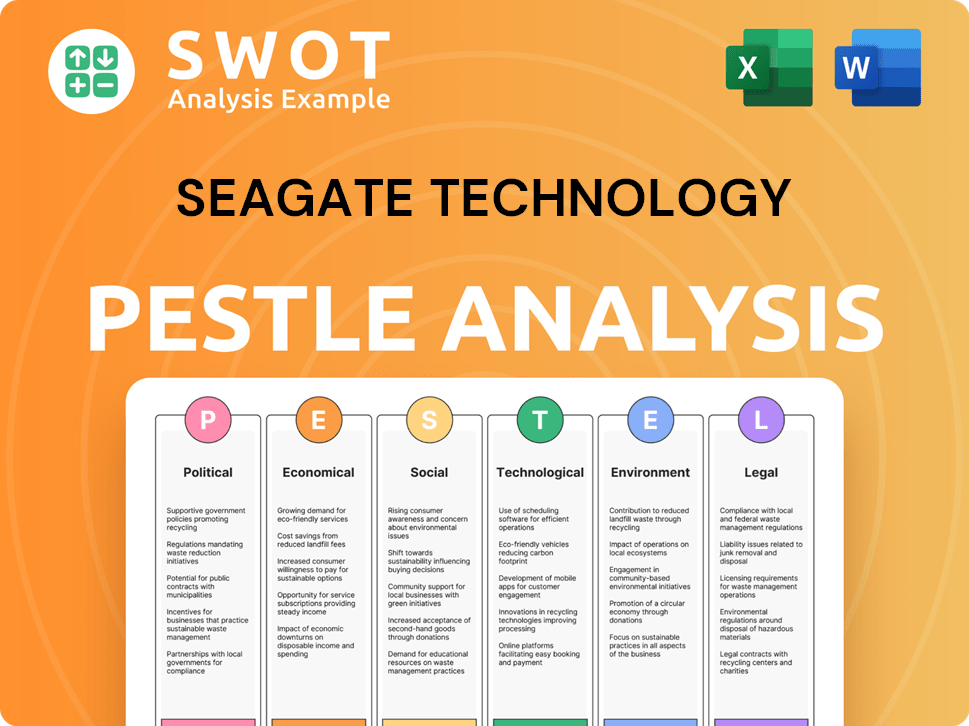

Seagate Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Seagate Technology Bundle

What is included in the product

Examines how political, economic, social, tech, environmental, and legal factors influence Seagate.

Helps support discussions on external risk during planning sessions.

What You See Is What You Get

Seagate Technology PESTLE Analysis

The content you see is the actual Seagate PESTLE analysis you'll receive. We believe in transparency: what you preview is exactly what you download. Fully formatted and complete, ready for immediate use. Expect no surprises with this in-depth analysis. Purchase and have it instantly.

PESTLE Analysis Template

Navigate the complexities of Seagate Technology's market position with our focused PESTLE Analysis. Discover how political, economic, social, technological, legal, and environmental forces shape its strategy. Get expert insights into the external factors affecting its performance and growth. This analysis arms you with essential knowledge for your next strategy. Equip yourself for smart decision-making by downloading the full analysis now!

Political factors

Geopolitical tensions, mainly between the US and China, affect trade policies and tech restrictions, impacting Seagate's sales. The US-China trade war poses risks. In 2023, the US imposed $300 billion in tariffs on Chinese tech exports. This led to a 17.2% drop in Seagate's export volumes to China in fiscal year 2023.

Government regulations significantly impact the retail and e-commerce sectors, crucial for Seagate. The EU's DSA, enforced by February 2024, mandates stricter content moderation and user protection. This impacts Seagate through its partners. In 2024, compliance costs for tech firms due to regulations are projected to rise by 15%.

The U.S. Department of Commerce's export controls, initiated in October 2022, restrict advanced computing and semiconductor manufacturing equipment exports to China. These controls, aimed at curbing China's tech progress, introduce market uncertainty. Seagate must adapt its supply chain, seeking diversification. In Q1 2024, Seagate reported $1.5 billion in revenue, reflecting these challenges.

Political Stability in Operating Regions

Seagate's international operations are heavily influenced by global political stability. Political unrest in manufacturing or key market regions can severely disrupt operations. For instance, geopolitical tensions in Asia, where Seagate has significant operations, could impact supply chains. In 2024, political risks have led to supply chain disruptions, increasing operational costs by approximately 5%.

- Geopolitical risks can lead to supply chain disruptions.

- Increased operational costs.

- Political instability impacts manufacturing and sales.

Lobbying and Political Contributions

Seagate Technology actively participates in lobbying and makes political contributions to shape policies relevant to its business operations. In 2024, the company reported lobbying expenses of $320,000 and contributed $78,928 during the 2024 election cycle. These actions demonstrate Seagate's strategic efforts to influence legislation and regulations. Such engagement is crucial in an industry influenced by trade policies and technology standards.

- Lobbying Expenses (2024): $320,000

- Political Contributions (2024 Cycle): $78,928

Political factors significantly shape Seagate's business landscape. US-China tensions, including tariffs, disrupt trade and exports. Regulations, like the EU's DSA, increase compliance costs for Seagate's partners. Export controls impact the company's supply chain, introducing uncertainty.

| Political Factor | Impact | Data (2024) |

|---|---|---|

| US-China Trade War | Reduced Export Volumes | Seagate's exports to China dropped 17.2% (FY2023) |

| Government Regulations | Increased Compliance Costs | Projected 15% rise in compliance costs for tech firms |

| Export Controls | Supply Chain Adjustments | Q1 2024 Revenue: $1.5 billion; operational costs +5% |

Economic factors

The semiconductor market's volatility directly impacts Seagate. Fluctuating prices and demand for semiconductors, essential for data storage, are a constant challenge. In fiscal year 2023, Seagate faced a significant drop in hard drive ASPs by 24.3% YoY. This decline significantly contributed to a 20.5% decrease in revenue for the same period.

A global economic slowdown poses significant risks to Seagate. Enterprise storage investments saw a 16.8% decline in 2023. Cloud storage infrastructure spending also fell by 12.5% in the same year. These trends highlight sensitivity to economic downturns. The company must adapt to reduced demand.

Inflation and economic downturns significantly influence Seagate's performance. High inflation can erode consumer purchasing power, leading to decreased demand for storage solutions. During economic downturns, businesses often cut capital expenditures, potentially impacting enterprise storage investments. In Q1 2024, the U.S. inflation rate was around 3.5%, influencing consumer behavior. These factors can reduce Seagate's sales and profitability.

Currency Exchange Rate Fluctuations

Seagate, as a global entity, faces currency exchange rate risks. These fluctuations affect revenue and profitability when converting international sales. For instance, a stronger U.S. dollar can reduce the value of sales from other regions. This can lead to lower reported earnings. In Q1 2024, currency impacts were noted in Seagate's financial reports.

- Q1 2024: Currency fluctuations affected Seagate's financial outcomes.

- Stronger USD: Can diminish the value of international sales.

- Risk: Potential for lower reported earnings.

Market Capitalization and Financial Performance

Seagate's market capitalization reflects its economic standing, standing at $21.81 billion as of April 13, 2025. The company's financial performance indicates a positive trend, with revenue and net income increases in Q1 and Q3 of fiscal year 2025. This suggests improved operational efficiency and market competitiveness. Seagate's ability to sustain this growth trajectory is vital for long-term economic stability.

- Market Cap: $21.81 billion (April 13, 2025)

- Revenue Growth: Positive in Q1 and Q3 FY2025

- Net Income: Increased in Q1 and Q3 FY2025

Seagate navigates economic volatility, affected by semiconductor price fluctuations and global economic slowdowns impacting storage investments. High inflation and economic downturns decrease storage demand. Currency exchange rates also pose risks to revenue.

| Economic Factor | Impact | Data |

|---|---|---|

| Semiconductor Market | Price and Demand Volatility | Hard drive ASPs down 24.3% YoY in FY2023 |

| Global Slowdown | Reduced storage investments | Enterprise storage down 16.8% in 2023 |

| Inflation | Erosion of purchasing power | U.S. inflation around 3.5% in Q1 2024 |

Sociological factors

The rise in remote work significantly boosts the need for cloud storage and data solutions. Gartner forecasts global spending on public cloud services to hit $679 billion in 2024. Approximately 27% of employees are in hybrid work models, creating more demand for data storage.

Consumer concerns about data privacy and security are rising. The cybersecurity market, valued at $172.32 billion in 2024, reflects this. A significant 83% of consumers worry about data privacy. Seagate must prioritize robust security features.

Demographic shifts drive digital transformation worldwide. IDC forecasts $3.4 trillion in digital transformation spending for 2024. Digitalization is key, with 65% of global GDP becoming digitalized, increasing the demand for data storage solutions.

Demand for Sustainable Technology

Demand for sustainable technology is significantly rising. Consumers increasingly favor eco-friendly products. The sustainable technology market was projected at $417.35 billion in 2024. 78% of consumers prefer environmentally responsible brands, impacting tech companies like Seagate. This shift influences product design and supply chain choices.

- Market Value: $417.35 billion (2024)

- Consumer Preference: 78% favor eco-friendly brands

Labor and Talent Shortages

The technology sector, including data storage, is significantly impacted by labor and talent shortages, a key sociological factor. These shortages can specifically affect manufacturing, research and development, and overall operational efficiency for companies like Seagate. The demand for skilled tech workers continues to outpace supply, especially in specialized areas. This scarcity can lead to increased labor costs and project delays, influencing Seagate's ability to innovate and compete effectively in the market.

- In Q4 2024, the US tech sector saw a 3.5% increase in job openings, highlighting the ongoing demand.

- The global shortage of semiconductor engineers is projected to worsen through 2025, affecting data storage component production.

Remote work drives cloud storage demand; hybrid models account for about 27% of employment.

Data privacy concerns are crucial; the cybersecurity market hit $172.32 billion in 2024. Over 80% of consumers worry about data security.

Digital transformation, fueled by demographic shifts, expects a $3.4 trillion spending in 2024. Labor shortages continue, especially for engineers.

Sustainability is increasingly important, with consumers preferring eco-friendly products.

| Sociological Factors | Impact | Statistics (2024/2025) |

|---|---|---|

| Remote Work | Increased cloud storage demand | 27% employees in hybrid work. |

| Data Privacy | Heightened consumer concern | Cybersecurity market $172.32B, 83% consumer concern |

| Digital Transformation | Boost in data storage needs | $3.4T digital transformation spend |

| Sustainability | Demand for eco-friendly products | 78% prefer green brands, $417.35B sustainable tech market. |

| Labor Shortages | Affects tech sector | US tech job openings up 3.5% (Q4 2024). |

Technological factors

The data storage sector thrives on constant innovation. Seagate invests heavily in advanced tech, such as HAMR. This aims to boost storage capacity. In Q1 2024, Seagate's revenue was $1.55 billion, reflecting tech's impact. They expect continued growth.

The surge in cloud computing, AI, and IoT fuels data storage needs. AI's growth is set to boost data center demand. Seagate benefits from this, with AI data center spending expected to reach $35 billion by 2025.

Seagate's focus on Hard Disk Drives (HDDs) confronts competition from Solid State Drives (SSDs). The SSD market is significant, with an estimated value of $63.58 billion in 2024. Forecasts suggest considerable growth, reaching $102.43 billion by 2029, intensifying the competitive landscape for Seagate's HDD business.

Need for Scalable Storage Innovations

The world is experiencing an unprecedented mass data surge, driven by the exponential growth in data creation. Scalable storage solutions are vital for the AI ecosystem, preventing a potential storage shortage. Seagate Technology is at the forefront, offering innovative storage technologies to meet these demands. This is crucial, as global data creation is projected to reach 181 zettabytes by 2025, according to Statista.

- Data creation is expected to continue growing.

- AI's expansion relies on storage.

- Seagate offers innovative storage solutions.

- Storage shortage is a potential crisis.

Advancements in Energy Efficiency

Technological factors significantly influence Seagate's operations. Advancements in energy-efficient technologies are vital for data centers. Higher storage areal density helps boost data capacity, cut environmental impact, and decrease ownership costs. Seagate is investing in these areas. This is crucial for its future success.

- In 2024, data center energy consumption is projected to increase by 15%.

- Seagate's new drives reduce power consumption by up to 20% compared to older models.

- The company plans to invest $500 million in energy-efficient technologies by 2025.

- Data storage density has increased by 40% since 2020, lowering costs.

Seagate leverages tech advancements for storage solutions. AI, cloud computing, and IoT drive data storage demand. The company faces SSD competition. In 2024, data center energy use is rising.

| Technology Impact | Data Point | Year |

|---|---|---|

| Data Center Energy Increase | 15% rise projected | 2024 |

| Global Data Creation | 181 zettabytes | 2025 (projected) |

| SSD Market Value | $63.58 billion | 2024 (estimated) |

Legal factors

Data privacy laws are expanding worldwide, like GDPR and CPRA. By 2024, roughly 75% of the world's population had their data protected by local laws. Seagate must adapt to these ever-changing legal demands to avoid penalties and maintain consumer trust. This includes adhering to data breach notification rules and consent requirements.

Seagate must comply with export control regulations and trade restrictions, affecting sales in specific regions. These regulations, particularly from the U.S. government, may limit the company's ability to supply products to countries like China. In 2024, Seagate's international sales accounted for roughly 80% of its total revenue, highlighting the potential impact of these restrictions. The company closely monitors and adapts to changing trade policies to mitigate risks.

Seagate Technology must adhere to industry standards for data security. These standards, like those from the Storage Networking Industry Association, ensure data integrity and interoperability. In 2024, the global data storage market was valued at $122.37 billion. Meeting these standards is critical for maintaining trust and avoiding penalties.

Legal Risks and Litigation

Seagate Technology faces legal and regulatory hurdles that could affect its finances. Compliance costs and litigation risks are significant concerns. These can arise from data privacy laws and intellectual property disputes. The company must stay compliant with evolving global regulations.

- In 2024, legal expenses for Seagate totaled $45 million.

- Data privacy regulations, like GDPR and CCPA, necessitate ongoing compliance efforts.

- Patent litigation cases could lead to substantial financial penalties.

- Failure to comply with trade regulations may result in fines.

Acquisition and Merger Regulations

Seagate's acquisitions and mergers face legal hurdles. These deals, like the Intevac acquisition, require regulatory approval. Such reviews can delay or block transactions. Compliance with antitrust laws is crucial. The Federal Trade Commission (FTC) and similar bodies globally scrutinize these activities.

- In 2024, global M&A activity decreased by 15% due to heightened regulatory scrutiny.

- Seagate's Intevac acquisition was reviewed by multiple international agencies.

Seagate navigates a complex legal landscape. Data privacy laws like GDPR and CPRA require continuous compliance, with expenses totaling $45 million in 2024. Export controls and trade restrictions impact international sales, which accounted for approximately 80% of revenue. Mergers and acquisitions also face scrutiny from regulatory bodies.

| Legal Aspect | Compliance Challenges | Financial Impact (2024) |

|---|---|---|

| Data Privacy | GDPR, CCPA compliance; data breaches | $45M in legal expenses |

| Trade Regulations | Export controls, trade restrictions | Potential revenue loss in specific regions. |

| M&A | Antitrust reviews (FTC, etc.) | Deal delays; decrease in global M&A activity by 15% |

Environmental factors

Seagate actively works to cut its environmental impact, especially in its manufacturing. In 2023, they decreased greenhouse gas emissions by 7%. Furthermore, renewable energy made up 46% of its total energy use. These actions reflect a growing trend of corporate environmental responsibility.

Data centers' energy use is a major environmental issue. With data volumes growing and AI expanding, firms face pressure to cut carbon emissions. Energy use is a priority for many leaders. In 2024, data centers consumed roughly 2% of global electricity. Projections estimate this could rise to 8% by 2030.

Sustainable manufacturing is gaining importance. Seagate focuses on eco-friendly practices. The company's 2024 Sustainability Report showed a 15% reduction in water usage. This boosts its environmental standing.

Life Cycle Management and Circularity

Seagate acknowledges life cycle management and circularity as essential for minimizing environmental impact. They aim to extend the lifespan of storage equipment by refurbishing, reusing, and maintaining products. However, a significant gap remains in prioritizing life cycle management within purchasing decisions. This indicates an area where further advancements could significantly benefit both the environment and the company's sustainability goals.

- In 2024, Seagate reported a 15% increase in products returned for refurbishment.

- The company targets a 20% reduction in waste by 2025 through circular economy initiatives.

- Refurbished drives offer up to 70% cost savings compared to new ones.

Water Usage in Operations

Seagate Technology actively manages water usage within its operations, integrating water-related factors into its enterprise risk assessment. Facilities contribute input based on local conditions, and the company conducts river basin-level water risk assessments to understand potential challenges. This proactive approach helps Seagate mitigate environmental impacts and ensure sustainable practices. In 2023, the company reported a water withdrawal of 1.28 million cubic meters.

- Water withdrawal of 1.28 million cubic meters in 2023.

- Enterprise risk assessment process includes water-related factors.

- River basin-level water risk assessments are conducted.

Seagate's environmental strategy prioritizes reducing greenhouse gas emissions and expanding renewable energy usage. In 2023, emissions fell by 7%, with 46% of energy from renewables. Sustainable manufacturing is another focus, exemplified by a 15% water usage reduction in 2024.

| Metric | 2023 | 2024 (Projected/Reported) |

|---|---|---|

| Greenhouse Gas Emission Reduction | 7% | Ongoing efforts |

| Renewable Energy Usage | 46% | Increasing targets |

| Water Usage Reduction | N/A | 15% reduction |

PESTLE Analysis Data Sources

This PESTLE analysis integrates data from industry reports, financial databases, and government publications, ensuring a comprehensive understanding of Seagate's macro environment.