Segro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Segro Bundle

What is included in the product

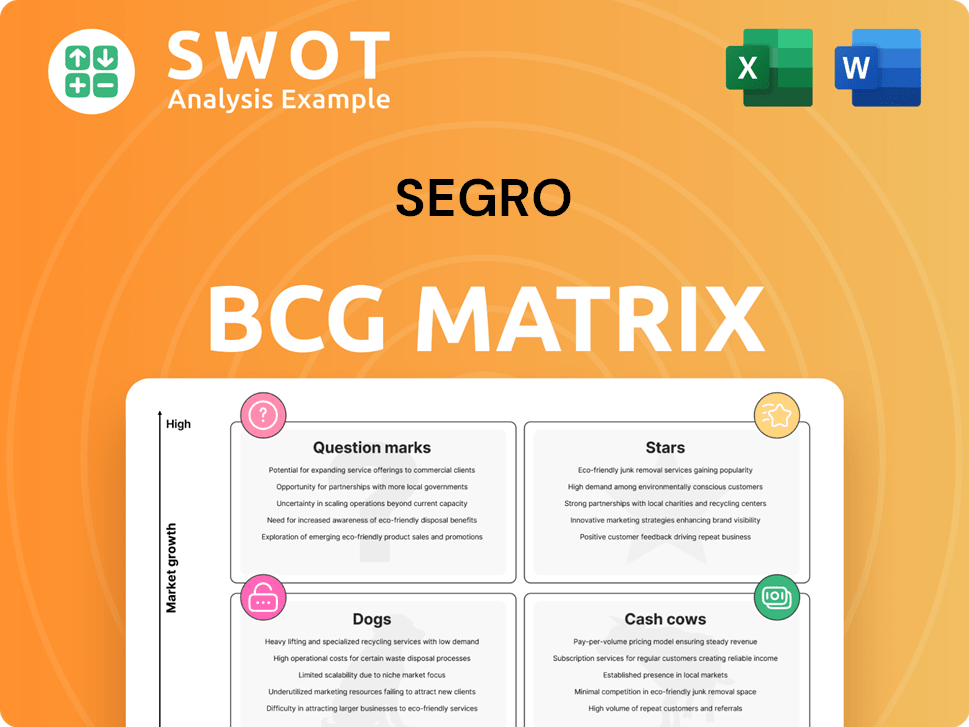

Segro BCG Matrix: tailored analysis for their product portfolio.

Clear visualization identifying growth opportunities and resource allocation.

What You See Is What You Get

Segro BCG Matrix

The displayed preview mirrors the Segro BCG Matrix you receive after purchase. It’s the complete, fully editable report, prepared for strategic insights and immediate implementation.

BCG Matrix Template

This company’s BCG Matrix offers a glimpse into its product portfolio's potential—Stars, Cash Cows, Dogs, and Question Marks. See how products perform in terms of market share and growth rate. The preview is just the beginning. Purchase the full BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

SEGRO's data center strategy, highlighted by its 2.3GW European pipeline, is a key focus. This sector benefits from the rising need for data storage and processing, making it a high-growth area. While requiring major investments, the potential returns are significant, aligning with digitalization trends. In 2024, the data center market is expected to reach $500 billion globally.

SEGRO's urban warehouses are strategically placed near major cities, meeting the surge in last-mile and e-commerce needs. These locations benefit from high demand, limited space, and easy access to transport. In 2024, SEGRO's portfolio saw strong occupancy rates, reflecting its prime positioning. The focus on sustainability and innovation is also a key factor for businesses.

SEGRO's joint venture with Pure Data Centres Group highlights its strategic growth approach. This partnership, as of 2024, is projected to develop data centers with a combined value exceeding £500 million. Leveraging external expertise and capital, SEGRO accelerates development. These collaborations enhance its competitive edge and access to specialized resources. SEGRO's strategic partnerships increased its total assets by 12% in 2024.

Sustainability Initiatives

SEGRO's dedication to sustainability, reflected in its Responsible SEGRO framework, responds to the increasing demand for eco-friendly properties. This commitment boosts SEGRO's image and draws stakeholders prioritizing sustainability, as seen in its focus on reducing emissions and investing in communities. Development projects are designed to meet high environmental standards. In 2024, SEGRO reported that 97% of its developments achieved BREEAM ratings of 'Very Good' or higher.

- Responsible SEGRO framework aligns with environmental standards.

- Focus on cutting carbon emissions.

- Investment in local communities.

- 97% of developments achieved BREEAM ratings 'Very Good' or higher in 2024.

Capturing Rent Reversion and Leasing Vacant Space

SEGRO excels at boosting income by leveraging its portfolio. They aim to gain £173 million more in rent through current assets and filling empty spaces. Active management and customer care are key to increasing rents and keeping properties full. This approach ensures SEGRO's revenue remains strong and consistently increases.

- £173 million potential rental income uplift.

- High occupancy rates maintained.

- Focus on asset optimization.

SEGRO's data centers and urban warehouses represent "Stars" in the BCG matrix, indicating high growth potential and market share. The company's strategic focus on digitalization and e-commerce drives these segments. In 2024, the data center market reached $500 billion globally, and SEGRO's occupancy rates remained high.

| Aspect | Details | 2024 Data |

|---|---|---|

| Data Centers | High growth, large investment | $500B global market |

| Urban Warehouses | Strategic locations, e-commerce focus | Strong occupancy rates |

| Strategic Partnerships | JV with Pure Data Centres | £500M+ development value |

Cash Cows

SEGRO's big box warehouses, positioned near key logistics points, offer steady rental income. These properties, supported by long-term leases, see robust demand from distribution centers. In 2024, SEGRO's portfolio occupancy rate remained high at 97.8%, highlighting its stability. This segment provides a dependable cash flow source, crucial for overall financial health.

SEGRO's UK industrial portfolio is a "Cash Cow" due to its mature market. In 2024, UK industrial property saw strong demand. SEGRO's UK assets generated consistent income. Rental uplifts supported revenue growth. The portfolio's value is estimated at £8.5 billion.

SEGRO prioritizes enduring customer relationships, crucial for stable revenue and occupancy. Tailoring solutions boosts loyalty, decreasing turnover. The customer-focused strategy fortifies SEGRO's market standing. In 2024, SEGRO's occupancy rate hit 97.8%, reflecting successful relationship management.

Efficient Asset Management

SEGRO's asset management boosts its "Cash Cows" status, focusing on existing properties. Proactive strategies, like rent reviews and lease renewals, enhance income. Property improvements ensure tenant attractiveness and strong returns. This operational excellence is key to SEGRO's financial stability.

- In 2024, SEGRO reported a passing rent of 7.5%.

- Lease renewals are crucial, with 94% of leases renewed in 2024.

- SEGRO's focus on operational excellence in 2024 increased net rental income by 8.8%.

Strategic Land Bank

SEGRO's strategic land bank, a key cash cow, is a valuable asset for future development. It's located in prime markets, supporting expansion and revenue generation. This land bank helps deliver significant new rent and boosts long-term growth. Strategic management ensures SEGRO seizes market opportunities, maintaining a competitive advantage. In 2024, SEGRO's portfolio was valued at £20.2 billion.

- Land bank provides development opportunities.

- Supports future rent and growth.

- Strategic management is crucial.

- Portfolio valued at £20.2 billion in 2024.

SEGRO's "Cash Cows" are key in the UK, fueled by mature markets. Consistent income and strong demand in 2024 led to rental uplifts. These assets generate steady revenue, like the £8.5 billion UK portfolio.

| Metric | Value | Year |

|---|---|---|

| Passing Rent | 7.5% | 2024 |

| Lease Renewals | 94% | 2024 |

| Net Rental Income Growth | 8.8% | 2024 |

Dogs

Older properties lacking sustainability are "Dogs" in the SEGRO BCG Matrix. These properties often need costly upgrades, hindering returns. Selling them allows reinvestment in better assets. In 2024, upgrading non-sustainable buildings cost an average of £200 per sq ft.

SEGRO's properties in areas with slower economic growth or poor logistics may struggle. These locations could see lower demand and rents, affecting SEGRO's overall results. In 2024, focus remains on UK and Continental Europe properties. Consider that in 2024, SEGRO's UK portfolio accounted for 45% of its total value.

Properties with high vacancy rates drain resources instead of producing income. Turnaround strategies can fail, turning these assets into financial burdens. Consider selling or changing the use of these underperforming properties. In 2024, some commercial real estate markets saw vacancy rates above 15%, highlighting this issue.

Assets with Limited Growth Potential

Properties with limited growth potential, often dubbed "Dogs," are those in areas with stagnant infrastructure or intense competition. These assets might struggle to increase rental income or property value significantly. For instance, older industrial sites in the UK saw a 2.5% average rental yield in 2024, lagging behind newer developments. Strategic choices include upgrades or disposal.

- Limited rental yield growth.

- Value appreciation struggles.

- Located in stagnant areas.

- Strong competition exists.

Properties Requiring Significant Capital Expenditure

Properties needing hefty capital outlays to stay competitive can be a drag on finances, potentially offering poor returns. These assets might become outdated or need expensive updates to satisfy tenants. For example, in 2024, commercial real estate saw significant renovation costs. Careful assessment is critical to decide if these investments are worthwhile.

- High maintenance costs can erode profitability.

- Functional obsolescence reduces property value.

- Upgrades are often needed to meet market standards.

- Investments must be carefully evaluated for ROI.

Dogs within SEGRO's portfolio often face challenges like low growth and high costs. These properties can drag down overall returns, especially those needing costly upgrades. In 2024, older industrial sites in the UK yielded just 2.5% compared to newer developments. Strategic decisions include upgrades or selling these assets.

| Characteristic | Impact | 2024 Data Point |

|---|---|---|

| Rental Yield | Stunted Growth | 2.5% in older UK industrial sites |

| Upgrade Costs | Financial Burden | £200/sq ft for non-sustainable buildings |

| Vacancy Rates | Resource Drain | Over 15% in some markets |

Question Marks

Venturing into new geographic markets offers SEGRO opportunities for growth but demands careful consideration. Expansion can boost revenue; however, substantial investments and potential lower returns pose risks. In 2024, companies expanding internationally saw varying success rates, with some experiencing rapid growth and others facing setbacks. Market research and strategic partnerships are vital to navigate new regions. SEGRO should evaluate market dynamics and growth prospects before committing.

Speculative development projects, lacking pre-let agreements, increase SEGRO's risk profile. Although these projects offer high return potential, they risk losses if demand is weak. In 2024, SEGRO's speculative developments accounted for a portion of its portfolio, demanding careful market analysis. Effective risk management is crucial for these ventures. For example, in 2024, SEGRO's total portfolio was valued at £20.0 billion.

Investment in new technologies, like smart building solutions and automation, is crucial. These technologies improve efficiency and attract tenants, but require a large initial investment. The benefits might not be immediately visible, and there's a risk of becoming obsolete. In 2024, the smart building market is estimated to reach $94.6 billion. Staying current is vital.

Expansion into Fully-Fitted Data Centres

SEGRO's move into fully-fitted data centers signals a strategic shift, aiming for higher returns. This expansion demands substantial capital and specialized skills. The company must evaluate market needs and competition. In 2024, data center demand continues to grow significantly.

- SEGRO's 2023 data center revenue was £70 million.

- Fully-fitted centers can offer higher yields compared to powered-shell options.

- The data center market is projected to reach $62.3 billion by 2026.

- Increased competition may impact profitability.

New Sustainability Initiatives

SEGRO's sustainability initiatives, categorized as "Question Marks," involve investments in areas like carbon capture and renewable energy. These projects aim to improve SEGRO's reputation and attract eco-conscious tenants. However, the financial returns and long-term benefits of these initiatives remain uncertain, requiring careful consideration.

- In 2024, SEGRO invested heavily in green initiatives, with approximately £100 million allocated to renewable energy projects.

- Such investments may face challenges, including fluctuating energy prices and technological uncertainties.

- A balanced approach is essential to ensure investments deliver both environmental and financial returns.

- SEGRO aims to achieve net-zero carbon emissions by 2050, driving its sustainability efforts.

Sustainability initiatives, classified as "Question Marks," involve investments in carbon capture and renewable energy. These aim to boost SEGRO's reputation and attract tenants. Uncertainty surrounds financial returns, demanding careful evaluation.

| Aspect | Details | 2024 Data |

|---|---|---|

| Investment Focus | Carbon capture, renewable energy | £100M allocated to renewable projects |

| Challenges | Fluctuating energy prices, tech uncertainties | Renewable energy costs: Variable, with fluctuations |

| Goal | Enhance reputation, attract eco-tenants, and Net-Zero by 2050 | 2024: Progress reported in various ESG metrics |

BCG Matrix Data Sources

This BCG Matrix uses market data from financial reports, market research, and sales figures, ensuring precise and strategic evaluations.