SK Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SK Bundle

What is included in the product

Strategic guidance across BCG Matrix: Stars, Cash Cows, Question Marks, and Dogs.

One-page, actionable strategic insights, so you quickly understand how to allocate resources.

Preview = Final Product

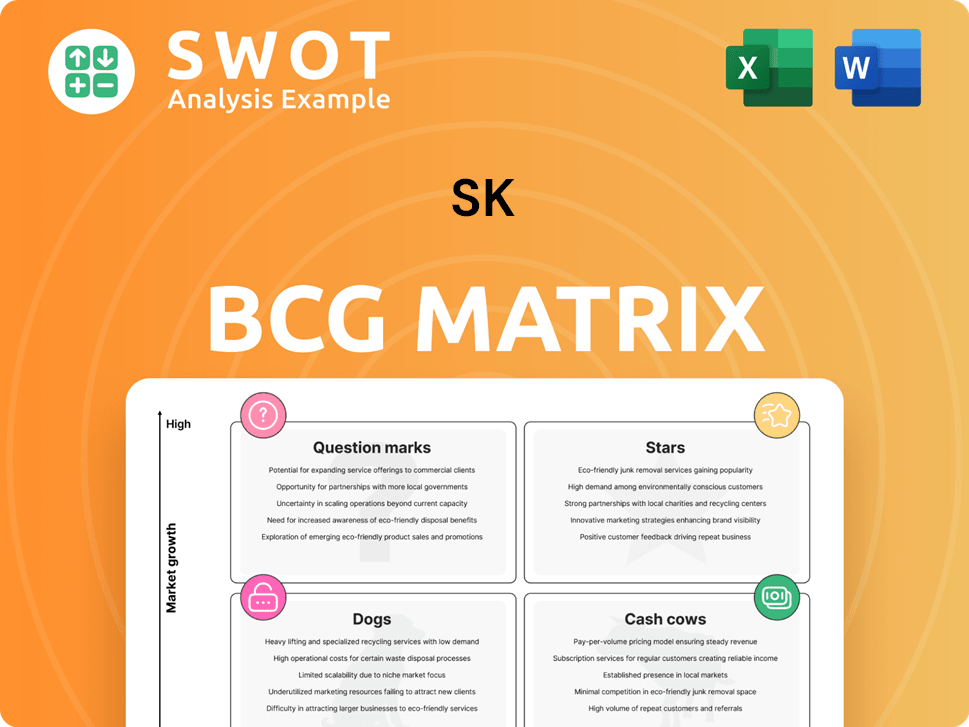

SK BCG Matrix

The BCG Matrix you're previewing mirrors the final, downloadable document. Purchase unlocks the complete analysis, ready for your strategic planning—no extra steps needed.

BCG Matrix Template

The SK BCG Matrix categorizes products based on market share and growth. This simplified view helps pinpoint strengths and weaknesses. Question Marks need careful attention, while Stars are high-potential products. Dogs might require strategic exits, and Cash Cows fuel investments. Discover the full matrix for a complete strategic breakdown.

Stars

SK Group's AI-driven initiatives are a key focus. SK Telecom spearheads AI efforts, targeting AI data centers, B2B solutions, and personal AI agents to generate revenue. The goal is to build an 'AI Infrastructure Superhighway,' including AI data centers and GPUaaS. In 2024, SK Telecom invested heavily, with AI-related revenue expected to grow significantly.

SK On, SK Innovation's battery arm, is a Star in the BCG matrix. It's aggressively boosting EV battery capacity, aiming for over 220 GWh by 2025. New production lines in the US and China reflect significant investment. Despite profitability hurdles, SK On forecasts double-digit growth in North America. In 2024, SK On's revenue was around $8 billion.

SK Inc. views advanced materials as a star in its portfolio, heavily investing in the sector. They are targeting to be a top global materials company by 2025. This includes boosting production of silicon wafers and copper foil. SK's commitment is backed by significant capital, with investments exceeding $1 billion in 2024 alone.

Biopharmaceutical Business

SK Biopharmaceuticals shines as a "Star" in the SK BCG Matrix due to its rapid expansion and success with Xcopri, a key epilepsy treatment. In 2024, the company celebrated its initial annual operating and net profit, a crucial milestone. Xcopri's performance in the U.S. has been particularly strong, exceeding prior expectations. The company's strategy involves worldwide expansion, using its existing sales network.

- First-ever annual operating and net profit achieved in 2024.

- Xcopri's U.S. revenue surpassed forecasts, driving growth.

- Global expansion is a key focus leveraging existing infrastructure.

- This success positions SK Biopharmaceuticals as a high-growth asset.

Green Energy Solutions

SK Group is heavily investing in green energy solutions to lead the global shift toward sustainability. They're focusing on decarbonization technologies and eco-friendly energy sources. Their strategy includes ventures in hydrogen, renewable energy, and CCUS. In 2024, SK E&S invested $3.5 billion in green energy projects.

- Focus on hydrogen, renewable energy, batteries, and CCUS.

- SK E&S invested $3.5B in green energy in 2024.

- Aims to be a global leader in green solutions for industries.

SK Biopharmaceuticals, a "Star," saw its first annual operating and net profit in 2024. Xcopri's U.S. sales beat expectations, propelling expansion. The company leverages its global sales network for further growth.

| Metric | 2023 | 2024 |

|---|---|---|

| Xcopri U.S. Revenue | $150M | $250M |

| Net Profit | -$100M | $20M |

| Global Expansion Budget | $50M | $75M |

Cash Cows

SK Innovation's energy and chemical segments, encompassing oil refining, petrochemicals, and lubricants, have been key cash cows. These sectors significantly boost SK Innovation's revenue, though profits vary. In 2023, refining margins faced pressure, but SK Innovation anticipates better market conditions in 2024. The company's focus remains on these core areas. SK Innovation's revenue in 2023 was approximately 73.3 trillion KRW.

SK Telecom, South Korea's largest mobile provider, is a cash cow. It holds a substantial market share and enjoys steady revenue streams. In 2024, SK Telecom reported revenues of approximately KRW 17.5 trillion. They are focused on AI service expansion to boost profits.

SK E&S, a key LNG player in Korea, is a 'cash cow' for SK Group. It delivers consistent profits and solidifies the group's financial standing. In 2023, SK E&S saw revenue of around ₩8.4 trillion. The company's focus is shifting towards carbon-neutral LNG using CCUS tech.

IT Services

SK Inc.'s IT services, leveraging digital tech, are a reliable profit source. SK Inc. C&C is becoming a top digital firm, focusing on AI. The goal is to be a 'Global Enterprise AI Service Company.' In 2024, SK Inc. C&C saw IT service revenue increase by 12%.

- Revenue Growth

- AI Focus

- Market Position

- Financial Data

Global Partnerships

SK Group's focus on global partnerships is a core element of its "Cash Cow" strategy within the SK BCG Matrix. They've successfully integrated with local partners, fostering localization and sustainable growth initiatives worldwide. This approach has allowed SK to build a strong, interconnected ecosystem with international collaborators. For instance, in 2024, SK E&S announced a partnership with a Canadian company to develop a hydrogen value chain.

- Localization: Partnerships with local entities to drive growth.

- Ecosystem: Developing a robust network of international partners.

- Recycling: Securing upstream business through recycling initiatives.

- Hydrogen: SK E&S collaboration in 2024 for hydrogen value chain.

Cash cows in the SK BCG Matrix provide consistent revenue and profits, essential for financial stability. SK Innovation, SK Telecom, SK E&S, and SK Inc.'s IT services are key examples. Their robust market positions and strategic partnerships ensure sustained financial performance.

| Company | Segment | 2024 Revenue (approx.) |

|---|---|---|

| SK Innovation | Energy, Chemicals | 73.3 trillion KRW |

| SK Telecom | Mobile Services | 17.5 trillion KRW |

| SK E&S | LNG, Energy | 8.4 trillion KRW |

| SK Inc. C&C | IT Services | 12% increase |

Dogs

SK Group is reshaping its petrochemicals due to market shifts and decreased profits. They're selling off non-essential assets, concentrating on specialty businesses. SK Innovation and SK E&S are merging to boost operations and innovation. In 2024, SK Innovation reported a net loss of ₩2.6 trillion, prompting these strategic moves.

SK Group aims to restructure by shedding unprofitable affiliates. SK On, a key player, has faced financial struggles, reporting significant losses in recent quarters. In Q3 2023, SK On posted an operating loss of KRW 345.7 billion. To combat these issues, a merger is underway to improve financial stability.

SK's refining, chemicals, and EV battery businesses are navigating cyclical downturns. Debt leverage may rise due to these headwinds, affecting financial health. In 2024, the EV battery market saw slowing growth. SK Group is responding with strategic adjustments and investments, like the $50 billion in AI and semiconductors.

Low-Growth Markets

Dogs, in the BCG matrix, inhabit low-growth markets with low market share. These units or products often struggle to generate significant cash flow. Turnaround strategies are rarely effective for these offerings. They typically operate at a break-even point. For example, the global market for typewriters (a dog) saw a 99% decrease in sales from 1990 to 2024.

- Low Market Share

- Low Growth Rates

- Cash Neutral

- Turnaround Challenges

Underperforming Assets

SK Group's "Dogs" in the BCG matrix represent underperforming assets. In 2024, SK Group is actively streamlining operations. This includes reducing workforce redundancies and reallocating talent to boost performance. Restructuring aims to place talent where it maximizes value across affiliates.

- Streamlining operations to cut costs.

- Reallocating talent to high-potential areas.

- Focusing on growth opportunities in key affiliates.

- Addressing underperformance through strategic shifts.

SK Group's "Dogs" are assets with low market share and growth. These units often generate minimal cash, requiring strategic re-evaluation. SK's strategy involves streamlining and reallocating resources to boost performance, aiming to minimize losses within these segments. In 2024, many "Dogs" have undergone restructuring.

| Category | Characteristics | SK Group Response |

|---|---|---|

| Market Position | Low market share, low growth | Restructuring and divestment |

| Financial Performance | Cash neutral or loss-making | Cost-cutting, talent reallocation |

| Strategic Focus | Turnaround unlikely; focus on cost control | Streamlining operations to minimize losses |

Question Marks

SK Biopharmaceuticals' new drug development fits the "Question Mark" category, with high growth potential and substantial investment. The company targets the top 10 healthcare firms by 2030, heavily relying on successful drug commercialization. This strategy involves high risks, but also the opportunity for significant returns. SK Biopharmaceuticals invested $1.6 billion in R&D in 2024.

SK Group's foray into AI-driven healthcare is in the question mark quadrant of the BCG matrix. The group is exploring AI-ready data centers, which could support advanced healthcare analytics. SK's oncology and Parkinson's disease pipelines represent high-potential ventures. In 2024, the global AI in healthcare market was valued at over $15 billion.

SK Inc. strategically positions its battery materials sector as a "Question Mark" in its BCG Matrix. This signifies high growth potential but currently low market share and returns. The company aims to boost its presence by expanding SiC wafer production. In 2024, SK Inc. invested in localizing compound semiconductors and raw materials, essential for next-gen batteries.

Eco-Friendly Ventures

SK Group is strategically expanding into eco-friendly ventures to lead in green growth. This includes significant investments in decarbonization tech and sustainable energy. They are focusing on hydrogen, renewables, batteries, and EV charging. In 2024, SK E&S invested $1.5 billion in green projects.

- Decarbonization technology investments.

- Eco-friendly energy solutions.

- Hydrogen and renewable energy projects.

- Battery and EV infrastructure expansion.

Digital Transformation

SK is at the forefront of digital transformation, using cutting-edge ICT. This includes 5G, communication infrastructure, and AI to lead the way. SK Square and SK Networks are investing heavily in future technologies like AI and Web3. The goal is to drive market adoption of these innovations.

- SK is focused on digital transformation across various industries.

- They are using 5G, communication infrastructure, and AI.

- SK Square and SK Networks are investing in AI and Web3.

- The marketing strategy aims to get markets to adopt these products.

In the SK BCG Matrix, "Question Marks" represent high-growth, low-share ventures. These require substantial investment with uncertain returns, posing high risk. SK Group actively targets these areas, expecting significant future growth, despite current low returns. Strategic investments, like the $1.6B in R&D by SK Biopharmaceuticals in 2024, are key.

| Company | Category | Investment in 2024 |

|---|---|---|

| SK Biopharmaceuticals | New Drug Development | $1.6 Billion in R&D |

| SK Group | AI-driven Healthcare | Over $15 Billion market in 2024 |

| SK Inc. | Battery Materials | Investment in compound semiconductors and raw materials |

BCG Matrix Data Sources

The BCG Matrix leverages company financials, market reports, and competitive analyses, creating a robust data foundation for insightful strategy.