T-Mobile US Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T-Mobile US Bundle

What is included in the product

Tailored analysis for T-Mobile's product portfolio, identifying investment, hold, or divest strategies.

Clean, distraction-free view optimized for C-level presentation.

What You See Is What You Get

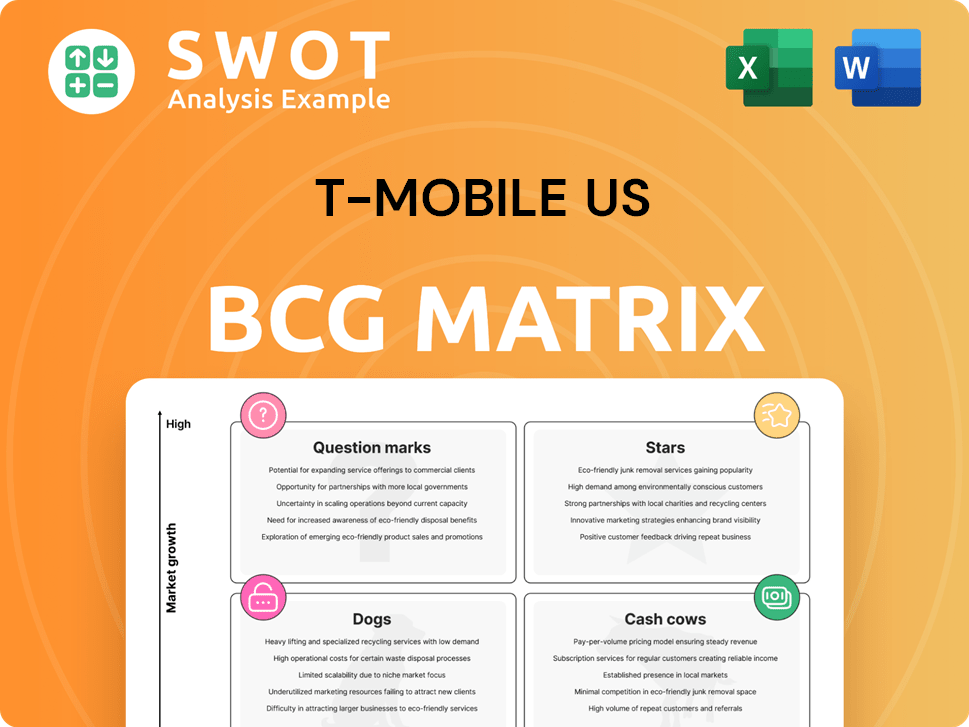

T-Mobile US BCG Matrix

The preview showcases the complete T-Mobile US BCG Matrix report you'll receive upon purchase. It's a ready-to-use, fully formatted document for strategic analysis, complete with market insights.

BCG Matrix Template

T-Mobile US's 5G network likely shines as a Star, generating high growth in a competitive market.

Its mature mobile services could be a Cash Cow, providing steady revenue with lower growth.

Some legacy offerings might be Dogs, requiring careful management to minimize losses.

New service bundles represent Question Marks, needing strategic investment decisions.

Explore the complete BCG Matrix for in-depth insights into each quadrant and drive effective strategic decisions.

Get the full BCG Matrix report to see where to focus resources for long-term growth and competitive advantage.

Purchase now for a detailed analysis and a roadmap to smarter, data-driven choices.

Stars

T-Mobile's 5G network leadership, fueled by its mid-band spectrum, sets it apart from AT&T and Verizon. T-Mobile's 5G covers over 300 million people with high-capacity 5G. This leads to superior speed and capacity. Network superiority is key for customer attraction in 2024.

T-Mobile excels in postpaid customer growth, a key strength in its BCG matrix. In Q1 2024, it added 1.3 million postpaid net customers. This growth stems from its network and pricing strategies. This strong subscriber growth highlights its market leadership.

T-Mobile's Fixed Wireless Access (FWA) is a key growth area. It holds a significant share of U.S. fixed wireless subscribers. The company is targeting 12 million FWA subscribers by 2028. In Q4 2024, they added 428,000 net high-speed internet customers.

Strategic Acquisitions

T-Mobile's strategic acquisitions, such as the deal with US Cellular, are key for growth. This boosts its subscriber base and network coverage, especially in less populated areas. The US Cellular acquisition also brings valuable spectrum assets. These deals help T-Mobile strengthen its market position.

- Q1 2024: T-Mobile added 934,000 net customers.

- 2024: Analysts predict further growth through strategic acquisitions.

- Acquisitions enhance T-Mobile's network capabilities.

Innovation in Customer Experience

T-Mobile's innovation in customer experience is a key focus. The company leverages AI for personalized services, including billing and network optimization. Partnering with OpenAI, T-Mobile developed IntentCX to enhance customer interactions. This strategy aims to boost satisfaction and loyalty, supporting growth. In 2024, T-Mobile invested heavily in AI, with customer satisfaction scores rising.

- Focus on AI-driven personalization.

- Partnership with OpenAI for IntentCX.

- Goal: Enhance customer satisfaction and loyalty.

- Driving growth through improved experiences.

T-Mobile is a Star in the BCG Matrix. It has a strong market share and high growth potential. T-Mobile's investments in 5G and acquisitions drive this status. Its strong customer base and focus on innovation ensure continued leadership.

| Aspect | Details | Data |

|---|---|---|

| Market Share | Strong and growing in the US | Increased market share in Q1 2024 |

| Growth Rate | High, driven by 5G and FWA | Postpaid net adds of 934,000 in Q1 2024 |

| Investment | Significant in network and AI | Major investments in 5G and AI-driven customer experience |

Cash Cows

T-Mobile's 'Un-carrier' strategy built a strong brand, valued for transparency and innovation. This brand recognition, a key asset, supports its solid market position. In 2024, T-Mobile's brand value reflects its customer-centric approach. This enables consistent revenue generation.

Metro by T-Mobile targets the prepaid market, providing affordable wireless options. It generates consistent revenue without needing rapid growth. Metro's focus on value attracts budget-conscious consumers. In Q4 2023, T-Mobile added 531,000 prepaid net customers. New plans ensure Metro's financial stability.

T-Mobile's value-driven plans, like Essentials Saver, target budget-minded consumers. These plans generate a reliable revenue stream. In Q4 2023, T-Mobile added 934,000 net postpaid customers. Value plans enhance customer retention and boost its competitive standing.

5G Home Internet in Saturated Areas

In regions where T-Mobile's 5G Home Internet is well-established, it functions as a cash cow. With the network infrastructure already built, the company sees steady revenue from existing users, requiring little extra spending. This strategy allows T-Mobile to capitalize on its network, boosting profitability. In 2024, T-Mobile added 523,000 net new home internet customers.

- Mature Deployment: Focus on areas with completed 5G Home Internet infrastructure.

- Revenue Generation: Consistent income from a stable subscriber base.

- Minimal Investment: Low additional capital expenditure needed.

- Network Leverage: Utilizing existing infrastructure for maximum returns.

Wholesale Agreements

T-Mobile's wholesale agreements, where it provides network access to MVNOs, are cash cows. These agreements are a steady revenue stream, although it can fluctuate. They capitalize on existing infrastructure, requiring minimal extra investment. In 2024, T-Mobile's wholesale revenue contributed to its overall financial performance.

- Wholesale revenue provides a consistent income source.

- Minimal additional investment is needed.

- Revenue can fluctuate.

- T-Mobile capitalizes on its infrastructure.

T-Mobile's cash cows generate steady revenue with low investment. These include 5G Home Internet in mature areas and wholesale agreements with MVNOs. They leverage existing infrastructure to maximize returns. These segments ensure financial stability.

| Cash Cow | Characteristics | 2024 Data Highlights |

|---|---|---|

| 5G Home Internet | Mature network, steady revenue, low investment | Added 523,000 net new home internet customers. |

| Wholesale Agreements | Consistent income, minimal investment, infrastructure utilization | Wholesale revenue contributed to financial performance. |

Dogs

T-Mobile is actively dismantling its 2G and 3G networks. These older networks represent a low market share, costing significant upkeep. By retiring these, T-Mobile boosts 4G LTE and 5G investments. In 2024, this improves efficiency and profitability, as seen by network modernization efforts.

T-Mobile's past bundling missteps, like home security, didn't click. These ventures demanded capital but didn't boost profits notably. Discontinuing these services is smart to cut losses. Focusing on winning strategies is key, like its 2024 growth in 5G.

T-Mobile's "Dogs" include smaller, underperforming MVNO partnerships. These partnerships consume resources without significant revenue. Consider that in Q4 2023, T-Mobile's net customer additions were 934,000, while struggling MVNOs might not contribute much. Divesting or restructuring could boost profitability. In 2024, assess their financial impact.

Outdated Devices and Accessories

Outdated devices and accessories represent a "Dog" in T-Mobile's BCG Matrix. This category includes items like older phone models and obsolete accessories that have lost market appeal. These products tie up capital and are challenging to sell at their original prices. Clearing this inventory through discounts or liquidation is crucial. It frees up resources and reduces storage expenses.

- Inventory write-downs can significantly impact profitability.

- Liquidation sales often involve substantial price reductions.

- Storage costs for obsolete items add to financial burdens.

- Focus shifts to promoting newer, in-demand products.

Specific Legacy Contracts

Specific legacy contracts for T-Mobile US represent agreements with less-than-ideal terms, affecting profitability. These contracts, stemming from past strategies, may have low-profit margins or unfavorable conditions. Addressing these contracts is essential for optimizing financial performance. Renegotiation or phasing them out can free up resources and boost overall financial health.

- Historical contracts often involve outdated pricing models, leading to reduced revenue per user.

- The company must evaluate and potentially terminate contracts that no longer align with current market rates.

- This can lead to an increase in the average revenue per user (ARPU).

- In 2024, T-Mobile's ARPU was around $49.97.

Dogs in T-Mobile's portfolio include underperforming MVNOs and obsolete inventory. MVNOs that don't generate significant revenue are considered "Dogs". Outdated devices and accessories are also in this category. These areas consume resources and affect profitability.

| Category | Details | Impact |

|---|---|---|

| MVNO Partnerships | Underperforming partnerships | Resource drain |

| Obsolete Inventory | Older phones, accessories | Capital tied up |

| Financials (2024 est.) | ARPU $49.97 | Profitability assessment |

Question Marks

T-Mobile's T-Satellite, powered by Starlink, is a "question mark" in its BCG matrix, representing a high-growth, low-market-share venture. This partnership aims to extend mobile coverage, addressing dead zones. As of Q4 2023, T-Mobile had 113.6 million subscribers. Its success hinges on customer adoption and profitable satellite service monetization.

T-Mobile's AI-RAN Innovation Center, backed by NVIDIA, Ericsson, and Nokia, is a strategic investment in AI for network management. This venture is a question mark in the BCG Matrix due to its uncertain market share and impact, despite its potential to transform network capabilities. The initiative's success hinges on effective AI solutions for network optimization, with T-Mobile investing billions in network upgrades. In 2024, T-Mobile's capital expenditures were around $10 billion, showing significant investment in future technologies.

T-Mobile for Business is a "Question Mark" in its BCG Matrix. T-Mobile aggressively pursues enterprise clients, offering wireless services. Although gaining business customers, market share lags behind rivals. Success hinges on scaling offerings. In Q3 2024, business service revenue reached $2.7B.

Fiber Expansion

T-Mobile's fiber expansion, exemplified by the Lumos acquisition, aims to broaden its broadband services. This strategic move allows T-Mobile to offer faster, symmetrical gigabit speeds, enhancing its competitive edge. However, fiber deployment demands substantial capital outlays and contends with established fiber players. Success hinges on effective deployment and marketing of fiber services.

- Lumos acquisition: $950 million.

- Fiber broadband net customer additions (Q3 2023): 45,000.

- Fiber market competition: AT&T, Verizon.

- Targeted fiber coverage: Millions of homes.

Digital Advertising

T-Mobile's digital advertising arm, a relatively new venture, presents a mixed bag in the BCG matrix. The company has aggressively expanded its advertising business, offering marketing solutions. This segment has already generated over $1 billion in annual revenue, demonstrating its potential. However, its classification leans towards a question mark due to uncertain long-term growth and market share.

- Revenue: Over $1 billion annually.

- Market Position: Still establishing market share.

- Growth Potential: Long-term uncertain.

- Competition: Faces established advertising players.

T-Mobile's question marks face growth uncertainty with low market share.

These ventures require strategic investments to gain traction.

Success depends on effective execution and adoption.

| Venture | Description | Key Challenges |

|---|---|---|

| T-Satellite | Extending mobile coverage via Starlink. | Customer adoption, monetization. |

| AI-RAN Innovation Center | AI for network management with NVIDIA. | Effective AI solutions, network optimization. |

| T-Mobile for Business | Offering wireless services to enterprises. | Scaling offerings, market share gains. |

BCG Matrix Data Sources

The T-Mobile US BCG Matrix utilizes company filings, industry analyses, and market growth data to define each business segment.