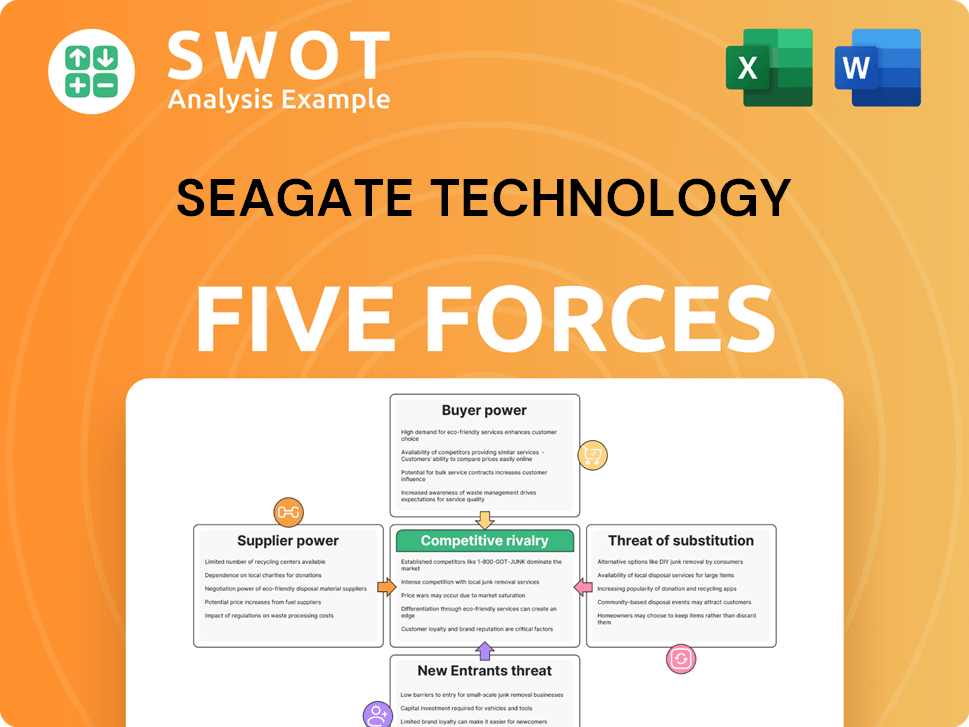

Seagate Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Seagate Technology Bundle

What is included in the product

Tailored exclusively for Seagate Technology, analyzing its position within its competitive landscape.

Customize each force's impact to show the competitive landscape's dynamic shifts.

What You See Is What You Get

Seagate Technology Porter's Five Forces Analysis

This preview details Seagate's Porter's Five Forces. It examines competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. This comprehensive analysis is the exact document you'll download immediately after purchase.

Porter's Five Forces Analysis Template

Seagate Technology faces intense competition in the data storage market, especially from established players and evolving technologies. Buyer power is significant, as customers have multiple storage options and pricing leverage. Suppliers, particularly those providing key components, exert considerable influence. The threat of new entrants, while moderate, is always present with technological advancements. Substitute products, like cloud storage, pose a growing challenge.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Seagate Technology.

Suppliers Bargaining Power

Seagate's hard drive production is heavily reliant on a few key component suppliers. These suppliers, specializing in items like read/write heads, wield significant power. This concentration can drive up Seagate's costs, impacting profitability. In 2021, over 70% of Seagate's components came from a restricted supplier base.

Seagate's reliance on key suppliers boosts their power. Toshiba provides magnetic recording components, and Western Digital delivers mechanical parts. The top three suppliers control a large share of specialized hard drive components. In 2024, this dependency impacts Seagate's cost structure and supply chain resilience.

Seagate faces supplier power challenges due to manufacturing equipment. High costs and infrequent replacements of specialized tools, like those used in magnetic head fabrication, limit supplier options. For example, a single advanced wafer fabrication system can cost over $100 million. This concentration gives existing suppliers significant leverage.

Supply Chain Concentration

The bargaining power of suppliers significantly impacts Seagate Technology. A concentrated supply chain gives suppliers leverage over pricing and component availability. Limited suppliers of critical components may drive up costs and threaten supply reliability for Seagate. This can lead to profitability challenges.

- Seagate faces supply chain concentration issues with key component suppliers.

- Concentration metrics reveal a small number of companies control vital components.

- This concentration can lead to higher costs and supply disruptions.

- These factors directly affect Seagate's operational efficiency.

Supplier Integration Potential

Supplier integration potential significantly impacts Seagate's bargaining power. Some suppliers, like Micron Technology and Intel, could integrate forward into manufacturing, becoming direct competitors. This capability to produce essential components, such as chips, strengthens their position. The forward integration strategy allows suppliers to capture more value, increasing their leverage over Seagate.

- Micron's revenue in 2024 was approximately $16.7 billion.

- Intel's 2024 revenue was around $54.2 billion.

- These figures highlight the substantial resources suppliers possess.

- The power dynamic shifts when suppliers can enter Seagate's market.

Seagate's profitability faces challenges due to supplier concentration. Key suppliers of components like read/write heads wield significant pricing power. This reliance affects Seagate's operational costs and supply chain resilience.

The ability of suppliers to integrate forward into manufacturing presents another risk. Companies such as Micron and Intel have considerable financial strength. This forward integration potential increases their leverage over Seagate.

In 2024, the top three suppliers of specialized hard drive components control a significant market share. These factors shape the competitive landscape for Seagate.

| Factor | Impact on Seagate | Data |

|---|---|---|

| Supplier Concentration | Higher costs, supply risks | Over 70% of components from limited base (2021) |

| Supplier Power | Pricing pressure | Micron revenue ~$16.7B (2024), Intel ~$54.2B (2024) |

| Forward Integration | Increased competition | Potential for suppliers to enter manufacturing |

Customers Bargaining Power

Seagate's customer base is concentrated, with a significant portion of revenue from a few large cloud service providers and OEMs. This concentration gives major customers, like Microsoft and Amazon Web Services, substantial bargaining power. In 2024, these key players influenced pricing and contract terms significantly. This dynamic can pressure Seagate's margins, as large customers can negotiate favorable deals.

The data storage market's intense competition makes customers price-sensitive. Internal hard drive prices continue to fall, boosting buyer power. Seagate faces the challenge of customers readily switching to rivals if prices aren't competitive. In 2024, the average selling price of hard disk drives (HDDs) decreased further due to market pressures. Competitors like Western Digital also influence pricing dynamics.

Product commoditization significantly impacts Seagate Technology. Hard disk drives (HDDs) face limited product differentiation, enhancing customer bargaining power. This lack of distinction reduces brand loyalty, making customers more price-sensitive. In 2024, HDDs demand will likely be flat, with a shift towards enterprise applications.

Information Availability

Customers possess significant bargaining power due to readily available information. They can easily compare Seagate's products against competitors based on detailed specifications and pricing. This informational advantage allows customers to negotiate better deals and demand higher value. The trend of increasing online reviews and comparisons further strengthens this power.

- Online reviews and comparisons are a key factor.

- Customers can easily compare specifications and prices.

- This empowers customers to negotiate.

- Seagate must offer competitive value.

Switching Costs

Switching costs for data storage solutions are often low, particularly for customers using standard interfaces and protocols. This ease of switching boosts customer bargaining power significantly. Customers can readily move to different storage solutions, increasing their leverage. Seagate faces pressure to offer competitive pricing and services due to this.

- Standardization allows easy vendor changes.

- Competitive pricing is crucial to retain customers.

- Customers can easily compare and choose alternatives.

- Seagate must focus on differentiation.

Seagate faces strong customer bargaining power due to concentrated buyers like cloud providers. Price sensitivity is high, with falling HDD prices impacting margins, and customers easily switchable. Product commoditization and readily available info further empower customers.

| Factor | Impact | 2024 Data |

|---|---|---|

| Customer Concentration | High bargaining power | Microsoft, Amazon, etc. |

| Price Sensitivity | Easy switching | HDD ASP decrease by 5% |

| Product Commoditization | Reduced differentiation | Flat HDD demand |

Rivalry Among Competitors

The data storage industry is fiercely competitive, with Seagate facing rivals like Western Digital and Toshiba. This competition drives down prices and fuels innovation. In 2024, the hard disk market saw Western Digital holding about 36% of the market share and Seagate around 34%. This rivalry impacts profitability.

Seagate actively differentiates its products through technological innovation, performance enhancements, and cost efficiencies. The company's development of Heat-Assisted Magnetic Recording (HAMR) technology exemplifies this strategy. In 2024, Seagate invested $1.2 billion in R&D. This innovation, along with Micro-Actuator and Multi-Actuator technologies, aims to boost storage efficiency, counteracting the ongoing decline in hard disk drive (HDD) sales. As of Q3 2024, Seagate's revenue was $1.86 billion.

Seagate faces intense competition, leading to market share battles. Competitors use pricing and promotions aggressively. This impacts Seagate's profits and market standing. In 2024, Western Digital and Samsung are key rivals. Faster tech from rivals could erode Seagate's market share.

Consolidation Trends

The hard disk drive (HDD) and solid-state drive (SSD) market is marked by intense competition, with consolidation reshaping the landscape. Mergers and acquisitions have created larger competitors like Western Digital and Seagate. Western Digital's strategic separation of its HDD and Flash businesses aims to boost growth. This restructuring is expected to enhance operational efficiency and capital management.

- Western Digital's revenue in 2024 was approximately $12.2 billion.

- Seagate's revenue in 2024 was around $7.3 billion.

- The SSD market is projected to reach $100 billion by 2025.

- Consolidation reduces the number of major players, intensifying competition.

Global Presence

Seagate Technology operates in a global market, facing intense competition due to the widespread presence of major players. This broad geographic footprint forces companies to compete on multiple fronts, increasing rivalry. Competitors like Western Digital and Samsung also have extensive global operations, intensifying the competitive landscape. The need to maintain market share across various regions further escalates the pressure on pricing and innovation. This global competition dynamic is a key factor in Seagate's strategic considerations.

- Seagate's revenue in 2023 was approximately $7.3 billion.

- Western Digital's revenue in 2023 was roughly $12.3 billion.

- Samsung's global semiconductor sales (including storage) were over $60 billion in 2023.

Seagate faces fierce competition in the data storage market. Key rivals like Western Digital and Samsung aggressively compete on price and innovation. This intense rivalry affects Seagate's profitability and market position. The HDD and SSD market consolidation further intensifies these competitive pressures.

| Metric | Seagate (2024) | Western Digital (2024) |

|---|---|---|

| Revenue | $7.3B | $12.2B |

| Market Share (HDD) | ~34% | ~36% |

| R&D Investment | $1.2B | N/A |

SSubstitutes Threaten

SSDs present a formidable substitute threat to HDDs. They boast superior speed and durability, enticing consumers and businesses. The shift towards SSDs is evident, with their adoption in PCs and enterprise systems. In 2024, SSDs captured a significant market share, intensifying the pressure on HDD manufacturers.

Cloud storage poses a significant threat to Seagate. Cloud services, like those from Amazon Web Services and Microsoft Azure, offer alternatives to physical storage. Adoption of cloud storage is rising; the global market was valued at $137.36 billion in 2023. This shift reduces demand for traditional storage devices, impacting Seagate's sales. Cloud providers innovate with SDS and AI, intensifying competition.

Tape storage persists as an alternative for long-term data archiving, particularly for large enterprises. Though slower than HDDs and SSDs, it offers cost benefits. The global tape storage market was valued at approximately $2.1 billion in 2024, showing its ongoing relevance.

Hybrid Storage Systems

Hybrid storage systems, blending SSDs and HDDs, present a substitute threat to Seagate. These systems offer a balance of performance and cost-effectiveness, appealing to data centers. By utilizing SSDs for fast access and HDDs for bulk storage, they can optimize costs. Adoption of hybrid storage solutions continues to grow, with the hybrid cloud storage market valued at $77.6 billion in 2024, projected to reach $205.5 billion by 2029.

- Hybrid storage solutions offer a cost-effective alternative to traditional storage systems.

- The hybrid cloud storage market is experiencing rapid growth.

- Data centers are increasingly adopting hybrid storage to optimize performance and cost.

- The threat of substitutes impacts Seagate's market share.

Emerging Storage Technologies

Emerging storage technologies pose a long-term threat. Innovations like DNA storage and 5D optical storage could disrupt traditional solutions. While early, these advancements could challenge established players. Rapid SSD enhancements and AI integration in data optimization are key. The market will be reshaped by 5G technology and quantum dot adoption.

- DNA storage could reach 1 exabyte per gram, far exceeding current capacities.

- 5D optical storage promises data density up to 5 terabytes per disc.

- SSD adoption grew by 30% in 2024, increasing competition.

- AI-driven data optimization reduced storage costs by 15% in 2024.

The threat of substitutes significantly affects Seagate's market position. SSDs and cloud storage solutions are major competitors, offering speed and cost advantages. Hybrid storage further challenges Seagate, balancing performance and affordability. Emerging technologies add to the pressure, reshaping the storage landscape.

| Substitute | Impact | 2024 Market Data |

|---|---|---|

| SSDs | Superior speed & durability | SSD market share grew by 25% |

| Cloud Storage | Cost-effective, accessible | Cloud storage market: $150B |

| Hybrid Storage | Balance of performance & cost | Hybrid cloud market: $77.6B |

Entrants Threaten

The data storage industry demands hefty initial investments. New entrants face obstacles due to high capital needs. Seagate benefits from this barrier, strengthening its position. Building manufacturing and R&D facilities is expensive. The hard disk market is especially tough for newcomers.

The hard disk drive (HDD) industry requires intense technological expertise. New entrants face high barriers due to the need for specialized knowledge in magnetic recording and data management. Seagate's strong R&D, with $782 million invested in fiscal year 2024, provides a significant advantage. This investment fuels their areal density product roadmap, positioning them well.

Seagate, alongside established competitors, benefits from strong brand recognition and customer trust, creating a significant barrier for new entrants. Seagate's reputation in data storage, especially in hard disk drives, is a key advantage. New companies face the challenge of building similar brand equity and customer loyalty. This makes it hard for them to compete effectively. Seagate's revenue in fiscal year 2024 was around $7.3 billion, showing its market strength.

Economies of Scale

Existing companies like Seagate, which have already established economies of scale, possess a significant edge against new competitors. They benefit from lower production costs due to their established manufacturing processes, bulk purchasing power, and efficient distribution networks. The cloud capital investments by Seagate's customers grew approximately 50% in 2024, showing increased demand for their products and services.

- Established companies have lower production costs.

- Seagate's customers increased cloud capital investments by roughly 50% in 2024.

- New entrants face higher initial costs.

- Economies of scale create a barrier to entry.

Intellectual Property

The data storage industry, including Seagate Technology, faces challenges from new entrants due to strong intellectual property protections. It's difficult for newcomers to compete without infringing on existing patents. Seagate's transition to MR technology is a strategic move. This allows for increased exabyte production without expanding unit capacity. This technological advancement helps maintain a competitive edge.

- Intellectual property rights are crucial in this industry, protecting innovations.

- New entrants struggle to develop and commercialize without IP infringements.

- Seagate's MR technology transition supports exabyte production growth.

- This technological shift helps to maintain a competitive advantage.

New competitors in data storage face tough challenges. High initial capital needs and significant R&D investments, like Seagate's $782 million in 2024, act as barriers. Building brand recognition and competing with established firms' economies of scale also proves difficult.

| Barrier | Impact | Seagate Advantage |

|---|---|---|

| High Capital Costs | Expensive infrastructure setup. | Established manufacturing & R&D. |

| R&D Needs | Need for technological expertise. | $782M R&D in fiscal 2024. |

| Brand Recognition | Building customer trust takes time. | Strong reputation & loyalty. |

Porter's Five Forces Analysis Data Sources

Seagate's analysis utilizes financial reports, industry surveys, and competitor statements. Public databases & market share reports provide further insights.