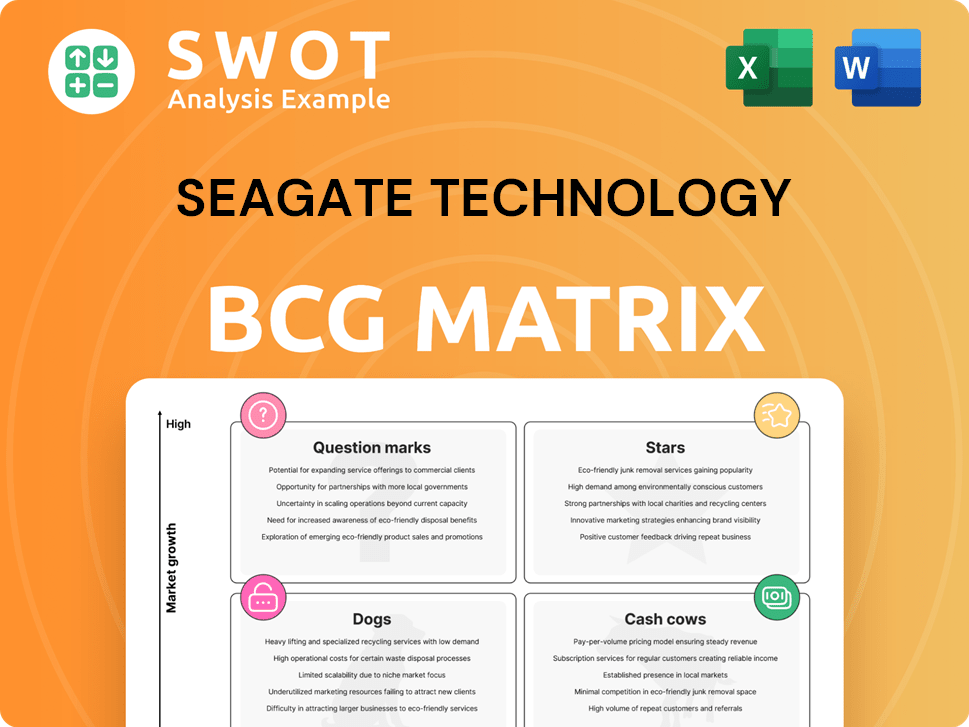

Seagate Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Seagate Technology Bundle

What is included in the product

Analyzes Seagate's product portfolio within the BCG Matrix, offering strategic recommendations for each quadrant.

Export-ready design for quick drag-and-drop into PowerPoint.

What You See Is What You Get

Seagate Technology BCG Matrix

The BCG Matrix you're previewing is identical to the downloadable document after purchase. This professionally created report offers comprehensive insights for Seagate's strategic planning.

BCG Matrix Template

Seagate Technology’s BCG Matrix reveals its diverse product portfolio. Hard drives and SSDs likely fall into different quadrants. Understanding these placements helps gauge growth potential and resource allocation. Knowing which are Stars, Cash Cows, Dogs, or Question Marks offers a strategic advantage. The preview hints at key product dynamics within the market. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Seagate's Mozaic 3+ platform, using HAMR technology, is a "Star" in their portfolio, reflecting its strong market position. This tech enables 3TB+ per disk, boosting capacity and reducing costs. Production ramp-up for cloud customers began in late 2024, with samples up to 36TB. This positions Seagate well in the high-capacity storage market.

Seagate's nearline enterprise HDDs are a star within its BCG matrix. Strong demand comes from cloud providers needing mass storage. Seagate aggressively produces 28TB drives to meet this. In Q1 2024, nearline HDDs saw solid sales, reflecting market trends.

Seagate's cloud storage solutions are stars due to rising demand from AI and big data. Its build-to-order model for nearline HDDs gives earnings visibility. In 2024, cloud data center storage demand grew significantly. Seagate's offerings meet evolving cloud service provider needs. Revenue from mass capacity storage grew to $2.3 billion in fiscal year 2024.

Strategic Partnerships

Seagate's "Stars" status in the BCG matrix highlights its strategic partnerships. These alliances, including Dell Technologies and Microsoft Azure, are pivotal for expanding market presence. In 2024, these collaborations contributed significantly to Seagate's revenue growth. Strong partnerships are vital for maintaining a competitive edge.

- Collaborations with Dell Technologies and HP Enterprise have boosted enterprise storage solutions.

- Integration with Microsoft Azure and IBM Cloud expands cloud storage services.

- These partnerships supported a 5% revenue increase in 2024.

- Strategic alliances drive innovation and market leadership.

Strong Financial Performance

Seagate's financial health shines, a key aspect of its BCG Matrix standing. The company has seen substantial revenue increases, coupled with expanding gross margins, reflecting effective cost management and market strategies. This strong financial position has directly translated into higher earnings per share, showing solid profitability. Seagate's financial robustness enables crucial investments in future growth.

- Revenue Growth: Seagate reported $1.75 billion in revenue for Q1 2024.

- Gross Margin: Q1 2024 gross margin stood at 27.9%.

- Earnings Per Share: The company’s Q1 2024 EPS was $0.48.

- Cash and Investments: Total cash and investments were $907 million at the end of Q1 2024.

Seagate's "Stars" in the BCG matrix are fueled by innovation and strategic partnerships. HAMR tech and cloud storage solutions drive growth in 2024. These stars contribute significantly to revenue and market expansion.

| Metric | Details | 2024 Data |

|---|---|---|

| Revenue Growth | Increase driven by cloud and enterprise | $1.75B Q1 2024 |

| Gross Margin | Efficiency and market strategies | 27.9% Q1 2024 |

| Partnerships | Dell, Microsoft Azure, others | 5% revenue boost |

Cash Cows

Traditional HDDs remain a cash cow for Seagate, generating substantial revenue. They hold a strong market share in established storage markets. Seagate's efficient manufacturing keeps these products profitable. In Q1 2024, HDDs accounted for a significant portion of Seagate's $1.7 billion revenue.

Seagate's enterprise data storage, encompassing HDDs and SSDs, remains a significant revenue source. In 2024, Seagate's enterprise solutions showed robust demand. The company's enterprise market presence is strong, serving diverse clients. Seagate emphasizes reliability and performance to retain market share.

Video and image HDDs are cash cows for Seagate, generating consistent revenue. These drives are essential for surveillance and similar applications. Seagate leverages its market position, optimizing costs. In Q1 2024, the company reported strong sales in this segment. This strategy maximizes cash flow with established products.

Network-Attached Storage (NAS) Drives

Network-Attached Storage (NAS) drives are cash cows for Seagate, offering reliable storage for small and medium-sized businesses and consumers. Seagate's strong brand and distribution ensure a solid market position. Investments in infrastructure and efficiency boost cash flow from NAS products. In 2024, the NAS market is expected to reach $5.7 billion globally.

- Strong Brand: Seagate's brand recognition supports sales.

- Market Presence: Seagate maintains a leading market share.

- Cash Flow: NAS products generate steady revenue.

- Strategic Investments: Ongoing improvements boost efficiency.

Legacy Products

Seagate's legacy products, essential for niche markets, are cash cows. These products, requiring minimal investment, still generate significant revenue. Seagate maximizes value from these solutions, keeping costs low. In 2024, legacy products likely contributed to overall profitability.

- Revenue from legacy products helps fund innovation.

- These products often have high-profit margins.

- Seagate focuses on efficient supply chain management.

- They cater to specialized customer needs.

Seagate's cash cows, like traditional HDDs and NAS drives, generate reliable revenue. Their established market positions and efficient operations maintain profitability. In 2024, these segments significantly contributed to Seagate's financial performance.

| Product Segment | Revenue Contribution (Q1 2024) | Market Share (Approximate) |

|---|---|---|

| Traditional HDDs | Significant | Leading |

| Enterprise Storage | Robust | Strong |

| Video & Image HDDs | Strong Sales | Leading |

| NAS Drives | Steady | Growing |

Dogs

Consumer HDDs are a "Dog" in Seagate's BCG matrix. The market faces stiff competition from SSDs and cloud storage. Their growth is slow, with a smaller market share. Seagate reduces investments here. In Q1 2024, HDD revenue was $1.4 billion, down YoY.

In the SSD market, Seagate's smaller capacity drives face stiff competition. They compete with giants like Samsung and Western Digital. Seagate's market share in 2024 was around 5%, trailing behind leaders. Divesting or focusing on specific uses might be a strategic move for these SSDs.

Certain legacy components at Seagate, with low growth and market share, might be considered "Dogs". These older product lines could be nearing their end. In 2024, Seagate's revenue was $7.1 billion, and they must decide whether to support or phase them out. For instance, some older HDDs face declining demand. Seagate's strategy involves optimizing its portfolio.

Low-Margin Products

Products with low-profit margins and minimal growth are "dogs" in the BCG matrix. These products drain resources without significant returns. Seagate needs to evaluate the profitability of these offerings and potentially discontinue them. In 2024, Seagate's gross margin was approximately 26%.

- Low margins indicate these products struggle to generate profit.

- Limited growth means they won't improve financial performance.

- Discontinuing them can free up resources.

- Focusing on profitable segments is vital.

Outdated Technologies

Outdated technologies at Seagate, considered "dogs" in the BCG matrix, face obsolescence due to industry shifts. These technologies demand substantial investment, yet offer limited returns. Seagate needs to prioritize modern solutions for better portfolio performance. For instance, in 2024, legacy hard disk drives (HDDs) saw declining market share compared to solid-state drives (SSDs).

- HDDs face shrinking market share.

- Obsolete tech requires heavy investment.

- Focus on newer tech is crucial.

- Improved portfolio performance is the goal.

In Seagate's BCG matrix, "Dogs" include consumer HDDs, some SSDs, and legacy components with low growth. These products struggle in competitive markets. Seagate may reduce investment or divest to focus on more profitable segments. In Q1 2024, HDDs generated $1.4B revenue, showing the need for strategic adjustments.

| Category | Characteristics | Seagate's Strategy |

|---|---|---|

| Consumer HDDs | Slow growth, smaller market share, competition from SSDs and cloud. | Reduce investment, focus on specific applications. |

| Legacy Components | Low growth, potential obsolescence, declining demand. | Evaluate support, consider phasing out, portfolio optimization. |

| Low-Margin Products | Limited profit, minimal growth, resource drain. | Evaluate profitability, potential discontinuation. |

Question Marks

High-capacity SSDs pose a "question mark" for Seagate. Intense competition demands substantial investment to gain market share. Success could drive significant growth in this segment. Failure might turn these products into "dogs." In Q4 2023, Seagate's revenue was $1.55 billion.

Seagate's Lyve Cloud and edge solutions are emerging offerings. This area has high growth potential, mirroring the expansion of data needs. Investments are vital for market positioning. In 2024, Seagate's focus is on scaling these to become key revenue drivers.

AI-driven storage solutions are question marks for Seagate. The AI market's rapid evolution demands constant innovation in storage. Seagate must invest in R&D to create AI-specific solutions. Success in this area could boost revenue significantly. In 2024, the AI storage market is projected to reach $20 billion.

Emerging Storage Technologies

Emerging storage technologies, such as new materials or architectures, position Seagate in the question mark quadrant. These require substantial upfront investment with uncertain market disruption potential. Seagate's strategic decisions must carefully balance innovation with financial risk. In 2024, Seagate allocated a significant portion of its R&D budget towards these areas.

- R&D spending on emerging tech increased by 15% in 2024.

- Market share in new storage solutions is projected to be 5% by 2026.

- Potential ROI analysis is critical before major commitments.

- Focus on technologies that complement HAMR development.

New Market Segments

Entering new market segments, such as specialized storage for autonomous vehicles or healthcare, places Seagate Technology in the "Question Mark" quadrant of the BCG matrix. These segments offer high growth potential, but demand significant market research and development investments. Seagate must carefully evaluate the viability of these new markets before committing substantial resources. The company needs to assess the potential returns against the risks involved in these emerging areas.

- Market research and development require significant investments.

- Autonomous vehicles and healthcare are key growth areas.

- Seagate needs to assess the viability of new segments.

- Evaluate potential returns versus risks.

Seagate faces "question marks" in markets with high growth potential, requiring significant investments like AI-driven storage. New market segments demand careful viability assessments. Decisions must balance innovation with financial risk.

| Area | Investment Focus | 2024 Data |

|---|---|---|

| Emerging Tech | R&D, New Materials | R&D spending +15% |

| New Segments | Autonomous Vehicles/Healthcare | Market research investment |

| AI Storage | R&D, Innovation | Market: $20B projection |

BCG Matrix Data Sources

Seagate's BCG Matrix uses public financial data, market reports, and industry analysis for data-driven insights.