Southwest Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Southwest Airlines Bundle

What is included in the product

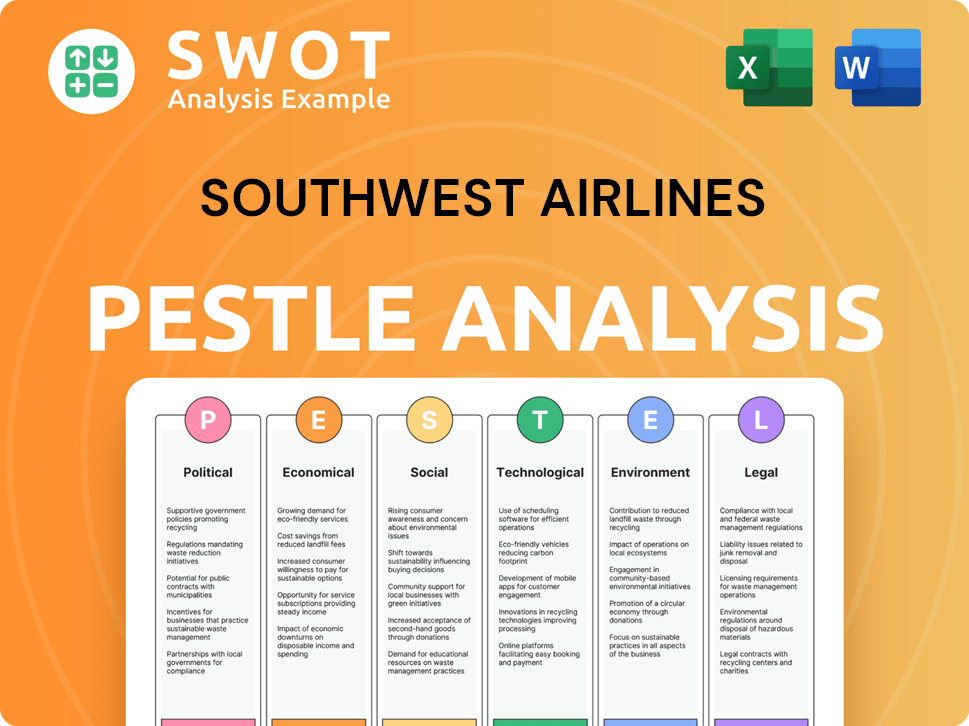

The Southwest Airlines PESTLE Analysis examines external macro factors impacting the airline across Political, Economic, Social, etc.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Southwest Airlines PESTLE Analysis

The Southwest Airlines PESTLE analysis preview reflects the complete document.

This detailed examination of the airline's external factors is ready-made for you.

You'll find the same organized content and structure you see right now.

Immediately upon purchase, download this exact file to begin your work.

PESTLE Analysis Template

Explore Southwest Airlines's external environment with our detailed PESTLE analysis. We dissect how political factors impact its operations. Uncover economic trends shaping the airline's trajectory. Discover the technological advancements they're navigating. Analyze social changes influencing customer behavior. Examine legal and environmental considerations affecting its strategies. Get a competitive edge! Download the full analysis today.

Political factors

Southwest Airlines navigates a heavily regulated environment, primarily influenced by the FAA and DOT. The Airline Deregulation Act of 1978 provided operational flexibility. Federal aviation policy shifts and budget adjustments directly impact operational standards and infrastructure spending. The FAA's budget for 2024 was $19.9 billion, showing the scale of regulatory influence. Furthermore, the DOT proposed new rules in early 2024 regarding airline fees.

Southwest Airlines' international operations are significantly impacted by global political dynamics. International trade agreements, like open skies agreements, are crucial; they either facilitate or restrict access to international markets. In 2024, Southwest's international revenue accounted for roughly 5% of its total operating revenue. Changes in diplomatic relations can directly affect route viability and profitability. For example, political instability in certain regions could lead to route suspensions or cancellations.

Government funding for aviation infrastructure, like airport upgrades, boosts Southwest's operations. Investments in sustainable aviation technologies align with the airline's environmental targets. In 2024, the U.S. government allocated billions to airport improvements, supporting airline efficiency. This support includes grants for sustainable aviation fuel initiatives. Such initiatives can reduce operational costs.

Political Stability and Geopolitical Events

Political stability and global events significantly influence Southwest Airlines. Unstable regions can deter travel, affecting revenue and operational logistics. Trade policies, like tariffs, can raise expenses for aircraft parts and maintenance. For example, in 2024, geopolitical events caused a 5% drop in international travel demand.

- Geopolitical factors can cause fluctuations in fuel prices by up to 10%.

- Changes in trade agreements may increase aircraft maintenance costs.

- Political instability may lead to flight route adjustments.

Advocacy and Lobbying Efforts

Southwest Airlines actively lobbies for policies that benefit its operations. They focus on areas like fuel efficiency and sustainable aviation fuel (SAF) incentives. The airline collaborates with groups such as Airlines for America (A4A) to push for advantageous government programs. For instance, in 2024, A4A spent over $8 million on lobbying efforts.

- Lobbying focuses on fuel efficiency and SAF incentives.

- Partnerships with A4A support favorable policies.

- A4A spent over $8 million on lobbying in 2024.

Political factors deeply impact Southwest Airlines' operations, influencing regulations, international routes, and infrastructure funding. In 2024, FAA's budget stood at $19.9 billion, and international revenue comprised 5% of the total. Geopolitical events caused a 5% drop in international travel demand.

| Factor | Impact | Data |

|---|---|---|

| Regulations | Operational standards, infrastructure spending | FAA's 2024 budget: $19.9B |

| International Relations | Route viability, profitability | Int'l revenue: ~5% of total (2024) |

| Political Instability | Travel demand, operational logistics | 5% drop in int'l travel (2024) |

Economic factors

Economic growth and consumer spending are key for Southwest. Strong U.S. economic health boosts demand for air travel. A dip in consumer confidence can hit leisure travel hard. In Q1 2024, U.S. GDP grew by 1.6%, influencing travel spending. Any recession fears could cause fewer bookings and lower revenue for the airline.

Fuel prices are a major expense for Southwest. In Q1 2024, jet fuel represented 33% of operating expenses. Price volatility directly affects profitability. Southwest uses fuel hedging to manage risk; in 2024, they expect a fuel price of $2.60-$2.70 per gallon.

Inflation significantly affects Southwest's operations, particularly labor and fuel costs. Wage inflation, driven by union negotiations, and supply chain disruptions, escalate expenses. For 2024, the airline projects a cost per available seat mile (CASM) increase. This could pressure profitability if revenue growth lags behind rising costs.

Competition and Pricing Pressures

The airline industry is fiercely competitive, with numerous players like Delta and United battling for market share. This environment puts constant pressure on pricing. Southwest's low-cost strategy hinges on keeping costs down to offer competitive fares. This requires ongoing efficiency improvements.

- In Q1 2024, Southwest's operating revenue per available seat mile (RASM) decreased by 3.7% year-over-year due to pricing pressures.

- Competitors like Spirit and Frontier often engage in aggressive pricing strategies.

- Southwest aims to maintain a cost advantage; in 2023, its cost per available seat mile (CASM) excluding fuel and profit sharing was around 11.5 cents.

Currency Exchange Rates

Currency exchange rate volatility affects Southwest Airlines' international revenue and operational costs. Though mainly domestic, its international routes face currency risks. For instance, a strong US dollar can make international travel more expensive for foreign customers, potentially reducing demand. The airline must manage these risks to protect profitability. In 2024, the USD has shown fluctuations against major currencies.

- Impact: Currency fluctuations affect revenue from international flights.

- Risk Management: Hedging strategies are used to mitigate currency risks.

- Example: A stronger USD can decrease demand for international flights.

- Data: The USD's value has varied against the Euro and other currencies in 2024.

U.S. economic health greatly impacts Southwest, with Q1 2024 GDP growth at 1.6% affecting travel demand. Fluctuating fuel prices, with Q1 2024 jet fuel at 33% of costs, also weigh heavily. Competitiveness and inflation, especially labor costs, create challenges for maintaining profitability.

| Factor | Impact | Data |

|---|---|---|

| Economic Growth | Influences demand | Q1 2024 GDP: 1.6% |

| Fuel Prices | Major expense | Q1 2024: 33% operating costs; $2.60-$2.70 per gallon |

| Inflation | Raises costs (labor) | CASM increase projected for 2024 |

Sociological factors

Consumer preferences are shifting, impacting Southwest's strategies. Customers now seek assigned seating and premium choices. Southwest is adjusting to these desires. For instance, in Q1 2024, they reported a 10% rise in revenue from ancillary services. They are responding to evolving demands.

A large segment of travelers prioritizes affordability, sustaining demand for budget airlines. Southwest has historically catered to this price-sensitive market segment. In 2024, low-cost carriers captured about 30% of the U.S. air travel market. This trend is expected to persist through 2025, with increasing inflation. Southwest's strategy remains well-aligned.

Southwest Airlines' reputation hinges on customer service quality, significantly affecting its brand image. Issues like flight delays or mishandled baggage can quickly damage this perception. Social media and news outlets now amplify these experiences, impacting public opinion swiftly. In 2024, Southwest saw a customer satisfaction score of 78, reflecting service impact.

Demographic Shifts and Travel Trends

Shifting demographics significantly impact Southwest's strategies. An aging population might increase leisure travel, while younger generations' preferences could drive demand for specific routes and services. The rise of remote work presents both challenges and opportunities, potentially decreasing business travel but increasing flexible leisure trips. In 2024, the U.S. population aged 65+ grew by 3.4%, indicating a rising demand for leisure travel.

- Aging population trends.

- Impact of remote work.

- Changing traveler preferences.

Health and Safety Concerns

Public health concerns significantly influence travel behavior, necessitating airlines like Southwest to adapt. Perceptions of safety, especially post-COVID-19, are crucial for attracting passengers. Airlines must invest in and clearly communicate health and safety protocols to reassure travelers. A recent study shows that 65% of travelers are more likely to fly with airlines that emphasize health safety.

- Increased demand for enhanced cleaning protocols.

- Implementation of contactless check-in and boarding.

- Mandatory mask policies or vaccination checks.

- Clear communication about air filtration systems.

Societal shifts like evolving customer preferences and demographic changes require strategic adaptation from Southwest Airlines. Customer expectations, including desires for assigned seating and premium options, are in flux. Furthermore, demographic shifts, such as an aging population and the rise of remote work, impact travel behaviors and demands.

| Factor | Impact | Data |

|---|---|---|

| Customer Preferences | Demand for premium and assigned seating. | Q1 2024: 10% revenue rise in ancillary services. |

| Demographics | Increasing leisure travel demand. | U.S. population 65+ grew by 3.4% in 2024. |

| Remote Work | Potential shift in travel patterns. | Forecast: Remote work impacts remain variable. |

Technological factors

Southwest Airlines invests in modern, fuel-efficient aircraft to cut costs and emissions. Their fleet includes Boeing 737 MAX models. In Q1 2024, Southwest reported a 1.7% decrease in fuel consumption per available seat mile. This is a key part of their environmental strategy.

Southwest Airlines heavily invests in technology to improve customer experience and operational efficiency. Their online booking platforms and mobile apps are constantly updated. In 2024, Southwest reported a 15% increase in mobile bookings. Data analytics is crucial for understanding customer behavior and optimizing services.

Southwest Airlines leverages technology to boost operational efficiency. Air traffic control modernization and tools for faster turnarounds help save fuel and improve on-time performance. NextGen initiatives are key. In 2024, Southwest aimed for a 90% on-time rate.

Data-Driven Decision Making

Southwest Airlines leverages data-driven decision-making, using analytics platforms to optimize operations. This includes refining pricing strategies and enhancing customer experiences. For instance, in 2024, data analytics helped Southwest improve flight scheduling efficiency by 5%, leading to better resource allocation. Data is crucial for future growth and adapting to market changes.

- Improved efficiency: 5% gain in flight scheduling in 2024.

- Data-driven strategies: Key for pricing and customer targeting.

- Technology investment: Continuous to stay competitive.

- Future focus: Data is critical for strategic decisions.

Sustainable Aviation Fuel (SAF) Technology

Sustainable Aviation Fuel (SAF) technology is vital for reducing carbon emissions in the airline industry. Southwest Airlines supports SAF development and usage. In 2024, SAF use is projected to increase. The airline's commitment includes partnerships and investments in SAF projects. This aligns with global efforts to decarbonize aviation.

- Southwest aims to use 10% SAF by 2030.

- SAF can cut lifecycle emissions by up to 80%.

- SAF production faces scaling challenges.

- Investments support SAF plant development.

Technological advancements drive Southwest Airlines’ operations. Fuel efficiency gains, such as the 1.7% decrease in Q1 2024, improve profitability. Enhanced digital platforms and data analytics enhance customer experience. Data-driven strategies increased flight scheduling by 5% in 2024.

| Aspect | Details | Impact |

|---|---|---|

| Fleet Modernization | Boeing 737 MAX; fuel-efficient aircraft | Cost reduction; emissions decrease |

| Digital Platforms | Mobile bookings up 15% in 2024 | Improved customer experience; operational efficiency |

| Data Analytics | 5% improvement in flight scheduling (2024) | Better resource allocation; enhanced profitability |

Legal factors

Southwest Airlines operates under stringent regulations from the FAA and DOT, impacting safety, operations, and passenger rights. The FAA conducted 1,678 safety inspections in 2024. Non-compliance can lead to significant fines; for example, in 2024, the DOT imposed over $10 million in penalties on airlines for various violations. These legal challenges necessitate robust compliance programs.

Southwest Airlines heavily relies on its unionized workforce, making it subject to labor laws and union negotiations. In 2023, approximately 85% of Southwest employees were unionized. Labor costs significantly impact operating expenses; in Q4 2023, salaries, wages, and benefits totaled $2.3 billion. Successful negotiations are critical to avoid disruptions and manage costs.

Southwest Airlines must comply with consumer protection laws. These laws cover flight delays, cancellations, and baggage handling. Non-compliance can result in legal action and fines. In 2024, the Department of Transportation (DOT) fined airlines over $6 million for consumer protection violations.

Environmental Regulations

Environmental regulations are increasingly impacting Southwest Airlines. Stricter rules on emissions, noise, and waste force investments in compliance and sustainability. Airlines must adapt to these changes to avoid penalties and maintain their operational licenses. Compliance costs are rising, affecting profitability. Southwest's initiatives include fuel efficiency and waste reduction.

- 2024: Airlines face higher carbon taxes and stricter emission limits.

- 2025: Noise pollution regulations at major airports could increase operational restrictions.

- Sustainable fuel usage will be essential to comply with emerging environmental standards.

Data Privacy and Security Laws

Data privacy and security are critical legal factors for Southwest Airlines, given its reliance on digital platforms and customer data. Southwest must adhere to regulations like GDPR and CCPA to protect passenger information. Non-compliance can lead to hefty fines; for example, the average cost of a data breach in the US reached $9.48 million in 2023. These laws mandate robust data protection measures.

- GDPR and CCPA compliance is essential.

- Data breaches can cost millions.

- Robust data protection measures are required.

- Cybersecurity investments are a must.

Legal factors significantly influence Southwest Airlines' operations, requiring compliance with FAA and DOT regulations, with the FAA conducting over 1,600 safety inspections in 2024. Labor laws and union negotiations, especially with their 85% unionized workforce in 2023, directly impact costs, such as $2.3 billion in Q4 2023 for wages. Data privacy, driven by regulations like GDPR, is crucial given increasing cybersecurity threats and hefty breach costs.

| Regulatory Area | Compliance Challenge | Financial Impact (2023-2024) |

|---|---|---|

| FAA/DOT | Safety and Operational Standards | Fines over $10M (DOT 2024), inspections increased in 2024. |

| Labor | Union Negotiations/Labor Costs | Q4 2023 Salaries, wages, and benefits $2.3B |

| Data Privacy | GDPR, CCPA Compliance, Data Security | Avg. data breach cost in the US $9.48M (2023) |

Environmental factors

The aviation industry significantly contributes to carbon emissions. In 2024, air travel accounted for roughly 2-3% of global CO2 emissions. Growing climate change awareness and regulations compel airlines to reduce emissions. Southwest Airlines, like others, faces pressure to meet sustainability goals, which may influence operational strategies. The EU's "Fit for 55" package, for example, mandates emission cuts, impacting airlines operating in Europe.

Southwest Airlines faces environmental pressure to adopt Sustainable Aviation Fuel (SAF). SAF adoption is essential for reducing aviation's carbon footprint. However, SAF's limited availability and higher cost compared to traditional jet fuel pose financial hurdles. In 2024, SAF prices were 2-5 times more expensive than conventional fuel, impacting profitability.

Southwest Airlines is under pressure to minimize waste and plastic use. In 2024, the airline announced plans to reduce single-use plastics. This is in response to growing environmental regulations and customer expectations. The initiatives aim to cut down on waste across all its operations.

Noise Pollution Regulations

Noise pollution regulations significantly affect Southwest Airlines. These regulations, particularly around airports, can influence flight paths and fleet choices, often promoting quieter aircraft. For instance, the FAA's noise standards mandate specific aircraft types for operations. These rules add to operational costs.

- FAA's Stage 3 noise standards compliance is crucial.

- Quieter aircraft may require higher upfront investments.

- Noise restrictions can limit flight schedules and routes.

- Compliance costs include modifications and operational adjustments.

Extreme Weather Events

Extreme weather events, intensified by climate change, present significant challenges for Southwest Airlines. These events, including hurricanes and severe storms, lead to flight disruptions, causing delays and cancellations. Such operational interruptions directly impact Southwest's profitability, potentially increasing costs related to rerouting and customer service. For example, in 2023, weather-related disruptions cost the airline millions due to flight cancellations and delays.

- Increased frequency of extreme weather events.

- Operational disruptions impacting flight schedules.

- Financial losses due to cancellations and delays.

- Potential rise in operational costs.

Environmental factors greatly impact Southwest Airlines. The industry faces scrutiny regarding carbon emissions and the need for Sustainable Aviation Fuel (SAF). Noise pollution regulations and extreme weather, intensified by climate change, pose challenges.

| Issue | Impact | Data |

|---|---|---|

| CO2 Emissions | Emission reduction pressure | 2-3% of global CO2 from air travel (2024) |

| SAF adoption | Financial hurdles, emissions cuts | SAF costs 2-5x conventional fuel (2024) |

| Weather Events | Flight disruptions and costs | Weather-related disruptions cost millions (2023) |

PESTLE Analysis Data Sources

Our Southwest Airlines PESTLE relies on airline industry reports, financial databases, government policies, and economic forecasts. We analyze trends from credible news sources, consumer behavior data, and technological advancements.