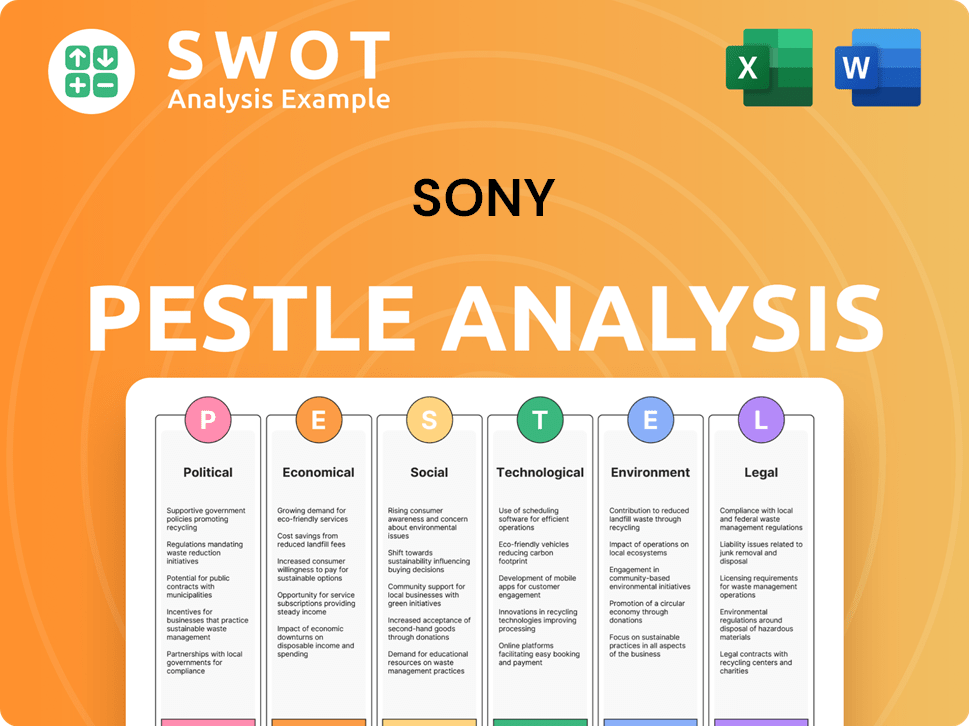

Sony PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sony Bundle

What is included in the product

Examines how external factors (Political, etc.) uniquely impact Sony. Offers insights for strategic planning and opportunity identification.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

Same Document Delivered

Sony PESTLE Analysis

This preview displays the comprehensive Sony PESTLE analysis. The document shown is identical to the file you'll receive. It includes detailed analysis across all PESTLE factors. Enjoy its fully formatted and ready-to-use content!

PESTLE Analysis Template

Navigate the complex world of Sony with our detailed PESTLE analysis.

Understand how political stability, economic shifts, social trends, tech advances, legal changes, and environmental issues impact Sony.

Our analysis unveils key drivers influencing its strategies.

Use our insights to grasp market dynamics and make informed decisions.

Perfect for investors and analysts, this analysis gives a competitive edge.

Download the complete version now and get comprehensive data at your fingertips!

Political factors

Sony thrives on political stability in its key markets. This reduces governmental hurdles and supports expansion.

Stable environments are vital for global operations, impacting trade and market access. For example, in 2024, Japan's political stability supported Sony's domestic market success, contributing significantly to its overall revenue, which reached $88.3 billion.

Consistent policies ensure predictable operations, which attracts investments. This predictability affects Sony's ability to introduce new products and expand its distribution networks.

Political stability also reduces risks associated with sudden policy shifts. This is particularly important for long-term strategic planning and investments.

These elements collectively support Sony's competitive advantage in a dynamic global market.

Governments globally are increasing focus on data security. This trend presents opportunities for Sony to strengthen online operations and services. Governmental support aligns with Sony's digital expansion plans, especially in gaming. For example, the global cybersecurity market is projected to reach $345.7 billion by 2025.

Governments globally are boosting online commerce. This is opening doors for Sony to expand its online services, like gaming. In 2024, the global e-commerce market hit $6.3 trillion. Sony can leverage this. For example, PlayStation Plus subscribers reached 47.5 million in Q4 2024.

International trade policies and tensions

Sony's international trade is highly susceptible to fluctuating trade policies and geopolitical tensions. Trade disputes, like those between the U.S. and China, can raise tariffs, increasing manufacturing costs. For example, in 2024, tariffs on certain electronic components impacted pricing strategies. These factors can affect Sony's global supply chains and profitability.

- Tariff increases on electronics components have risen by 5-10% in certain regions during 2024.

- Geopolitical tensions have caused a 7% decrease in consumer electronics exports from some Asian countries in Q1 2024.

- Sony's net sales from overseas markets constitute approximately 60% of its total revenue.

Government regulations on digital content and e-commerce

Sony faces increasing government regulations on digital content and e-commerce, especially in key markets like the EU. The Digital Services Act (DSA) and similar regulations mandate stricter rules for online platforms and content moderation. To comply and avoid fines, Sony needs to adapt its digital strategies and invest in robust compliance measures.

- The EU's DSA could lead to fines up to 6% of global turnover for non-compliance.

- Sony's PlayStation Network and streaming services must adhere to these regulations.

- Compliance costs for major tech companies are projected to rise significantly in 2024-2025.

Political stability is crucial for Sony, aiding expansion and attracting investments.

Governments' data security focus and e-commerce boosts present growth opportunities, especially in gaming and online services.

However, trade policies, geopolitical tensions, and stringent digital regulations present risks.

| Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Trade Disputes | Increased costs, supply chain disruption | Tariff increases: 5-10%; Electronics exports decrease: 7% (Q1 2024) |

| Data Security | Opportunities in online operations | Cybersecurity market: $345.7B (projected by 2025) |

| Digital Regulations | Compliance costs, operational adjustments | EU DSA fines up to 6% global turnover; compliance costs rise significantly. |

Economic factors

Developing markets present substantial growth prospects for Sony. In 2024, these regions accounted for a significant portion of Sony's revenue, with continuous expansion. The company is actively investing in these areas to capitalize on rising consumer demand. Sales in developing markets are expected to continue to grow, according to recent financial reports.

Economic stability in developed markets is crucial for Sony. This environment reduces market risks, supporting expansion. Consumer spending on electronics and entertainment thrives in stable economies. In 2024, the US GDP grew by 3.3%, signaling robust consumer confidence and spending. Japan's economy saw a modest growth of 1.9%, still providing opportunities.

Rising disposable incomes globally boost sales for Sony's products, especially gaming and consumer electronics. Consumers with more money can afford premium items. For example, global consumer spending is projected to reach $70 trillion in 2024. This trend supports Sony's revenue growth. The PlayStation 5 sales are a great example of this trend, with 59.3 million units sold by March 2024.

Impact of inflation rates

Inflation rates pose a significant economic factor for Sony, particularly in developed markets where consumer spending is sensitive. High inflation erodes purchasing power, potentially impacting sales of discretionary items like gaming consoles and premium electronics. Sony must strategically manage pricing and consider cost-saving measures to maintain profitability in an inflationary environment. For instance, the U.S. inflation rate was 3.1% in January 2024, and the Eurozone's was 2.8%.

- U.S. Inflation Rate (January 2024): 3.1%

- Eurozone Inflation Rate (January 2024): 2.8%

- Sony's Revenue (FY2023): ¥13.02 trillion

Currency exchange rate fluctuations

Currency exchange rate fluctuations significantly affect Sony's financial results due to its global operations. The USD/JPY rate, for example, is crucial for translating revenues from the US market. Sony actively hedges against currency risks to protect its profitability and revenue streams.

These strategies help stabilize earnings amidst volatile currency markets. For instance, a weaker yen against the dollar can boost the value of Sony's overseas earnings when converted back to yen. Conversely, a stronger yen can reduce the value.

- In FY2023, currency fluctuations had a notable impact on Sony's reported revenue.

- Sony employs financial instruments like forward contracts to mitigate currency risks.

- The company's financial reports often detail the impact of currency movements.

Sony thrives on global economic trends, focusing on emerging markets for expansion and leveraging consumer spending. The company manages risks through economic stability in key developed markets. Inflation rates and currency exchange rates are crucial factors, requiring strategic financial management.

| Economic Factor | Impact on Sony | 2024/2025 Data |

|---|---|---|

| Developing Markets | Growth Opportunities | Expected revenue growth in Asia, Latin America; India's consumer market: Significant expansion. |

| Economic Stability | Supports Consumer Spending | US GDP 3.3% (2024); Japan GDP 1.9% (2024); EU GDP projections. |

| Disposable Incomes | Boosts Sales | Global consumer spending projected $70T (2024); PS5 sales: 59.3M units (March 2024). |

| Inflation Rates | Impacts Sales | U.S. inflation: 3.1% (Jan 2024); Eurozone: 2.8% (Jan 2024). |

| Currency Exchange Rates | Affects Financials | USD/JPY rate; Hedging strategies; Currency impact on FY2023 revenues. |

Sociological factors

The global online gaming market is booming, creating a huge opportunity for Sony. This surge in popularity boosts demand for PlayStation consoles, games, and online services. Worldwide, the gaming market is projected to reach $263.3 billion in 2024. Sony's PlayStation 5 sales have been strong, with over 59.3 million units sold as of December 2023. This growth is fueled by increased internet access and social interaction through gaming.

Improved wealth distribution globally can significantly boost Sony's consumer base, especially in emerging markets. This increased purchasing power directly translates to higher demand for Sony's products. For instance, in 2024, smartphone sales in India and Africa, key growth areas, increased by 15% and 12%, respectively, reflecting rising disposable incomes.

Societal shifts embrace leisure, positively impacting Sony. This trend fuels growth in entertainment and gaming. Sony's focus on leisure-centric products is crucial. In Q3 2024, gaming revenue hit $7.2 billion. Marketing must align with evolving consumer leisure preferences. The PlayStation 5 sales reached 50 million units by December 2023.

Shifting consumer preferences towards sustainable products

Consumers are increasingly prioritizing sustainability. They favor eco-friendly electronics, influencing buying habits. Sony's eco-initiatives resonate with this shift. In 2024, the global green technology and sustainability market was valued at $36.6 billion. This focus on sustainability is expected to grow.

- Growing consumer demand for sustainable products.

- Sony's eco-friendly product development.

- Alignment with market trends.

Increasing demand for personalized and immersive experiences

The rising desire for personalized and immersive entertainment significantly impacts Sony's strategic direction. This trend fuels markets such as virtual reality (VR), where Sony has made substantial investments. Sony's VR hardware sales in fiscal year 2023 reached 4.6 million units. The company's response includes developing engaging experiences designed to resonate with individual consumer preferences. This approach is critical for maintaining a competitive edge in a market that values unique and captivating content.

- VR market growth is projected to reach $57.21 billion by 2025.

- Sony's PlayStation VR2 is a key player in the VR market.

- Personalized content is increasingly important for customer engagement.

The shift towards leisure is pivotal, boosting entertainment demand for Sony's products. Sony's gaming revenue reached $7.2 billion in Q3 2024, highlighting this trend. A rise in consumer prioritization of sustainable practices influences buying habits. The green tech market valued $36.6B in 2024.

| Factor | Impact on Sony | Data/Statistics |

|---|---|---|

| Emphasis on Leisure | Boosts demand | Gaming revenue Q3 2024: $7.2B |

| Sustainability | Influences buying | Green Tech market in 2024: $36.6B |

| Personalization | Drives product direction | VR market by 2025: $57.21B |

Technological factors

The world's reliance on digital tech is huge. Sony can add digital solutions to products like smart home tech. This boosts the market for Sony's connected devices. In 2024, the smart home market was valued at $126.1 billion. It's expected to hit $236.9 billion by 2028.

Sony can capitalize on the high adoption of mobile tech. In 2024, mobile gaming revenue hit $92.2 billion. This is a key area for Sony's PlayStation Mobile. Sony can improve its mobile devices, services, and gaming experiences.

Sony operates in a sector marked by intense R&D. High investment in R&D is crucial to stay competitive. Sony's R&D spending was approximately ¥860 billion in FY2023. Competitor innovations pose a constant threat of disruption. Sony must strategically allocate resources to R&D.

Advancements in artificial intelligence and other emerging technologies

Sony actively invests in AI, robotics, and VR to innovate its products. These technologies are key for staying ahead. In 2024, Sony's R&D spending reached ¥1.2 trillion. This investment aims at tech leadership. These advancements boost competitiveness.

- AI integration in imaging and audio.

- Robotics for entertainment and industrial applications.

- VR expansion with new hardware and content.

- Focus on sustainable and green technologies.

Technological disruption and rapid pace of advancement

Technological advancements and disruptions present significant challenges for Sony. The company faces competition from emerging firms offering competitive products at lower costs. To stay ahead, Sony needs continuous innovation in its product offerings and business models. Investment in R&D is crucial, with Sony allocating ¥920 billion (approximately $6.4 billion USD) to R&D in fiscal year 2023.

- R&D spending in fiscal year 2023: ¥920 billion.

- Potential for disruptive technologies to impact market position.

Sony boosts smart home tech to tap into digital trends. In 2024, mobile gaming was worth $92.2B. Sony's R&D reached ¥1.2T to lead in AI, robotics, and VR. Technological competition is a threat; R&D is key, with about $6.4B in 2023.

| Technology Area | Sony's Strategy | Financial Impact/Data |

|---|---|---|

| Smart Home | Integrate digital solutions | Smart Home Market valued at $126.1B in 2024, $236.9B by 2028 |

| Mobile Tech/Gaming | Enhance mobile devices, services & gaming | Mobile Gaming revenue hit $92.2B in 2024 |

| R&D (AI, VR, Robotics) | Continuous Innovation | R&D spending of ¥920B (~$6.4B USD) in FY2023, and ¥1.2T in 2024 |

Legal factors

Enhanced patent protection globally presents a significant opportunity for Sony to secure its innovative designs and technologies. Stronger legal frameworks protect Sony's intellectual property, critical for a company focused on innovation. In 2024, the global patent filings reached approximately 3.4 million, reflecting the importance of IP protection. This helps Sony maintain its competitive edge in the market.

E-waste regulations are intensifying globally, posing challenges for Sony. Compliance necessitates investment in recycling and sustainable practices, increasing operational expenses. However, these regulations also spur innovation in eco-friendly product development. For instance, the global e-waste market is projected to reach $102.7 billion by 2027. Sony can capitalize on this by improving its recycling programs and designing products for easier disassembly and material recovery.

Sony faces increasing product regulation globally, impacting manufacturing and design. Compliance with evolving safety standards and consumer protection laws is crucial. For instance, the EU's RoHS directive impacts electronics. In 2024, regulatory compliance costs rose by 5% for tech firms. Meeting these standards builds consumer trust and brand value.

Antitrust and competition laws

Sony faces antitrust scrutiny globally, influencing its business strategies. Recent cases show increased enforcement; for instance, in 2024, the EU fined Qualcomm €242 million for anticompetitive practices, a reminder of the risks. Sony must adhere to regulations to prevent market dominance issues. This includes scrutiny of mergers and acquisitions.

- Compliance with antitrust laws is critical to avoid fines and legal battles.

- The company must ensure fair market practices.

- M&A activities are often closely reviewed.

Data privacy and security regulations

Sony faces strict data privacy and security regulations globally. The General Data Protection Regulation (GDPR) in Europe, for instance, demands robust data protection measures. Non-compliance can lead to significant fines; for example, in 2023, the UK Information Commissioner's Office issued fines up to £17 million.

Sony must invest heavily in data security to protect customer information, which is critical for maintaining customer trust and brand reputation. These regulations influence Sony's operational costs and strategic decisions.

- GDPR fines can reach up to 4% of global annual turnover.

- Cybersecurity breaches cost companies an average of $4.45 million in 2023.

Legal factors significantly affect Sony's operations, requiring robust compliance strategies. Strong patent protection and regulatory compliance are essential for safeguarding innovations and brand reputation. Data privacy laws like GDPR demand substantial investments in security.

| Area | Impact | 2024 Data |

|---|---|---|

| Antitrust | Scrutiny of M&A and market practices | EU fines for anticompetitive practices (€242M). |

| Data Privacy | Compliance costs & reputational risk | Cybersecurity breaches cost avg. $4.45M (2023). |

| E-waste | Compliance costs & innovation driver | Global market projected at $102.7B by 2027. |

Environmental factors

Sony is actively working to cut down greenhouse gas emissions. They've set specific goals as part of their "Road to Zero" plan. This includes aiming for net-zero emissions by 2040. In 2023, Sony reduced its Scope 1 and 2 emissions by 55% compared to 2018. This progress is a key part of their environmental strategy.

Sony actively works to minimize water use across its operations. In 2023, Sony reduced water consumption by 3% compared to the previous year. The company's focus on water conservation aligns with global sustainability trends. Sony's water-saving initiatives include using water-efficient equipment and recycling water.

Sony actively reduces waste and boosts recycling across its operations and product lifecycles. They prioritize recycled plastics and minimize packaging waste. For example, in 2024, Sony's Green Management 2025 targets include reducing new virgin plastic use. The company aims to use more recycled materials.

Promoting environmentally conscious products

Sony actively designs and promotes products with a lower environmental impact, targeting energy and resource conservation, managing chemical substances, and increasing the use of recycled materials. This strategy is crucial, given the rising consumer preference for sustainable products. For example, in 2024, Sony increased the use of recycled plastics in its products by 10%. These efforts are also driven by regulatory changes and the push for carbon neutrality.

- Sony aims to eliminate plastic packaging by 2025.

- The company's "Road to Zero" plan includes reducing its environmental footprint across its value chain.

- Sony's Green Management 2025 plan focuses on environmental targets.

Conservation and biodiversity initiatives

Sony actively participates in conservation and biodiversity efforts. They support reforestation projects and other initiatives to reduce their environmental impact. These actions align with Sony's broader sustainability goals, aiming for carbon neutrality. For example, Sony's "Road to Zero" plan includes significant investments in environmental protection. In 2024, Sony invested $100 million in environmental initiatives.

- Supports reforestation projects.

- Aims for carbon neutrality.

- Invested $100 million in 2024.

Sony prioritizes reducing its environmental footprint, aiming for net-zero emissions by 2040. They've cut Scope 1 and 2 emissions by 55% since 2018. The company is focused on water conservation and waste reduction across its operations and products.

| Initiative | 2023 Performance | 2024 Goal/Investment |

|---|---|---|

| Emissions Reduction | -55% (vs. 2018) | Net-zero by 2040 |

| Water Consumption | -3% YoY | Continued Reduction |

| Environmental Investment | N/A | $100M |

PESTLE Analysis Data Sources

Our PESTLE leverages sources like the World Bank, government reports, and market analysis. We also use legal updates and technology trend data.