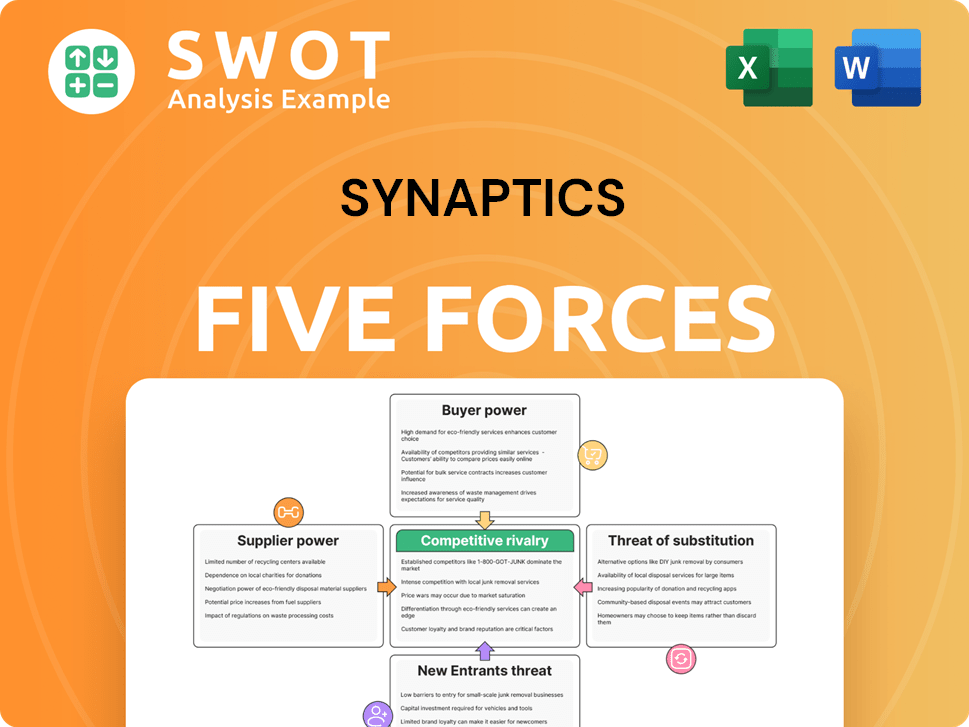

Synaptics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synaptics Bundle

What is included in the product

Analyzes competitive dynamics: threats, substitutes, & entry barriers unique to Synaptics.

Customize pressure levels based on new data or evolving market trends.

Full Version Awaits

Synaptics Porter's Five Forces Analysis

This preview demonstrates the comprehensive Porter's Five Forces analysis of Synaptics that you will receive. The document provides in-depth insights into the competitive landscape. You're viewing the complete, ready-to-use analysis; the very file you'll download after purchase. It offers a clear, concise, and expertly prepared analysis. The document is instantly accessible upon successful payment.

Porter's Five Forces Analysis Template

Synaptics faces moderate supplier power due to reliance on key component vendors. Buyer power is significant, influenced by price sensitivity and alternative options. Threat of new entrants is moderate, with high initial investment barriers. The threat of substitutes is high, due to evolving tech. Rivalry is intense in the competitive display and sensing market.

Ready to move beyond the basics? Get a full strategic breakdown of Synaptics’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Synaptics depends on various suppliers for components and manufacturing. A high concentration of suppliers could give them significant pricing power. For instance, if a few vendors control display drivers, they could dictate terms. In 2024, the display driver market saw fluctuations, impacting costs.

Switching costs significantly influence Synaptics' supplier power. High costs, like those from redesigning products, increase supplier leverage. For instance, if switching requires extensive testing, suppliers gain power. Synaptics' 2024 financials show that specialized components contribute to these costs, giving suppliers a stronger position.

If suppliers offer unique, specialized inputs, they gain bargaining power over Synaptics. Suppliers of advanced touch technology or AI processors, for example, can have an advantage. In 2024, the market for AI processors specifically grew significantly, with revenues reaching billions. This leverage allows these suppliers to influence pricing and terms.

Supplier Forward Integration

Suppliers could strengthen their position by integrating forward, potentially competing directly with Synaptics. Imagine a display panel maker entering the touch-enabled display market, increasing its bargaining power. This move could squeeze Synaptics' margins or force it to compete on price. In 2024, the display market saw significant consolidation, with major players like BOE and LG Display expanding their capabilities, thus increasing their potential for forward integration and supplier power. This trend underscores the need for Synaptics to manage its supply chain strategically.

- Forward integration by suppliers can disrupt established market dynamics.

- Increased supplier control can impact Synaptics' profitability.

- Market consolidation among suppliers amplifies this risk.

- Strategic supply chain management is crucial for Synaptics.

Impact of Inputs on Cost or Differentiation

The power suppliers hold significantly impacts Synaptics. If the inputs are vital to Synaptics' product costs or its ability to stand out, suppliers gain leverage. This is because they can influence prices and terms. For example, in 2024, the cost of specialized chips has risen. This impacts Synaptics' profitability and market position.

- High input costs directly affect Synaptics' profit margins.

- Critical components from a few suppliers increase vulnerability.

- Differentiation through unique materials reduces supplier power.

- Long-term contracts can stabilize input costs to some extent.

Suppliers' bargaining power affects Synaptics' profitability. Concentrated suppliers of critical components can dictate terms, particularly for specialized items like AI processors. In 2024, the AI processor market was worth billions, amplifying supplier influence.

| Factor | Impact on Synaptics | 2024 Data |

|---|---|---|

| Supplier Concentration | Increased costs, reduced margins | Display driver price fluctuations |

| Switching Costs | Higher supplier leverage | Specialized components impact costs |

| Unique Inputs | Pricing and terms influenced | AI processor market: $B revenue |

Customers Bargaining Power

Buyer concentration significantly impacts Synaptics. If a few large customers, like major smartphone or automotive manufacturers, account for a large part of Synaptics' sales, they have considerable bargaining power. In 2024, the top 10 customers of Synaptics generated approximately 60% of its revenues. This concentration allows these key customers to negotiate aggressively on prices and terms.

Switching costs significantly influence Synaptics' customer bargaining power. If it's easy for customers to switch to competitors like Cypress Semiconductor or Goodix, their power increases. For example, in 2024, Goodix's revenue grew by 15%, showing their ability to attract customers. Software integration and ecosystem lock-in can raise switching costs, potentially giving Synaptics more leverage.

If Synaptics can differentiate its AI and wireless connectivity solutions, buyer power decreases. Unique features make switching costly, reducing customer leverage. In 2024, Synaptics' focus on advanced tech aimed to boost differentiation. Strong differentiation allows for better pricing and customer relationships. This approach helps Synaptics maintain profitability in a competitive market.

Buyer Backward Integration

Customers, especially large tech firms, could integrate backward. They might develop their own human interface solutions, boosting their bargaining power. This threat is amplified if open-source alternatives gain traction. For example, in 2024, Apple spent $30 billion on R&D. This shows the capacity for in-house development.

- Backward integration increases customer bargaining power.

- Major tech companies have the resources to do this.

- Open-source options make this more feasible.

- Apple's R&D spending highlights this capability.

Price Sensitivity

Customer price sensitivity significantly shapes Synaptics' negotiating power. High price sensitivity, common in consumer electronics, forces Synaptics to consider price reductions. In 2024, the consumer electronics market faced intense price competition, impacting profitability. Synaptics must balance pricing with maintaining market share and margins.

- Price wars in the smartphone market, a key Synaptics customer base, intensified in 2024.

- Synaptics' Q3 2024 revenue showed a slight decrease due to pricing pressures.

- The average selling price (ASP) of certain components decreased by 5-7% in 2024.

- Competition from cheaper alternatives increased customer price sensitivity.

Synaptics faces significant customer bargaining power. Key factors include customer concentration, switching costs, and price sensitivity. In 2024, top customers drove 60% of revenues, amplifying their leverage.

| Factor | Impact | 2024 Data |

|---|---|---|

| Concentration | High power | Top 10 customers: 60% revenue |

| Switching | Moderate power | Goodix revenue up 15% |

| Price Sensitivity | High power | ASP decreased by 5-7% |

Rivalry Among Competitors

Competitive rivalry in the semiconductor industry is fierce due to many competitors. Synaptics faces intense competition, potentially leading to price wars. This impacts R&D investments and profit margins. Key rivals include Goodix and Elan Microelectronics. In 2024, the global semiconductor market was valued at approximately $526.8 billion.

Slower industry growth intensifies rivalry, as firms compete more fiercely for market share. Synaptics faces this, especially in mature markets. The PC market saw a shipment decline of 14.8% in 2023. This is a key area for Synaptics. This increases competition for market share.

Synaptics' product differentiation significantly influences competitive rivalry. If their offerings stand out, rivalry lessens; otherwise, it intensifies. Synaptics aims to differentiate through AI and wireless solutions. In Q1 2024, Synaptics reported $958 million in revenue, showcasing its market position. This differentiation strategy is vital for sustaining its competitive edge.

Switching Costs

Low switching costs amplify competitive rivalry for Synaptics. OEMs can readily swap touchpad, display driver, and fingerprint sensor suppliers, intensifying the need for Synaptics to offer competitive pricing and performance. This ease of switching creates a volatile market. Synaptics' ability to retain customers hinges on its ability to provide superior value.

- In 2024, the global market for display drivers was valued at approximately $6.5 billion.

- Touchpad market competition is fierce, with many suppliers vying for OEM contracts.

- Fingerprint sensor technology sees rapid innovation, increasing the risk of obsolescence if Synaptics doesn't keep up.

- Switching suppliers often involves minimal technical adjustments for OEMs.

Exit Barriers

High exit barriers, like Synaptics' significant R&D investments and specialized manufacturing partnerships, can intensify rivalry. Firms often persist in competitive battles even when profitability wanes, due to the high costs of leaving the market. Synaptics' long-term commitments, including those in 2024, make exiting difficult, fueling rivalry. These barriers necessitate continued competition, potentially squeezing profit margins. For example, in 2024, Synaptics' R&D expenses were approximately $300 million.

- R&D Spending: In 2024, Synaptics invested around $300 million in R&D.

- Manufacturing Partnerships: Long-term agreements lock in costs.

- Market Presence: Synaptics' continued presence impacts rivalry.

- Profitability: High exit costs may lead to lower profits.

Competitive rivalry for Synaptics is intense, heightened by many competitors like Goodix and Elan Microelectronics. Slower growth in markets such as PCs, which declined by 14.8% in 2023, intensifies competition. Differentiation through AI and wireless tech is crucial, as low switching costs allow OEMs to easily change suppliers. High exit barriers, such as approximately $300 million in R&D spending in 2024, keep rivalry high.

| Factor | Impact on Rivalry | Synaptics' Strategy |

|---|---|---|

| Many Competitors | High | Differentiation |

| Slow Growth | Intensifies | Market Focus |

| Low Switching Costs | Increases | Value Proposition |

| High Exit Barriers | Sustains | Innovation |

SSubstitutes Threaten

The threat of substitutes is a significant factor for Synaptics. Alternative technologies like voice control and gesture recognition could replace touch interfaces. These substitutes can erode Synaptics' market share and pricing ability. For example, in 2024, the voice recognition market was valued at $10.7 billion, showing the growing adoption of alternatives.

Switching costs significantly influence the threat of substitutes for Synaptics. If it's easy and cheap for customers to switch to alternative input methods, the threat increases. For example, integrating a new touchscreen technology into a smartphone might be complex, increasing switching costs. In 2024, the global touchscreen market was valued at approximately $15 billion, with competition from various players.

The price-performance ratio of substitute technologies directly impacts Synaptics. Cheaper alternatives, like voice control, threaten touch interfaces. In 2024, voice-activated tech saw a 20% adoption increase. If substitutes offer similar functionality at a lower cost, Synaptics faces pressure to cut prices or innovate. Assess the cost-effectiveness, always!

Customer Propensity to Substitute

The threat of substitutes in Synaptics' market hinges on customer willingness to switch. Some customers still prefer traditional interfaces, while others embrace new tech. For instance, in 2024, the adoption rate of haptic feedback technology, a substitute, showed a 15% year-over-year growth. Understanding customer preferences is vital for Synaptics. This helps in anticipating and responding to competitive pressures effectively.

- Haptic feedback adoption grew 15% YoY in 2024.

- Customer preference varies: traditional vs. new tech.

- Substitute products impact Synaptics' market share.

- Analyzing customer behavior is a key strategy.

Innovation in Adjacent Fields

Innovation in related fields poses a significant threat. Advances in AI and sensor tech could foster alternatives to Synaptics' products. For instance, better AI voice recognition could make voice control a strong substitute for touch interfaces. The rise of AR/VR might also introduce new interaction methods. Synaptics must constantly innovate to stay ahead.

- AI chip market is projected to reach $194.9 billion by 2030.

- Voice recognition market was valued at $10.7 billion in 2023.

- AR/VR market is expected to hit $78.3 billion by 2024.

The threat of substitutes is a critical factor for Synaptics, with emerging technologies like voice control and gesture recognition presenting viable alternatives to touch interfaces. The voice recognition market was valued at $10.7 billion in 2024, signaling the growing adoption of substitutes. Customer preferences and switching costs significantly affect this threat, influencing Synaptics’ market position.

| Factor | Impact | Data (2024) |

|---|---|---|

| Voice Recognition Market | Substitute Threat | $10.7 Billion |

| Haptic Feedback Growth | Substitute Adoption | 15% YoY |

| Touchscreen Market | Competitive Landscape | $15 Billion |

Entrants Threaten

The threat from new entrants for Synaptics is generally low due to high barriers. Significant capital is required for specialized manufacturing and R&D, typical of the semiconductor sector. Established players benefit from brand recognition and existing customer relationships. In 2024, the semiconductor industry saw consolidation, further increasing barriers to entry.

Entering the human interface solutions market demands significant capital. R&D, manufacturing, and marketing require substantial investments. This deters smaller firms. Synaptics's R&D spending in 2024 was around $200 million. High entry costs limit new competitors.

Synaptics' robust portfolio of patents and proprietary tech forms a significant barrier. New competitors face high costs and long timelines to replicate this. Synaptics boasts over 2,000 patents, demonstrating a strong IP position. This shields them from immediate threats. They reported $1.1 billion in revenue in fiscal year 2024.

Brand Identity

Synaptics benefits from its established brand identity, which creates a significant barrier against new entrants. Building brand recognition and customer loyalty takes considerable time and resources, giving Synaptics an edge. New competitors must overcome this hurdle to gain market share, often requiring substantial investments in marketing and relationship-building. This advantage helps Synaptics maintain its position in the competitive tech landscape.

- Synaptics' brand strength translates into customer trust and preference.

- New entrants face high marketing costs to match Synaptics' brand recognition.

- Established relationships with key clients further protect Synaptics.

- The cost of brand building is a major deterrent for potential competitors.

Government Regulations

Government regulations, and industry standards can significantly impact the ease with which new companies can enter a market. Compliance with these rules often demands substantial financial investment and time, creating a barrier. For example, companies in the tech sector, such as those in the semiconductor industry, must adhere to stringent data privacy laws and intellectual property regulations, which can be complex and expensive to navigate. These hurdles can deter new entrants.

- Regulatory compliance costs can include legal fees, certification processes, and ongoing audits, which might range from $50,000 to over $1 million annually, depending on the industry and scope of operations.

- In 2024, the average time to obtain necessary permits and licenses in the US can vary widely, from a few months to over a year, significantly delaying market entry.

- The semiconductor industry specifically faces regulations like the CHIPS Act, which provides substantial funding but also mandates compliance with complex reporting and auditing requirements.

The threat of new entrants to Synaptics is low due to high barriers. These include the large capital needed for R&D and manufacturing, with Synaptics investing around $200 million in R&D in 2024. Strong brand recognition and an extensive patent portfolio, like Synaptics' over 2,000 patents, further deter new competition. Strict regulations also raise entry costs.

| Barrier | Impact | Data (2024) |

|---|---|---|

| Capital Requirements | High | R&D spending ~$200M |

| Brand Recognition | Significant Advantage | Established customer trust |

| Intellectual Property | Protective | Over 2,000 patents |

Porter's Five Forces Analysis Data Sources

Our analysis synthesizes information from annual reports, market research, and financial filings to evaluate the competitive landscape. Industry publications and expert opinions also inform the assessment.