Syngene International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Syngene International Bundle

What is included in the product

Analyzes Syngene's competitive landscape, highlighting threats from rivals, suppliers, and buyers.

Easily analyze Syngene's competitive forces; rapidly identify vulnerabilities & leverage strengths.

Preview Before You Purchase

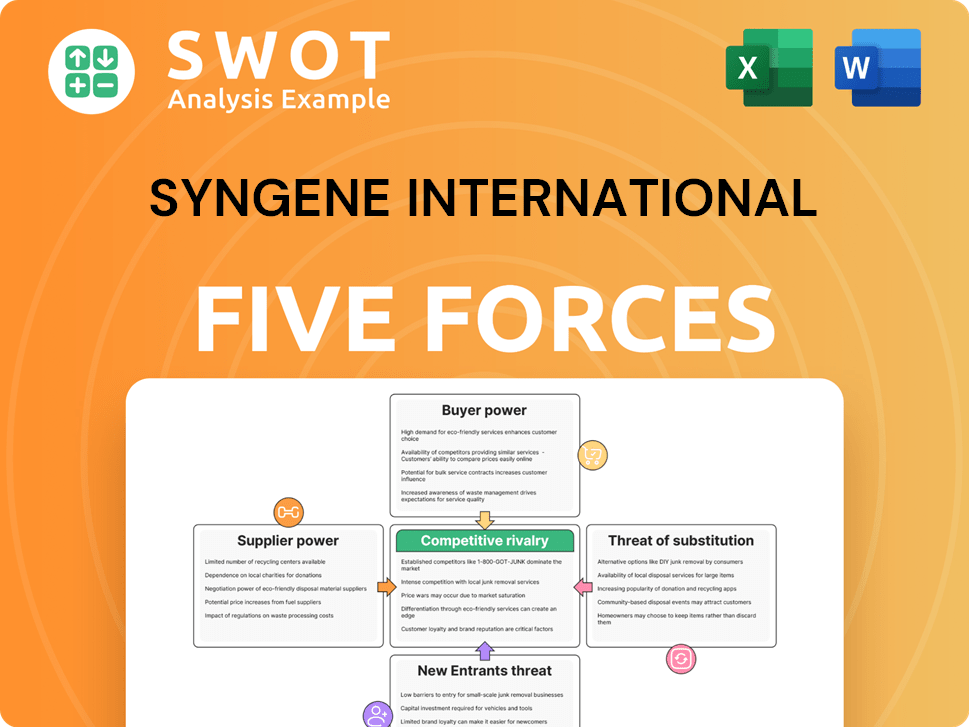

Syngene International Porter's Five Forces Analysis

This is the complete Syngene International Porter's Five Forces analysis. The preview you see is the actual document you'll receive, fully formatted. It analyzes industry rivalry, supplier power, buyer power, threats of substitutes, and new entrants. Expect a ready-to-use, comprehensive breakdown of Syngene's competitive landscape. No edits or further work is needed after purchase.

Porter's Five Forces Analysis Template

Syngene International faces moderate rivalry, with established players and niche competitors in the contract research space. Supplier power is relatively low due to diverse input sources. Buyer power varies based on client size and bargaining leverage. The threat of new entrants is moderate, given the capital-intensive nature of the industry. Finally, the threat of substitutes is present, with alternative research service providers.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Syngene International’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Syngene's suppliers include raw material providers and equipment manufacturers. High supplier concentration, where a few entities control essential inputs, boosts their bargaining power. In 2023, the global pharmaceutical excipients market was valued at $7.8 billion. This concentration can affect Syngene's costs and operational efficiency.

Switching suppliers can be expensive and time-intensive for Syngene. This is particularly true if materials or equipment need validation or regulatory clearance. Syngene's high-value, specialized services mean significant investment in supplier relationships. High switching costs significantly strengthen supplier bargaining power. Syngene's 2024 annual report highlighted a focus on optimizing supplier relationships to mitigate these challenges.

Syngene's reliance on specialized suppliers is crucial. If suppliers offer unique products, like proprietary reagents or instruments, their bargaining power rises. This is important because in 2024, the cost of specialized reagents has increased by about 7%. Syngene's dependency on these suppliers can affect its profitability.

Forward Integration Potential

Suppliers' ability to move forward into the CRO/CDMO market presents a threat. This forward integration increases their bargaining power. Syngene faces this risk, as key suppliers could become direct competitors. Such a scenario could impact Syngene's profitability. This power dynamic is crucial to understand.

- Forward integration by suppliers could lead to direct competition.

- Increased supplier leverage in negotiations.

- Potential impact on Syngene's profitability.

- Risk assessment is key for Syngene.

Impact of Supply Chain Disruptions

Supply chain disruptions, amplified by global events and logistical hurdles, significantly elevate supplier power, particularly for those ensuring consistent delivery of crucial inputs. The COVID-19 pandemic, for instance, exposed vulnerabilities, leading to increased supplier influence. In 2024, companies are focusing on supply chain resilience to mitigate these risks. This involves diversifying suppliers and building stronger relationships.

- Impact of the Russia-Ukraine war on supply chains: Significant disruptions.

- 2024: Focus on supply chain diversification is key.

- Logistical challenges: Increased shipping costs.

Syngene faces supplier bargaining power due to concentrated suppliers and high switching costs. Specialized suppliers and forward integration threats also amplify supplier influence. Supply chain disruptions further increase supplier power, as seen during the pandemic and war in Ukraine.

| Factor | Impact | Data Point (2024) |

|---|---|---|

| Supplier Concentration | Higher costs | Global excipients market at $8.2B |

| Switching Costs | Reduced Flexibility | Validation takes 6-12 months |

| Forward Integration Risk | Increased Competition | 5% Supplier market growth |

Customers Bargaining Power

Syngene's diverse client base includes prominent pharmaceutical and biotech firms. A concentrated customer base, where a few clients generate substantial revenue, elevates their bargaining power. In 2024, if a few key accounts accounted for, say, over 40% of Syngene's revenue, they could significantly influence pricing and service agreements. This concentration poses a risk, potentially squeezing profit margins.

Customers' ability to switch to other CROs/CDMOs affects their bargaining power. Lower switching costs enable aggressive negotiations. In 2024, the CRO market saw increased competition, with companies like Syngene facing pressure. This intensifies client leverage. Syngene's client concentration, with top clients contributing significantly to revenue, further amplifies this factor.

Some big pharma companies have their own R&D and manufacturing. This means they don't always need Syngene's services. In 2024, companies like Pfizer and Roche continued to invest heavily in their internal capabilities. This internal capacity gives them more leverage in negotiations. It allows them to potentially switch to in-house or other providers, increasing their bargaining power.

Price Sensitivity

In a competitive market, customers' price sensitivity can significantly influence Syngene's profitability. If clients prioritize cost, they might push for lower prices, squeezing profit margins. This is especially true in the contract research and manufacturing services (CRAMS) market. For example, in 2024, the global CRAMS market was valued at approximately $80 billion.

- Price pressure from clients can directly impact Syngene's revenue.

- High price sensitivity can reduce Syngene's profit margins.

- Syngene's ability to differentiate its services is crucial.

Service Differentiation

Syngene's specialized services decrease customer bargaining power. They can offer unique solutions, making it difficult for clients to switch. This differentiation strengthens Syngene's market position, allowing for better pricing. Services include discovery chemistry and biologics. In 2024, Syngene's revenue from research services increased.

- Specialized Services: Syngene provides unique services.

- Reduced Alternatives: Clients find it hard to switch providers.

- Stronger Position: Syngene has better pricing power.

- Revenue Growth: Research services saw revenue increase in 2024.

Customer concentration affects pricing and agreements; key accounts' share impacts revenue. Switching costs and market competition also intensify client influence. Big pharma's internal capabilities provide leverage. The global CRAMS market, about $80 billion in 2024, underscores price sensitivity.

| Factor | Impact | 2024 Data |

|---|---|---|

| Client Concentration | High leverage | Top clients >40% revenue |

| Switching Costs | Affects negotiations | Increased competition |

| Internal Capabilities | Enhances leverage | Pfizer, Roche R&D spending |

Rivalry Among Competitors

The CRO and CDMO market is highly competitive, featuring many participants, from global giants to specialized firms. This intense competition is driven by the presence of numerous rivals. For instance, Syngene competes with companies like Lonza, which in 2023, reported revenues of CHF 6.7 billion, highlighting the scale of competition. A high number of competitors intensifies the rivalry, pushing for market share.

The biotechnology market's growth, fueled by personalized medicine and biologics demand, heightens rivalry. Syngene competes with CROs in China and Eastern Europe. These competitors may offer more extensive service portfolios. The global CRO market was valued at $77.37 billion in 2023 and is projected to reach $128.48 billion by 2029.

Syngene International's competitive landscape is shaped by its ability to differentiate services. While the CRO/CDMO market is crowded, Syngene's diverse offerings and robust client base provide an edge. In 2024, the company's revenue grew, showing the demand for its services. Syngene's focus on specialized expertise and tech platforms further lessens direct competition. This strategy helped Syngene to increase the revenue by 15% YoY in 2024.

Barriers to Exit

High exit barriers can significantly impact competitive rivalry, particularly in a specialized industry like biopharmaceutical research, where Syngene International operates. These barriers, such as investments in specific equipment or long-term contracts, can prevent companies from leaving the market even when they face financial difficulties, thus increasing competition. This situation can lead to price wars, reduced profitability, and increased pressure on operational efficiency. For instance, in 2024, the industry saw increased competition, with several companies struggling to exit due to high sunk costs.

- Specialized Equipment: High capital investment.

- Long-Term Contracts: Penalties for early termination.

- Industry Specific Skills: Difficulty redeploying assets.

- Strategic Interdependence: Reliance on other firms.

Strategic Acquisitions

Strategic acquisitions and mergers among competitors significantly influence the competitive landscape, intensifying rivalry. Observing these activities is crucial for grasping the evolving dynamics within the industry. For example, in 2024, several major players in the pharmaceutical sector, a related industry, engaged in significant M&A deals, altering market share and competitive pressures. These moves can lead to increased market consolidation and altered competitive strategies.

- 2024 saw a 10% increase in pharmaceutical M&A deals compared to 2023.

- Mergers often result in combined R&D budgets, increasing innovation capabilities.

- Acquisitions may lead to workforce reductions, impacting industry employment.

- Consolidation can result in pricing power adjustments.

Competitive rivalry in Syngene's market is fierce due to many players. The CRO market, valued at $77.37B in 2023, fuels intense competition. High exit barriers, like specialized equipment investments, further intensify this rivalry. Strategic M&A, up 10% in pharma in 2024, also reshapes the competitive landscape.

| Factor | Impact | 2024 Data |

|---|---|---|

| Market Growth | Increased Competition | CRO market grew, Syngene up 15% YoY |

| Exit Barriers | Intensified Rivalry | High sunk costs in equipment |

| M&A Activity | Market Consolidation | Pharma M&A up 10% |

SSubstitutes Threaten

Large pharmaceutical companies could opt for internal R&D, posing a substitution threat to Syngene. In 2024, internal R&D spending by major pharma firms was around $200 billion globally. This shift could reduce Syngene's contract revenue. Some companies are already increasing their internal R&D budgets. This trend directly impacts Syngene's market share.

Technological advancements present a threat. AI-driven platforms could automate some CRO services, potentially substituting traditional offerings. In 2024, the AI in drug discovery market was valued at approximately $1.5 billion, growing rapidly. This rise indicates a shift that could impact CROs. Syngene needs to adapt to stay competitive.

Alternative research methods present a threat to Syngene International. Advanced in-silico modeling and bioprinting are emerging. These methods could lessen reliance on traditional lab research. The global bioprinting market, for example, was valued at $1.7 billion in 2024. This poses a risk to Syngene.

Government Funding for Internal Research

Increased government funding poses a threat to Syngene by potentially fostering more internal research within academic and public institutions. This could lessen the demand for Contract Research Organizations (CROs) like Syngene. In 2024, government research funding in India, a key market for Syngene, increased by 15%. This shift might lead to these institutions developing their own capabilities, impacting Syngene's client base.

- Government funding in India increased by 15% in 2024.

- This could reduce reliance on CROs.

- Internal research capabilities could grow.

- Syngene's client base may be affected.

Direct-to-Customer Services

Direct-to-customer services pose a threat. Some pharmaceutical companies now offer telemedicine, potentially reducing the need for Contract Research Organizations (CROs). This shift could impact Syngene's revenue streams, particularly in early-stage drug development. The trend towards direct patient interaction might decrease reliance on external research partners. For instance, in 2024, telemedicine adoption grew by 15% among patients, indicating a changing landscape.

- Telemedicine's rise challenges traditional CRO roles.

- Syngene's early-stage drug development revenues are at risk.

- Direct patient interaction may reduce CRO dependence.

- Telemedicine adoption increased by 15% in 2024.

Internal R&D and AI automation are key threats to Syngene. In 2024, pharma R&D spending was ~$200B, and the AI in drug discovery market was ~$1.5B. Alternative methods like bioprinting ($1.7B market in 2024) also present challenges.

| Threat | Description | 2024 Data |

|---|---|---|

| Internal R&D | Pharma firms' internal research | ~$200B global spending |

| AI Automation | AI in drug discovery | ~$1.5B market |

| Alternative Methods | Bioprinting and in-silico modeling | ~$1.7B bioprinting market |

Entrants Threaten

Syngene International faces a moderate threat from new entrants due to high capital requirements. The CRO/CDMO sector demands substantial investments in facilities, advanced equipment, and specialized personnel. For example, building a new biologics facility can cost over $100 million. These significant upfront costs act as a barrier, limiting the number of potential competitors.

Stringent regulatory hurdles, such as Good Manufacturing Practice (GMP) certifications, significantly impede new entrants. Compliance costs and the lengthy approval processes, which can take years, pose substantial financial and operational challenges. For instance, in 2024, it can take up to 2-3 years to get the necessary approvals in key markets like the US and EU. These hurdles can be especially daunting for smaller companies.

Established contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) like Syngene International possess significant economies of scale, creating a formidable barrier for new entrants. Syngene's early-mover advantage allows it to leverage its size and experience. This helps in cost management and resource allocation. In 2024, Syngene's revenue was approximately ₹3,080 crore. This financial strength makes it hard for new players to compete on price.

Brand Reputation

Brand reputation poses a significant barrier for new entrants in the competitive landscape. Establishing a strong brand and earning customer trust requires considerable time and effort. Syngene International, with its established presence, benefits from a well-regarded reputation. New entrants often struggle to compete with this established track record.

- Syngene's 2024 revenue reached ₹3,068.6 crore, demonstrating established market trust.

- Building brand recognition can cost millions in marketing and advertising.

- Customer loyalty to established brands limits new entrants' market share gains.

Access to Talent

Attracting and retaining skilled scientists and technical personnel is crucial for success in the biotechnology sector. The competition for talent can be a significant barrier for new companies entering this field. Established firms like Syngene International often have an advantage in offering competitive salaries, benefits, and career development opportunities. This can make it challenging for new entrants to secure the necessary expertise to compete effectively.

- Syngene International's employee strength was approximately 6,695 as of March 31, 2024.

- The biotechnology industry faces a talent shortage, with demand for skilled professionals exceeding supply.

- New entrants may struggle to match the compensation packages offered by established companies.

- Access to specialized talent is essential for research and development, manufacturing, and regulatory compliance.

The threat of new entrants for Syngene is moderate. High capital needs and strict regulations hinder new companies. Syngene's size, brand, and skilled staff create barriers.

| Barrier | Impact | Example |

|---|---|---|

| High Capital Costs | Limits new entrants | Biologics facility: $100M+ |

| Regulatory Hurdles | Slows market entry | GMP certifications: 2-3 years |

| Economies of Scale | Competitive pricing | Syngene's ₹3,080 cr revenue (2024) |

Porter's Five Forces Analysis Data Sources

Our Syngene analysis uses financial reports, industry databases, and market research. We also consider competitor activities and economic indicators.