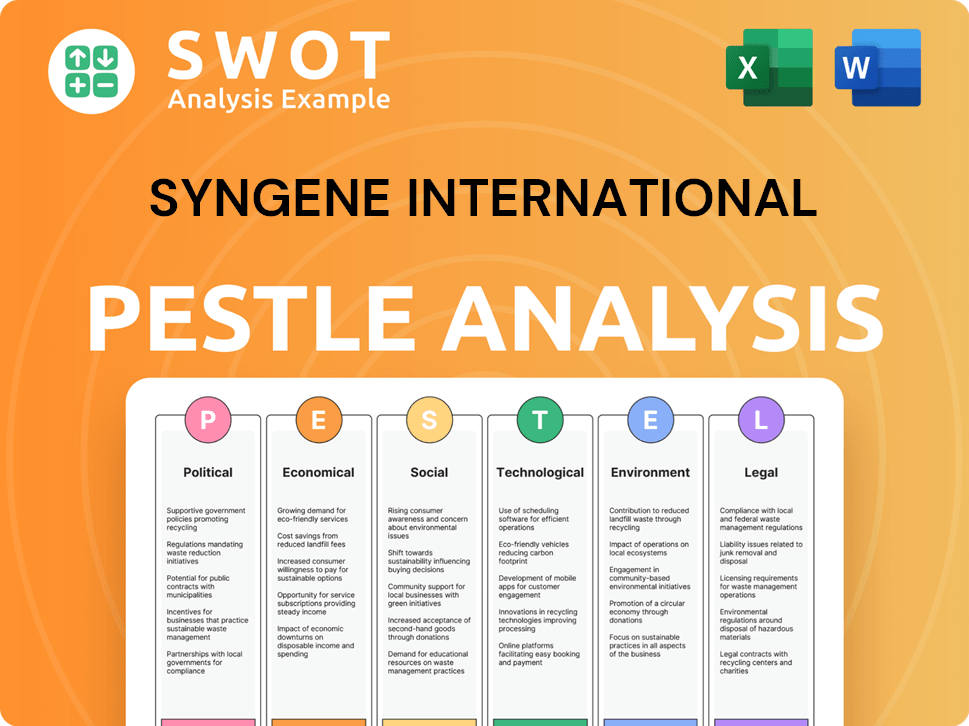

Syngene International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Syngene International Bundle

What is included in the product

This analysis assesses Syngene International's external environment across political, economic, social, technological, environmental, and legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Syngene International PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Syngene International PESTLE analysis details all relevant factors. The preview showcases its comprehensive approach. Download instantly after purchase. Get this complete report now!

PESTLE Analysis Template

Assess Syngene International's strategic environment with a detailed PESTLE analysis. Understand the complex interplay of political, economic, social, technological, legal, and environmental factors. Identify opportunities and mitigate potential risks facing the company. This analysis provides a snapshot of market forces. Take your analysis further! Download the full version now and gain invaluable insights to strengthen your business strategy.

Political factors

Syngene International faces significant impacts from government regulations in drug discovery, development, manufacturing, and clinical trials. Adherence to these regulations is crucial for operations and reputation. Regulatory changes or stricter enforcement could affect timelines and costs. In 2024, the global pharmaceutical market was valued at $1.5 trillion, with regulatory compliance costs a substantial factor.

Syngene International faces geopolitical risks due to its global presence and recent US acquisition. Political instability in critical markets can disrupt operations. For instance, changes in trade policies could affect supply chains. In 2024, geopolitical events led to a 5% increase in operational costs.

Syngene International's substantial reliance on international markets exposes it to shifts in global trade dynamics. Changes in tariffs and trade barriers can directly influence both the expenses of raw materials and the competitive edge of its services. For instance, the US-India trade relationship, with a 2023 goods trade of $128.6 billion, shows the scale of potential impacts. Any new tariffs could raise operational costs.

Government Support for R&D

Government backing for R&D significantly impacts Syngene. Initiatives and funding boost demand for its services. This support spurs innovation and drug development, creating growth opportunities. India's biotech market, valued at $11.7 billion in 2023, benefits from such policies. The Indian government allocated ₹36.6 billion ($440 million) to biotechnology R&D in the 2024-25 budget.

- Increased demand for Syngene's services.

- Support for innovation and drug development.

- Government funding boosts the biotech sector.

- Positive impact on market growth.

Intellectual Property Protection

Syngene International's success heavily relies on robust intellectual property (IP) protection. Strong patent enforcement in operational countries is essential for safeguarding their and their clients' innovations. Weak IP laws could lead to imitation and loss of market share, impacting revenue. The global pharmaceutical market was valued at $1.48 trillion in 2022 and is projected to reach $1.93 trillion by 2028.

- 2023 saw a 6% rise in pharmaceutical patent litigation cases globally, highlighting the importance of IP defense.

- India, a key market for Syngene, has improved its IP enforcement but still faces challenges compared to the US or Europe.

- Counterfeit drugs account for an estimated 10-15% of the global pharmaceutical market, underscoring the need for strong IP protection.

Syngene is shaped by stringent drug regulations, which impact its operations. Geopolitical instability and trade policy changes also introduce risks. Government support, like India's ₹36.6 billion for biotech R&D in 2024-25, affects market growth.

| Political Factor | Impact | Data Point (2024/2025) |

|---|---|---|

| Regulations | Compliance costs, timelines | Global Pharma Market: $1.5T, with rising compliance expenses. |

| Geopolitics | Supply chain, trade impacts | Geopolitical events increased operational costs by 5%. |

| Government Support | R&D and market growth | India's biotech R&D budget: ₹36.6 billion ($440 million). |

Economic factors

Syngene's success hinges on global economic health, especially in the US and Europe. Economic downturns can cut R&D spending by pharma and biotech firms. This directly impacts demand for Syngene's services, affecting revenue. In 2024, global R&D spending is projected to be around $2.5 trillion.

The biotech funding environment, particularly in the US, heavily impacts Syngene's research-based revenues. A funding slowdown can curtail research activities, affecting Syngene's discovery services. In 2024, biotech funding saw fluctuations, with venture capital investments reaching $18 billion. This environment influences Syngene's project pipeline and revenue projections.

Syngene, with significant international revenue, faces foreign exchange risk. Fluctuations in currency rates directly affect its financial outcomes, potentially impacting profitability. The company employs hedging strategies to manage these currency risks. In FY24, Syngene's revenue was INR 30,338 million, with a global presence.

Inflation and Operating Costs

Inflation poses a challenge for Syngene, potentially increasing operational expenses. This includes higher costs for raw materials and labor, which directly impact profitability. For example, in the fiscal year 2024, Syngene saw operating margins impacted by rising expenses. Managing these costs is essential for maintaining financial health.

- In FY24, Syngene's operating margins were affected by increased costs.

- Raw material and labor costs are key inflationary pressures.

- Effective cost management is vital for profitability.

Investment in R&D by Clients

The amount of research and development (R&D) spending by Syngene's clients, primarily pharmaceutical and biotechnology firms, significantly influences the company's revenue. Higher R&D investments mean more projects for Syngene. For instance, in FY24, Syngene's revenue from research services grew, reflecting increased client R&D spending. This trend is expected to continue in 2025.

- FY24 saw a revenue increase in research services.

- Increased client R&D spending drives Syngene's growth.

- This positive trend is projected to persist into 2025.

Global economic conditions greatly affect Syngene. Economic slowdowns in key markets like the US and Europe can reduce R&D spending, impacting Syngene's service demand and revenue. In FY24, Syngene's revenue was INR 30,338 million, highlighting the impact of client spending and funding environments on its performance. Forex risk due to currency fluctuations needs proper handling, and rising expenses, as seen in FY24, also need to be managed carefully.

| Factor | Impact | FY24 Data |

|---|---|---|

| Global R&D Spending | Influences service demand | $2.5T (Projected) |

| Biotech Funding | Affects research revenues | VC Investments: $18B |

| Foreign Exchange | Impacts financial outcomes | Revenue: INR 30,338M |

| Inflation | Increases operational costs | Operating Margins Impacted |

Sociological factors

Syngene relies heavily on a skilled workforce, especially scientists and researchers. Attracting and keeping talent is vital. In 2024, the company's employee count was approximately 7,000 people. The competition for talent in the biotech sector is fierce, affecting Syngene's expansion capabilities. High employee turnover can hinder project continuity and increase costs.

Syngene, operating in life sciences, is affected by society's emphasis on health and well-being. This drives demand for advanced healthcare products. According to a 2024 report, the global healthcare market is projected to reach $11.9 trillion by 2025. Ethical and safe research practices are also societal expectations.

Syngene's focus on diversity and inclusion shapes its corporate culture. In 2024, the company likely maintained or expanded its diversity programs. A diverse workforce can boost creativity and problem-solving. Research indicates diverse teams often outperform homogenous ones. Syngene's commitment supports its brand image.

Community Engagement

Syngene International actively engages with local communities as part of its social responsibility initiatives. This engagement includes community programs, educational support, and contributions to local development. Such efforts enhance Syngene's social license to operate, fostering positive relationships. These initiatives are crucial for long-term sustainability and community well-being.

- Community development projects: 15% of CSR budget.

- Educational programs: benefiting over 5,000 students.

- Partnerships with local NGOs: 10 active collaborations.

- Employee volunteer hours: 2,000 hours annually.

Public Perception and Trust

Public perception significantly influences Syngene International's success, especially given its involvement in pharmaceuticals and biotechnology. The industry faces scrutiny regarding drug pricing and clinical trial practices, impacting public trust. Maintaining ethical conduct and transparency are crucial for Syngene to foster positive relationships with stakeholders and mitigate reputational risks. A 2024 survey indicated that 68% of respondents believe the pharmaceutical industry prioritizes profits over patients. This highlights the importance of Syngene's commitment to integrity.

- Reputation is key in the biotech sector.

- Transparency is essential for maintaining public trust.

- Ethical practices are crucial for long-term sustainability.

- Public perception directly affects investor confidence.

Societal trends influence Syngene's operations, particularly its dependence on a skilled workforce. The biotech sector faces intense talent competition, which can affect expansion plans and boost operational expenses. In 2024, employee turnover rates may impact project timelines.

Societal emphasis on health boosts demand for advanced healthcare products, benefiting Syngene's offerings. Syngene's dedication to diversity, including corporate social responsibility, helps in developing good relations with its local communities. According to a 2024 survey, public perception also directly affects stakeholder's trust.

Syngene International is subject to the same societal scrutiny as the broader biotechnology and pharmaceutical industries, where it operates. This industry must navigate challenges around drug pricing and clinical trial transparency.

| Sociological Factor | Impact on Syngene | 2024/2025 Data |

|---|---|---|

| Workforce & Talent | Attracting & Retaining Skilled Labor | ~7,000 employees in 2024, high turnover |

| Health & Well-being | Demand for Healthcare Products | Global healthcare market projected to reach $11.9T by 2025 |

| Diversity & Inclusion | Boost Creativity & Brand Image | Diverse teams outperform homogeneous teams in research. |

Technological factors

Syngene International heavily relies on tech advancements in drug discovery, development, and manufacturing. Advanced analytics, AI, and new protein production platforms boost efficiency. For example, the global AI in drug discovery market is projected to reach $4.6 billion by 2025. These technologies are vital for Syngene's service offerings and competitive edge.

Syngene International's investment in automation and digitization is crucial. This includes advanced robotics and AI-driven systems. Such tech boosts productivity and efficiency, a trend with 20% growth in digital transformation spending in the biotech sector in 2024. These technologies also enhance data security. This is especially vital for research and manufacturing, with cybersecurity spending in pharma expected to reach $1.5 billion by 2025.

Syngene International's success hinges on top-tier data security and management. They must protect sensitive client research data. This includes robust systems for data integrity and confidentiality. In 2024, data breaches cost companies an average of $4.45 million. Staying compliant with regulations is also key.

Development of New Manufacturing Technologies

Syngene benefits from advancements in manufacturing technologies, crucial for its CDMO business, especially in biologics. Acquiring facilities with advanced lines expands capabilities and meets client needs. Recent expansions include a new biologics manufacturing facility. The company's capital expenditure for FY24 was ₹6.8 billion, demonstrating investment in advanced tech.

- Biologics manufacturing is a key area of focus.

- Investment in advanced manufacturing lines.

- FY24 capital expenditure was ₹6.8 billion.

- Enhances CDMO service offerings.

Integration of AI and Machine Learning

The integration of AI and machine learning is poised to reshape Syngene's service offerings. These technologies are accelerating drug discovery and development processes. In 2024, the global AI in drug discovery market was valued at approximately $4.5 billion, with projections to reach $11.4 billion by 2029. This growth reflects AI's increasing importance in the sector.

- AI can reduce drug development timelines by up to 30%.

- Machine learning enhances the accuracy of target identification.

- AI-driven tools improve the efficiency of clinical trials.

Technological advancements are crucial for Syngene, particularly in drug discovery and manufacturing. Investment in automation and digitization boosts efficiency, supported by a projected 20% growth in biotech digital transformation spending in 2024. AI and machine learning accelerate drug development, with the AI in drug discovery market reaching $4.6 billion by 2025, significantly impacting Syngene's service offerings and competitive edge.

| Aspect | Details | Impact |

|---|---|---|

| AI in Drug Discovery (2024) | Market Value: $4.5B | Enhances Syngene's offerings. |

| Biotech Digital Transformation (2024) | Spending Growth: 20% | Boosts efficiency and productivity. |

| Cybersecurity in Pharma (2025) | Spending: $1.5B | Ensures data security. |

Legal factors

Syngene International faces stringent regulatory compliance across geographies. This involves adhering to research, manufacturing (cGMP), and quality control standards. Non-compliance can lead to significant penalties. In 2024, the global pharmaceutical market was valued at over $1.5 trillion, with growth projected.

Syngene International heavily relies on intellectual property (IP) laws, including patents and trade secrets, to safeguard its innovations. These legal frameworks are vital for protecting the company's and its clients' research and development efforts. In 2024, Syngene's R&D expenditure was approximately INR 4.3 billion, indicating its commitment to innovation. Strong IP protection ensures Syngene can maintain its competitive edge and attract clients. This protection is crucial for the long-term value of the company's services.

Syngene's operations heavily rely on legally binding contracts with clients worldwide. The company's revenue streams and financial stability are directly tied to the enforceability of these agreements. In 2024, Syngene reported a revenue of ₹3,087 crore, a 14% increase YoY, illustrating the importance of contract adherence. Any legal challenges or breaches could significantly impact this revenue. Compliance with contract laws is thus crucial for sustained growth.

Labor Laws and Employment Regulations

Syngene International must adhere to labor laws and employment regulations in all operational countries. This covers working conditions, benefits, and non-discrimination. Non-compliance can lead to legal issues and damage the company's reputation. For example, in 2024, the company faced a minor dispute regarding employee benefits in one of its Indian facilities.

- Compliance with labor laws is crucial to avoid legal issues and penalties.

- Employee benefits, working conditions, and non-discrimination policies are key areas of focus.

- Legal disputes can impact Syngene's financial performance.

Environmental Regulations and Compliance

Syngene International faces environmental regulations concerning waste disposal, pollution, and emissions. Compliance is essential to avoid penalties and protect its reputation. The company must obtain necessary permits and adhere to environmental standards. In 2024, environmental fines for similar companies averaged $50,000-$100,000. Stricter regulations are expected by 2025.

- Waste Management: Proper disposal of chemical and biological waste.

- Air Quality: Control of emissions from manufacturing processes.

- Water Usage: Compliance with water consumption and discharge regulations.

- Permitting: Maintaining all required environmental permits.

Syngene must navigate complex global regulations affecting its research, manufacturing, and intellectual property. Adherence to contract laws and labor standards is crucial for business continuity. Environmental regulations pose additional challenges, with compliance costs expected to increase. By 2025, pharma market is forecasted to reach $1.7 trillion.

| Aspect | Description | Impact |

|---|---|---|

| Regulatory Compliance | Adherence to global standards for research, manufacturing, and quality control (cGMP). | Penalties for non-compliance, affecting operational costs. |

| Contractual Obligations | Enforcement of legally binding contracts with clients. | Direct impact on revenue streams, with a potential for legal disputes. |

| Labor and Environmental Laws | Compliance with labor laws, environmental regulations, and waste management. | Risk of penalties, reputational damage, and rising compliance costs. |

Environmental factors

Syngene International, operating in chemical and biological sectors, generates waste. Proper waste management and disposal are crucial for environmental compliance. In 2024, the global waste management market was valued at $385 billion. Effective waste reduction and recycling are key. Syngene must adhere to regulations to minimize environmental impact.

Water is essential for pharmaceutical and biotech. Syngene focuses on water management, including recycling and reusing wastewater. This is crucial for environmental responsibility. In 2024, the pharmaceutical industry's water footprint was significant. Syngene's initiatives help reduce this impact. Water conservation is a key focus for sustainable operations.

Syngene focuses on reducing energy use and boosting renewable energy. This shift cuts its carbon footprint and operational expenses. For example, in 2024, Syngene increased its use of solar power by 15% at its Bangalore facility. This move aligns with global sustainability goals, improving its environmental profile.

Greenhouse Gas Emissions

Syngene International actively monitors and aims to reduce its greenhouse gas emissions, aligning with worldwide climate targets. The company recognizes emission reduction goals as a crucial environmental factor that shapes its operations and reporting practices. In 2024, the focus remains on energy efficiency and sustainable practices to minimize its carbon footprint. Syngene's commitment involves setting and progressing toward specific emission reduction objectives.

- Syngene's sustainability report details its emission reduction strategies.

- Targets often align with Science Based Targets initiative (SBTi) guidelines.

- Focus areas include energy consumption, waste management, and supply chain impacts.

- Regular audits and disclosures are essential for progress tracking.

Biodiversity and Ecosystem Impact

Syngene International actively works to improve biodiversity, showing a commitment to environmental responsibility. This includes planting saplings and creating microforests to support local ecosystems. These actions boost environmental sustainability and improve Syngene’s public image. Such initiatives are increasingly important as investors and stakeholders prioritize environmental, social, and governance (ESG) factors. In 2024, ESG-focused investments reached over $40 trillion globally.

- Syngene’s initiatives include planting saplings.

- These efforts boost environmental sustainability.

- ESG-focused investments are growing.

Syngene International addresses waste, water use, and energy consumption in its environmental strategy. It prioritizes reducing environmental impact by implementing sustainable practices. This is vital, given that the global sustainability market was $8.5 trillion in 2024. Further, ESG investments are a growing factor.

| Aspect | Focus | 2024 Data/Initiative |

|---|---|---|

| Waste Management | Reduction and recycling | Waste management market valued at $385 billion. |

| Water | Conservation & recycling | Pharmaceutical water footprint substantial, Syngene's recycling efforts are ongoing. |

| Energy | Renewables & efficiency | 15% increase in solar use at Bangalore facility; global renewables grew by 12% in 2024. |

PESTLE Analysis Data Sources

This PESTLE Analysis relies on reliable data from regulatory bodies, industry reports, and economic forecasts to inform its assessment.