Sony Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sony Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Export-ready design for quick drag-and-drop into PowerPoint for efficient presentation building.

Full Transparency, Always

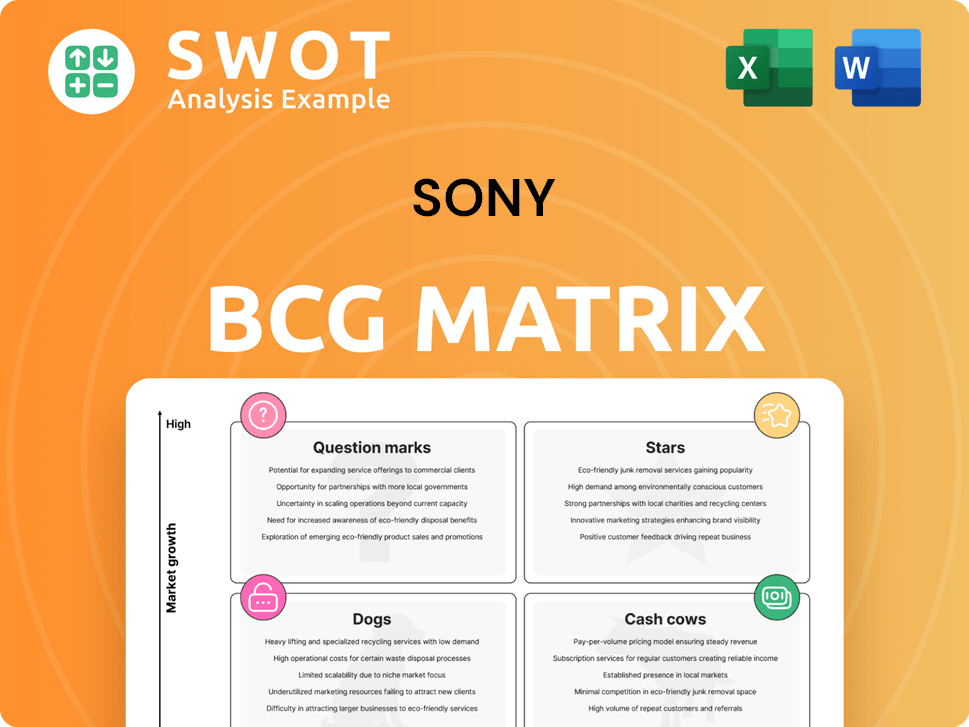

Sony BCG Matrix

The BCG Matrix preview is the full, ready-to-use document you'll get. There's no difference between what's shown here and what you'll download immediately after purchase – it's yours.

BCG Matrix Template

Sony's diverse product portfolio offers a fascinating case study for the BCG Matrix. This simplified view highlights key product areas, but a full understanding demands deeper analysis. Stars like PlayStation compete strongly; Cash Cows like cameras sustain growth. Dogs struggle, while Question Marks need careful nurturing.

Explore the complete BCG Matrix report and get a comprehensive look at Sony's strategic positioning. Uncover detailed quadrant placements and insights!

Stars

The PlayStation 5 (PS5) is a Star in Sony's BCG Matrix, showing a strong market share in the expanding gaming sector. Sony's gaming division is a significant revenue source; the PS5 sold 9.4 million units in Q3 2024. The company is focused on improving gaming experiences to maintain growth. Sony also plans to expand into PC gaming to diversify its market presence.

Sony's image sensor business is a Star in its BCG matrix. The Imaging & Sensing Solutions (I&SS) segment is a key growth driver. Despite flat sales in Q3 2024, Sony projects a 60% market share for image sensors in 2025. The company's focus on this area shows continued investment and potential for high returns.

Sony's Music division shines as a Star within its BCG matrix. Fueled by digital streaming, it generated ¥1.4 trillion in revenue for fiscal year 2023, a 17% increase. Live events and licensing boost its financial success. Favorable exchange rates add further support to its performance.

Anime Streaming (Crunchyroll)

Crunchyroll, a major player in anime streaming, was acquired by Sony in 2021. As of early 2024, Crunchyroll boasts over 13 million paid subscribers worldwide. This significant subscriber base contributes positively to Sony's Pictures segment. The expansion of Crunchyroll's user base demonstrates strong growth.

- Acquired in 2021 by Sony.

- Over 13 million paid subscribers as of early 2024.

- Contributes to the Pictures segment's growth.

- Shows strong growth in the anime streaming market.

Gran Turismo (Film Adaptation)

Sony's "Gran Turismo" film adaptation demonstrates the power of video game IP in the film industry. This successful adaptation is a prime example of how Sony leverages its assets. In 2023, the film grossed over $120 million worldwide, showcasing its financial success. Currently, Sony has several more projects in production, aiming to replicate this success.

- "Gran Turismo" grossed over $120 million worldwide in 2023.

- Sony is actively developing more film adaptations of its game IPs.

- Film adaptations are a key strategy for Sony to maximize IP value.

Sony's Stars also include Crunchyroll and "Gran Turismo" film. Crunchyroll had over 13 million subscribers in early 2024. "Gran Turismo" earned over $120 million in 2023, highlighting successful IP usage.

| Star | Performance | Key Data |

|---|---|---|

| Crunchyroll | Subscriber Growth | 13M+ subs (early 2024) |

| "Gran Turismo" | Box Office Success | $120M+ gross (2023) |

| Overall Strategy | IP & Expansion | Film & Streaming Growth |

Cash Cows

The PlayStation 4 (PS4) is a Cash Cow in Sony's BCG Matrix. Despite the PS5's success, the PS4 remains a revenue driver. By Q3 2023, it sold 117.2 million units globally. This sustained sales contribute significantly to Sony's gaming revenue. The PS4 continues to provide steady cash flow.

Sony's established electronics, like TVs and audio, are cash cows. These products have a stable customer base, ensuring consistent revenue. Sony should focus on efficient operations to boost profits. In 2024, Sony's electronics segment saw a 7.9% increase in sales.

Before its planned partial spin-off in October 2025, Sony Financial Services was a consistent cash cow. In fiscal year 2024, the financial services segment saw a revenue of ¥1.6 trillion. This unit significantly boosted Sony's financial stability. The spin-off seeks independent growth and capital strategies.

Legacy Consumer Audio Equipment

Sony's legacy consumer audio equipment, like high-end headphones, forms a cash cow due to its established customer base. While expansion opportunities are limited, these products ensure steady income. Sony can reduce spending here and boost efficiency to maintain strong cash flow. This allows for reinvestment in faster-growing sectors.

- In 2024, audio products contributed significantly to Sony's overall revenue, though specific figures for legacy equipment aren't always detailed.

- Sony's focus has shifted towards premium and high-resolution audio products, indicating a strategy to maintain profitability in the cash cow segment.

- The company aims to streamline operations in this segment, which helps in cost reduction.

Professional Broadcast Equipment

Sony's professional broadcast equipment, a cash cow, holds a strong market position within the media and entertainment sectors. This segment consistently generates substantial revenue and profit for Sony. Maintaining its market dominance requires a focus on brand strength, product quality, and fostering customer loyalty to protect its existing market share. In 2024, Sony's Professional Solutions segment reported a revenue of ¥727.1 billion.

- Revenue: ¥727.1 billion (2024)

- Market Position: Strong, within media and entertainment.

- Strategy: Brand strength, quality, customer loyalty.

- Focus: Protecting existing market share.

Sony's professional broadcast equipment is a cash cow, consistently generating revenue. The segment focuses on maintaining its market share through quality. Sony reported ¥727.1 billion in revenue from Professional Solutions in 2024.

| Category | Description | Financial Data (2024) |

|---|---|---|

| Revenue | Generated by broadcast equipment | ¥727.1 Billion |

| Market Position | Strong in media and entertainment | Dominant Market Share |

| Strategy | Focus on brand, quality, loyalty | Maintaining Customer Base |

Dogs

Sony's television segment faces challenges. Market share dropped to 7.2% globally in 2023, from 9.5% in 2020. Shipments fell to 8.6 million units in 2023, a 15.3% decrease. This indicates a "Dog" in the BCG matrix.

Sony's mobile phone hardware production faces challenges. Their market share has decreased, pressured by rivals. Profitability suffers due to competition and changing consumer tastes. In 2024, Sony's mobile segment faced a tough market, with sales figures remaining under pressure.

Older generation gaming hardware, like the PlayStation 4, sees declining consumer interest as newer consoles launch. Growth potential for older hardware is minimal. Sony's PS4 sales in 2024 are significantly lower than in previous years. The market share of older consoles is shrinking in the face of newer releases.

Certain Camera Models

Sony's digital camera models are considered "Dogs" in the BCG Matrix due to declining performance within the ET&S segment. The product mix deterioration in digital cameras has negatively impacted overall results. The industry is seeing a reduction in the number of camera models. This trend reflects the challenges and strategic decisions within Sony's camera business.

- The ET&S segment's operating income decreased by 12.6% year-over-year in the latest financial reports, reflecting the impact of digital camera performance.

- Sony has reduced the number of digital camera models offered, aligning with market trends.

- The shift in consumer preferences towards smartphones has contributed to the decline in digital camera sales.

Hi-C (Example)

In Sony's BCG Matrix, "Hi-C" represents products with low market share in a high-growth market, a "question mark." These ventures demand substantial investment to boost market share, potentially becoming "stars." However, they risk failure, transitioning into "dogs." Sony should critically assess "Hi-C" products, often divesting if they don't show promise. In 2024, Sony's strategic focus is on profitable sectors, so marginal products are likely to be avoided.

- High Investment Needed: Requires significant capital to grow market presence.

- Risk of Failure: Face the possibility of becoming "dogs" if they do not gain traction.

- Strategic Review: Subject to intense scrutiny to decide on future investment or divestment.

- Focus on Profitability: Sony prioritizes sectors with high profitability and growth potential.

Sony's "Dogs" include underperforming products with low market share and growth. This category often sees decreasing sales and profit margins, requiring strategic decisions. In 2024, Sony aimed to streamline its portfolio by possibly reducing or eliminating "Dogs" to focus on stronger segments. Digital cameras, older consoles, and some mobile hardware fall under this category.

| Segment | Market Share/Performance (2024) | Strategic Action (2024) |

|---|---|---|

| Digital Cameras | Declining; impacted by smartphone competition. | Reduced model offerings, potential divestment. |

| PS4 | Sales significantly lower than previous years. | Focus on newer console releases; potential discontinuation. |

| Mobile | Market share under pressure | Focus on core markets, potential restructuring. |

Question Marks

Sony's newer tech products, like AI-powered devices, are question marks. Sony must weigh heavy investment in marketing and development against divestiture. Market research and analysis are crucial to forecast growth and profitability. In 2024, the global AI market is valued at $200 billion, offering Sony a substantial opportunity. Success here could turn these question marks into stars.

Sony's AI and Robotics Ventures sit in the question mark quadrant of the BCG Matrix. These ventures have high growth potential, like the robotics market, projected to reach $214.1 billion by 2024. However, they currently hold a low market share. They require significant investment without immediate substantial returns, consuming cash. Sony is actively exploring these areas.

Electric Vehicles (EVs) currently represent a Question Mark for Sony in the BCG Matrix. These are new products, and market adoption is still uncertain. Sony's marketing strategy focuses on gaining consumer acceptance of EVs. Sony is investing in mobility, envisioning it as a new entertainment space. Global EV sales increased, with over 10 million sold in 2023.

Sports Technology

Sony's sports technology ventures are question marks in its BCG matrix. They are investing in sports tech. In August 2024, Sony partnered with the NFL. This aims to improve sports technology. These efforts are still developing.

- Partnerships drive growth.

- Focus on tech, like Hawk-Eye.

- NFL deal enhances tech.

- Future growth is uncertain.

Emerging Market Initiatives

The Music segment at Sony is strategically focusing on emerging markets to boost its growth, aiming to outpace the market. This involves expanding its presence and initiatives in these regions. Sony's commitment to emerging markets is a key part of its growth strategy, as seen in 2024. These efforts are crucial for capitalizing on the growing demand for music and entertainment globally.

- Sony's Music segment is actively expanding into emerging markets.

- The goal is to achieve growth exceeding the overall market performance.

- This expansion is a core element of Sony's business strategy.

- The focus on emerging markets aims to meet increasing global demand.

Sony's question marks include AI, EVs, robotics, and sports tech. These ventures have high growth potential but low market share, requiring major investment. Sony must strategically decide on investments or divestitures to maximize ROI.

| Category | Example | 2024 Data |

|---|---|---|

| AI Market | AI-powered devices | $200B global value |

| Robotics | Robotics Ventures | $214.1B market |

| EV Sales | EVs | 10M+ sold |

| Sports Tech | Sports Tech | NFL partnership |

BCG Matrix Data Sources

The Sony BCG Matrix utilizes company financials, market analyses, and competitor reports to evaluate each business unit's strategic position.