Chartered, like all global banks, faces stringent AML and sanctions compliance requirements. Non-compliance can lead to hefty fines; in 2019, they were fined $1.1 billion by U.S. and UK authorities for sanctions violations. These regulations, such as those from OFAC, are constantly updated. Banks must implement robust KYC/CDD procedures to mitigate risks.

Standard Chartered must comply with strict data privacy laws globally, including GDPR, to protect customer information. These regulations mandate strong data management and security measures, impacting operational costs. Breaches can lead to hefty fines; for instance, GDPR fines can reach up to 4% of global annual turnover. In 2024, data breaches cost businesses an average of $4.45 million, highlighting the financial risk.

Securities Litigation and Investor Protection

Standard Chartered faces legal scrutiny regarding securities and investor protection. Such actions, particularly those involving disclosure issues or reliance on published data, could harm its image and finances. In 2024, the bank allocated $1.5 billion for litigation provisions. The company's legal expenses surged by 18% in the last fiscal year.

- 2024 Litigation Provision: $1.5 Billion

- Year-over-year increase in legal costs: 18%

Contract Law and enforceability

Standard Chartered's global operations necessitate strict adherence to diverse contract laws. The bank must ensure agreements are legally sound and enforceable across different legal systems. This includes understanding local regulations and potential legal risks. In 2024, Standard Chartered faced legal challenges, with litigation expenses reaching $200 million. Proper contract management is crucial to protect the bank's interests.

- Legal challenges in 2024 cost $200 million.

- Contracts must comply with various international laws.

- Enforceability varies by jurisdiction.

Standard Chartered's global presence subjects it to varied banking laws, like Basel III, and data privacy regulations such as GDPR. Compliance includes AML/sanctions adherence, with past fines reaching $1.1 billion. Securities regulations, contract law complexities, and legal challenges, such as in 2024 with a $200 million litigation expense, pose ongoing legal risks.

| Aspect | Details | Data |

|---|---|---|

| Litigation Provision (2024) | Funds set aside for legal battles | $1.5 Billion |

| Year-over-year increase in legal costs | Percentage rise in legal expenditures | 18% |

| Legal Challenges (2024 Cost) | Total cost of legal cases | $200 Million |

Environmental factors

Climate change presents significant risks to Standard Chartered. In 2024, extreme weather events caused billions in damages. Transition risks include policy changes impacting high-emission sectors. These changes could affect loan portfolios. Standard Chartered's climate strategy aims to mitigate these risks.

Demand for sustainable finance is rising. Standard Chartered aims to fund green projects and include ESG factors in its decisions. In 2024, the bank committed to providing $300 billion in sustainable finance by 2030. They're also working on reducing their financed emissions.

Standard Chartered faces environmental regulations and reporting demands in its global markets. In 2024, the bank reported on climate-related financial risks. They also disclosed emissions data, aligning with sustainability goals. The bank's reports often include Scope 1, 2, and 3 emissions data.

Natural Resource Scarcity

Standard Chartered faces risks from natural resource scarcity in regions they serve. This scarcity can destabilize economies and challenge business operations. Such instability impacts the bank's clients and the value of its investments. For instance, water scarcity in key agricultural areas could affect loan repayment capabilities. The bank must assess these risks strategically.

- Resource scarcity can increase operational costs.

- Supply chain disruptions are a potential risk.

- Environmental regulations may tighten.

- Investment in sustainable practices becomes crucial.

Biodiversity Loss and Nature-Related Risks

Standard Chartered recognizes the growing significance of biodiversity loss and its related financial risks, integrating these concerns into its strategic planning. The bank is assessing how its operations and investments affect natural ecosystems, aligning with global efforts to protect biodiversity. This includes evaluating the financial implications of environmental degradation and the potential for nature-based solutions. Standard Chartered's approach reflects a commitment to sustainable finance and responsible business practices.

- In 2024, the Taskforce on Nature-related Financial Disclosures (TNFD) framework gained momentum, guiding companies in assessing and disclosing nature-related risks.

- The World Economic Forum estimates that over half of global GDP ($44 trillion) is moderately or highly dependent on nature.

- Standard Chartered aims to achieve net-zero emissions from its financing portfolio by 2050, which includes addressing nature-related impacts.

Environmental factors critically impact Standard Chartered's operations. Climate change-related events cost billions in 2024, with stricter regulations emerging globally. The bank focuses on sustainable finance, targeting $300 billion by 2030, aiming for net-zero emissions by 2050.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Climate Risks | Increased operational costs; loan defaults | Extreme weather losses hit $300B globally; TNFD framework adoption |

| Sustainability | Reputational risks; new opportunities | $300B sustainable finance commitment by 2030; 50% of GDP reliant on nature |

| Regulatory | Compliance costs; reporting burdens | Disclosing climate-related financial risks; Scope 1, 2, and 3 emissions reporting |

PESTLE Analysis Data Sources

This PESTLE Analysis is based on data from financial institutions, government sources, market research, and reputable news outlets. Insights are fact-based.