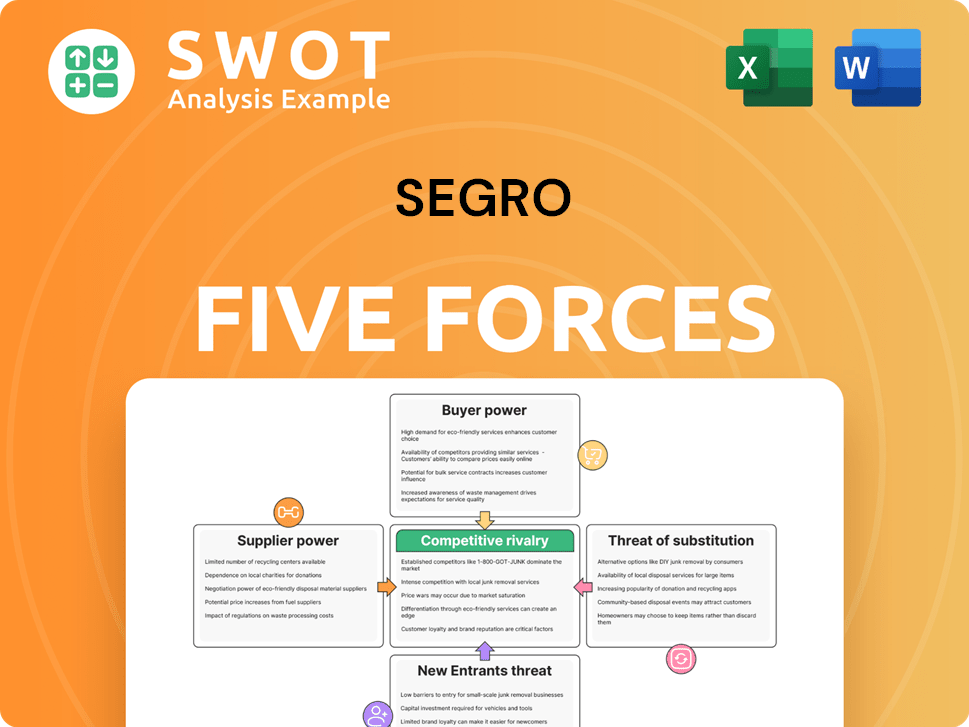

Segro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Segro Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Quickly identify weak spots with dynamic charts and clear visual displays.

Same Document Delivered

Segro Porter's Five Forces Analysis

This is the complete Segro Porter's Five Forces analysis. The preview displays the entire document, providing a comprehensive look at the industry dynamics. Expect no alterations: the file you see is the one you will download. This fully formatted analysis is instantly ready to use after purchase.

Porter's Five Forces Analysis Template

Segro's Porter's Five Forces assessment considers the competitive landscape. Analyzing buyer & supplier power reveals profit margin impacts. Threat of new entrants and substitutes assesses market disruption risks. Competitive rivalry evaluates the intensity among existing players. This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Segro.

Suppliers Bargaining Power

SEGRO's suppliers' power is generally low due to the REIT sector's characteristics. Specialized suppliers, like those for advanced warehouse tech, could have more influence. This is balanced by alternative suppliers and SEGRO's size. SEGRO's 2024 results showed a strong balance sheet, lessening supplier impact.

Fluctuations in construction material costs, like steel and concrete, directly affect project expenses. Suppliers of these materials have moderate bargaining power, especially during high demand or supply disruptions. In 2024, steel prices increased by approximately 10% due to global demand. SEGRO can mitigate this by securing long-term contracts and diversifying its supplier base. This strategy helps manage cost volatility.

Land is a crucial resource for SEGRO's operations. Landowners in sought-after urban areas wield substantial bargaining power. The scarcity of suitable land can inflate prices, thus increasing development expenses. In 2024, SEGRO's land acquisitions totaled £450 million, highlighting the strategic importance of land management for profitability.

Service provider contracts

SEGRO's service provider contracts involve entities like property management and security firms. These providers typically have less bargaining power due to the competitive market. SEGRO's substantial size allows it to negotiate favorable terms, ensuring cost-effectiveness. In 2024, SEGRO's focus on operational efficiency included optimizing these contracts. This strategy helps maintain profitability and competitive advantage.

- Service providers face competition, limiting their bargaining power.

- SEGRO's size enables advantageous contract negotiations.

- Focus on efficiency is a key operational goal.

- This approach supports profitability and competitiveness.

Impact of regulation

Environmental regulations and building codes significantly influence supplier dynamics, often increasing costs and narrowing the supplier pool. Suppliers adept at navigating these complex regulations might wield slightly more bargaining power. For instance, in 2024, the construction industry faced a 5-7% rise in material costs due to stricter environmental standards globally. SEGRO must prioritize compliance and seek suppliers with the necessary expertise to mitigate these impacts. This strategic approach is crucial for maintaining project timelines and cost-effectiveness.

- Increased Costs: Building material costs went up in 2024 due to green building standards.

- Limited Pool: Regulations can restrict the number of suppliers.

- Expertise Matters: Suppliers with regulatory knowledge gain an advantage.

- Compliance Focus: SEGRO must ensure adherence to all rules.

SEGRO generally faces low supplier bargaining power, especially with service providers. Construction material suppliers and landowners in prime areas possess moderate influence. Environmental regulations can shift bargaining power.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Materials | Price Fluctuations | Steel price increase: ~10% |

| Land | High Costs | Land acquisitions: £450M |

| Regulations | Cost Increases | Material cost rise: 5-7% |

Customers Bargaining Power

If SEGRO's tenant base is concentrated, with a few major clients, these tenants wield significant bargaining power. They can push for better lease conditions and influence rental rates. In 2024, SEGRO's strategy involves diversifying its tenant portfolio. This includes a broad range of industries and geographic locations to minimize tenant concentration risk. For example, in 2024, SEGRO's largest tenant accounted for less than 3% of its rental income.

Tenants' demand for flexible lease terms significantly affects SEGRO's bargaining power. Offering flexibility, like shorter leases, can attract tenants but potentially reduces long-term revenue stability. In 2024, SEGRO's occupancy rate was around 97.5%, showing strong demand, yet lease lengths averaged about 7 years. Balancing tenant needs with SEGRO's financial goals is essential for sustainable growth.

Switching costs for SEGRO's tenants, especially in smaller units, are often low. This situation grants tenants leverage during lease renewals. In 2024, with industrial vacancy rates around 4%, tenants have more options. SEGRO boosts switching costs by offering services and building strong tenant relationships. Consider that tenant retention rates directly impact profitability.

Market demand

High demand for warehouse space significantly boosts SEGRO's bargaining power in 2024. Low vacancy rates, like the 3.6% reported in London in Q3 2024, allow SEGRO to negotiate higher rents and more favorable lease terms. The increasing demand for logistics and urban warehousing further strengthens SEGRO's position, driven by e-commerce growth and supply chain needs. This demand dynamic enables SEGRO to maintain robust profitability.

- High demand supports SEGRO's strong negotiation stance.

- Low vacancy rates facilitate premium pricing.

- Rising logistics needs benefit SEGRO's market presence.

Economic conditions

Economic conditions significantly impact tenant bargaining power, especially during downturns. Weakened demand gives tenants leverage to negotiate favorable terms. In 2024, the UK's industrial market saw a slight slowdown, potentially increasing tenant bargaining power. SEGRO must maintain a strong financial footing to navigate economic fluctuations effectively.

- Industrial vacancy rates in the UK rose slightly in 2024, indicating increased tenant options.

- Economic uncertainty in Europe and the UK influenced tenant decisions.

- SEGRO's robust financial health is crucial for weathering economic pressures.

- Negotiating lease terms became more critical for both landlords and tenants.

Tenant concentration and lease flexibility affect SEGRO's bargaining power. In 2024, SEGRO's largest tenant contributed less than 3% of revenue, showing diversification. Strong demand and low vacancy rates support SEGRO's position, despite economic pressures.

| Factor | Impact on Bargaining Power | 2024 Data/Example |

|---|---|---|

| Tenant Concentration | High concentration weakens SEGRO's power | Largest tenant: less than 3% of rental income |

| Lease Flexibility | Shorter leases can reduce long-term revenue | Occupancy: 97.5%, Avg. lease length: 7 years |

| Vacancy Rates | Low rates boost SEGRO's negotiation position | London vacancy: 3.6% in Q3 2024 |

Rivalry Among Competitors

The REIT sector, particularly in prime areas, is fiercely competitive. SEGRO competes with major REITs and developers. This rivalry pressures rental rates and occupancy. In 2024, the UK industrial and logistics market saw a 5.2% vacancy rate. Competition in SEGRO's key markets remains high.

SEGRO and competitors distinguish themselves by providing value-added services. This includes customized spaces and comprehensive property management. To stay ahead, SEGRO must constantly innovate its service offerings. Sustainability and tech integration are crucial differentiators. For example, SEGRO's 2023 annual report highlighted significant investments in sustainable buildings.

The REIT sector is seeing consolidation, creating stronger rivals. Mergers and acquisitions intensify competition. SEGRO must track industry shifts and adjust its approach. In 2024, several significant mergers reshaped the landscape, increasing market concentration. This demands agile strategic responses from SEGRO.

Geographic focus

SEGRO's geographic focus on the UK and Continental Europe directly impacts its competitive rivalry. This strategy places SEGRO against firms also specializing in these regions. Success hinges on understanding local market dynamics. Adapting to regional preferences and regulations is key.

- SEGRO's 2023 results showed a strong focus on these regions, with a portfolio valued at £18.1 billion, primarily in the UK and Europe.

- Competition includes local and international players, intensifying in areas with high demand, like London and Paris.

- Regional regulations, such as those related to environmental standards and zoning, significantly affect operational costs.

- Understanding local market dynamics, including tenant demand and economic trends, is crucial for strategic decisions.

New development activity

New warehouse and industrial property development can significantly increase supply, intensifying competition among players like SEGRO. SEGRO must meticulously assess market demand before initiating new projects to avoid oversupply, which can lead to lower rental yields. Strategic site selection and efficient project management are critical for success in this competitive landscape. In 2024, the industrial property market saw a 4.5% increase in supply across key European markets, highlighting the pressure on existing players.

- Increased supply can lower rental rates.

- Careful market analysis is crucial to avoid overbuilding.

- Efficient project management minimizes costs.

- Strategic site selection enhances competitiveness.

Rivalry in the REIT sector, like SEGRO, is intense, especially in prime areas. Competition affects rental rates and occupancy, driving the need for differentiation. Market consolidation and new developments further intensify the competitive landscape. In 2024, the UK industrial market experienced a 5.2% vacancy rate, emphasizing competition.

| Aspect | Impact on SEGRO | 2024 Data Point |

|---|---|---|

| Competition | Pressures rental rates | UK Industrial Vacancy: 5.2% |

| Differentiation | Required to stay ahead | SEGRO’s Sustainability Investments |

| Market Dynamics | Influences strategic decisions | European Supply Increase: 4.5% |

SSubstitutes Threaten

Tenants could explore options like office spaces for light industrial uses. The appeal of these alternatives hinges on the tenant's specific needs. In 2024, the vacancy rate for industrial properties was around 4.5%, indicating strong demand. SEGRO must highlight its modern warehousing advantages to counter this threat.

Tenants might move to cheaper locations, particularly if real estate costs are a big deal for them. This could mean leaving prime city spots. SEGRO must show why its higher rents are worth it, maybe with better infrastructure or customer access. In 2024, industrial vacancy rates were around 4-5% in many major UK cities, indicating some pressure.

Technological advancements pose a threat to SEGRO's business model. Automation and robotics can reduce reliance on physical warehouse space. This shift could diminish demand for traditional warehousing. SEGRO must adapt by providing flexible, tech-integrated spaces. In 2024, the industrial real estate sector faced pressure from these trends, with some companies downsizing their footprint.

Changes in supply chain management

Changes in supply chain management, like the shift to "just-in-time" inventory, pose a threat to SEGRO. This can alter the demand for warehousing, potentially reducing the need for large storage spaces. Businesses might opt for different warehouse types or locations to suit their evolving needs. SEGRO must adapt to these shifts to remain competitive and relevant in the market.

- Demand for warehouse space in the UK saw a slight decrease in 2024, with vacancy rates increasing slightly.

- The rise of e-commerce continues to influence warehouse requirements, with a focus on last-mile delivery locations.

- SEGRO's 2024 financial reports show a focus on modern, flexible warehouse spaces to meet changing demands.

Remote work trends

The increasing adoption of remote work poses a subtle but relevant threat to SEGRO. While not directly impacting all industrial spaces, the shift could decrease demand for distribution centers that serve offices. SEGRO should carefully assess the long-term effects of this trend on its tenants and their space requirements. Focusing on e-commerce and essential industries can help lessen the impact of remote work. According to a 2024 study, 30% of the workforce works remotely.

- Remote work reduces office-related distribution needs.

- SEGRO's tenant base could evolve because of it.

- E-commerce and essential industries remain key.

- About 30% of the workforce works remotely.

Substitutes include office spaces, cheaper locations, and tech-driven solutions. Tenants may seek alternatives to reduce costs or adapt to evolving needs. SEGRO's 2024 performance indicates the ongoing need to highlight its value through modern facilities.

| Substitute | Impact | SEGRO's Response |

|---|---|---|

| Office/Industrial Spaces | Reduced demand if tenants switch. | Highlight advantages of modern warehousing. |

| Cheaper Locations | Tenant relocation. | Show value with better infrastructure. |

| Tech/Automation | Reduced warehouse space needs. | Offer flexible, tech-integrated spaces. |

Entrants Threaten

The real estate sector, including industrial properties, demands considerable upfront capital, acting as a significant hurdle. Land purchase, construction, and ongoing property upkeep represent major financial commitments. In 2024, SEGRO reported a portfolio value of approximately £18.7 billion, showcasing the capital intensity of the business. This high initial investment shields existing companies from new competitors.

Established REITs like SEGRO have an edge due to economies of scale. They manage properties and secure financing more efficiently. New entrants find it hard to match this cost advantage. In 2024, SEGRO's operational efficiency led to higher profit margins. Their size allows them to get better financing deals.

SEGRO's established brand and reputation pose a significant barrier. New entrants must invest heavily to build comparable trust, which is essential for attracting tenants and investors. SEGRO's strong reputation allows it to secure favorable financing terms and attract high-quality tenants. In 2024, SEGRO's occupancy rate remained high, demonstrating its strong market position.

Regulatory hurdles

The real estate sector faces regulatory hurdles like zoning and environmental rules. New entrants find it tough to navigate these complexities. SEGRO's deep experience in compliance gives it an edge. This advantage limits the threat from new competitors. This regulatory advantage is a key aspect of SEGRO's competitive positioning.

- Zoning regulations impact development timelines and costs.

- Environmental regulations add to project expenses and approvals.

- SEGRO's compliance expertise reduces delays and risks.

- New entrants may face higher compliance costs.

Access to prime locations

New entrants face significant challenges in securing prime locations within key urban and logistics markets. Established companies like SEGRO benefit from existing portfolios, providing a strategic advantage. These companies often have pre-existing relationships with landowners and developers, making it difficult for newcomers to compete. The difficulty in acquiring land and buildings in desirable areas acts as a barrier to entry.

- SEGRO's portfolio includes prime logistics properties across Europe, providing a significant competitive edge.

- The value of European logistics real estate has grown significantly in recent years, increasing the cost of entry for new players.

- Established REITs often have access to capital at more favorable terms, further aiding their ability to acquire and develop properties.

- Planning regulations and environmental considerations can also create delays and increase costs for new entrants.

High capital needs create a barrier for new entrants. SEGRO’s £18.7B portfolio in 2024 reflects this barrier. Established scale, brand reputation, and regulatory compliance further protect SEGRO. Prime location access strengthens its market position.

| Factor | Impact on New Entrants | SEGRO's Advantage |

|---|---|---|

| Capital Requirements | High initial investment. | Established portfolio. |

| Economies of Scale | Difficult to match cost. | Efficient operations. |

| Brand Reputation | Need for heavy investment. | Strong market position. |

Porter's Five Forces Analysis Data Sources

We draw on sources like annual reports, market research, and financial databases to evaluate Segro's competitive landscape.