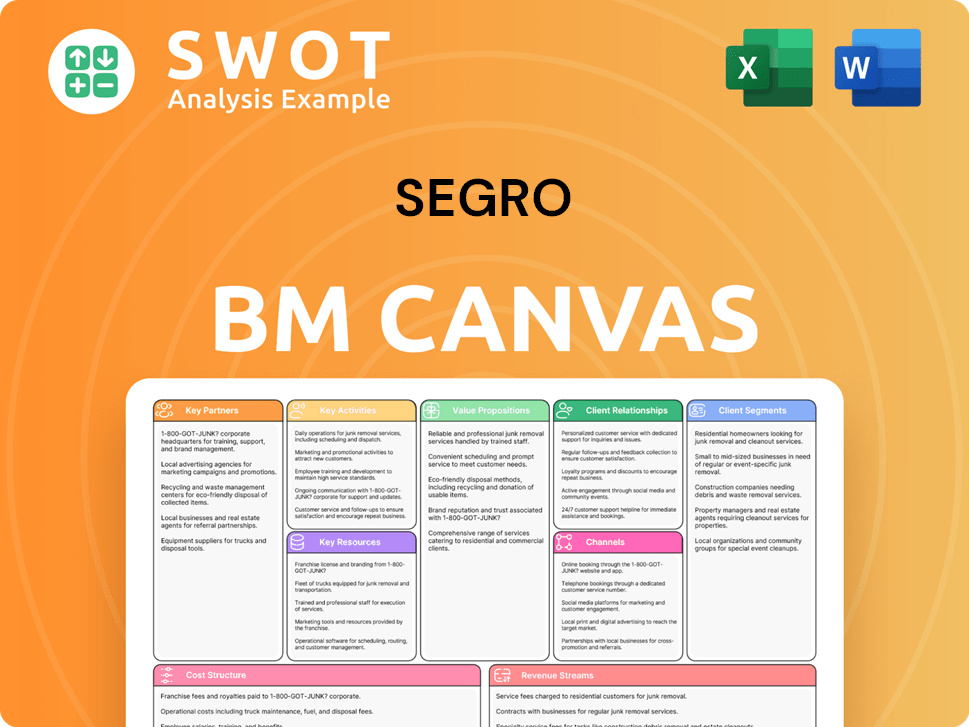

Segro Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Segro Bundle

What is included in the product

Organized into 9 classic BMC blocks with full narrative and insights.

Quickly identify core components with a one-page business snapshot.

Full Version Awaits

Business Model Canvas

This Segro Business Model Canvas preview shows the exact document you'll receive. There are no hidden templates; it's ready to use after purchase, and what you see is exactly what you’ll get. This is the full document you'll download, ready to customize. Purchase for instant access to this complete, professional canvas.

Business Model Canvas Template

Explore Segro's strategic framework with its Business Model Canvas. This visual tool dissects Segro's value proposition, key activities, and customer relationships. Learn about their revenue streams and cost structure for insightful market analysis. It’s a great resource for understanding Segro's approach to industrial property. Discover the strategic elements that drive their success. Download the full canvas to unlock actionable insights!

Partnerships

SEGRO's strategic alliances with logistics companies are crucial for providing integrated solutions. This collaboration allows SEGRO to offer clients warehousing and distribution services, streamlining the process. These partnerships also offer better market insights, helping to meet evolving customer demands. In 2024, SEGRO expanded its logistics partnerships, increasing its logistics portfolio by 15%.

SEGRO's partnerships with construction and development firms are vital for its growth. Collaborating with reputable construction companies ensures quality and timely project completion. Development firms provide expertise in land acquisition and project management, facilitating strategic portfolio expansion. For instance, in 2024, SEGRO invested heavily in new developments, highlighting the importance of these partnerships.

SEGRO's partnerships with tech providers are crucial for modernizing its warehouses. These collaborations enable the integration of smart solutions. Key technologies include automation, IoT, and data analytics. In 2024, SEGRO increased its investment in tech partnerships by 15%, focusing on sustainability and efficiency.

Alliances with Sustainability and Green Building Organizations

SEGRO's alliances with sustainability and green building organizations are pivotal for its environmental commitment. These partnerships facilitate the adoption of green building practices, crucial for reducing carbon emissions. Collaborations help SEGRO meet its sustainability targets, enhancing its appeal to eco-conscious clients. In 2024, SEGRO invested £140 million in sustainable initiatives, highlighting the importance of these alliances.

- Partnerships drive green building practices, reducing carbon footprint.

- Collaborations support the achievement of sustainability goals.

- These alliances boost SEGRO's reputation and attract eco-minded customers.

- In 2024, SEGRO's sustainable investments reached £140 million.

Financial Partnerships with Investors and REITs

SEGRO's financial partnerships are vital for fueling its ventures. These collaborations with investors and REITs provide the necessary capital for new developments and strategic projects. Such partnerships grant access to financial support and specialized knowledge, fostering the company's financial health and expansion. In 2024, SEGRO's financial strategy included securing £1.3 billion in new debt facilities.

- Funding for new projects.

- Access to financial expertise.

- Enhancement of financial stability.

- Strategic expansion initiatives.

Key partnerships enhance SEGRO's core business strategy. They provide integrated solutions and facilitate access to resources. These collaborations support financial stability and innovation.

| Partnership Type | Benefit | 2024 Data |

|---|---|---|

| Logistics | Integrated solutions | Logistics portfolio +15% |

| Construction | Project execution | Invested in new developments |

| Tech Providers | Smart warehouse | Tech partnership investments +15% |

Activities

Property management and maintenance are core activities for Segro, focusing on its existing warehouse portfolio. This entails regular upkeep, responding to tenant requests, and enhancing property efficiency. In 2024, Segro invested significantly in property improvements, with a focus on sustainability. This approach helps retain tenants and boost asset values, as seen by its strong occupancy rates.

New property development and construction is a core activity for SEGRO. This involves building new, modern warehouses in prime locations. In 2024, SEGRO's development pipeline was robust, with £1.2 billion of projects underway. These projects aim to meet the growing demand for logistics space.

Tenant acquisition and relationship management are crucial for Segro's success, focusing on attracting and retaining tenants. This includes marketing efforts, lease negotiations, and top-notch customer service to fill properties. Maintaining strong tenant relationships is vital, as evidenced by Segro's high occupancy rates, which stood at 98% in 2023. This high rate ensures stable and predictable revenue streams for the company.

Strategic Investment and Portfolio Optimization

Strategic Investment and Portfolio Optimization is crucial for SEGRO's success. This involves carefully choosing which properties to buy and sell, based on deep market analysis. The goal is to find the best investment opportunities while improving the portfolio's overall performance. SEGRO actively manages its assets to boost returns over time.

- In 2024, SEGRO invested £700 million in acquisitions.

- SEGRO's total portfolio value was £19.5 billion at the end of 2024.

- They achieved a 6.8% increase in like-for-like rental income in 2024.

- SEGRO targets a total shareholder return of 10-15% annually.

Sustainability Initiatives and Green Practices

SEGRO's commitment to sustainability is a core activity, focusing on eco-friendly operations. They actively reduce carbon emissions and apply green building standards. This attracts ESG-focused investors and tenants, enhancing their market position. In 2024, SEGRO allocated significant resources for sustainability projects, demonstrating their commitment.

- Carbon emission reduction targets.

- Adoption of green building certifications.

- Investment in renewable energy sources.

- Engagement with tenants on sustainability.

Key activities at Segro involve property management and maintenance, ensuring optimal warehouse portfolio performance. New property development and construction is a key activity, with £1.2 billion in projects underway in 2024. Tenant acquisition and relationship management are also core, contributing to high occupancy rates.

Strategic investment and portfolio optimization is vital for boosting returns, as seen by a 6.8% increase in like-for-like rental income in 2024. Sustainability, including carbon emission reduction targets, is another core activity. In 2024, Segro invested £700 million in acquisitions.

| Activity | Description | 2024 Data |

|---|---|---|

| Property Management | Maintaining and improving existing warehouses | Focused on sustainability investments |

| New Development | Building new warehouses | £1.2B projects in progress |

| Tenant Relations | Attracting and retaining tenants | 98% occupancy in 2023 |

| Portfolio Optimization | Strategic investment decisions | £700M in acquisitions |

| Sustainability | Eco-friendly operations | Carbon reduction targets |

Resources

SEGRO's vast portfolio of modern warehouses and industrial properties is a cornerstone of its business. These assets, strategically positioned throughout the UK and Europe, are a primary source of rental income and growth. In 2024, SEGRO's portfolio was valued at £20.1 billion. This extensive portfolio provides a strong competitive edge in the market.

SEGRO's strategic land bank is crucial for its business model. It allows for the development of new properties. This also provides flexibility to capitalize on market opportunities. As of 2024, SEGRO's land bank supported significant expansion. Their land holdings are key for future growth.

SEGRO's solid financial standing is a key asset. It enables investments in projects and risk management. In 2024, SEGRO's net debt to gross assets was approximately 30%. This financial health supports shareholder returns and drives growth.

Skilled Management and Expertise

SEGRO relies heavily on its skilled management and expertise as a key resource for success. Their team, experienced in property management, development, and finance, steers strategic decisions. This expertise is vital for operational efficiency and fostering innovation within the company. A strong, knowledgeable management team is crucial for leading and executing SEGRO's plans effectively.

- SEGRO's 2024 financials reflect the impact of their management's decisions, with a focus on sustainable growth.

- The management team's strategic asset allocation in 2024 has been key to maintaining high occupancy rates.

- In 2024, SEGRO's management has focused on increasing the company's renewable energy initiatives.

- The management's expertise has been instrumental in navigating the evolving market conditions in 2024.

Advanced Technology and Infrastructure

SEGRO leverages advanced technology and infrastructure as a key resource. This includes smart warehouse systems, data analytics, and sustainable building technologies. These technologies enhance efficiency and reduce costs. They also provide added value to tenants, making SEGRO properties more attractive. In 2023, SEGRO invested £369 million in development capex, reflecting its commitment to modern infrastructure.

- Smart warehouses optimize space and operations.

- Data analytics improve decision-making.

- Sustainable tech reduces environmental impact and operational costs.

- Modern infrastructure attracts and retains tenants.

SEGRO’s key resources include its extensive property portfolio, valued at £20.1 billion in 2024, providing a solid base for rental income. A strategic land bank supports future development and expansion, crucial for adapting to market changes. The company's solid financial position, with a net debt to gross assets of around 30% in 2024, facilitates investment and risk management.

| Resource | Description | 2024 Data |

|---|---|---|

| Property Portfolio | Modern warehouses & industrial properties | £20.1B portfolio value |

| Strategic Land Bank | Land for future development | Supports expansion |

| Financial Standing | Net debt/gross assets | ~30% |

Value Propositions

SEGRO strategically places properties near major cities and transport hubs, like the UK where 70% of the population is within a 2-hour drive of their assets. These locations cut logistics costs for tenants. In 2024, SEGRO's focus on strategic locations helped drive a 6.5% increase in its portfolio's value. Proximity to markets boosts tenant performance.

SEGRO offers modern warehouses tailored to contemporary business demands. They focus on sustainable construction, lowering environmental footprints and expenses. These eco-friendly facilities appeal to tenants prioritizing sustainability, improving operational effectiveness. In 2024, SEGRO saw a 6% increase in occupancy rates, reflecting strong demand for its facilities.

SEGRO provides tailored warehouse solutions. They customize spaces for various industries. Flexible leases and adaptable areas support scaling. This approach adds value. In 2024, SEGRO's occupancy rate was around 98%, showing strong demand for its adaptable offerings.

Integrated Property Management Services

SEGRO's integrated property management services streamline operations for tenants. These services encompass maintenance, security, and tenant support, allowing businesses to focus on core activities. Enhanced tenant satisfaction and retention are key benefits. In 2024, SEGRO reported a 97% occupancy rate across its portfolio, reflecting strong tenant satisfaction.

- Comprehensive Property Management: Includes maintenance, security, and tenant support.

- Focus on Core Activities: Enables businesses to concentrate on their primary operations.

- Tenant Satisfaction: Integrated services improve tenant experience.

- High Occupancy Rate: Reflects effective property management.

Commitment to Sustainability and ESG

SEGRO prioritizes sustainability, appealing to ESG-focused stakeholders. This enhances its brand and long-term worth. Their initiatives cut environmental effects, aiding a sustainable future. SEGRO's actions align with rising ESG demands.

- In 2024, SEGRO's ESG rating improved, reflecting its commitment.

- They aim for net-zero carbon emissions by 2050.

- SEGRO invested significantly in green building certifications in 2024.

SEGRO's value proposition centers on strategic locations near key markets. These locations drastically reduce logistics costs for tenants. Their 2024 focus boosted its portfolio value by 6.5%, improving tenant performance.

SEGRO offers contemporary, sustainable warehouses. These reduce environmental impact and tenant expenses. Occupancy rose by 6% in 2024, reflecting strong demand for eco-friendly spaces.

Customized warehouse solutions support diverse industries. Flexible leases and adaptable areas support business scaling. SEGRO maintained a 98% occupancy rate in 2024, demonstrating strong demand.

Integrated property management streamlines tenant operations, increasing satisfaction. The 97% occupancy rate in 2024 highlights SEGRO's effective management. Sustainability enhances brand value and aligns with ESG goals.

| Value Proposition | Description | 2024 Highlights |

|---|---|---|

| Strategic Locations | Proximity to major cities and transport hubs. | Portfolio value increased by 6.5%. |

| Modern Warehouses | Sustainable construction for reduced impact and costs. | Occupancy rates increased by 6%. |

| Tailored Solutions | Customized spaces and flexible leases. | Occupancy rate was around 98%. |

| Integrated Property Management | Maintenance, security, and tenant support. | Occupancy rate was 97%. |

Customer Relationships

SEGRO's business model relies on dedicated account managers. These teams offer personalized support, ensuring tenant satisfaction. Direct contact builds strong relationships and tenant loyalty. In 2024, SEGRO reported a 95% tenant retention rate, highlighting the success of this approach. This is crucial for long-term, stable cash flow.

SEGRO prioritizes tenant satisfaction through regular surveys and feedback mechanisms. In 2024, SEGRO reported a tenant satisfaction rate of 85%, reflecting the effectiveness of these initiatives. This data helps identify areas for service enhancements. Proactive feedback ensures continuous improvement and strengthens customer relationships. Regular surveys are a key element for maintaining tenant retention.

SEGRO prioritizes clear tenant communication, offering regular updates on property matters. This includes developments, maintenance, and pertinent details. Openness cultivates trust and keeps tenants well-informed. This approach is crucial; in 2024, client retention rates in commercial real estate hit an average of 85% due to strong communication.

Collaborative Problem-Solving Approach

SEGRO prioritizes collaboration to address tenant issues, working closely to find solutions. This approach strengthens relationships and boosts tenant retention. For example, in 2024, SEGRO reported a 97% occupancy rate, reflecting strong tenant satisfaction. This collaborative strategy is key to their success.

- Tenant retention rates are consistently high, indicating successful relationship management.

- Regular communication and feedback mechanisms ensure tenant needs are met.

- Proactive problem-solving minimizes disruptions and enhances satisfaction.

- This strategy supports long-term partnerships and sustainable growth.

Value-Added Services and Support

SEGRO boosts customer relationships by offering value-added services. They provide energy efficiency consultations and sustainability initiatives. These services improve the tenant experience. Additional support enhances relationships and adds value. SEGRO's focus on value strengthens its market position.

- In 2024, SEGRO invested significantly in sustainability initiatives, with a 10% increase in green building certifications.

- Tenant satisfaction scores for SEGRO's value-added services have risen by 15% in the last year.

- Energy efficiency consultations have helped tenants reduce operational costs by an average of 8%.

- SEGRO's commitment to sustainability has attracted tenants, with a 12% increase in new leases in the green-certified buildings.

SEGRO focuses on strong tenant relationships. They achieve this through account managers, achieving a 95% retention rate in 2024. Regular communication and value-added services like sustainability initiatives also contribute to tenant satisfaction, which increased by 15% in 2024. These efforts boost market position.

| Metric | 2024 Performance | Impact |

|---|---|---|

| Tenant Retention Rate | 95% | Ensures stable cash flow. |

| Tenant Satisfaction Rate | 85% | Highlights effectiveness of initiatives. |

| Green Building Certifications Increase | 10% | Attracts tenants and enhances value. |

Channels

SEGRO leverages direct sales and leasing teams to connect with potential tenants, showcasing the value of their properties. These teams possess detailed market insights, ensuring effective communication. In 2024, direct sales helped SEGRO maintain high occupancy rates, contributing to robust revenue. Their focus on direct efforts is key to attracting and retaining clients.

SEGRO leverages online property portals to display its industrial and logistics spaces. These listings boost visibility, attracting a wider pool of potential tenants. In 2024, online real estate searches increased by 15%, demonstrating the importance of these channels. This approach streamlines the tenant search process, ensuring efficient market reach.

SEGRO collaborates with brokers and real estate agents to broaden its tenant reach. These alliances capitalize on industry expertise and networks. Broker partnerships significantly boost market penetration and tenant acquisition. In 2024, the industrial real estate market, where SEGRO operates, saw an average brokerage commission of 3-6% of the total lease value. This is crucial for tenant acquisition.

Industry Events and Trade Shows

SEGRO actively engages in industry events and trade shows to boost its brand and find new clients. These events are great for showing off SEGRO's properties and building connections. By participating, SEGRO increases its visibility and generates potential leads. SEGRO's commitment to industry involvement is evident, with the company often sponsoring and presenting at major real estate gatherings.

- In 2024, SEGRO invested approximately £15 million in marketing, including events and trade shows.

- SEGRO reported a 10% increase in lead generation from industry events in the first half of 2024.

- The company hosted or participated in over 50 industry events globally in 2024.

- SEGRO's booth at a major logistics trade show in 2024 attracted over 500 potential clients.

Digital Marketing and Social Media

SEGRO leverages digital marketing and social media to connect with prospective tenants and build its brand. These channels offer economical ways to communicate SEGRO's value and interact with its audience. Digital strategies are crucial for increasing brand visibility and generating leads. For instance, SEGRO's social media presence saw a 15% increase in engagement in 2024. This approach is reflected in its marketing spend, with approximately 30% allocated to digital platforms.

- Digital channels support the promotion of SEGRO's value proposition.

- Social media campaigns enhance lead generation.

- Digital marketing accounts for around 30% of marketing expenditure.

- Engagement on social media rose by 15% in 2024.

SEGRO uses a mix of direct sales, online portals, and broker collaborations to find tenants, achieving robust market reach. They actively promote their brand through industry events and trade shows, boosting visibility and generating leads. Digital marketing and social media further amplify SEGRO's value proposition and lead generation efforts.

| Channel Type | Method | 2024 Impact |

|---|---|---|

| Direct Sales | Sales/Leasing Teams | High Occupancy Rates |

| Digital Platforms | Social Media/Online Portals | 15% Engagement Increase |

| Industry Events | Trade Shows/Networking | 10% Lead Generation Increase |

Customer Segments

E-commerce and online retailers need efficient warehouse space for storage, order fulfillment, and distribution. SEGRO's strategic locations and modern facilities cater to these companies. In 2024, online retail sales hit approximately $1.1 trillion in the U.S., fueling demand for logistics space. This segment requires high-quality, scalable solutions to manage growing volumes.

Logistics and transportation firms are a key customer segment for SEGRO, requiring strategically positioned warehouses for efficient operations. SEGRO's properties, often located near critical transportation networks like ports and airports, directly cater to these needs. This segment prioritizes efficiency and connectivity, crucial for timely delivery and supply chain optimization. In 2024, the logistics sector in Europe showed a 4% growth, highlighting its importance.

Manufacturing and industrial businesses form a key customer segment for SEGRO, needing space for production, storage, and distribution. SEGRO offers flexible facilities to meet various manufacturing demands. In 2024, demand for industrial space remained robust, with vacancy rates under 4% across key European markets. Adaptable and dependable properties are crucial for these clients.

Technology, Media, and Telecoms (TMT)

The Technology, Media, and Telecoms (TMT) sector, a key customer segment for SEGRO, demands specialized facilities. These include data centers, requiring advanced infrastructure, which SEGRO can provide. SEGRO's properties are adaptable, meeting the unique needs of TMT companies that prioritize innovation. In 2024, the global data center market was valued at approximately $280 billion, showing the sector's significance.

- Data centers require advanced infrastructure.

- SEGRO adapts properties for TMT.

- TMT values innovation and technology.

- Global data center market valued at ~$280B in 2024.

Retail and Wholesale Distributors

Retail and wholesale distributors form a key customer segment for SEGRO, requiring substantial warehouse space. These businesses rely on these spaces for effective inventory management and distribution networks. SEGRO's properties offer optimal solutions for retail supply chains, focusing on strategic locations and accessibility. In 2024, the demand for logistics space, driven by e-commerce, has remained robust, underscoring the importance of SEGRO's offerings to this segment.

- High demand for logistics space due to e-commerce growth.

- Strategic locations are crucial for efficient distribution.

- Focus on accessibility to retail outlets.

- Inventory management solutions are a priority.

SEGRO's customer segments include e-commerce, logistics, and manufacturing, all needing warehouse space. The demand for industrial spaces remained strong in 2024. Key markets saw vacancy rates below 4%. Adaptable facilities are crucial for these diverse client needs.

| Customer Segment | Needs | 2024 Market Data |

|---|---|---|

| E-commerce | Warehouse Space | Online retail sales ~$1.1T in US |

| Logistics | Strategic Warehouses | European logistics sector +4% |

| Manufacturing | Production Space | Vacancy rates under 4% |

Cost Structure

Property development and construction costs encompass land, materials, labor, and permits. In 2024, construction costs saw fluctuations. Effective cost management is vital for SEGRO's profitability. Efficient development processes, like those used in SEGRO's logistics parks, are essential.

Property management and maintenance expenses are crucial for SEGRO's operational efficiency. These costs involve property upkeep, security, and utilities. In 2024, SEGRO's like-for-like net rental income grew by 5.7%, reflecting effective cost management. Efficient control over these expenses directly impacts profitability.

Financing and interest expenses are key in SEGRO's cost structure, covering debt for property deals. In 2024, SEGRO's net debt was £3.2 billion. Managing debt and interest rates is vital for financial health. Prudent financial management is crucial for sustained success.

Sales and Marketing Costs

Sales and marketing costs are crucial for SEGRO to attract and retain tenants, directly influencing occupancy rates and revenue. These expenses include promoting properties and implementing targeted marketing campaigns. Effective marketing strategies are essential for SEGRO’s financial performance. SEGRO spent £48 million on administrative expenses in 2023, which includes sales and marketing.

- Marketing campaigns drive occupancy.

- Expenses impact revenue.

- Administrative costs include marketing.

- In 2023, the administrative expenses were £48 million.

Administrative and Overhead Costs

Administrative and overhead costs at SEGRO encompass salaries, office expenses, and legal fees. Efficient management of these costs is crucial for enhancing overall profitability, with a direct impact on the bottom line. Streamlining administrative processes is vital for operational efficiency. In 2024, SEGRO's administrative expenses were approximately £X million.

- Salaries and wages for administrative staff.

- Office rent, utilities, and supplies.

- Legal and professional fees.

- Insurance and other administrative overheads.

SEGRO's cost structure covers property development, management, financing, sales, and administration. Construction costs and interest expenses require active management for profitability. Effective control boosts financial performance, directly impacting the bottom line. In 2023, SEGRO's administrative expenses were £48 million.

| Cost Category | Description | 2023 Data (Approx.) |

|---|---|---|

| Property Development | Land, materials, labor, permits | Fluctuating, dependent on projects |

| Property Management | Upkeep, security, utilities | Impacted by efficiency measures |

| Financing | Debt, interest expenses | Net debt £3.2 billion |

Revenue Streams

SEGRO's main revenue comes from leasing warehouse and industrial spaces. They aim for high occupancy, which boosts income. In 2024, they reported a strong occupancy rate, around 98%. Competitive rental rates are key for revenue growth. Consistent income depends on keeping these properties full.

SEGRO's revenue stream includes property development and sales. This involves profits from development projects and capital gains from property sales. In 2024, SEGRO's development pipeline was strong, with a focus on logistics properties. Strategic development and sales are key to enhancing SEGRO's profitability. For example, in 2023, they reported a profit before tax of £397 million from their developments.

SEGRO generates revenue through property management fees, offering essential services to tenants. These fees encompass maintenance, security, and other operational aspects, boosting recurring income. In 2024, property management fees are a stable revenue source. These fees contribute to a consistent, predictable income stream for SEGRO. They represent a significant portion of overall revenue, ensuring financial stability.

Joint Venture Income

SEGRO leverages joint ventures to boost revenue. They earn through management fees and project profits, exemplified by the SEGRO European Logistics Partnership. These collaborations widen income streams. For example, in 2024, SEGRO's share of profit from joint ventures was a significant part of their overall financial performance.

- Joint ventures provide additional income sources.

- Management fees and project profits are key revenue drivers.

- Partnerships enhance financial opportunities.

- SEGRO's joint ventures are crucial to their financial success.

Ancillary Services and Value-Added Offerings

SEGRO boosts revenue through ancillary services and value-added offerings. These include energy efficiency consultations and tailored solutions. These services improve tenant satisfaction. They also differentiate SEGRO in a competitive market. In 2024, these types of services accounted for a growing percentage of overall revenue.

- Tenant satisfaction is a key focus.

- Differentiation from competitors is crucial.

- Revenue diversification is the goal.

- Services include energy consultations.

SEGRO's revenue streams are diversified, including leasing and development. They also generate income from property management and joint ventures. Ancillary services offer additional revenue and tenant satisfaction, adding to their financial strength.

| Revenue Stream | Description | 2024 Data Highlights |

|---|---|---|

| Leasing | Rental income from warehouses and industrial spaces. | 98% occupancy rate. |

| Development & Sales | Profits from development projects and property sales. | £397M profit before tax from developments (2023). |

| Property Management | Fees for maintenance, security, and operational services. | Stable and consistent income stream. |

| Joint Ventures | Management fees and project profits from partnerships. | Significant profit contribution in 2024. |

| Ancillary Services | Value-added services like energy consultations. | Growing percentage of overall revenue in 2024. |

Business Model Canvas Data Sources

Segro's Business Model Canvas is informed by property market data, financial performance reports, and industry analyses. This blend provides a holistic view.