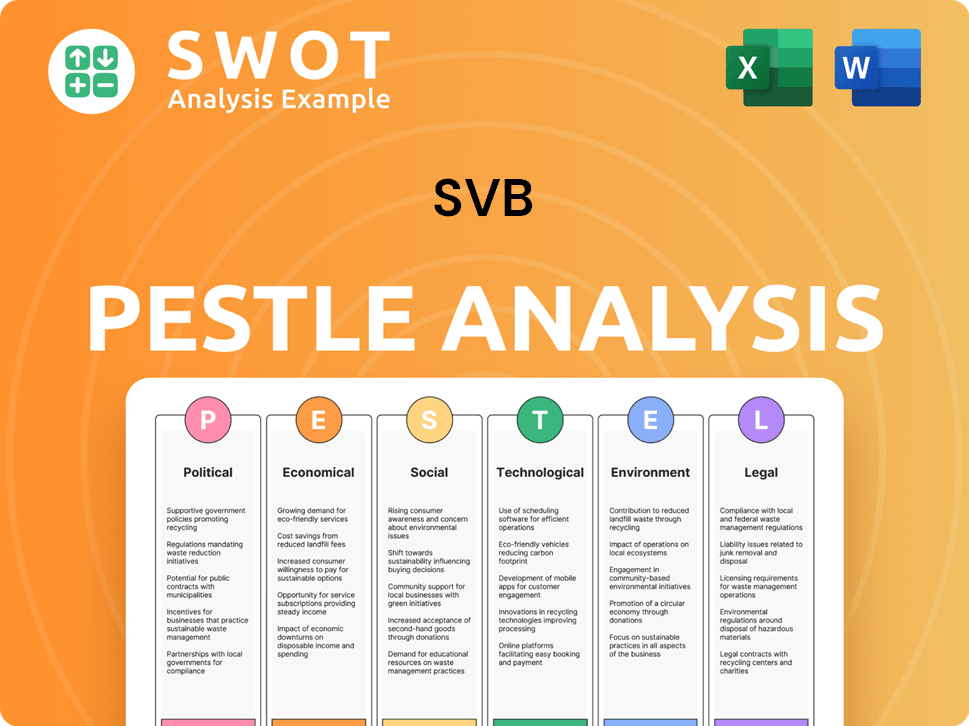

SVB PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SVB Bundle

What is included in the product

Provides a thorough PESTLE analysis of SVB, examining external influences across multiple key dimensions.

Helps quickly identify & communicate external factors impacting SVB, supporting crucial discussions.

Preview the Actual Deliverable

SVB PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured for SVB's PESTLE analysis. This comprehensive report dives into political, economic, social, technological, legal, and environmental factors. Gain valuable insights with the same structure. The file is ready to download right after purchase.

PESTLE Analysis Template

Assess SVB's external landscape through our detailed PESTLE Analysis. Uncover how political, economic, social, technological, legal, and environmental factors affect its performance. Understand market dynamics and navigate future challenges. Our report is perfect for strategic planning, investment decisions, and market research. Gain a comprehensive advantage; download the full analysis instantly.

Political factors

Government policies and regulations heavily influence financial services. The Dodd-Frank Act, enacted post-2008, increased compliance expenses for banks. Regulatory priorities can change with administrations, affecting financial institutions. In 2024, banks faced evolving rules on capital requirements and cybersecurity, increasing operational complexities and costs. The regulatory environment directly shapes SVB's operations and profitability.

The Federal Reserve's monetary policy, especially interest rate adjustments, significantly shapes lending and bank earnings. Higher rates can decrease asset values, particularly in long-term bonds. In 2024, the Fed maintained its benchmark rate, influencing SVB's financial health. As of May 2024, the federal funds rate is between 5.25% and 5.50%.

Political stability is crucial; instability breeds investment uncertainty. Geopolitical events, such as trade disputes, disrupt supply chains. Economic nationalism further impacts tech companies. Recent data shows a 15% decrease in tech investment due to these factors. The US-China trade tensions continue to be a major concern in 2024/2025.

Government Intervention and Bailouts

Government intervention is a key political factor, especially during financial crises. After SVB's collapse in March 2023, the U.S. government took swift action. This included ensuring depositors had access to their funds, a move that cost the FDIC an estimated $20 billion. The government's approach aimed to stabilize the financial system and prevent a wider panic.

- FDIC insured all depositors, even those exceeding the $250,000 limit.

- The Federal Reserve created a new lending facility, the Bank Term Funding Program (BTFP), to provide liquidity to banks.

- These measures aimed to restore confidence and prevent a broader banking crisis.

Lobbying and Political Influence

Lobbying by banks impacts regulations. SVB's lobbying influenced past deregulation. In 2023, the financial sector spent over $350 million on lobbying. This spending can shape laws. It can also affect the industry's operating environment.

- Financial sector lobbying totaled $357 million in 2023.

- Lobbying can lead to more favorable regulations.

- SVB's past lobbying supported deregulation.

Political factors are key for SVB. Regulations change, impacting costs and operations, with cybersecurity rules and capital requirements as ongoing focuses in 2024/2025. The Fed's interest rate policies also strongly influence lending and bank earnings. Geopolitical issues, like US-China tensions, affect tech investments, causing uncertainty. The government's actions during crises, such as after SVB’s collapse in March 2023, and lobbying efforts significantly impact the industry.

| Aspect | Details | Impact |

|---|---|---|

| Regulation | Dodd-Frank, cybersecurity | Increased compliance cost |

| Monetary Policy | Fed rates (5.25%-5.50%) | Influences lending and asset values |

| Geopolitics | US-China trade, nationalism | Tech investment decreased 15% |

Economic factors

Rapidly rising interest rates are a major concern for banks, especially those with long-term fixed-rate assets. For instance, in 2023, the Federal Reserve raised interest rates several times. As rates increase, the market value of these assets decreases. If a bank must sell these assets, it could face substantial losses. In Q4 2023, the average interest rate on 30-year mortgages was around 6.61%, impacting asset values.

Economic downturns negatively affect loan portfolios. Startups struggle, reducing lending opportunities and increasing non-performing loans. Economic slowdowns affect deposits, potentially increasing withdrawals. For example, in 2023, the US saw a rise in non-performing loans across various sectors. The Federal Reserve's actions in 2024/2025 will significantly influence these trends.

The venture capital market's vitality significantly affects banks catering to startups and tech firms. A VC downturn can force startups to use deposits for operations. In Q1 2024, VC funding dropped by 20% compared to the previous year. This reduces bank liquidity.

Inflationary Pressures

Inflationary pressures significantly impact the banking sector. High inflation often leads central banks, like the Federal Reserve, to increase interest rates to curb rising prices. For example, in March 2024, the Federal Reserve held its benchmark interest rate steady, but future decisions hinge on inflation data. These rate hikes can devalue bank assets and increase borrowing costs for businesses. This environment can slow economic growth and negatively affect banks' profitability and stability.

- The U.S. inflation rate was 3.5% in March 2024.

- The Federal Reserve has indicated they anticipate three rate cuts in 2024.

- Higher interest rates increase the cost of loans for businesses.

Competition in the Banking Sector

Competition within the banking sector is intensifying. Increased competition from traditional banks, financial institutions, and fintech companies puts pressure on deposit and loan markets. Established banks are increasingly targeting the technology sector, potentially affecting specialized banks. For example, in 2024, fintech lending grew by 15%, challenging traditional banking models. This shift highlights the need for banks to adapt and innovate to maintain their market share.

- Fintech lending grew by 15% in 2024.

- Traditional banks are expanding into tech-focused areas.

- Competition is increasing for deposits and loans.

Economic factors present significant risks for banks. Rising interest rates, with the Federal Reserve holding steady in March 2024, devalue assets and increase borrowing costs.

Economic downturns and reduced venture capital funding impact loan portfolios and liquidity.

Inflation, at 3.5% in March 2024, coupled with increasing competition from fintech, adds to sector pressures.

| Economic Factor | Impact on SVB | 2024/2025 Data |

|---|---|---|

| Interest Rates | Asset devaluation, higher borrowing costs | Fed anticipated 3 rate cuts in 2024. |

| Economic Downturn | Reduced lending, increased non-performing loans | Non-performing loans rose in 2023, trends to be seen. |

| Venture Capital | Reduced deposits, decreased liquidity | Q1 2024 VC funding down 20% YoY. |

Sociological factors

SVB's concentration in tech startups created vulnerability. In 2022, over 97% of its deposits came from the tech and venture capital sectors. This meant sector-specific downturns could trigger massive withdrawals, as seen in March 2023, when the bank faced a $42 billion run.

Customer and investor confidence are crucial for banks. A decline in confidence can lead to a bank run, as depositors rush to withdraw funds. SVB's collapse in March 2023, triggered by a loss of confidence, saw over $42 billion in deposits withdrawn in a single day. This highlights the speed at which confidence can erode and the impact on liquidity.

Social media's role in banking is significant. Rapid information spread can trigger bank runs, as seen with SVB. In 2023, around 70% of U.S. adults used social media, indicating broad reach. This amplifies concerns, potentially causing panic. For example, SVB's downfall showed how quickly rumors can spread, affecting depositor behavior.

Risk Culture and Management

A bank's risk culture deeply affects its stability. Effective leadership and robust risk management are essential for identifying and addressing potential threats. Poor practices can amplify the effects of external economic pressures. For example, in 2023, the Federal Deposit Insurance Corporation (FDIC) reported that banks with weak risk management frameworks faced higher failure rates. The failure rate was 0.25% for banks with weak risk management.

- Leadership failures led to SVB's collapse.

- Poor risk assessment and inadequate stress tests were critical.

- Lack of diversification in investments increased risks.

- Rapid deposit growth and uninsured deposits amplified vulnerabilities.

Demographic Trends of Client Base

SVB's client base, heavily skewed towards tech startups, dictates its deposit structure and liquidity needs. These firms often demand rapid access to substantial capital, influencing the bank's financial strategies. For example, in 2024, the venture capital market saw a slight uptick, with $170.6 billion invested in U.S. companies, indicating continued demand. However, the 2025 forecast suggests a more cautious approach from investors. This dynamic necessitates SVB to maintain robust liquidity. The bank's ability to meet these needs is crucial.

- Tech startups frequently seek large capital injections.

- Venture capital investments totaled $170.6B in 2024.

- The 2025 outlook anticipates investor caution.

- SVB must maintain sufficient liquidity.

Social factors such as media, leadership failures, and customer confidence profoundly shape a bank's success.

Rapid social media spreads rumors. In 2024, social media use remained high, affecting bank runs. Trust's erosion can spark rapid deposit withdrawals, intensifying risks.

| Factor | Impact on SVB | Data/Statistics |

|---|---|---|

| Social Media | Accelerated Bank Run | ~70% of adults used social media in 2023 |

| Customer Confidence | Massive Withdrawals | $42B withdrawn from SVB (March 2023) |

| Leadership | Poor Risk Mgmt | FDIC: higher failure rates weak risk frameworks in 2023 |

Technological factors

Digital banking and online platforms have transformed how customers interact with financial institutions, offering unprecedented convenience. This shift enables swift account management and transaction initiation. However, this same technology can accelerate deposit outflows during a crisis, as seen in the SVB collapse. In 2024, mobile banking users reached 190 million in the U.S., highlighting the scale of digital adoption. This rapid access to funds can exacerbate the impact of negative news, potentially leading to a bank run.

The speed of information dissemination, fueled by technology, is a critical factor. Social media and online news platforms enable the rapid spread of news, including bank vulnerabilities. For example, in the 2023-2024 period, online news consumption increased by 15% globally. This can accelerate bank runs, as seen with SVB.

Cybersecurity threats are escalating as digital banking expands. In 2024, the financial sector faced a 23% rise in cyberattacks. Data breaches can lead to significant financial losses and reputational damage. SVB, like all banks, must invest heavily in robust cybersecurity measures. These costs are projected to increase by 15% annually through 2025.

Innovation in Financial Technology (Fintech)

The fintech sector's rapid growth introduces both opportunities and challenges for SVB. Innovative products from fintech startups can reshape traditional banking, intensifying competition. Banks must invest in technology to stay relevant and meet evolving customer expectations. This includes adapting to digital payment systems and cybersecurity enhancements. Recent data shows fintech investments reached $109.8 billion globally in 2023.

- Increased competition from fintech startups offering specialized services.

- The need for significant investment in technology and cybersecurity.

- Potential for partnerships or acquisitions to integrate new technologies.

- Adaptation to evolving digital payment systems and customer preferences.

Use of AI and Data Analytics

SVB could use AI and data analytics for advanced risk management, fraud detection, and personalized customer experiences. These technologies improve operational efficiency and security. According to a 2024 report, AI in banking could save up to $447 billion. Increased tech adoption can also help SVB navigate evolving regulations.

- AI-driven fraud detection systems can reduce losses by up to 50%.

- Personalized banking experiences can boost customer satisfaction scores by 20%.

- Data analytics can optimize loan portfolio management.

- Cybersecurity spending is projected to reach $10.2 billion by 2025.

Technological advancements like digital banking offer convenience, but also accelerate deposit outflows and increase cybersecurity threats. The fintech sector intensifies competition. Investment in tech and cybersecurity is crucial. Fintech investments reached $109.8 billion globally in 2023.

| Factor | Impact | Data |

|---|---|---|

| Digital Banking | Rapid account management, potential for bank runs. | Mobile banking users in U.S. reached 190 million in 2024. |

| Information Speed | Accelerated spread of news; quicker bank runs. | Online news consumption increased by 15% globally (2023-2024). |

| Cybersecurity | Increased risk of data breaches and financial loss. | Financial sector faced a 23% rise in cyberattacks in 2024. |

Legal factors

Banking regulations are extensive, spanning local, national, and international levels. Compliance is crucial, affecting operations and profitability. In 2024, the FDIC insured deposits up to $250,000, a key regulation. Banks must meet capital requirements, like Basel III, and liquidity rules. These rules can influence strategic decisions.

Regulatory oversight is key for bank stability. Bodies like the Federal Reserve monitor banks. They conduct stress tests to assess resilience. For example, the Federal Reserve's 2024 stress tests showed banks were generally well-capitalized. Compliance enforcement is also crucial.

Government-backed deposit insurance protects depositors if a bank fails. In the US, the Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000 per depositor, per insured bank. The handling of uninsured deposits is legally complex, affecting how creditors are paid during bank failures. The FDIC's actions, like the SVB takeover in March 2023, highlight the legal frameworks' impact on financial stability. The FDIC has been managing about 4,700 insured banks in 2024.

Legal Implications of Bank Failure

Bank failures like SVB initiate complex legal battles. Regulatory bodies launch investigations to determine the causes of the collapse, which can lead to lawsuits. Legal actions may target the bank's officers for mismanagement. Loan defaults and contract breaches also become major legal issues. In 2023, the FDIC took over 4 banks.

- Investigations into failures: Regulatory probes to determine the cause.

- Legal actions: Potential lawsuits against the bank and its executives.

- Loan defaults: Legal issues related to outstanding loans.

- Contract breaches: Legal problems arising from broken agreements.

Changes in Financial Legislation

Amendments to financial laws and regulations can drastically reshape how banks, like SVB, operate. Recent changes in capital requirements, risk management, and consumer protection are critical. The Basel III framework, for example, continues to evolve, influencing capital adequacy. Regulatory scrutiny, especially post-2023 banking events, is intensifying. SVB's operations would have been highly impacted by these changes.

- Basel III: Banks must meet higher capital ratios.

- Consumer Protection: Stricter rules on lending and disclosures.

- Risk Management: Enhanced oversight of liquidity and interest rate risk.

- Regulatory Scrutiny: Increased after several bank failures in 2023.

Legal factors significantly shape SVB's operations through complex regulations. Banking regulations mandate compliance with standards set by bodies like the FDIC. Post-2023, regulatory scrutiny intensified, particularly in areas like risk management. Changes in Basel III influence capital requirements, impacting strategic decisions.

| Factor | Details |

|---|---|

| FDIC Insurance | Insures deposits up to $250,000 per depositor, per insured bank (2024). |

| Bank Failures (2023) | The FDIC took over 4 banks, highlighting legal impacts. |

| Basel III | Evolving framework influencing capital adequacy and risk. |

Environmental factors

Climate change indirectly affects SVB. Economic impacts from extreme weather can destabilize investments. For example, according to the IPCC, global average temperatures have risen by 1.1°C since the late 1800s, increasing the frequency of extreme weather events. This can affect tech clients. Regulatory changes related to carbon emissions also pose risks.

Compliance with environmental regulations is not a primary focus for SVB. However, it indirectly affects the bank. Increased environmental scrutiny on tech clients could impact SVB. In 2024, environmental regulations continue to evolve, especially for tech firms. This requires SVB to stay informed and adapt.

Sustainability and Environmental, Social, and Governance (ESG) factors are increasingly important. They affect how investors view a bank, influencing its reputation and access to funds. SVB focused on social aspects, but weak governance in ESG was a factor in its failure. In 2024, ESG-focused assets reached $30 trillion globally.

Natural Disasters

Natural disasters pose a significant threat, capable of halting economic activity and hitting SVB's clients' ability to repay loans. These events can damage the bank's physical infrastructure, causing operational disruptions. In 2024, the U.S. faced over $92.9 billion in damage from severe weather events. This includes hurricanes and flooding. These disasters can lead to loan defaults and increased operational costs.

- 2024 saw over $92.9B in U.S. disaster damage.

- Disasters lead to loan defaults and higher costs.

Resource Scarcity and Cost

Resource scarcity and rising costs, especially in energy, indirectly impact SVB. Higher energy prices can increase operational expenses for SVB's clients, potentially affecting loan repayment ability. The Federal Reserve's actions, such as interest rate adjustments, also play a role in managing inflationary pressures tied to resource costs. For example, in 2024, energy prices increased by 5.4%, impacting various sectors.

- Energy prices increased by 5.4% in 2024.

- Federal Reserve influences inflation through interest rate adjustments.

Environmental factors indirectly affect SVB through climate change, regulation, and resource issues. Extreme weather, as seen in 2024 with $92.9B in U.S. damages, increases risks.

Regulatory changes, such as those related to carbon emissions, pose challenges for tech clients, indirectly affecting SVB's portfolio and operational risks.

Sustainability and ESG are crucial, influencing reputation and funds. While social factors were prioritized, weak governance, highlighting systemic failures. ESG assets globally reached $30T in 2024.

| Factor | Impact | Data (2024) |

|---|---|---|

| Climate Change | Extreme weather impacts tech clients, operational disruptions | $92.9B US disaster damage |

| Regulations | Compliance costs for clients | Evolving emission standards |

| ESG | Affects reputation, funding access | $30T in ESG assets globally |

PESTLE Analysis Data Sources

SVB's PESTLE draws on data from financial reports, tech news, regulatory updates, and market research. Each analysis relies on verifiable facts and sources.