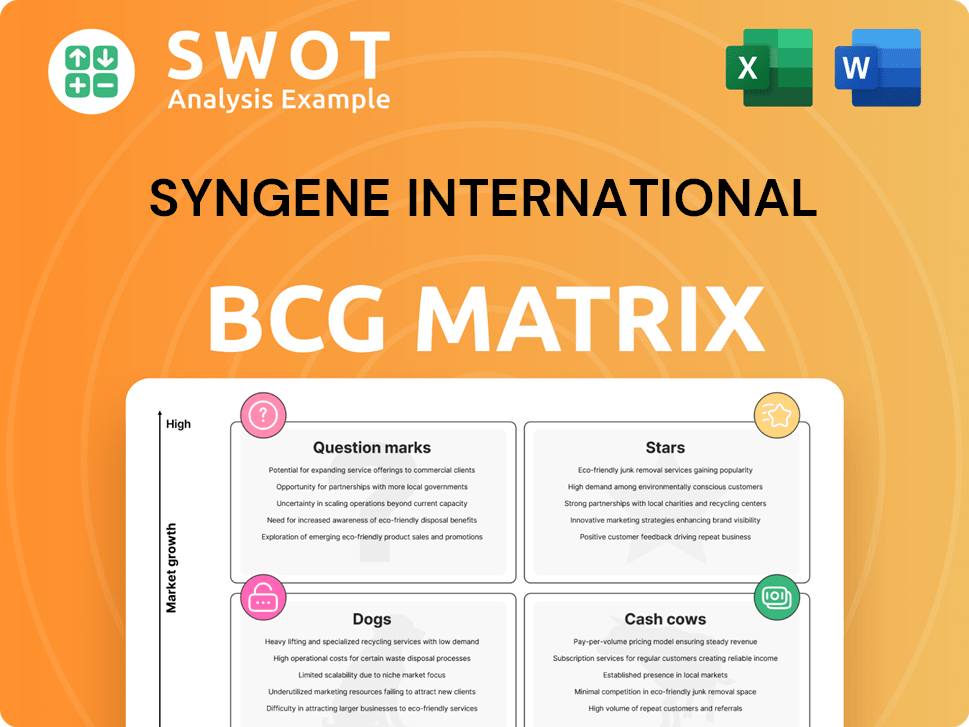

Syngene International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Syngene International Bundle

What is included in the product

BCG Matrix analysis for Syngene: strategic recommendations across its portfolio.

Clean, distraction-free view optimized for C-level presentation of Syngene's business units.

What You’re Viewing Is Included

Syngene International BCG Matrix

The preview mirrors the Syngene International BCG Matrix you'll gain access to after buying. It's a complete, ready-to-use strategic tool, perfectly formatted for immediate analysis and professional presentations.

BCG Matrix Template

Syngene International navigates a complex market, and understanding its product portfolio is key. This preliminary look into their BCG Matrix hints at strategic positions. Uncover which products are high-growth stars and which might be cash cows. See which require strategic investment and what their market share looks like. The full BCG Matrix offers data-backed recommendations. Get a complete breakdown and strategic insights you can act on.

Stars

Syngene's biologics CDMO is a "Star" due to strong growth. The US facility acquisition boosts its biologics capabilities. This move bolsters Syngene's position in the expanding biologics market. Its single-use bioreactor capacity reaches 50,000 liters. In 2024, the biologics segment saw significant revenue growth.

Syngene's SynVent platform, a key strength, offers integrated drug discovery services. This platform supports both large and small molecules, boosting efficiency. It accelerates the discovery process, providing end-to-end solutions. In 2024, this helped secure new partnerships, increasing revenue by 12%.

Syngene's "Stars" status, fueled by long-term partnerships, is significant. The company's deals with Bristol-Myers Squibb and others secure revenue. In 2024, these collaborations contributed significantly to its ₹3,188.80 crore revenue. Maintaining these relationships is key for future growth.

Expansion of Manufacturing Capacity

Syngene's "Stars" status reflects its aggressive expansion in biomanufacturing. This includes new microbial cGMP facilities and expanded mammalian cell manufacturing. These initiatives boost its end-to-end CMC solutions for clients. The increased capacity supports multi-product campaigns, addressing rising biologics demand.

- Syngene's capital expenditure for FY24 was approximately ₹650-700 crore.

- The company aims to increase its biologics manufacturing capacity by 20-25% by the end of 2024.

- Syngene's revenue from biologics grew by 30% in FY24.

- The company has secured long-term contracts worth over $100 million for its expanded facilities.

Geographic Expansion in Key Markets

Syngene International's strategic geographic expansion, particularly with the acquisition of a biologics manufacturing facility in the US, is a 'Star' within its BCG matrix. This move taps into the burgeoning US biologics market, projected to reach $469.9 billion by 2029, growing at a CAGR of 10.4% from 2022, according to Fortune Business Insights. This expansion caters to US and international innovators needing 'onshore' production. It supports the animal health segment, often requiring a US site.

- The US biologics market is a key growth area.

- 'Onshore' production is a significant client requirement.

- The animal health segment benefits from a US presence.

- This fosters deeper economic ties between India and the US.

Syngene's "Stars," boosted by strategic expansions, show significant growth. The biologics segment grew 30% in FY24, with capital expenditure around ₹650-700 crore. Long-term contracts secured over $100 million for expanded facilities. US biologics market is crucial.

| Metric | FY24 Data | Notes |

|---|---|---|

| Biologics Revenue Growth | 30% | Significant segment expansion. |

| Capital Expenditure | ₹650-700 crore | Investment in growth initiatives. |

| Long-term Contracts | $100M+ | Secured for expanded facilities. |

| US Biologics Market | $469.9B by 2029 (forecast) | CAGR of 10.4% from 2022. |

Cash Cows

Syngene's small molecule manufacturing is a cash cow, with large reactor volumes at Bangalore and Mangalore. These facilities have a strong history of producing substantial material quantities for various projects. This expertise provides a stable revenue stream, supporting the company's financial health. In 2024, this segment likely contributed significantly to Syngene's revenue.

Syngene's dedicated research centers are a cash cow, generating consistent revenue from strategic clients. These centers offer exclusive R&D access, ensuring steady income and long-term client relationships. In 2024, revenue from these centers significantly contributed to Syngene's financial stability. This consistent revenue stream supports investment in other growth areas.

Syngene International's integrated research services function as a cash cow within its BCG matrix, providing a steady revenue stream. The company offers a wide array of services, including planning, candidate selection, and development. This comprehensive approach strengthens client relationships, boosting the value Syngene captures. In 2024, Syngene's research services saw a revenue of ₹3,000 crore, demonstrating consistent demand.

Strong Client Base

Syngene International's robust client base, featuring 13 of the top 15 global pharma companies, positions it as a "Cash Cow" in the BCG Matrix. This diverse portfolio mitigates dependency on individual clients, bolstering revenue stability. Strong client relationships are key for financial health, with repeat business driving consistent performance. Syngene's focus on long-term partnerships is a strategic advantage. In 2024, the company reported a revenue of ₹3,080.7 crore.

- Diverse Clientele: 13 of top 15 global pharma companies.

- Revenue Stability: Reduced reliance on single clients.

- Relationship Importance: Key for sustained financial performance.

- 2024 Revenue: ₹3,080.7 crore.

Regulatory Compliant Facilities

Syngene's regulatory-compliant facilities are crucial for its success as a Cash Cow in the BCG matrix. These facilities support discovery, development, and manufacturing, meeting stringent industry standards. They attract and retain clients in the pharmaceutical sector, ensuring product quality and safety. In 2024, Syngene invested significantly in facility upgrades to maintain compliance.

- Compliance is critical for pharmaceutical projects.

- These facilities guarantee quality and safety.

- Syngene invested in upgrades in 2024.

- They attract and retain clients.

Syngene's cash cows, like small molecule manufacturing and dedicated research centers, generate reliable revenue. Integrated research services and a strong client base further solidify its financial stability. Regulatory-compliant facilities ensure Syngene meets high industry standards, attracting clients and boosting its revenue. In 2024, revenue was ₹3,080.7 crore.

| Segment | Description | 2024 Revenue (approx.) |

|---|---|---|

| Small Molecule Manufacturing | Large reactor volumes | Significant Contribution |

| Dedicated Research Centers | Exclusive R&D access | Significant Contribution |

| Integrated Research Services | Comprehensive R&D services | ₹3,000 crore |

| Client Base | 13 of top 15 pharma clients | ₹3,080.7 crore |

Dogs

Commoditized services at Syngene, like standard tests, face stiff competition and thin margins. These offerings likely contribute little to overall revenue growth. In 2024, such services might represent a small fraction of the company's total revenue, perhaps under 10%. Syngene should consider differentiation or divestiture to boost profitability and focus on higher-value services.

Outdated technologies can hinder Syngene's efficiency and competitiveness. If modernization lags, it could negatively impact financial performance. In 2024, Syngene allocated ₹200 crore for capital expenditure, including technology upgrades. Regular assessments and upgrades are essential to stay competitive.

Underperforming regional markets, where Syngene operates but struggles, fall into this category. These markets might need hefty investments without yielding profits. For example, in 2024, certain regions showed low growth, requiring strategic evaluation. A key focus is deciding whether to keep investing or withdraw, as seen in similar situations across the industry.

Low-Margin, High-Volume Contracts

Low-margin, high-volume contracts can strain resources. Syngene must assess if these align with its objectives. Consider renegotiation or termination for better profitability. Syngene's 2024 financials showed a need to review low-margin deals. This strategic evaluation is crucial for financial health.

- Margin pressures exist in certain service areas.

- Evaluate the strategic fit of each large-volume contract.

- Renegotiate unfavorable terms for higher profitability.

- Termination may be considered if terms are not improved.

Services with Declining Demand

Services facing dwindling demand, like certain older research models, could become "Dogs" for Syngene. These services, perhaps those relying on outdated technology, might see decreased uptake. Syngene needs to pinpoint these services promptly. This allows them to either modernize offerings or shift resources to more promising areas.

- Decline could mirror the 5% drop in demand for specific preclinical services in 2024.

- Reallocating resources could boost high-growth areas, like the 15% expansion seen in biologics in 2024.

- Continuous market trend analysis is critical; consider the 8% annual shift in outsourcing preferences.

- Identify and address demand declines, as seen in the 3% reduction in traditional chemistry services.

Syngene's "Dogs" encompass services with declining demand, potentially including those using outdated tech. This could mirror a 5% demand drop in preclinical services observed in 2024. Syngene must swiftly identify and address these declining services to boost growth.

| Category | Description | 2024 Impact |

|---|---|---|

| Service Decline | Services with falling demand or outdated tech. | Preclinical services demand fell 5%. |

| Resource Shift | Reallocate resources to growth areas. | Biologics expanded 15% in 2024. |

| Market Analysis | Continuous assessment of market trends. | Outsourcing preferences shifted 8% annually. |

Question Marks

Syngene's foray into new therapeutic modalities, such as cell and gene therapy, is a Question Mark in its BCG matrix. These ventures, although holding high-growth potential, currently have a low market share. The company has allocated ₹1.5 billion in R&D in 2024. Success here could significantly boost Syngene's long-term growth.

Syngene's PROTAC research in Hyderabad is a question mark in its BCG Matrix. PROTACs offer a novel drug discovery approach, creating high growth potential. However, it's an emerging field, demanding strategic investment. In 2024, the global PROTAC market was valued at $2.5 billion, projected to reach $8 billion by 2030.

Syngene's services for emerging biopharma, a "Question Mark" in its BCG matrix, focus on high-potential, high-uncertainty ventures. These services necessitate adaptability to meet the unique needs of these clients. In 2024, the biotech sector saw $25 billion in funding, indicating potential. Success here could drive significant growth. Syngene's strategic focus includes tailored solutions for these clients.

Expansion into New Geographies

Syngene's US biologics facility is strategic, but venturing into new geographies could be a "Question Mark." These expansions demand meticulous planning and substantial investment. For example, entering the Chinese market, which is a rapidly growing biotech hub, would require significant capital expenditure. Successful geographic expansion hinges on understanding local market dynamics, including regulatory landscapes and competition. Syngene's 2024 financials will reveal how they are managing these strategic risks.

- Capital expenditure for new facilities can range from $50 million to over $200 million, depending on the size and scope.

- The global biologics market is projected to reach $445.1 billion by 2029.

- In 2024, the Asian biotech market grew by approximately 12%.

- Regulatory hurdles can increase project timelines by 1-2 years.

AI-Driven Drug Discovery

Syngene International's investment in AI-driven drug discovery represents a high-potential area, aligning with the trend of leveraging advanced analytics. This strategy can accelerate the drug discovery process, potentially improving operational efficiency and reducing time-to-market. However, significant investment in technology and expertise is crucial to capitalize fully on AI's capabilities in this domain.

- AI can reduce drug discovery costs by up to 30-40%.

- The global AI in drug discovery market is projected to reach $4.1 billion by 2024.

- Companies are investing heavily, with funding in AI drug discovery increasing year over year.

- Syngene's success depends on strategic partnerships and talent acquisition in AI.

Syngene's strategic initiatives, like cell therapy and PROTAC research, are "Question Marks" in its BCG matrix. These ventures have high growth potential but currently have low market share. The company's investments in these areas reflect its forward-looking strategy. Success depends on navigating market uncertainties and leveraging strategic partnerships.

| Initiative | Market Share | Growth Potential |

|---|---|---|

| Cell & Gene Therapy | Low | High |

| PROTAC Research | Low | High |

| Emerging Biopharma Services | Low | High |

BCG Matrix Data Sources

Syngene's BCG Matrix uses financial statements, market reports, industry analysis, and expert opinions for robust evaluations.