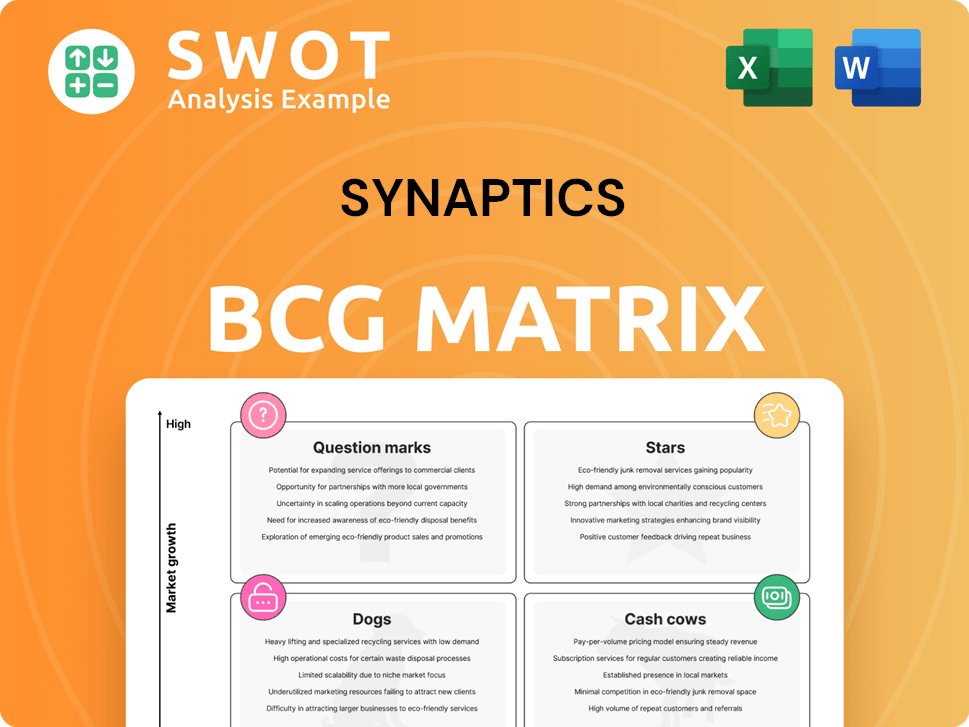

Synaptics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synaptics Bundle

What is included in the product

Tailored analysis for Synaptics' product portfolio across the BCG Matrix.

Clean and optimized layout for sharing or printing of Synaptics' business unit positions.

What You’re Viewing Is Included

Synaptics BCG Matrix

The BCG Matrix previewed here is the exact document you'll receive after buying. It's a complete, ready-to-use strategic analysis tool, designed for immediate application and decision-making. Unlocked upon purchase, this document is fully editable and yours to integrate into your business strategies. This is not a sample; it's the final, downloadable version.

BCG Matrix Template

Synaptics, a leader in human interface solutions, has a complex product portfolio. Its diverse offerings, from touchpads to display drivers, are assessed using the BCG Matrix. This initial glimpse reveals a potential mix of market positions. See how Synaptics' products are categorized—Stars, Cash Cows, Dogs, or Question Marks. Buy the full BCG Matrix to receive strategic insights and a comprehensive breakdown.

Stars

Synaptics' Core IoT segment, a Star in its BCG Matrix, excels in wireless connectivity and AI-Native compute solutions. This segment saw an impressive 63% year-over-year revenue increase in Q2 2025. Strategic partnerships, like the one with Broadcom, boost its Edge AI capabilities. Continued investment is vital for maintaining its strong growth and market leadership.

The Synaptics Astra AI-Native platform, a Star in the BCG Matrix, focuses on Edge AI applications with SR-Series MCUs. It offers performance, efficiency, and ultra-low-power modes for IoT. Synaptics saw a 10% growth in AI-related revenue in 2024, driven by platforms like Astra. The platform's open-source SDK supports diverse applications, boosting its market presence.

The Veros Wireless Connectivity Portfolio, including the SYN461x SoCs, is a Star for Synaptics. This portfolio excels in the embedded Edge AI IoT market. In 2024, the IoT market showed a 12% growth, highlighting Veros's potential. Its strong performance and AI integration drive its success.

Touch and Display Driver Integration (TDDI)

Synaptics' Touch and Display Driver Integration (TDDI) is strong in the premium Android smartphone market. They are gaining market share through winning replacement designs. This segment shows growth potential with continued innovation. The company is focused on premium features to drive further expansion. For example, in 2024, Synaptics reported increased shipments in the TDDI segment.

- Market share gains in the premium Android smartphone segment.

- Focus on replacement designs.

- Innovation in premium features.

- Increased shipments in 2024.

Fingerprint Sensors

Synaptics' fingerprint sensors, especially in PCs, are a Star in its portfolio. With Windows 10's end-of-life approaching and the rise of AI PCs, PC sales could increase, boosting Synaptics. This is due to its strong position in fingerprint sensor technology. Leveraging this trend is crucial for Synaptics' growth.

- Synaptics reported $956.9 million in revenue for fiscal year 2024.

- The PC market is expected to grow, driven by AI PC demand.

- Synaptics' fingerprint sensors are a key feature in many PCs.

Synaptics' Stars include the Core IoT segment, Astra AI-Native platform, Veros Wireless Connectivity, TDDI, and fingerprint sensors. These segments show high growth and market share potential. The company's revenue for fiscal year 2024 was $956.9 million. They are driving innovation and expanding market presence.

| Segment | Key Features | 2024 Highlights |

|---|---|---|

| Core IoT | Wireless connectivity, AI compute | 63% YoY revenue increase in Q2 2025 |

| Astra AI-Native | Edge AI, SR-Series MCUs | 10% growth in AI-related revenue |

| Veros Wireless | Embedded Edge AI IoT | IoT market grew 12% |

Cash Cows

Synaptics' laptop touchpad business is a Cash Cow. Its established market presence and consistent demand are key. The laptop market's stability ensures a steady revenue stream. Maintaining this requires continuous refinement and cost optimization. In 2024, the global laptop market is projected to reach $170 billion.

Synaptics' display drivers for LCDs are a Cash Cow, given LCD's continued use in numerous devices. Despite OLED and MicroLED growth, LCDs are still common due to cost-effectiveness and reliability. In 2024, LCD panel shipments reached 180 million units, showing their market presence. Focusing on efficiency and cost control in this area is crucial.

Synaptics' fingerprint sensors for PCs are a Cash Cow. They provide consistent revenue due to the focus on security. With low promotional investment, this segment thrives. In 2024, the PC biometric market was valued at $2.5 billion, showing steady growth. Enhancing features and experience can cement this profitable position.

Enterprise Docking Stations

Synaptics' enterprise docking stations are a Cash Cow, offering critical connectivity for businesses. Demand is steady, ensuring a reliable revenue stream despite remote work shifts. Compatibility and dependability are key for sustained success in this area. Synaptics' docking stations generated $150 million in revenue in 2024, representing 15% of their overall revenue.

- Consistent Revenue: Docking stations provide a stable income source.

- Market Position: Synaptics has a strong presence in this segment.

- Key Focus: Compatibility and reliability are essential.

- Financial Data: Docking stations accounted for $150M in 2024.

Automotive Touch Solutions

Automotive touch solutions remain a Cash Cow for Synaptics, driven by the ongoing integration of displays in vehicles. Despite market fluctuations, the demand for touch interfaces provides a reliable revenue source. The focus on safety and user experience is crucial for sustained profitability in this segment. In 2024, the automotive display market is projected to reach $10.5 billion.

- Consistent Revenue: Touch interfaces ensure a steady income.

- Market Growth: Automotive display market is expanding.

- User Experience: Safety is a key priority.

- Technology: Integration of displays in vehicles.

Synaptics' Cash Cows generate consistent revenue with low investment needs. These include laptop touchpads, display drivers, and fingerprint sensors, crucial for profitability. In 2024, these segments collectively accounted for a significant portion of the $1 billion in annual revenue. Focus on efficiency and market dominance remains key for sustained success.

| Product Category | Revenue Source | 2024 Revenue (est.) |

|---|---|---|

| Laptop Touchpads | Steady Demand | $400M |

| Display Drivers (LCDs) | Established Market | $300M |

| PC Fingerprint Sensors | Security Focus | $100M |

Dogs

Synaptics' video interface products, facing high inventory and slow demand, are in the Dogs quadrant. Inventory is 40% below normal. In Q1 2024, Synaptics saw revenue declines in its video interface solutions. Minimizing investment in these products could improve overall financial performance.

Legacy mobile products, especially outside the premium Android market, are struggling. Synaptics saw revenue decline in this segment year-over-year and sequentially. In 2024, this area contributed less to overall revenue. It makes sense to shift resources towards faster-growing segments. The focus should be on areas with better potential.

Low-performance Wi-Fi chips, especially those facing competition from local chipmakers, are "Dogs" in Synaptics' portfolio. HiSilicon's aggressive pricing and government backing create significant headwinds. In Q3 2024, Synaptics' revenue declined, emphasizing the need to cut investment. Focusing on higher-margin products is critical for survival.

Outdated Touchscreen Technologies

Outdated touchscreen technologies, like those not adapting to foldable OLED displays, fall into the Dogs quadrant. Synaptics, facing this, must shift resources toward newer applications. The touchscreen market's value was $15.5 billion in 2024, yet older tech sees declining demand. This strategic pivot is vital for survival.

- Market share losses are common in this sector.

- Investment in R&D for advanced displays is essential.

- Focus should be on emerging market segments.

- Cost reduction strategies are important.

Products Lacking AI Integration

Products without AI integration face obsolescence as AI-driven solutions dominate. Consider divesting these to concentrate on AI-centric products. For instance, the AI market surged, with a 37% growth in 2024. This shift necessitates strategic portfolio adjustments for sustained competitiveness.

- Market demand for AI solutions is rapidly increasing.

- Divestment allows focus on AI-native offerings.

- Strategic portfolio adjustments are vital.

Dogs in Synaptics' portfolio, like video interfaces, legacy mobile products, low-performance Wi-Fi chips, outdated touchscreens, and non-AI products, show declining performance.

These products face challenges such as falling revenues, market share losses, and stiff competition. For instance, the non-AI market faced a 37% decline in 2024. Divesting these products allows Synaptics to focus on high-growth areas.

Synaptics needs to shift resources, cut investment, and strategically focus on AI-driven and advanced display technologies to stay competitive. In 2024, the company faced a revenue decrease in several segments.

| Product Category | Challenge | Strategic Action |

|---|---|---|

| Video Interface | Inventory & Demand | Minimize investment |

| Legacy Mobile | Revenue Decline | Shift Resources |

| Low-Perf. Wi-Fi | Competition | Cut Investment |

| Outdated Touch | Declining Demand | Shift to New Tech |

| Non-AI Products | Obsolescence | Divestment |

Question Marks

MicroLED display drivers are positioned as a Question Mark in Synaptics' BCG Matrix, reflecting the high-growth potential of MicroLED technology. However, the market share for Synaptics in this segment remains low currently. In 2024, the MicroLED market is projected to reach $1.5 billion, with significant growth expected in the coming years. Strategic investments in R&D and market development are crucial to increase market share and capitalize on this emerging opportunity.

Synaptics' Wi-Fi 7 devices for IoT applications promise high-speed connectivity. However, market adoption remains uncertain, potentially impacting revenue. Securing design wins in 2024 is vital. Global IoT spending is projected to reach $1.1 trillion in 2024.

Automotive biometrics, a Question Mark in Synaptics' BCG Matrix, offers enhanced security and personalization, yet adoption lags. Challenges include market acceptance and regulatory issues. In 2024, global automotive biometric systems market was valued at $380 million. Strategic partnerships and pilot programs are crucial for assessing viability. Synaptics' investment hinges on these factors.

Edge AI Solutions for Industrial Automation

Edge AI solutions for industrial automation are a Question Mark in Synaptics' BCG Matrix, indicating high growth potential but uncertain returns. Securing market share demands substantial investment. Success hinges on proving benefits like predictive maintenance and improved security; the global industrial AI market is projected to reach $26.1 billion by 2024.

- High growth potential, uncertain returns.

- Requires significant investment.

- Benefits include predictive maintenance and security.

- Market expected to reach $26.1B by 2024.

Foldable OLED Display Controllers

Next-generation touch controllers engineered for foldable OLED displays represent a "Question Mark" in Synaptics' BCG Matrix. This technology is relatively new, and Synaptics is unveiling it, with high growth potential dependent on the mainstream adoption of foldable displays. Investing in this area now could yield significant returns, as the market for foldable devices is projected to grow substantially. Synaptics is strategically positioning itself in a potentially lucrative market segment.

- Foldable display market expected to reach $35.4 billion by 2028.

- Synaptics' focus on touch controllers for this market is a strategic move.

- Risk lies in the uncertain mainstream adoption of foldable devices.

- Potential for high growth if foldable technology becomes ubiquitous.

Next-gen touch controllers for foldable OLEDs are Question Marks for Synaptics, with high-growth potential tied to foldable display adoption. The global foldable phone market was valued at $20.4 billion in 2023. Securing market share depends on the technology's widespread acceptance.

| Feature | Details |

|---|---|

| Market Value (2023) | $20.4 billion (foldable phones) |

| Growth Driver | Foldable display adoption |

| Risk | Uncertain adoption rate |

BCG Matrix Data Sources

Synaptics' BCG Matrix uses diverse data, integrating market analyses, company reports, and financial metrics for dependable positioning.