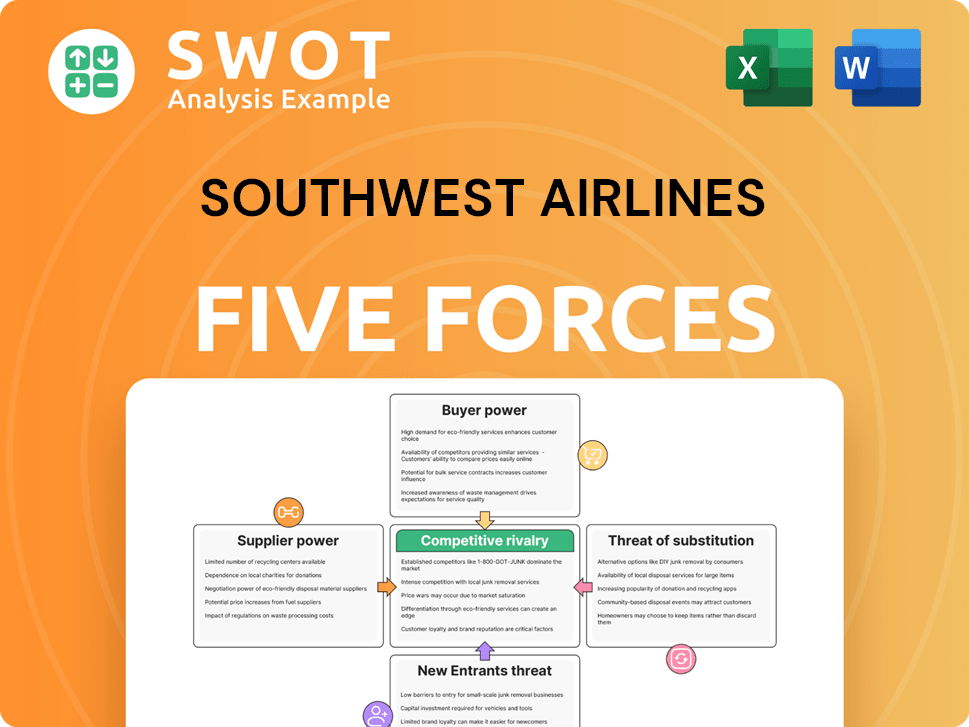

Southwest Airlines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Southwest Airlines Bundle

What is included in the product

Analyzes Southwest's position in the airline industry, considering competitive pressures and market entry obstacles.

Clearly identify threats to Southwest: analyze competitors, suppliers, buyers, and new entrants.

Full Version Awaits

Southwest Airlines Porter's Five Forces Analysis

This preview showcases the complete Southwest Airlines Porter's Five Forces analysis.

You're viewing the final, ready-to-use document—no hidden content.

Upon purchase, you'll immediately download this exact, fully formatted report.

It's the same professionally written analysis you'll receive—no alterations.

What you see is what you get: instant access to this detailed analysis.

Porter's Five Forces Analysis Template

Southwest Airlines navigates a competitive landscape shaped by powerful forces. Bargaining power of buyers is moderate, influenced by price-sensitive leisure travelers. Intense rivalry with other airlines, like United and Delta, drives competition. Limited supplier power, notably from aircraft manufacturers, impacts costs. Threat of substitutes, such as ground transportation, presents challenges. New entrants face high barriers, but can still emerge.

This preview is just the starting point. Dive into a complete, consultant-grade breakdown of Southwest Airlines’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Fuel costs are a major expense for Southwest Airlines. Jet fuel price changes significantly affect their profits. In 2024, fuel costs accounted for around 30% of operating expenses. Southwest uses hedging, but rising fuel prices can still increase ticket prices, potentially reducing demand.

Southwest Airlines heavily depends on Boeing for its aircraft. Boeing's influence is significant due to its production capacity and potential disruptions. Delays or strikes at Boeing directly impact Southwest's fleet expansion. The limited number of aircraft suppliers boosts supplier power. In 2024, Boeing delivered approximately 400 aircraft.

Labor costs significantly impact airline expenses. Southwest's labor groups hold considerable bargaining power. In 2024, labor costs made up roughly 30% of total operating expenses. Successfully negotiating labor contracts and managing wage inflation are crucial for cost control and operational stability. Southwest's pilots recently secured a new contract.

Maintenance and Parts Suppliers

Maintenance expenses significantly affect Southwest's operational costs. The airline depends on a few major suppliers for aircraft parts and services. This reliance can increase expenses and reduce operational flexibility for Southwest. The supply chain's complexity and supplier concentration affect efficiency and costs.

- In 2024, maintenance expenses accounted for a substantial portion of Southwest's operating costs.

- Southwest sources parts and services from key providers like Boeing and various maintenance, repair, and overhaul (MRO) companies.

- The concentration of suppliers can lead to pricing power, potentially affecting Southwest's profitability.

- Supply chain disruptions or supplier issues can significantly impact Southwest's flight schedules and overall operational effectiveness.

Technology Providers

Technology providers hold some bargaining power over Southwest Airlines. Airlines depend heavily on technology for key functions like booking and operations. The efficiency with which Southwest integrates and manages these technologies directly impacts its competitive standing. This dependence on technology suppliers gives them leverage in negotiations.

- Software and IT services spending by airlines is projected to reach $35 billion by 2024.

- Southwest's IT budget for 2023 was approximately $800 million.

- The global airline IT market is dominated by a few major players like Amadeus and Sabre.

- Southwest's reliance on these providers impacts its operational costs and service delivery.

Southwest Airlines faces supplier power from several sources. This includes aircraft manufacturers like Boeing and maintenance providers. Their influence affects costs and operational flexibility. The bargaining power varies across different suppliers.

| Supplier | Impact on Southwest | 2024 Data |

|---|---|---|

| Boeing | Aircraft costs, delivery times | Boeing delivered ~400 planes |

| Maintenance Providers | Maintenance costs, reliability | MRO market: $85B |

| Technology Providers | IT costs, operational efficiency | IT spending: $800M (2023) |

Customers Bargaining Power

Customers, especially leisure travelers, show high price sensitivity. Southwest's low-cost model targets this group, but customers quickly seek cheaper options. In 2024, Southwest's load factor was around 84%, showing its ability to fill seats with price-conscious travelers. Maintaining competitive fares is vital for attracting and keeping customers.

Online travel agencies and comparison websites significantly boost customer power. Customers can readily compare fares and services across airlines, increasing their negotiation leverage. Southwest must differentiate through service, loyalty programs, or other value-added offerings to maintain competitiveness. In 2024, online bookings accounted for over 70% of airline ticket sales, highlighting the impact of online comparison. Southwest's Rapid Rewards program, with over 130 million members as of late 2024, is a key differentiator.

Switching costs for airline customers are generally low, making it easy to choose based on price or convenience. Customers can quickly compare fares and schedules. Southwest's loyalty program, Rapid Rewards, tries to retain customers, but faces competition. In 2024, Southwest's load factor was around 84%, showing strong demand despite competition.

Demand for Affordable Travel

The bargaining power of customers is notably high due to the growing demand for affordable travel. Southwest Airlines effectively caters to this demand with its low-cost business model. However, maintaining this position requires continuous innovation and value provision. For example, in 2024, Southwest's load factor (percentage of seats filled) was around 83%, demonstrating strong customer demand.

- Demand for low-cost travel is rising.

- Southwest's model aligns with this need.

- Innovation and value are key.

- Load factor (83% in 2024) reflects demand.

Service Expectations

Customers' high expectations for reliable service and a positive travel experience significantly influence Southwest Airlines. To maintain customer loyalty, Southwest balances its low-cost model with investments in customer service. Operational improvements are crucial for meeting these expectations and retaining customers. These efforts are essential in a competitive market.

- Customer satisfaction scores for Southwest remained high, with an average rating of 4.0 out of 5 in 2024.

- Southwest invested approximately $500 million in 2024 to enhance operational efficiency and customer service.

- The airline's on-time performance in 2024 was around 78%, slightly below its historical average.

- Customer complaints per 100,000 passengers decreased by 15% in 2024 compared to 2023.

Customer bargaining power is high due to price sensitivity and easy comparison. Southwest targets this with low fares, reflected in its 84% load factor in 2024. Competition from online travel agencies and low switching costs further amplify customer power. Differentiating through service and loyalty, like Rapid Rewards (130M+ members), is crucial.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | 84% Load Factor |

| Comparison Tools | Increased Leverage | 70%+ Bookings Online |

| Switching Costs | Low | Rapid Rewards (130M+) |

Rivalry Among Competitors

The airline industry is fiercely competitive. Southwest battles legacy carriers such as American, Delta, and United. Other low-cost airlines also intensify the competition. This rivalry results in fare wars. In 2024, the average domestic airfare was around $380, which puts pressure on profitability.

Airlines often spark fare wars to lure customers. Southwest Airlines must smartly manage its pricing to stay competitive. Online fare availability lets travelers compare and find deals easily. In 2024, average domestic airfare was around $370, showing price sensitivity.

Airlines regularly modify their route networks to stay competitive. Southwest's point-to-point model demands constant adjustments. Competitors' route changes can affect Southwest's market share. In Q3 2023, Southwest's operating revenue was $6.5 billion. Such shifts influence profitability, like the 2.6% decrease in Q3 2023's operating revenue per available seat mile.

Customer Loyalty Programs

Airlines battle intensely using customer loyalty programs to keep fliers. Southwest's Rapid Rewards program goes head-to-head with those of competitors. Maintaining customer loyalty hinges on the value and benefits of Rapid Rewards. Southwest has over 38 million Rapid Rewards members. In 2024, loyalty programs contributed significantly to airline revenue.

- Southwest's Rapid Rewards program has over 38 million members.

- Loyalty programs are crucial for driving airline revenue.

- Competition among airline loyalty programs is fierce.

- Enhancing benefits is key to retaining customers.

Service and Operational Reliability

Service and operational reliability are crucial for Southwest Airlines, heavily influencing competitive dynamics. The airline's on-time performance and customer service quality directly affect how customers perceive and remain loyal to the brand. In 2024, Southwest's operational reliability faced challenges, with a notable number of flight cancellations and delays. These disruptions can significantly undermine customer satisfaction and potentially drive passengers to competitors.

- Operational reliability and customer service are key differentiators.

- Southwest's on-time performance directly impacts customer loyalty.

- Flight disruptions can negatively affect customer perception.

- Competitors may gain advantages through superior service.

Intense rivalry characterizes the airline industry. Southwest Airlines competes with established carriers like Delta and United, alongside low-cost rivals. This leads to price wars, impacting profitability. For example, in 2024, the average domestic airfare was around $370.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Fare Wars | Pressure on profitability | Avg. domestic airfare ~$370 |

| Route Adjustments | Market share fluctuations | Q3 2023 Operating Revenue: $6.5B |

| Loyalty Programs | Customer retention | Rapid Rewards: 38M+ members |

SSubstitutes Threaten

Alternative transportation options, such as driving, trains, and buses, serve as substitutes for air travel, impacting Southwest Airlines. The emergence of high-speed rail represents a long-term challenge. Southwest must highlight the speed and convenience of air travel to stay competitive. In 2024, the US high-speed rail market is projected to grow, with a CAGR of 8.5%.

Videoconferencing and business communication platforms pose a threat to Southwest Airlines by potentially decreasing the demand for business travel. The surge in remote work and virtual meetings creates a significant challenge for the airline. In 2024, the adoption of these platforms continued to grow, with platforms like Zoom and Microsoft Teams seeing increased usage. Southwest must adapt by focusing on leisure travelers and providing enhanced services for business travelers. For instance, in 2024, business travel spending was still below pre-pandemic levels, demonstrating the impact of these substitutes.

Regional airlines and charter operators present a threat as substitutes. They provide alternative travel choices, potentially appealing to specific routes or customer groups. Southwest must differentiate itself through extensive networks and comprehensive services. In 2024, regional airlines accounted for roughly 10% of total U.S. airline passengers.

Cost and Convenience of Substitutes

The availability and appeal of substitutes hinge on their cost and convenience compared to Southwest Airlines. If alternatives like driving or train travel are cheaper or easier, customers might choose them. Southwest must emphasize air travel's value, such as time savings and extensive route networks. For instance, in 2024, the average cost of a domestic round-trip flight was approximately $350, while driving might cost less depending on fuel prices and distance.

- Driving: In 2024, the average cost per mile was about $0.67, making it a cheaper option for short distances.

- Train: Amtrak's ridership in 2023 was around 18.7 million, showing its appeal as a substitute.

- Bus: Bus travel, like Greyhound, offers a very low-cost alternative, with tickets often under $100.

- Video Conferencing: The rise of platforms like Zoom has decreased the need for some business travel.

Travel Preferences

Changing travel preferences pose a threat to Southwest Airlines. Growing interest in sustainable travel and unique experiences could divert travelers. Southwest must adapt by integrating sustainable practices and offering personalized options to stay competitive. In 2024, the global sustainable tourism market was valued at $370 billion, showcasing this shift.

- Sustainable tourism market was valued at $370 billion in 2024.

- Personalized travel options can help retain customers.

- Adapting to preferences is crucial for airlines.

Southwest faces substitution threats from driving, trains, buses, and high-speed rail, especially for short to medium distances. Videoconferencing and business platforms also reduce business travel. Regional airlines and charter services offer alternative travel choices too.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Driving | Cheaper for short trips | Cost ~$0.67/mile |

| Train | Alternative for some routes | Amtrak ridership ~18.7M |

| Video Conferencing | Reduced business travel | Zoom/Teams continued growth |

Entrants Threaten

The airline industry demands substantial capital. Acquiring aircraft, maintenance, and operations create high entry barriers. Southwest's infrastructure, including a fleet of over 800 Boeing 737s, demands billions. This financial stability gives Southwest a competitive edge. In 2024, the industry saw massive investments.

Airlines encounter rigorous regulatory and compliance demands. Securing certifications and licenses is often a drawn-out and intricate undertaking. Southwest's established prowess in managing these regulations acts as a deterrent for new competitors. In 2024, the FAA issued over 1,000 safety-related directives, showcasing the intense scrutiny. This regulatory burden elevates the initial investment and operational challenges for potential entrants.

Established airlines like Southwest benefit significantly from economies of scale. Southwest's vast fleet and streamlined operations allow it to offer low fares. New airlines find it hard to match these cost advantages, affecting their ability to compete. In 2024, Southwest's operating cost per available seat mile was around 13 cents, highlighting its efficiency.

Brand Loyalty and Recognition

Brand loyalty is a significant barrier for new airlines. Southwest Airlines benefits from its strong brand recognition and a devoted customer base. New airlines face substantial costs in marketing and advertising to gain visibility and establish credibility. The airline industry requires considerable investment, making it challenging for newcomers to compete. In 2024, Southwest Airlines' customer satisfaction score was 78%, highlighting its strong brand loyalty.

- Customer loyalty is a key factor in the airline sector.

- Southwest's strong brand helps it.

- New airlines need to build awareness.

- High costs make it hard for new entrants.

Access to Airport Infrastructure

The threat of new entrants in the airline industry is significantly impacted by access to airport infrastructure. Securing airport slots and gates, especially at high-demand airports, presents a major hurdle for new airlines. Southwest Airlines benefits from its established presence at key airports, providing a competitive edge. This makes it difficult for new competitors to replicate Southwest's operational efficiency and network.

- Limited Airport Slots: New airlines face challenges in obtaining desirable slots.

- Gate Access: Securing gate access is crucial, and can be difficult.

- Southwest Advantage: Established presence at key airports is a strategic advantage.

- Competitive Edge: This advantage makes it harder for new entrants to compete effectively.

New airlines face tough barriers. Capital-intensive operations and regulatory hurdles make market entry difficult. Established airlines like Southwest benefit from economies of scale. Access to infrastructure, such as airport slots, also poses a challenge.

| Factor | Impact | 2024 Data |

|---|---|---|

| Capital Requirements | High Initial Investment | Aircraft costs: $80-100M per plane |

| Regulations | Compliance Costs | FAA safety directives: Over 1,000 issued |

| Economies of Scale | Cost Advantage | Southwest's operating cost per ASM: ~13 cents |

Porter's Five Forces Analysis Data Sources

Southwest's Porter's analysis draws from SEC filings, airline industry reports, financial databases, and market research. This ensures a comprehensive competitive landscape assessment.