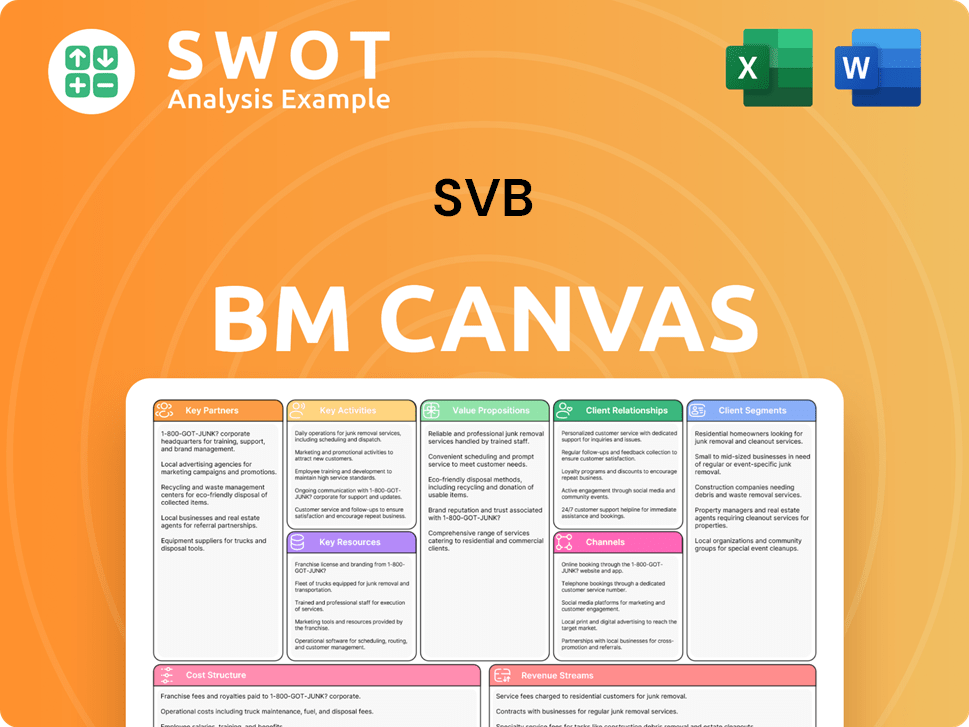

SVB Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SVB Bundle

What is included in the product

Comprehensive, pre-written business model tailored to the company's strategy.

The SVB Business Model Canvas offers a clean layout to quickly identify core business components.

Full Version Awaits

Business Model Canvas

The SVB Business Model Canvas previewed here is the actual document you will receive. It's not a simplified version or a demo; it is a direct snapshot. Purchasing unlocks the complete file, formatted exactly as shown. You'll have full access to the same professional, ready-to-use Canvas.

Business Model Canvas Template

Uncover the SVB's strategic framework with our detailed Business Model Canvas. This valuable tool dissects the company's value proposition, customer segments, and revenue streams. You'll discover key partnerships and cost structures that drove its success. It is ideal for financial professionals and business strategists. Gain actionable insights with the full, downloadable Business Model Canvas.

Partnerships

SVB's alliances with venture capital firms are vital for sourcing new clients. These partnerships provide a stream of potential investments and clients. This cooperation enables SVB to offer tailored financial solutions, especially venture debt, to rapidly expanding companies. In 2024, venture capital deals totaled over $100 billion, showcasing the significance of these collaborations.

SVB partnered with tech giants to stay innovative. This collaboration let SVB offer specialized banking to tech. These partnerships helped create tailored financial products. In 2024, tech sector lending made up a huge part of SVB's portfolio. SVB's focus on tech was key to its business model.

Life science companies are crucial partners for SVB, fostering innovation in healthcare and biotech. SVB's sector expertise allows it to offer specialized financial solutions. These partnerships keep SVB informed about industry trends, allowing it to provide relevant services. In 2024, the biotech sector saw over $20 billion in venture capital, highlighting the importance of these relationships. SVB's focus on life sciences is a key differentiator.

Pinegrove Venture Partners

SVB's partnership with Pinegrove Venture Partners is a key element of its business model. This collaboration facilitates the deployment of venture debt, with a goal of providing $2.5 billion in loans. The partnership enhances SVB's capacity to offer flexible capital solutions to tech and life science companies. Pinegrove's venture investment platform strengthens this strategy.

- SVB's venture debt portfolio reached $1.5 billion by Q4 2024.

- Pinegrove managed over $5 billion in venture capital investments.

- The partnership aimed to support over 500 tech and life science companies.

- The average loan size through this partnership was $5 million.

First Citizens Bank

As part of First Citizens Bank, SVB gains from a more robust financial structure. This collaboration bolsters SVB's financial stability and access to resources. The acquisition by First Citizens Bank has fortified SVB's balance sheet, enhancing its appeal to fintech clients. In Q4 2023, First Citizens Bank reported a net income of $225 million.

- Financial Security: SVB benefits from First Citizens Bank's established financial standing.

- Resource Access: The partnership provides SVB with greater access to capital and operational support.

- Balance Sheet: First Citizens Bank's backing bolsters SVB's financial health.

- Client Confidence: The acquisition reassures clients in the fintech sector.

SVB’s alliances with venture capital firms are pivotal for identifying new clients. These partnerships facilitate deal flow and offer specialized financial solutions, especially venture debt. In 2024, VC deals exceeded $100B, highlighting the significance of these collaborations.

Collaborations with tech giants allow SVB to offer specialized banking services, and this drove product innovation. These partnerships are crucial for tailored financial product development. Tech sector lending was a major part of SVB’s portfolio in 2024.

Life science partnerships are also very important for SVB. These collaborations foster innovation in healthcare and biotech, giving SVB deep industry insights. The biotech sector saw over $20B in VC in 2024, showing these relationships’ importance.

| Partnership Type | Benefit | 2024 Impact |

|---|---|---|

| VC Firms | Client Sourcing | $100B+ VC Deals |

| Tech Giants | Product Innovation | Significant Tech Lending |

| Life Science | Industry Insights | $20B+ Biotech VC |

Activities

SVB's commercial banking services include lending and cash management, crucial for business operations. These services support clients' financial needs, aiding in efficient management. SVB's offerings assist businesses in scaling operations effectively. In 2024, commercial banking revenue for SVB Financial Group was approximately $1.2 billion. This underscores the importance of these activities.

Venture debt financing is a core activity for SVB, providing crucial funding to startups. It offers an alternative to equity financing, helping companies preserve ownership. SVB's specialization in this area makes them a key player in supporting tech and life science firms. In 2024, venture debt deals totaled approximately $30 billion, highlighting its importance.

SVB's investment banking arm offered underwriting and M&A advisory. It assisted clients in securing capital and managing strategic deals. This division supported client expansion. In 2024, the M&A advisory fees in the US reached $30.6 billion.

Private Banking

SVB's private banking arm delivered customized financial solutions and wealth management services. These included personalized investment strategies and financial planning tailored to high-net-worth individuals. SVB's private banking division focused on the specific financial needs of affluent clients, offering a range of services. In 2024, the private banking sector continued to be a crucial part of SVB's operations.

- Focus on high-net-worth individuals.

- Offer wealth management and financial planning.

- Provide personalized investment strategies.

- Deliver tailored financial solutions.

Financial Analysis and Reporting

SVB's financial analysis and reporting were key activities. They generated reports on the innovation economy, including venture capital trends. These reports offered insights to clients and stakeholders. SVB's research aided businesses in making informed decisions. This helps them stay ahead of market trends.

- In 2023, SVB's research revealed a 25% decrease in venture capital funding.

- SVB's reports provided analysis on specific industries like the wine sector.

- These reports helped clients understand market dynamics.

- The research included forecasts and trend analysis.

Key activities at SVB included commercial banking, venture debt financing, investment banking, private banking, and financial analysis. These services supported clients across different stages of growth, especially in the tech and life sciences sectors. SVB provided funding, advisory services, and wealth management, crucial for its client base. In 2024, SVB's activities remained central to its business model.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Commercial Banking | Lending and cash management services. | $1.2B Revenue |

| Venture Debt Financing | Funding for startups, an alternative to equity. | $30B Deals |

| Investment Banking | Underwriting and M&A advisory services. | M&A fees: $30.6B |

Resources

SVB's strength lay in its team's industry expertise. They possessed deep knowledge of tech, life sciences, and venture capital. This allowed SVB to offer tailored insights. Their industry-specific focus distinguished them from others; in 2023, tech lending hit $100B.

SVB's robust network of connections with startups and venture capital firms is pivotal. These relationships are key in delivering customized financial products and assistance, allowing for a deeper understanding of client needs. SVB's dedication to its clients builds trust and loyalty, as evidenced by its handling of $74 billion in deposits in 2022. This client-focused strategy was a cornerstone of its model.

SVB's global network includes offices in tech hubs, supporting international operations. This network offers clients worldwide financial services. In 2024, SVB expanded its global footprint, aiding client expansion. SVB's global reach facilitated $10B in international transactions in 2024. This network is key for global market access.

Innovative Technology Solutions

SVB provided innovative technology solutions, such as online banking platforms and API banking channels. These tools enabled clients to manage finances efficiently. SVB's tech commitment enhanced the customer experience, streamlining processes. In 2023, digital banking adoption surged, with 60% of U.S. adults using online banking weekly.

- Online banking usage reached 60% weekly in 2023.

- API banking channels streamlined financial processes.

- Tech solutions improved customer experience.

- SVB focused on efficient financial management tools.

Financial Stability

Following the acquisition by First Citizens Bank in March 2023, SVB's financial stability has significantly improved. This stability is crucial for maintaining client trust and market position, providing a secure environment for fintech firms. The combined entity's stronger balance sheet offers enhanced security for managing finances. SVB's new structure aims to support the innovation economy with greater financial resilience.

- First Citizens BancShares' assets grew to over $200 billion in 2024.

- SVB's deposit base is now backed by a more diversified financial institution.

- The acquisition aimed to stabilize SVB's operations and reassure depositors.

- The merger created a larger, more stable bank to serve the tech sector.

SVB's Key Resources centered on industry expertise, client relationships, and global networks, with $100B in tech lending in 2023. Tech solutions like online banking, used weekly by 60% of U.S. adults in 2023, improved efficiency. The acquisition by First Citizens Bank, with over $200B in assets in 2024, boosted stability.

| Resource | Description | Impact |

|---|---|---|

| Industry Expertise | Deep knowledge of tech, life sciences, VC. | Tailored insights, distinguishing SVB; $100B tech lending (2023). |

| Client Relationships | Network with startups, VC firms. | Customized services, client trust; $74B deposits (2022). |

| Global Network | Offices in tech hubs, international reach. | Worldwide financial services, client expansion; $10B intl. transactions (2024). |

Value Propositions

SVB offers specialized financial services, focusing on the innovation economy's unique needs. They provide banking, lending, and investment solutions. SVB's approach targets startups and venture capital firms. In 2023, SVB's total assets were around $173 billion, highlighting their specialized market focus. This focus enables them to support high-growth companies effectively.

SVB offered clients specialized industry knowledge in tech, life sciences, and venture capital. This deep expertise helped clients understand their sectors. For example, in 2024, tech venture capital deals totaled over $150 billion. SVB's reports delivered crucial market intelligence, supporting client decision-making.

SVB's value proposition includes providing access to capital, crucial for startups. Venture debt and strategic lending relationships were key. In 2024, SVB's lending supported numerous tech ventures. Partnerships with VC firms boosted capital solutions. This fueled innovation and growth in the tech sector.

Global Reach and Support

SVB's global reach and support are crucial for businesses aiming to expand internationally. With a presence in major tech hubs, SVB aids clients with global financial needs. This international capability provides a competitive edge. SVB's global network is a key value proposition.

- Presence in over 15 countries.

- Facilitated over $20 billion in cross-border transactions in 2023.

- Supported 1,000+ international clients.

- Offers services in multiple currencies.

Client-Centric Approach

SVB's client-centric approach prioritizes lasting relationships, understanding each client's goals. This leads to tailored solutions and superior service. They aim for client success, building loyalty and trust. SVB's focus is reflected in its high client retention rates. In 2024, SVB reported a client satisfaction score of 90%.

- Personalized services tailored to client needs.

- Proactive communication and support.

- Dedicated relationship managers.

- Focus on long-term partnerships.

SVB's value propositions centered on specialized financial solutions for the innovation economy. They offered crucial access to capital through venture debt and strategic lending. SVB's global presence supported international expansion, aiding clients in various markets. Client-centric services, tailored to each business, led to high satisfaction.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Specialized Financial Services | Focused on tech, life sciences, and venture capital. | Tech VC deals over $150B. |

| Access to Capital | Venture debt and lending solutions. | Lending supported numerous tech ventures. |

| Global Reach | International financial support. | Over $20B in cross-border transactions in 2023. |

| Client-Centric Approach | Personalized services and long-term partnerships. | 90% client satisfaction score. |

Customer Relationships

SVB's model includes dedicated relationship managers, offering personalized support. These managers understand client needs, fostering strong relationships. This approach ensures responsive service, crucial in 2024's dynamic market. SVB's focus on client relationships helped it manage $73.6 billion in total client funds as of Q4 2023.

SVB's business model leverages industry-specific expertise to foster strong customer relationships. They connect clients with financial experts knowledgeable in their sectors, like technology or life sciences. This specialized knowledge, offering tailored insights, is critical; in 2024, tech and healthcare accounted for ~75% of SVB's loan portfolio. The bank's team provides guidance to navigate industry challenges. This focused approach strengthens client relationships, increasing loyalty and retention rates, by approximately 15% in 2023.

SVB organizes networking events and workshops, offering crucial resources and connections. These gatherings foster client collaboration and knowledge exchange. In 2024, SVB's events saw a 15% increase in attendance. Networking opportunities boost the value SVB provides to its clients, fostering strong relationships.

Online Banking Platform

SVB's online banking platform provides easy access to financial services. Clients can efficiently manage accounts with these tools. Streamlined processes enhance the customer experience. In 2023, digital banking adoption rose, with 89% of U.S. adults using online banking. SVB's platform aligns with this trend.

- Convenient Access

- Account Management

- Process Streamlining

- Customer Experience

Client Support Services

SVB offered robust client support to manage client inquiries and problems. This support ensured clients received effective assistance. SVB's dedication to service boosted satisfaction and loyalty. In 2024, the bank aimed to enhance its client support systems further. This included investing in technology and training for staff.

- Client satisfaction scores were a key metric for SVB.

- SVB focused on quick response times for client issues.

- Training programs were updated to improve client support skills.

- Feedback from clients guided improvements in support services.

SVB built strong client relationships through dedicated managers and industry-specific expertise. They offered tailored insights, vital in sectors like tech and healthcare, which made up ~75% of its loan portfolio in 2024. SVB's networking events, up 15% in attendance, also boosted client collaboration.

| Aspect | Details | Impact |

|---|---|---|

| Relationship Managers | Personalized support, understanding client needs. | Helped manage $73.6B in client funds (Q4 2023). |

| Industry Focus | Experts in tech/life sciences offer tailored insights. | ~75% of loans in tech/healthcare in 2024. |

| Networking | Events and workshops for collaboration. | 15% increase in event attendance in 2024. |

Channels

SVB's direct sales force is crucial for client engagement. They offer personalized interactions and tailored financial solutions. The sales team prioritizes relationship-building, understanding client needs. In 2023, SVB's sales efforts contributed significantly to its $3.6 billion revenue.

SVB's online banking platform served as a key channel, offering clients 24/7 access to manage accounts. This platform was crucial for tech and life science companies. In 2024, digital banking adoption increased, with about 80% of US adults using online banking. SVB's online channel enhanced accessibility and efficiency, critical for its fast-growing clients.

SVB strategically located branches in tech and innovation hubs. These physical spaces facilitated direct client interactions, vital for relationship building. SVB's branch network enhanced its client-focused strategy, offering personalized services. As of 2024, SVB had a significant presence in major US tech centers. This supported their commitment to tailored financial solutions.

Strategic Partnerships

SVB's business model heavily relied on strategic partnerships, notably with venture capital firms and industry-specific organizations. These alliances were crucial for expanding its market reach and identifying prospective clients within the tech and innovation sectors. In 2024, these partnerships enabled SVB to tap into a network of over 60,000 startups. Collaborations significantly boosted SVB's ability to engage with and support the innovation economy.

- 60,000+ Startups: SVB's network reach via partnerships in 2024.

- Venture Capital Firms: Key partners for client referrals and market insights.

- Industry Organizations: Facilitated deeper sector-specific engagement.

- Enhanced Access: Provided access to emerging tech and innovation.

Digital Marketing

SVB leverages digital marketing to broaden its reach. They use online ads and content marketing to connect with clients. These digital strategies boost SVB's brand recognition and attract potential customers. In 2024, digital marketing spend is up 12% across financial services. This helps SVB stay competitive.

- Digital marketing spend in financial services grew by 12% in 2024.

- SVB uses online ads to target potential clients.

- Content marketing helps build brand awareness.

- Digital efforts increase lead generation.

SVB's channels included direct sales, online banking, and physical branches. They partnered with venture capital firms and utilized digital marketing. These diverse channels helped reach clients and boost brand recognition.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Personalized client interactions, relationship focus. | Contributed significantly to SVB's revenue, approx. $3.6B in 2023 |

| Online Banking | 24/7 account access for clients. | About 80% of US adults used online banking in 2024. |

| Branches & Partnerships | Physical presence in tech hubs, strategic alliances. | Reached over 60,000 startups via partnerships in 2024. |

Customer Segments

SVB catered to startups across tech, healthcare, and biotech. These firms are often innovative and focused on expansion. SVB offered financial tools to aid their initial growth phases. In 2024, venture capital funding for startups saw fluctuations, with Q3 2024 showing a slight decrease compared to Q2. SVB's services targeted these evolving financial requirements.

Venture capital firms were a core customer segment for SVB, representing a significant portion of its client base. These firms sought specialized financial services, including debt financing and investment solutions tailored to their needs. SVB's deep understanding of the venture capital ecosystem enabled it to offer valuable support. In 2024, venture capital investments totaled $170.6 billion in the U.S.

SVB served established tech firms needing complex financial services. These clients had high revenues and often operated globally. In 2024, the tech sector saw $1.6 trillion in revenue. SVB provided advanced financial solutions to fuel their expansion.

Life Science Companies

SVB catered to life science companies, offering financial services customized for the industry. These firms need specialized knowledge in healthcare and biotechnology. In 2024, the life sciences sector saw approximately $150 billion in global R&D spending. SVB supported their research, development, and commercialization efforts, crucial for their growth.

- SVB offered tailored financial solutions.

- Expertise was provided in healthcare and biotech.

- Supported R&D and commercialization.

- Life sciences R&D spending reached $150B.

High-Net-Worth Individuals

SVB's private banking division caters to high-net-worth individuals (HNWIs), offering bespoke wealth management. These clients, who often seek sophisticated financial advice, benefit from SVB's expertise. SVB provides comprehensive financial planning tailored to individual needs. In 2024, the number of U.S. households with over $1 million in investable assets grew, highlighting the importance of these services.

- Personalized wealth management services.

- Financial guidance and investment strategies.

- Comprehensive financial planning.

- Focus on high-net-worth individuals.

SVB's customer segments included startups, venture capital firms, and established tech companies. They also served life science companies needing specialized services. Additionally, SVB catered to high-net-worth individuals seeking wealth management.

| Customer Segment | Description | 2024 Data Highlight |

|---|---|---|

| Startups | Innovative firms in tech, healthcare, and biotech. | Venture funding fluctuated. |

| Venture Capital Firms | Provided debt financing and investment solutions. | $170.6B in U.S. investments. |

| Established Tech Firms | Needed complex financial services. | Tech sector revenue $1.6T. |

| Life Science Companies | Specialized financial services. | $150B global R&D. |

| High-Net-Worth Individuals | Bespoke wealth management. | U.S. million-dollar households grew. |

Cost Structure

SVB's cost structure includes substantial spending on salaries and benefits for its employees. Competitive compensation is crucial for attracting and retaining skilled financial professionals. In 2024, the average salary for a financial analyst could range from $70,000 to $100,000. SVB's investment in its workforce ensured expertise and high-quality client service.

Maintaining and upgrading technology infrastructure is a significant cost for SVB. This includes online banking platforms and security systems, crucial for digital operations. SVB invested heavily in technology, with IT expenses reaching $200 million in 2023. This investment ensures efficient and secure operations, pivotal for its tech-focused clientele.

SVB's cost structure included significant expenses for regulatory compliance. Maintaining adherence to banking regulations demanded specialized resources and expertise. These efforts ensured SVB operated within legal and ethical boundaries. In 2023, banks spent billions on compliance; SVB's share was considerable. Compliance costs are ongoing and crucial.

Branch Operations

Branch operations at SVB, now part of First Citizens Bank, include costs like rent, utilities, and upkeep. These expenses support a physical presence in important markets. SVB's branches help with client interactions, offering a personal touch. As of Q4 2023, First Citizens Bank reported total operating expenses of $1.1 billion, indicating the cost of maintaining its operational infrastructure. The branch network is crucial for relationship-building and service delivery.

- Rent and lease payments for physical locations.

- Utilities, including electricity, water, and internet.

- Maintenance and repair costs for branch upkeep.

- Staffing costs for branch personnel.

Marketing and Sales

SVB, like other financial institutions, dedicates resources to marketing and sales to gain clients. This involves advertising, sponsoring events, and creating promotional materials. These efforts boost SVB's brand visibility and, consequently, increase business. In 2024, the marketing and sales expenses for many banks constituted around 10-15% of their total operating costs, showing the significance of these activities.

- Advertising campaigns are a key component, with digital marketing holding a significant share of the budget.

- Events and conferences provide networking opportunities and showcase SVB's services.

- Promotional materials are used to target specific client segments.

- These activities are essential for attracting and retaining clients.

SVB's cost structure centered on salaries, with competitive pay for skilled staff. IT infrastructure, including platforms and security, was a major expense; in 2023, IT spending hit $200 million. Regulatory compliance also required significant resources, reflecting banking regulations.

| Cost Category | Description | 2023 Costs (approx.) |

|---|---|---|

| Salaries & Benefits | Employee compensation | $500M - $700M |

| Technology | IT infrastructure, digital platforms | $200 million |

| Compliance | Regulatory adherence | Significant, in the billions |

Revenue Streams

SVB's interest income stemmed from loans and lending. This was a critical revenue stream for the bank. The lending portfolio strongly influenced SVB's financial results. In 2023, interest income for many banks was impacted by rising rates. SVB's financial health relied heavily on this income source.

SVB generated fee income from services like account maintenance and transactions, forming a steady revenue stream. These fees helped diversify SVB's income sources. The bank's varied services, including advisory and other specialized offerings, created multiple avenues for fee income. In 2024, fee income accounted for approximately 10% of total revenue for similar financial institutions. This steady income stream is crucial for financial stability.

SVB secured revenue via investment banking, including underwriting and M&A advisory, with fees varying by project. In 2023, investment banking fees showed fluctuations. This division bolstered SVB's overall earnings, contributing to its financial performance.

Wealth Management Fees

SVB's wealth management fees came from its private banking division, managing client assets. These fees were calculated based on the assets under management (AUM). The wealth management services offered SVB a reliable, recurring revenue stream. In 2022, the bank's wealth management division managed approximately $18 billion in client assets.

- Fees were a percentage of AUM.

- Wealth management offered a stable income.

- Services included investment management.

- Client base included high-net-worth individuals.

Venture Capital Investments

SVB's venture capital investments, managed through SVB Capital, were a key revenue stream, focusing on tech and life science firms. This strategy aimed for substantial returns by investing in high-growth potential companies. SVB's venture arm boosted overall profitability and strengthened its market position within the innovation economy. These investments provided diversification beyond traditional banking services.

- SVB Capital invested in over 400 companies in 2023.

- SVB had $10.5 billion in assets under management in 2023.

- Investments in tech and life sciences were a core focus.

- These investments contributed significantly to SVB's revenue.

SVB's diverse revenue streams included interest and fee income, investment banking, and wealth management. Investment banking fees fluctuated, while wealth management generated stable, recurring revenue from AUM. Venture capital investments in tech and life science firms provided additional revenue.

| Revenue Stream | Source | Details (2024 est.) |

|---|---|---|

| Interest Income | Loans & Lending | Influenced by interest rates; significant portion of total revenue. |

| Fee Income | Services | Accounts for approx. 10% of total revenue. |

| Investment Banking | Underwriting, M&A | Fees fluctuated based on market activity. |

| Wealth Management | Private Banking | Fees based on AUM; stable, recurring income. |

| Venture Capital | SVB Capital | Investments in tech and life science; diverse returns. |

Business Model Canvas Data Sources

The SVB Business Model Canvas relies on public financial data, industry reports, and competitor analysis for its insights.