Southwest Airlines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Southwest Airlines Bundle

What is included in the product

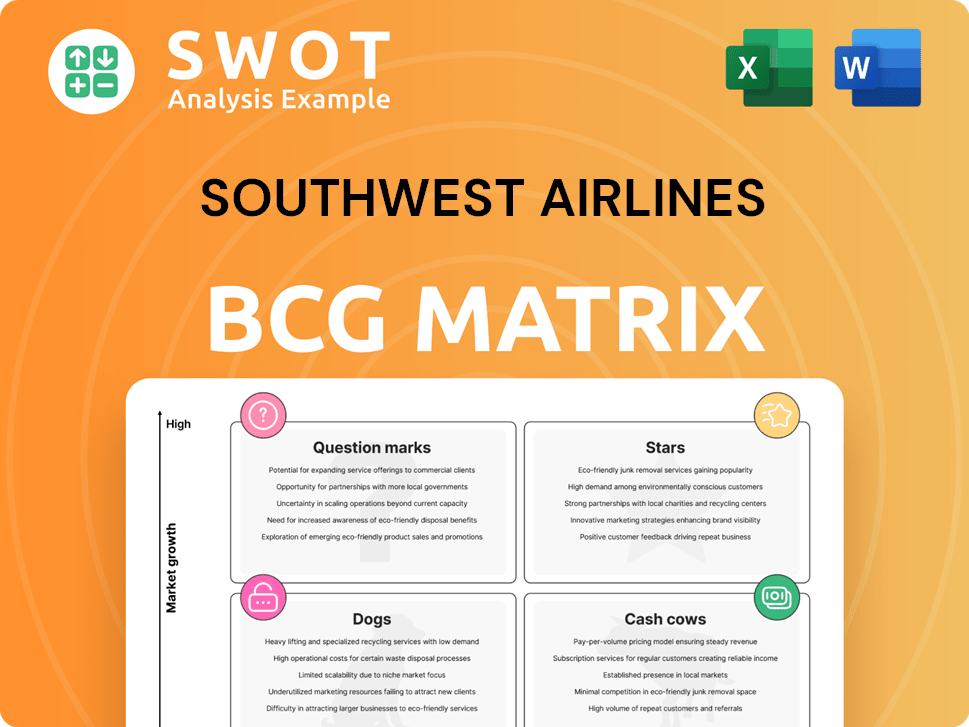

Southwest's BCG Matrix analysis reveals high-growth routes (Stars), mature routes (Cash Cows), and areas for strategic decisions (Question Marks & Dogs).

Share Southwest's BCG Matrix with a clean layout, easy to present to stakeholders.

What You’re Viewing Is Included

Southwest Airlines BCG Matrix

The Southwest Airlines BCG Matrix you're previewing is the same document you'll receive upon purchase. No hidden extras, just a complete, ready-to-use strategic tool for your analysis.

BCG Matrix Template

Southwest Airlines faces a dynamic market. Their routes could be stars, thriving in competitive skies.

Some routes are cash cows, generating steady profit with established demand. Others might be dogs needing evaluation or re-positioning.

New route expansions could be question marks, needing investment to grow. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Southwest's strategic route expansion places it in the "Star" quadrant of the BCG matrix. The airline is adding routes to boost growth. In 2024, Southwest added routes like Austin to San Francisco and Nashville to Louisville. This strategy aims to increase revenue. In Q1 2024, Southwest's operating revenue was $6.29 billion, a 10.9% increase year-over-year.

Southwest Airlines' fleet modernization involves adding Boeing 737 MAX 8s and retiring older planes. In 2024, they added 22 MAX 8s. They plan for 38 more in 2025. This improves fuel efficiency and cuts costs. This supports both operational and environmental goals.

Southwest Airlines is upgrading customer experience. They are implementing improved WiFi, in-seat power, and larger overhead bins to attract and keep customers. Assigned and premium seating options are also being added. These moves should boost demand and increase revenue per passenger, as seen with a 10% rise in ancillary revenue in 2024.

Loyalty Program Innovations

Southwest Airlines is boosting its Rapid Rewards program. They're letting members earn points on the cash part of Cash+Points bookings. Cash payments now count towards A-List and A-List Preferred statuses. These moves aim to boost customer engagement and keep loyal flyers happy.

- Rapid Rewards members can earn points faster.

- Cash payments now help achieve A-List status.

- These changes aim to increase customer loyalty.

- Southwest is adapting to reward customer spending.

Operational Efficiency Improvements

Southwest Airlines is actively improving operational efficiency to manage costs and update procedures. They're funding new capacity growth without needing more aircraft capital. This involves strategies like 24-hour operations, including redeye flights, and reducing flight turnaround times. These efforts aim to boost aircraft use and simplify daily operations.

- In Q3 2023, Southwest's operating revenue increased by 11.9% to $6.4 billion.

- The airline is targeting a reduction in unit costs, excluding fuel and profit sharing, for 2024.

- Southwest aims to increase aircraft utilization rates through these efficiency improvements.

Southwest's strategic initiatives, such as route expansions and fleet modernization, place it as a "Star" in the BCG Matrix. These efforts are aimed at capturing market share and boosting financial performance.

Customer experience enhancements, including better WiFi and seating options, also fuel growth, reflecting investment and revenue expansion in 2024.

The company's Rapid Rewards and operational efficiency initiatives further contribute to this "Star" status by improving customer loyalty and managing costs. For example, in Q1 2024, Southwest's total operating revenue was $6.29 billion.

| Strategic Area | Initiative | 2024 Impact |

|---|---|---|

| Route Expansion | New routes like Austin to San Francisco | Increased Q1 operating revenue by 10.9% year-over-year |

| Fleet Modernization | Adding Boeing 737 MAX 8s | Improved fuel efficiency, supporting cost reduction |

| Customer Experience | Improved WiFi, in-seat power | 10% rise in ancillary revenue |

Cash Cows

Southwest Airlines is a cash cow due to its robust domestic market share. It's the largest low-cost carrier in the U.S. airline market, with a 17.3% market share. This position provides a stable revenue and cash flow base. Southwest generates consistent cash from its established routes and loyal customer base.

Southwest Airlines leverages ancillary revenue streams to bolster its financial standing. Rapid Rewards and co-branded credit cards are key contributors. The airline consistently innovates its loyalty program. These streams buffer ticket sales fluctuations, ensuring stable cash flow. In 2024, ancillary revenue accounted for 19.2% of Southwest's total operating revenue.

Southwest's cost-effective strategy, a key cash cow element, involves a standardized fleet of Boeing 737s and point-to-point routes, reducing maintenance costs. This focus allows it to offer competitive fares and sustain profitability. The airline's efficient operations enabled a 9.3% operating margin in 2024. This efficiency is crucial.

Strategic Partnerships

Southwest Airlines strategically forms partnerships to boost its network and revenue. A key example is the upcoming 2025 partnership with Icelandair, expanding global reach. These collaborations attract new customers and offer more international travel options. This move aligns with Southwest's growth strategy.

- Icelandair partnership expected to launch in 2025.

- These partnerships expand gateways.

- These partnerships provide customers with more international travel options.

- These partnerships attract new customers.

Financial Stability

Southwest Airlines exemplifies financial stability, a key characteristic of a Cash Cow in the BCG matrix. The airline's robust financial health is evident in its ability to generate consistent profits and maintain a strong balance sheet. Southwest's financial performance in 2024 included a net income of $465 million, underscoring its profitability and operational efficiency.

- Net Income (2024): $465 million

- Liquidity (March 31, 2025): $9.3 billion

- Shareholder Value: Dividends and Buybacks

As of March 31, 2025, Southwest held $9.3 billion in liquidity, providing a significant cushion for future investments and operational needs. This financial strength is further supported by its commitment to returning value to shareholders via dividends and share buybacks, reflecting a mature and stable business model. This solid financial footing enables Southwest to navigate market fluctuations and pursue strategic growth opportunities.

Southwest Airlines' cash cow status is solidified by its dominant U.S. market share and robust financial performance.

Its 2024 net income of $465 million and $9.3 billion in liquidity as of March 31, 2025, highlight its financial strength.

The airline’s commitment to shareholders via dividends and buybacks further supports its stability.

| Metric | Value |

|---|---|

| Market Share (2024) | 17.3% |

| Ancillary Revenue (2024) | 19.2% of Operating Revenue |

| Net Income (2024) | $465 million |

| Liquidity (March 31, 2025) | $9.3 billion |

Dogs

Southwest Airlines faces constraints due to its limited international presence, unlike competitors with extensive global networks. Its focus is primarily on domestic routes, which limits access to international markets. In 2023, Southwest generated approximately 90% of its revenue from domestic flights. This lack of global reach restricts expansion and market share growth. Despite partnerships, its international footprint remains small compared to global airlines.

Southwest Airlines' complete reliance on the Boeing 737 is a major concern. The Boeing 737 MAX grounding in 2019 significantly disrupted operations. In 2024, any further issues could severely affect Southwest's schedule. This dependence could lead to operational and financial struggles.

Southwest Airlines grapples with rising union labor costs, a significant factor impacting its financial performance. Labor contracts and inflation have increased costs per available seat mile (CASM-X), a key metric. In 2024, labor costs are a major concern. Managing these costs is vital for competitiveness.

Operational Disruptions

Southwest Airlines faces operational disruptions, a "Dog" in the BCG matrix, due to events like the 2022 holiday meltdown. These disruptions, including flight cancellations, can harm its brand and cause financial setbacks. Improved operational resilience and infrastructure are critical to manage weather and other issues. Addressing these challenges is essential for maintaining customer trust and stability.

- 2022 holiday meltdown cost estimated at $725 million.

- Flight cancellations negatively impact customer loyalty and revenue.

- Operational inefficiencies contribute to increased costs.

- Infrastructure improvements are needed to mitigate future disruptions.

Decreased Domestic Bookings

Southwest Airlines finds itself in the "Dogs" quadrant of the BCG Matrix. Decreased domestic bookings are a key challenge, particularly as higher-spending travelers opt for international travel. This shift impacts Southwest's leisure-focused routes. The airline's decision to withdraw 2025 and 2026 financial forecasts reflects the uncertainty.

- Domestic revenue per available seat mile (RASM) decreased in 2024.

- Southwest's load factor (percentage of seats filled) is under pressure.

- Inflationary pressures and recession risks play a significant role.

- Adapting to changing travel patterns is vital.

Southwest Airlines is categorized as a "Dog" in the BCG Matrix, facing significant challenges. It struggles with operational disruptions and increased costs. The airline experiences decreased domestic bookings, impacting its financial performance.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| Domestic RASM | - | Decrease |

| Load Factor | - | Under Pressure |

| Labor Cost Increase | - | Significant |

Question Marks

Southwest's premium seating is a question mark due to uncertain customer acceptance. Investing in extra legroom aims to boost revenue. Success hinges on effective marketing and pricing strategies. In 2024, Southwest's load factor was around 85%. Revenue from premium seating is crucial for growth.

The move to assigned seating is a major shift for Southwest. Its impact on customer loyalty and operational efficiency is not yet fully known. Assigned seating could attract new customers, yet it might upset loyal ones who like the old open policy. A smooth boarding process is key to this transition. Southwest's revenue in 2024 was $26.8 billion.

Southwest's $1.7 billion tech investment lands in the question mark quadrant of its BCG matrix. These upgrades target cloud migration, data analytics, and AI, aiming to boost efficiency and customer service. The return on investment remains uncertain. Success hinges on effective implementation and leveraging these technologies.

International Partnerships Integration

International partnerships, like the Icelandair agreement, are question marks. They boost Southwest's reach but complicate operations. Integrating systems and ensuring smooth customer experiences are key challenges. Maintaining Southwest's customer satisfaction is critical with these partnerships. As of 2024, international revenue is growing, but integration costs could impact profitability.

- Icelandair partnership expands Southwest's network to new destinations.

- System integration and coordination are critical for seamless travel.

- Customer satisfaction is a key measure of partnership success.

- International revenue growth must offset integration costs.

Basic Economy Rollout

The introduction of Southwest Airlines' Basic Economy fare is a classic "Question Mark" in the BCG Matrix. It's a new offering with the potential for high growth, but its success is uncertain. The main concern is its impact on customer perception and brand loyalty, which is crucial for Southwest's success.

This fare aims to attract price-sensitive travelers, but it could backfire if customers perceive it as diminishing the value of flying Southwest. Careful management of the rollout and clear communication about the benefits are crucial. The company must balance attracting new customers without alienating existing ones.

- Southwest's revenue in 2024 was $26.8 billion.

- The airline's load factor (percentage of seats filled) was around 84% in 2024.

- Basic Economy fares aim to capture a share of the $40 billion low-fare market.

- Customer satisfaction scores will be vital in the rollout.

Southwest's Basic Economy is a question mark due to uncertain customer acceptance. This fare targets a share of the $40 billion low-fare market. Success depends on balancing new customer attraction with existing loyalty. Customer satisfaction scores are vital.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Southwest's Total | $26.8 billion |

| Load Factor | Percentage of seats filled | ~84% |

| Market Share | Low-fare market target | $40 billion |

BCG Matrix Data Sources

The Southwest BCG Matrix utilizes public financial statements, market share analyses, and industry growth projections for dependable results.