Synaptics Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synaptics Bundle

What is included in the product

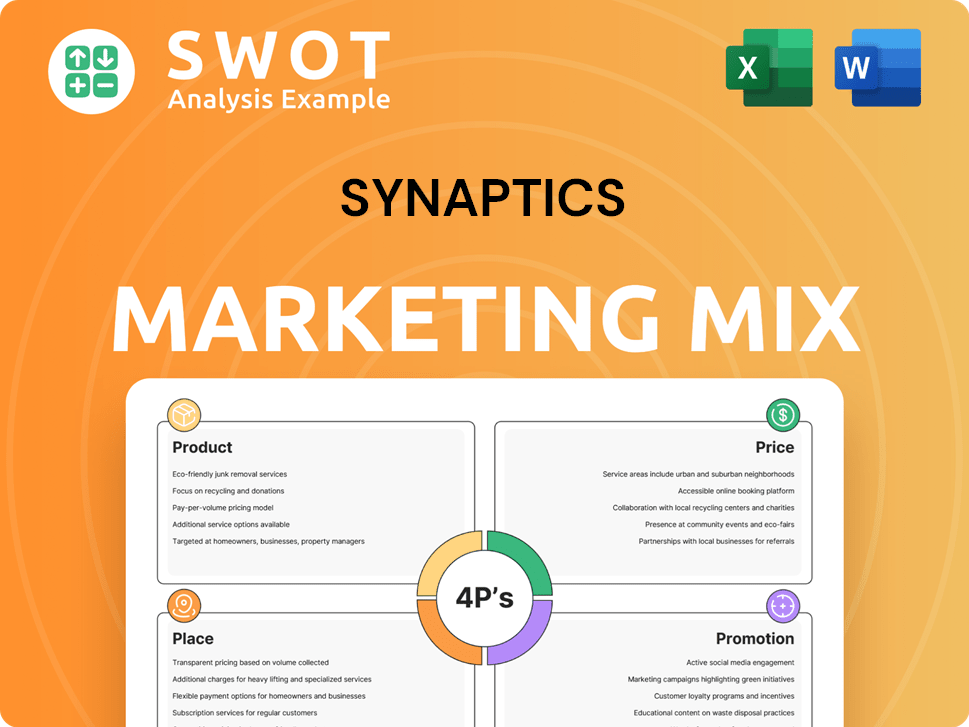

Offers a comprehensive 4Ps analysis of Synaptics, detailing product, price, place, and promotion strategies.

Summarizes the 4Ps concisely, perfect for executive reviews and quick project updates.

What You See Is What You Get

Synaptics 4P's Marketing Mix Analysis

The Synaptics 4P's Marketing Mix Analysis you see here is the same document you'll receive immediately after purchase.

4P's Marketing Mix Analysis Template

Understand Synaptics's marketing success with a detailed 4Ps analysis. Uncover product strategies, pricing models, and distribution channels. Examine promotional campaigns and their impact. This concise overview highlights key marketing tactics. Learn how Synaptics positions itself strategically. Dive deeper into the complete analysis, and gain invaluable insights. Instantly access a professionally crafted report.

Product

Synaptics' AI-Native IoT solutions concentrate on AI-enhanced offerings, including AI-Native processing and intelligent connectivity. These solutions aim to accelerate Edge AI app development across consumer, enterprise, and industrial markets. The Astra platform is crucial, designed for multimodal Edge AI workloads. Synaptics' focus reflects the growing Edge AI market, projected to reach $60 billion by 2025.

Synaptics' Wireless Connectivity leverages its Veros™ portfolio, integrating Wi-Fi, Bluetooth, and other technologies. This allows for seamless IoT connectivity. The company focuses on high performance and power efficiency. In Q1 2024, the IoT segment contributed significantly to Synaptics' revenue.

Synaptics' human interface technologies, including touch controllers and biometrics, are central to its product strategy. These solutions drive their presence in key markets like mobile, PCs, and automotive. Synaptics reported revenue of $988.9 million in fiscal year 2023. They aim to expand their market share by innovating in human-machine interfaces.

Edge AI Microcontrollers and SoCs

Synaptics is enhancing its Edge AI offerings with advanced MCUs and wireless SoCs for ultra-low-power IoT devices. These solutions integrate context-aware AI and robust connectivity, targeting wearables, audio, and industrial automation. The global edge AI chip market is projected to reach $28.7 billion by 2025, with a CAGR of 21.4% from 2019 to 2025. Synaptics aims to capitalize on this growth.

- Target applications: Smartwatches, audio devices, and factory automation.

- Market growth: Edge AI chip market expected to hit $28.7B by 2025.

- Key features: Contextually-aware AI and reliable connectivity.

- Product focus: High-performance adaptive MCUs and wireless SoCs.

Specialized Solutions for Various Markets

Synaptics offers specialized solutions, going beyond core technologies. This includes video interface and automotive innovations. They are actively developing next-gen automotive wireless connectivity modules. Additionally, they are working on touch controllers for foldable OLED displays.

- Synaptics' automotive segment saw a revenue increase of 20% in fiscal year 2024.

- The market for foldable OLED displays is projected to reach $30 billion by 2025.

Synaptics focuses on AI-driven IoT solutions, like the Astra platform. Their wireless connectivity uses Veros™ portfolio for IoT integration. Human interface tech is vital, with revenue at $988.9 million in fiscal year 2023. Edge AI chip market is set to reach $28.7 billion by 2025.

| Product Segment | Key Technologies | Market Focus |

|---|---|---|

| AI-Native IoT | AI processing, intelligent connectivity | Consumer, enterprise, industrial |

| Wireless Connectivity | Wi-Fi, Bluetooth | IoT devices |

| Human Interface | Touch controllers, biometrics | Mobile, PCs, automotive |

| Specialized Solutions | Video interface, automotive | Automotive and Display markets |

Place

Synaptics focuses on direct sales to OEMs, including mobile, PC, IoT, and automotive sectors. This strategy is crucial for integrating their tech into end products. In fiscal year 2024, revenue from mobile products was significant. Their success is linked to the market performance of their OEM partners, reflecting a B2B model. As of 2024, this approach has generated $1.2 billion in revenue.

Synaptics leverages global distribution agreements. This strategy, including partnerships like the one with Mouser Electronics, expands market reach. The aim is to ensure accessibility of their multimodal solutions globally. In 2024, Mouser's revenue was approximately $4.4 billion, reflecting the impact of such collaborations.

Synaptics strategically partners with companies to expand its market reach. A key example is its collaboration with Murata, focusing on automotive wireless connectivity. This partnership leverages established distribution networks for industry-specific product launches. In fiscal year 2024, Synaptics' automotive revenue grew, reflecting the success of such alliances.

Presence in Key Design Hubs

Synaptics strategically positions itself in key design hubs to bolster its marketing mix. India, now its second-largest design hub, enables comprehensive product development and global support. This localized approach enhances responsiveness and innovation, driving efficiency. It is expected that in 2024-2025, Synaptics will continue investing in these hubs.

- India's tech sector is projected to reach $350 billion by 2026.

- Synaptics' R&D spending in 2024 was approximately $300 million.

- The global semiconductor market grew by 13.3% in 2024.

Industry Events and Showcases

Synaptics actively engages in industry events to boost visibility. Events like CES and Embedded World are key platforms for showcasing their innovations. These events allow direct interaction with customers and partners. Participation is crucial for staying competitive and generating leads. In 2024, Synaptics likely invested significantly in these events.

- CES 2024 saw over 135,000 attendees.

- Embedded World 2024 had over 24,000 visitors.

- Event participation costs can range from $100,000 to $1 million.

Synaptics uses strategic design hubs like India to drive innovation. This approach improves responsiveness and enhances global support capabilities. Investment in these hubs is expected to continue through 2024-2025.

| Design Hub Focus | Strategic Benefit | 2024-2025 Outlook |

|---|---|---|

| India | Comprehensive Product Development & Global Support | Continued Investment |

| Localized Approach | Enhanced Responsiveness & Innovation | Expansion of Operations |

| Key Design Hubs | Improved Efficiency & Market Reach | Focus on Growth |

Promotion

Synaptics uses industry conferences, like CES and Embedded World, to showcase its tech. These events allow Synaptics to connect with clients and media. In 2024, Synaptics likely spent a significant sum on these events, with costs ranging from $100K-$500K+. These conferences boost brand visibility and generate leads.

Synaptics actively uses press releases to share key updates. They announce new products, partnerships, and financial performance. These releases are distributed widely. In Q1 2024, Synaptics announced a strategic partnership with a major tech firm. This helped boost their stock by 5%.

Synaptics focuses on investor relations through earnings calls and conferences. They share financial reports to engage with investors and analysts. In Q1 2024, Synaptics reported revenue of $282.9 million. The company's investor relations efforts aim to boost stakeholder confidence.

Online Presence and Digital Marketing

Synaptics leverages its online presence to showcase its offerings and communicate with stakeholders. Their website serves as a central hub for product details, tech updates, and company news. Digital marketing efforts include using cookies and partnering with advertisers for targeted campaigns. In 2024, digital ad spending is projected to reach $270 billion in the US.

- Website as a primary source of information.

- Digital marketing through cookies and advertising.

- Focus on retargeting and promotional activities.

- Estimated digital ad spend of $270B in US (2024).

Collaborative Marketing with Partners

Synaptics boosts its reach via collaborative marketing. They team with partners like Google on Edge AI for IoT, co-promoting solutions to target customers. This likely includes joint campaigns, leveraging each other's brand recognition. In 2024, the global IoT market was valued at $212 billion, showing significant potential for such partnerships. These collaborations help broaden market penetration.

- Joint marketing campaigns with partners.

- Focus on co-developed solutions.

- Target specific customer segments.

- Leverage partner brand recognition.

Synaptics employs a multi-channel promotion strategy to boost visibility. This includes industry conferences, such as CES and Embedded World, to showcase their technology. Digital marketing, targeting $270 billion in ad spend in the US by 2024, is also key.

They use press releases, strategic partnerships (e.g., in Q1 2024, stock up 5%), and investor relations via earnings calls.

Synaptics also boosts reach with collaborative marketing, which will include campaigns focused on co-developed solutions. In 2024, the global IoT market valued at $212 billion.

| Promotion Element | Methods | Key Metrics |

|---|---|---|

| Conferences | CES, Embedded World | Brand Visibility, Lead Generation |

| Press Releases | Product, Partnership Announcements | Stock impact (+5% Q1 2024) |

| Digital Marketing | Website, Ads (Cookies) | Targeting, Ad Spend ($270B US 2024 est.) |

Price

Synaptics employs value-based pricing, aligning prices with the worth customers place on its tech. This strategy is especially evident in areas like automotive, where tech leadership justifies premium pricing. For example, in Q1 2024, Synaptics reported a gross margin of 50.1%, reflecting value-driven pricing. This approach allows Synaptics to capture more value from its innovations.

Synaptics faces intense competition in the semiconductor market, especially in IoT and Edge AI. Their pricing strategy must balance competitive pressures with the value of their innovative solutions. In Q1 2024, the global semiconductor market saw fluctuating revenues, highlighting the need for adaptable pricing. Synaptics' pricing should reflect its technological advancements while ensuring market share.

Synaptics' pricing is significantly affected by end-customer demand for products using their components. For instance, strong demand for smartphones and wearables directly boosts Synaptics' sales. In 2024, the demand for these products, particularly those with advanced touch and display technologies, influenced Synaptics' revenue. This demand dynamic impacts Synaptics' ability to set prices, affecting profitability.

Financial Performance and Margins

Synaptics' financial performance reveals its pricing strategies and operational efficiency. Their gross margins offer insights into their ability to manage costs and maintain profitability. For instance, in Q1 2024, Synaptics reported a gross margin of 47.5%. Healthy margins indicate strong pricing power in specific market segments, crucial for sustained profitability.

- Q1 2024 gross margin was 47.5%.

- Focus on high-margin product categories.

- Pricing strategies impact profitability.

- Operational efficiency is key.

Strategic Agreements and Licensing

Strategic agreements, like the licensing deal with Broadcom, influence Synaptics' pricing strategy. These deals boost their product range and expand market access, affecting their costs and pricing freedom. For example, in fiscal year 2024, Synaptics' revenue was significantly impacted by licensing agreements, showcasing their pricing strategy's importance. These agreements are crucial for maintaining competitive pricing.

- Broadcom deal expanded Synaptics' product portfolio.

- Licensing affects cost structure and pricing.

- Revenue in 2024 showed the impact of these agreements.

Synaptics uses value-based pricing. This boosts margins, demonstrated by a 50.1% gross margin in Q1 2024. Competitive pressures necessitate adaptable pricing strategies, mirroring semiconductor market fluctuations in 2024. Customer demand for tech, like in smartphones, influences pricing and profitability.

| Metric | Q1 2024 | FY 2024 |

|---|---|---|

| Gross Margin | 50.1% | 47.5% |

| Revenue Impact (Licensing) | Significant | Significant |

| Semiconductor Market Fluctuation | Present | Ongoing |

4P's Marketing Mix Analysis Data Sources

The analysis relies on SEC filings, product details, website content, pricing information, and promotional activities. We also use industry reports.